-

Hot CEOs Mean Hot Profits

Posted by Eddy Elfenbein on January 15th, 2008 at 10:50 amA new academic study finds that more profitable companies have more attractive CEOs.

Using photographs of the highest and lowest ranked Fortune 1000 companies’ CEOs, psychologists Nicholas Rule and Nalini Ambady quizzed ordinary college students to determine which of the pictured faces were characteristic of a leader.

Without knowledge of the pictured individuals’ job titles, and by rating the faces on competence, dominance, likeability, facial maturity and trustworthiness, the students were able to distinguish between the successful and the not-so-successful CEOs.

Despite the ambiguity of the images, which were cropped to the face, put into grayscale and standardized in size, ratings of power- and leadership-related traits from CEOs’ faces were significantly related to company profits.

“These findings suggest that naive judgments may provide more accurate assessments of individuals than well-informed judgments can,” wrote the authors. “Our results are particularly striking given the uniformity of the CEOs’ appearances.” The majority of CEOs, who were selected according to their Fortune 1000 ranking, were Caucasian males of similar age.Could be, but color me skeptical.

(Via Joe Weisenthal) -

Citigroup’s Loses $10 Billion

Posted by Eddy Elfenbein on January 15th, 2008 at 8:18 amToday is Reckoning Day for Citigroup (C). The company just reported its worst loss ever. Thanks to subprime investments gone bad, Citigroup incurred a write down of $18 billion. For the quarter, Citi lost nearly $10 billion, or $1.99 a share. That’s like burning $100 million every day. I think it’s safe to assume that Citigroup tried to thorw out as much garbage as it could, but I still expect to see more. The Street was looking for a loss of $1.03 a share. For last year’s Q4, Citi reported a profit of $1.03 a share.

The company also said that it will cut its quarterly dividend from 54 cents a share to 32 cents a share. That’s not as bad as I thought. Going by yesterday’s close, that implies a yield of 4.4% which beats most of the yield curve. Citigroup also announced job cuts of 4,200.

The big problem for Citigroup is its eroding capital base. That’s why it has turned again to outside investors for a capital infusion. The Wall Street Journal reports:A new round of investments announced Tuesday includes $12.5 billion of preferred securities. The Government of Singapore Investment Corp., or GIC, will buy $6.88 billion, which follows the government fund’s plan to invest $9.6 billion in Switzerland’s UBS AG. Other investors include former Chairman and Chief Executive Sandy Weill and Prince Alwaleed bin Talal bin Abdulaziz Alsaud, already one of Citi’s biggest investors.

Citigroup also announced it would offer public investors about $2 billion in newly issued convertible preferred securities.I thought the last bit was interesting. I’m not sure how much demand there is from investors to sink more money into Citigroup, but we’ll find out.

-

Not So Efficient Markets

Posted by Eddy Elfenbein on January 15th, 2008 at 7:35 amHere’s an interesting setback for the Efficient Market Hypothesis. Researchers ran a wine tasting and found that people preferred wines they thought were more expensive. Not wines that are more expensive, just wines they think are pricier.

Researchers scanning the volunteers’ brains while they drank confirmed they enjoyed the pricier wines more. The experiment helps explain how marketing practices can influence both the preferences of consumers and the enjoyment registered by their brains, said Antonio Rengel, one of the study’s authors.

“The lesson is a very deep one, not only about marketing but about the human experience,” said Rangel, an associate professor of economics at the California Institute of Technology in Pasadena. “This study shows that the expectations that we bring to the experience affect the experience itself.”On a related note, I’m raising the price of Crossing Wall Street to $1 million a year.

-

Maybe the Economy Isn’t So Dead Yet

Posted by Eddy Elfenbein on January 14th, 2008 at 4:01 pmToday’s action:

Morgan Stanley Cyclical Index (CYC) +2.24%

Morgan Stanley Consumer Index (CMR) -0.27%

That’s a huge spread for one day, but I doubt it will last. I still think the cyclicals will underperform the market for a long stretch. -

Risk Premiums in the Bond Market

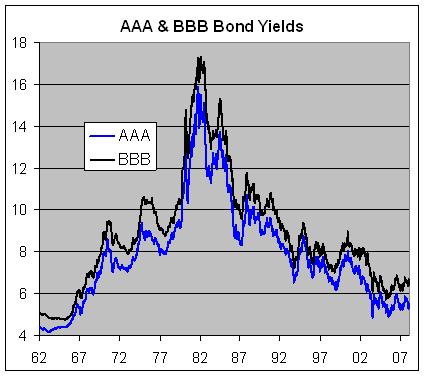

Posted by Eddy Elfenbein on January 14th, 2008 at 12:48 pmA good way of gauging the market’s appetite for risk is by looking at the difference in bond yields of high-grade and lower-grade bonds. Here’s a look at AAA and BBB bond yields since 1962:

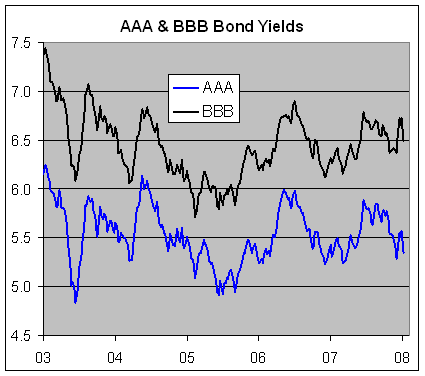

Notice how the BBB yields are always just a bit more. But that gap varies over time. Here’s a closer look since at the same graph but since 2003:

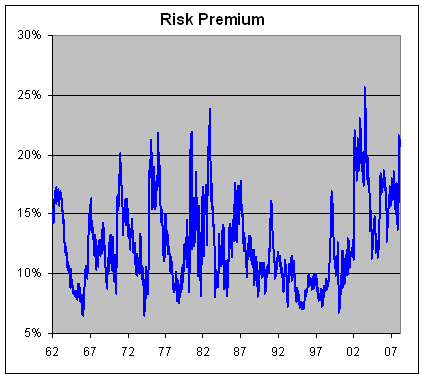

Now, here’s a look at the risk premium for BBB bonds. By rate premium, I mean the difference between the AAA and BBB bond yields. For example, if AAA bonds are going for 10% and the BBBs are going for 12%, the premium would be 20%.

