-

Dell’s Earnings Restatement

Posted by Eddy Elfenbein on October 31st, 2007 at 12:15 pmDell (DELL) has finally restated its earnings for the past few years. As you can see blow, the difference between the restatement and the original isn’t very much. Profits for FY ’06 were revised a little higher and the years before that were a little lower.

OriginalYear………Sales……..Oper. Income…..EPS

2003………$35,404………$2,844………..$0.80

2004………$41,444………$3,544………..$1.01

2005………$49,205………$4,254………..$1.18

2006………$55,908………$4,347………..$1.46

2007………$57,420………$3,070………..$1.14Updated

Year………Sales……..Oper. Income…..EPS

2003………$35,262………$2,738………..$0.77

2004………$41,327………$3,525………..$1.00

2005………$49,121………$4,206………..$1.18

2006………$55,788………$4,382………..$1.47

2007………$57,420………$3,070………..$1.14Note that Dell’s fiscal year ends in late-January or early February so we’re currently in FY ’08.

Two things stand out. First, is the large amount of shares that Dell has bought back. In FY ’07, there were 14% fewer diluted shares than there were in FY ’03.

The other is the decline and fall of Dell’s operating margins. This is the key stat to watch in Dell. Not too long ago, Dell’s operating margins were around 11%. Today, they’re around 6%. In other words, you sell twice as much just to stand still. -

Slate to Launch Business Site

Posted by Eddy Elfenbein on October 31st, 2007 at 10:40 amThe New York Observer has the details:

Slate deputy editor David Plotz told The Observer he believes there’s a clear opening for Slate’s distinctive editorial voice. He argued that while political journalism has diversified with the arrival of blogs and other independent sites, business journalism is “still dominated by the big brands. We think there’s an opening for a really smart, analytical, opinionated Web site that could be Webby and fast and agile.”

Mr. Plotz cautioned that the new project is still awaiting final authorization from Post company executives. Assuming it goes forward, it will likely capitalize on the Slate brand with a logo at the top of the home page. He would not comment on the projected budget for the site.

According to a source at Washingtonpost.Newsweek Interactive, the publishers of Slate, the new site, which does not yet have a name, could go live as early as next summer. It was born in part out of the recent launch of Slate’s newly branded video Web site, SlateV, which Post executives are pleased with. Plans call for it to follow the same basic staffing model that has helped make Slate a success—using a few editors and assistants to run the operation, while relying for content mostly on freelancers.

No one’s been hired yet. According to a different source, Slate editors offered the top job to Elizabeth Spiers, the founding editor of both Gawker and the business blog DealBreaker, who now writes for New York magazine, but were turned down. They’ve since asked both Ms. Spiers and Daniel Gross, Slate’s regular business columnist, among others, to write for the site. -

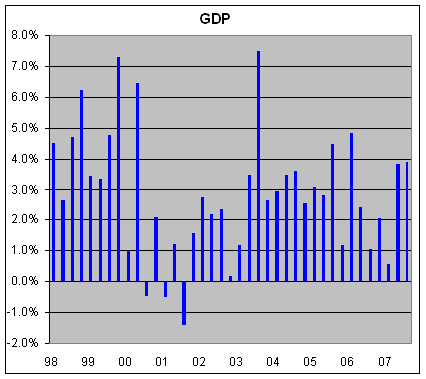

Today’s GDP Report

Posted by Eddy Elfenbein on October 31st, 2007 at 10:02 amToday’s report on GDP growth for the third-quarter was a surprisingly strong 3.9%. This is nearly identical to the 3.8% for the second quarter. My only warning is that these numbers are subject to endless revisions.

It’s very likely that nominal GDP for 2007 will be over 25% more than 2003.

Update: BR calls BS. -

Fair Isaac’s Earnings

Posted by Eddy Elfenbein on October 31st, 2007 at 9:46 amIt’s no secret that Fair Isaac (FIC) has been a disappointment this year. Yesterday’s earnings report appears to be a small bright spot.

