-

No Comment

Posted by Eddy Elfenbein on April 16th, 2008 at 10:55 amFrom The Inquirer:

-

The Education of Warren Buffett

Posted by Eddy Elfenbein on April 16th, 2008 at 10:29 amHere’s an interesting article looking at why Warren Buffett has quietly walked away from the coal business. The article contains this tidbit:

A final clue to Buffett’s change of direction on coal comes from looking at his history on other controversial issues, especially his decision in the early 1990s to revise his investment policies regarding tobacco. In 1987, Buffett told John Gutfreund of Salomon, “I’ll tell you why I like the cigarette business. It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.”

By 1994, however, Buffett was ready to drop his tolerance of tobacco lucre, telling Berkshire Hathaway’s annual meeting that tobacco investments are “fraught with questions that relate to societal attitudes and those of the present administration … I would not like to have a significant percentage of my net worth invested in tobacco businesses.”

The upshot: Buffett keeps his finger in the wind and reacts quickly when he feels society shift. For this reason, his reversal on coal, though it may have been largely forced upon him, is significant nevertheless. As usual, Buffett has made the “smart move” a bit faster than some of his colleagues. Let’s hope they take note and follow his lead. -

Not Getting Predictions Market

Posted by Eddy Elfenbein on April 16th, 2008 at 9:46 amJames Ledbetter at Slate brings up one of my pet peeves today. He’s about the 600th writer to ask why are predictions markets so often wrong.

The answer is simple: They’re not predictions markets, they’re really odds-setting markets. Just because the event with the highest odds didn’t come to pass, doesn’t mean that the market is somehow wrong.

The Giants beat the point spread in the Super Bowl. Did Vegas fail? No, it’s called an upset.

Nearly four years ago, Google went public at $85. Did the stock market get it wrong? Of course not, Google proved its worth to shareholders over time. Over the last six months, the reverse is happening. The markets adjust.

As I’ve said many times, I don’t take these markets too seriously. They’re for fun and most of the standard complaints are accurate (too small, too partisan).

Another aspect that people must understand about these markets is that they’re futures markets. This means there’s a very large dispersion of returns. In other words, you get all or nothing. That’s a little different from your standard stock market. As a result, these markets can be far more volatile than what you may normally be used to.

By the way, John McCain’s contract to win the GOP nomination is going for 94.1/94.3. Hmmm. That could be a good money market substitute until the convention this summer. -

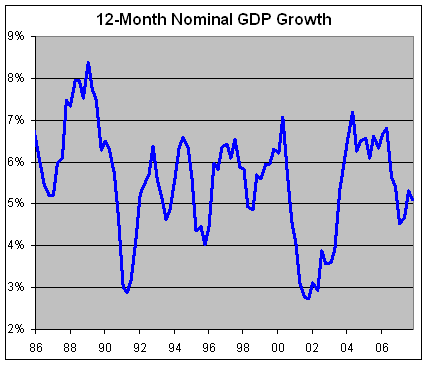

Nominal GDP Growth

Posted by Eddy Elfenbein on April 16th, 2008 at 9:36 amContinuing on yesterday’s post about debt levels and interest rates, I wanted to look at nominal (meaning, not adjusted for inflation) GDP growth. Here’s how it looks on a trailing 12-month basis going back to 1986:

These are, of course, the government’s numbers, so use at your own risk. But you can clearly see where the recessions are, and I expect that for the immediate future, the line will droop down.

What I find interesting is that long-term Treasury yields have still trended below GDP growth. Will all those foreigners dump their Treasuries? I doubt it, but if they do, it’s not because we’re unable to pay them back. -

Herb Greenberg Leaving MarketWatch

Posted by Eddy Elfenbein on April 15th, 2008 at 3:40 pmHerb Greenberg, one of my favorite reporters, is leaving MarketWatch:

Just a bit of housekeeping – actually, house cleaning!

On May 1, I’m leaving MarketWatch, Dow Jones and traditional journalism to start an independent research firm with my friend, Debbie Meritz, an analyst/accountant who has been a very good source of ideas in the past.

I’ve devoted my career to journalism, starting in elementary school by delivering copies of the Miami News from my bicycle, to my first job out of college in 1974 as the first business reporter for the Boca Raton News.

I’ve since been part of the evolution of modern business journalism, working from beat reporter to correspondent to columnist to blogger.

When Debbie and I first started talking about the idea of setting up a research firm, it seemed like the next logicial step, just as it did when I left traditional print journalism 10 years ago to join the fledging online world.