As you can see, the risk premium seems to bounce between two points. It’s either less than 10%, or more than 20%. That’s a very rough generalization but there’s not much in between.

When the premium rises above 20%, that means that investors are demanding more money to take on greater risk. The high premium signals fear with investors are generally coincides, and often causes, a recession.

The risk premium shot over 20% shortly after 9/11 and eventually got as high as 25% in mid-2003. However, the premium gradually drifted lower although it never felt below 11%. Just recently, the premium jumped over 20% for the first time in over four years. -

Citigroup Could Write-Down $24 Billion

Posted by Eddy Elfenbein on January 14th, 2008 at 10:03 amThis is going to be an ugly week for bank earnings. At CNBC, Charlie Gasparino writes:

Citigroup could write down as much as $24 billion due to subprime and credit-related losses, CNBC has learned. In addition, the company could lay off as many as 20,000 workers as part of a comprehensive plan to slash costs and raise capital.

The plans will be unveiled Tuesday, when it reports fourth-quarter earnings. At the same time, Citigroup could also announce that it is cutting its dividend payment.

Citigroup also intends to raise as much as $15 billion from various foreign and domestic entities including Saudi Arabian Prince Alwaleed bin Talal, Citigroup’s largest individual shareholder, as America’s biggest bank grapples with heavy mortgage market losses.

Alwaleed has owned his Citi stake since the early 1990s and helped engineer a previous rescue plan for the bank more than a dozen years ago. According to a report on the Wall Street Journal’s Web site, he is likely to keep his total stake in the bank below 5 percent to avoid regulatory scrutiny.

By raising so much captial, Citigroup CEO Vikram S. Pandit is hoping layoffs can be kept to a minimum.In my opinion, the truly scary part is that we don’t know what we don’t know. These products are so opaque, it’s difficult for anyone to properly analyze what’s truly happening. I also think this ruins the chance that Robert Rubin will be part of any future Democratic administration.

-

Oopsie

Posted by Eddy Elfenbein on January 12th, 2008 at 1:16 pmFrom the Chicago Sun-Times:

Ace employee makes $152 million accounting error

BY SANDRA GUY

Ace Hardware discovered that a mid-level employee made innocent but enormously expensive and incorrect entries in ledger books that eventually led to a $152 million accounting error, Ace Hardware CEO Ray Griffith said today.

The poorly trained employee, who worked in the finance department at the co-op’s headquarters in Oak Brook, is no longer employed at Ace Hardware, Griffith said.

The accounting error initially was revealed last summer.

Ace Hardware will be forced to restate its earnings for fiscal years 2004, 2005 and 2006, and will correct its numbers for fiscal 2007.

Investigators hired by Ace Hardware’s board of directors told the board of their findings Tuesday, and Griffith revealed the situation to Ace Hardware store owners today. The five-month investigation cost roughly $10 million.

The unidentified employee, who had worked at Ace Hardware for at least eight years, made journal entries of a “sizeable amount” that “masked” a difference in numbers between two ledger books.

The ledgers looked as though they were reconciled, but were not.

The journals are the general ledger and the perpetual inventory journal.

“Numbers were flowing through one of the ledgers but not flowing into the other,” Griffith said.

About 25 percent of the error, or $34.6 million, dates back to 1995, Griffith said. The remainder, $117.4 million, occurred from 2002 through 2006.

The employee did nothing fraudulent, and no inventory or money is missing, Griffith said.

The person was not properly trained or equipped to do the job, and Griffith conceded that that was Ace Hardware’s fault.

“We are embarrassed by it,” Griffith said. “We did not provide the training, oversight or checks and balances to help that person do [his or her] job,” Griffith said. “[The employee’s] only intent was to try to do the best job for the boss and for our company.”

Part of the problem is the increasingly complex and competitive situation that hardware stores face, Griffith said. -

Mississippi Fred McDowell

Posted by Eddy Elfenbein on January 12th, 2008 at 12:04 pm -

Mishkin: Stop Obsessing about the Fed

Posted by Eddy Elfenbein on January 11th, 2008 at 2:41 pmI have to agree with Frederic Mishkin of the Fed:

I think there is too much focus on what decision will be made about the federal funds rate target at the next FOMC meeting. What is important for pricing most financial assets is the path of monetary policy, not the particular action taken at a single meeting.

One of the great myths of the market is the over-agency of the Federal Reserve. In reality, the Fed is much less powerful than is commonly believed.

I think some people have to believe that there’s some mysterious group that’s in charge and running things. Ron Paul even blames the Fed for higher oil prices.

Nobel Laureate, Edward Prescott, wrote in the Wall Street Journal:I am not saying that there are no real costs to inflation — there certainly are. And if we get too much inflation we can exact high costs on an economy (witness Argentina as an example). However, I am talking here of the vast majority of industrialized countries who live in a low-inflation regime and who are in no danger of slipping into hyperinflation. It is simply impossible to make a grave mistake when we’re talking about movements of 25 basis points.

-

Zacks Earnings Commentary

Posted by Eddy Elfenbein on January 11th, 2008 at 10:07 amHere’s an interesting breakdown of the upcoming earnings season from Zacks.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His