Fair Isaac Corp.’s profit climbed 28 percent in the fiscal fourth quarter, as the business advisory reserved much less to pay taxes, the company said Tuesday.

Fair Isaac earned $28.2 million, or 52 cents per share, in the quarter ended Sept. 30, compared with profit of $22.1 million, or 35 cents per share, in the fourth quarter last year.

Analysts polled by Thomson Financial forecast profit of 41 cents per share.

Revenue was roughly flat at $207.2 million, versus analysts’ expectations for $201 million.

Fair Isaac sells financial advice and business analysis. The primary difference between the fourth quarter and the comparable period a year earlier was the provision for income taxes. That provision was $2.8 million in the fourth quarter, compared with $11 million in the fourth quarter last year.The stock is doing well this morning, but it still has a long way to go to make up for its poor performance this year.

-

Will the 90s Ever End?

Posted by Eddy Elfenbein on October 30th, 2007 at 4:47 pmCool!

March 14, 2007: BigBand Networks Announces Pricing of Initial Public Offering

Wow!

Um…

Sept. 27, 2007:

BigBand Networks Announces Revised Revenue Outlook for Third Quarter of 2007Oh.

October 30, 2007: BigBand reports Q3 loss, to cut workforce by 15 pct

No fair. I’m suing!!

-

Becky and Dylan on Wing Women

Posted by Eddy Elfenbein on October 30th, 2007 at 3:52 pm -

Gender Differences and Mutual Fund Managers

Posted by Eddy Elfenbein on October 30th, 2007 at 1:35 pm

academic study has found that the gender of a mutual fund manager might have an impact on its returns.What I’m saying is – and this is not a come-on in any way, shape, or form – is that men and women can’t be friends, because the sex part always gets in the way.

– When Harry Met Sally…

Not that men are better or worse managers than women. Instead, an all-male or all-female team might be better than a mixed gender team.

Perhaps Harry was right. -

Management Matters

Posted by Eddy Elfenbein on October 30th, 2007 at 11:36 amSome numbers to consider:

Both Merrill Lynch (MER) and Bear Stearns (BSC) are 33% below their 52-week high.

Lehman Brothers (LEH) is 28% off its high.

Goldman Sachs (GS) made a new high today. The stock is up over $46 a share this year.

Of those 4,600 pennies, Lloyd Blankfein’s pay last year was $53.4 million or about 13 cents a share.

Remember that next time someone complains about executive compensation. -

Wall Strip on Agrium

Posted by Eddy Elfenbein on October 30th, 2007 at 10:56 amHoward and Lindsay hit the links to talk Agrium (AGU):

-

ADP’s Earnings

Posted by Eddy Elfenbein on October 30th, 2007 at 10:28 amLast month, I highlighted Automatic Data Processing (ADP):

ADP is starting to catch my eye as a good contrarian stock. (The first step, however, is to ignore their notoriously inaccurate monthly employment reports.)

The stock is down to $44 from $50 in early June. I’m not claiming any great insight on its business, but it’s simply a good stock at a good price. In the last three years, earnings are up 56%. Gross margins are around 50% and the company has a solid balance sheet.

The company also raised guidance for FY 08. ADP is now looking for 12% sales growth and profit growth of 18% to 21%. I like those numbers.The company reported earnings today of 45 cents a share, two cents more than expectations. Last year, ADP earned 39 cents a share. Revenues were up 13.5%% to $1.99 billion.

The company also nudged up its guidance for next year. ADP sees earnings coming in at the high end of its earlier forecast of $2.12 to $2.18 a share. Sales growth is now projected at 12%-13% instead of just 12%.

The stock is up about 3% this morning to $48.64.

As with many contrarian picks, ADP does face some serious problems. Scott Rothbort, my colleague at Real Money, summarized the headwinds facing ADP:First is the slowing growth in payrolls. While employment growth remains positive, the rate of growth has declined over the last year. Second are declining interest rates. ADP makes a considerable amount of money on the float, which is due to the timing between the employer payment of payrolls to ADP and the clearing of the individual employee checks. Furthermore, with more people opting for direct debit, ADP’s float base is also declining.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His