Change is never easy, especially leaving a place as great as MarketWatch, which has been my home for the past four years. But change is also exciting and I’m looking forward to the next adventure.

Until then… you’re stuck with me for a few more weeks.

The beat goes on…I’m sad to see you go, but best of luck in your new business.

-

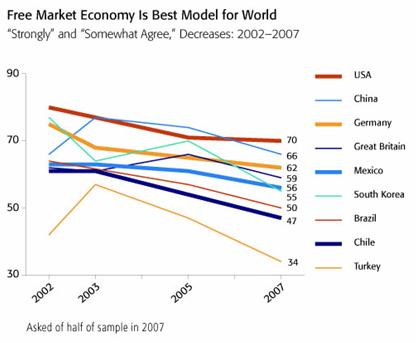

Erosion of Support for Free Markets

Posted by Eddy Elfenbein on April 15th, 2008 at 3:19 pm

From World Public Opinion:Majorities in most countries continue to support the free market system, but over the last two years support has eroded in 10 of 18 countries regularly polled by GlobeScan. In several countries this drop in support has been quite sharp.

The latest polling was completed before the current stock market volatility that began earlier this year.

Back in 2005 only one country polled–France–had more citizens disagreeing than agreeing with the statement that “the free enterprise system and free market economy is the best system on which to base the future of the world.”

Displacing France as the least supportive of the free market system today is Turkey where approval of the free market system has plunged from 47 percent in 2005 to 34 percent now, while opposition has risen from 36 to 41 percent.

Support for free markets has also dropped 15 points in South Korea since 2005, though a majority (55%) continue to be supportive. Opposition there has jumped 20 points from 19 to 39 percent.

Support among Chileans is also down 14 points since 2003 when Chileans were last polled on this question.

Support in other countries is down by more modest though significant numbers: China (down 9 points), Britain (7 points), Brazil (7 points), Mexico (6 points), and Kenya (6 points).

The one country to show upward movement in agreement with the free market system is France–up five points. However, more continue to disagree (45%) than agree (41%).

The GlobeScan poll of 9,357 people worldwide also found that large numbers continue to look to their government to take a strong hand in regulating the market. In 17 of the 18 countries a majority (15 countries) or a plurality (two countries) agreed that “the free enterprise system and the free market system work best in society’s interest when accompanied by strong government regulation.”

Interestingly, supporters of the free market show more enthusiasm for a strongly regulated free market system than critics. Among those who agree that the free market system is the best system, three-quarters also agree that it works best with strong government regulation.

Those who are not enthusiastic about the free market system are divided as to whether it works best with government regulation.

At the same time agreement with this proposition, while still averaging 62 percent across all countries polled, is down in ten countries. This appears to be related to the drop in confidence in the free market system. Among the ten countries for which there was a drop in agreement with the proposition that the free market system works best with strong regulation, six of them also had a significant drop in support for the free market system, and only one had an increase.

Interestingly, three countries that in 2005 were among the four highest in support for the free market system–China, the Philippines, and South Korea–showed substantial increases in agreement with the idea that the market works best with regulation.

The results come from a private multi-client poll conducted by international polling firm GlobeScan between May 29 and August 10, 2007. GlobeScan’s paying clients had exclusive use of the poll’s findings until today’s first-time public release. The Program on International Policy Attitudes (PIPA) at the University of Maryland assisted GlobeScan with the analysis and interpretation of these findings.

GlobeScan president Doug Miller says, “The results suggest that the free enterprise system was already beginning to lose the unquestioned trust of citizens before the current banking meltdown. It underscores the importance of re-building trust sooner rather than later.”

Steven Kull comments, “It appears that as people have doubts about the ability of government to regulate the free market, confidence in the market diminishes.”

A total of 9,357 citizens in Brazil, Canada, Chile, China, France, Germany, Great Britain, India, Indonesia, Italy, Kenya, Mexico, Nigeria, the Philippines, Russia, South Korea, Turkey, and the United States were interviewed face-to-face or by telephone. Polling was conducted by GlobeScan and its research partners in each country. In eight of the 18 countries, the sample was limited to major urban areas. As the questions were asked to half samples in each country, the margin of error per country ranges from +/-3.3 to 5.0 percent.Here’s a PDF of the report.

-

Could the U.S. Lose it AAA Rating?

Posted by Eddy Elfenbein on April 15th, 2008 at 2:11 pmB-Riz notes a WSJ story on the possibility of the U.S. government losing its triple-A rating. Barry, rightly, thinks S&P isn’t brave enough (though he alluded to their “stones”).

To me, it’s a hugely frivolous issue. U.S. Treasuries receive a credit rating every day. It’s better known as the price. I don’t see how some rating from a questionable firm could possibly have an impact greater than price movements. If anything, a downgrade would merely confirm what the market is already saying.

There’s also the fact that the government owns the printing press, so they’ll get those dollars to bondholders one way or another.

I would go as far as saying it’s safe to look past all forms of debt measurements and ratios, and concentrate on Treasury yields. Is the debt too high? Depends, what are T-bonds yielding? If their yields are going up, then yes. If not, then I’m not concerned.

There are lots of good reasons for lower debt. But long-term nominal GDP growth can easily top current yields. -

Happy Tax Day

Posted by Eddy Elfenbein on April 15th, 2008 at 1:34 pmJust a quick reminder for those of you who waited to the last minute, you can head on over to Dunkin Donuts for a free doughnut today (with coffee purchase).

Now about taxes, Megan McArdle reposts her clear-the-decks tax plan.

1) Get rid of all our poverty programs, except those aimed at the disabled, and temporary unemployment assistance, and institute the negative income tax. That is to say, the system should be continuously progressive, from a steep negative rate of up to 100% on very low earners, gradually declining until it zeroes out around $28,000 a year, and then rising gradually until it maxes out around 35% on the top brackets.

2) Eliminate FICA and pay for Social Security and Medicare out of general revenue. It’s time to stop pretending it’s a pension system, when there are no assets in the “trust fund.”

3) Eliminate the corporate income tax

4) Eliminate the special treatment for capital gains. All income should be taxed at the same level, regardless of its source.

5) Eliminate all deductions. Period, end of statement. No mortgage, student, child, etc. All causes are equally worthy in the eyes of the person who possesses the deduction; it is a waste of our time as a nation to sit around arguing about who deserves what.

6) Just say no to the Value Added Tax. In theory, it’s a good tax. In practice, because it is extremely hard to tell what proportion of the price of anything represents the tax, it removes the good and natural pressure upon tax rates.

7) Get rid of the estate tax, and tax the capital gains on whatever is sold.

I’m on board. Of course, getting rid of the mortgage deduction is about as likely as…let’s just say it ain’t gonna happen anytime soon.

-

Johnson & Johnson’s Earnings

Posted by Eddy Elfenbein on April 15th, 2008 at 1:16 pmA small bit of evidence against a broad-based slowdown came today with Johnson & Johnson’s (JNJ) earnings. For the first quarter, the company earned $1.26 a share, which beat the Street’s estimates by six cents a share.

The company said it expects 2008 EPS of $4.40 to $4.45. That’s a penny a share higher on both the high and low ends. I’m not sure if that qualifies as “guiding higher,” but there you are.

Bear in mind that JNJ isn’t 100% health care. The company also has many consumer products (like Listerine). Drug sales only increased by 3.3%, and it you don’t count currency gains, they actually fell a bit. MarketWatch reports:J&J said that lower sales of the company’s anemia drug Procrit contributed to the slump. Sales of Procrit have been under pressure in recent quarters due to the imposition of tightened prescribing restrictions by the Food and Drug Administration and tougher reimbursement standards by Medicare. Amgen Inc. (AMGN) markets a similar product under the name Epogen.

J&J said worldwide Procrit sales fell 27% operationally to $629 million for the quarter. The sharpest decline was seen in the U.S., where Procrit sales tumbled 37% operationally to $334 million.

J&J’s top-selling drug, Risperdal, also saw signs of sales erosion, due largely to the advent of generic competition. Worldwide sales of the antipsychotic slid 9% operationally to $809 million. This was offset to some degree by sales of a newer formulation of the drug, Risperdal Consta, which grew 10% operationally to $309 million.So is JNJ a good buy. Two years ago, I said the stock was cheap. At the time, JNJ was going for $57, and today it’s over $65. For an investor with a long-term horizon, I’d say JNJ is a still a good buy. However, it would be a better buy under $60. This is still a nervous market (over $3.5 trillion in cash) and I think JNJ could hit in the next few months.

-

WR Berkley Now Trading Under New Symbol

Posted by Eddy Elfenbein on April 15th, 2008 at 10:48 amSome Buy List housekeeping. WR Berkley is now trading under WRB instead of of BER, which makes a lot more sense.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His