-

Biomet Shareholders Approve Merger

Posted by Eddy Elfenbein on September 5th, 2007 at 12:42 pmIt’s official. Over 91% of Biomet (BMET) shareholders approved the merger agreement with LVB Acquisition, Inc., which is the consortium of Blackstone, Goldman, KKR and TPG. The deal is for $46 a share in cash.

When the initial deal came out at $44 a share, the Internet went crazy. Actually, it was just me. But five months after my first post complaining that the offer was too low, Institutional Shareholder Services agreed. So the consortium raised the bid by $2 a share, and now, it’s a done deal. -

Hedge-Fund Manager Invests Millions In Spouse’s Appearance

Posted by Eddy Elfenbein on September 5th, 2007 at 12:01 pmThe Onion Radio News is on the scene.

-

September Is the Worst Month for the Dow

Posted by Eddy Elfenbein on September 5th, 2007 at 11:15 amCNBC looks at the average monthly performance of the Dow from 1896 to 2007:

Month………% Positive……..% Negative……..Avg % Return

Dec………………71.6………………28.4 ………………1.4

Jan………………64.9………………34.2……………….1.1

Aug………………63.6………………36.4………………1.2

Nov………………61.5………………38.5………………1.1

Jul………………..60.7………………39.3………………1.3

Mar………………60.4………………39.6………………0.7

Oct………………59.1………………40.9………………0.3

Apr………………55.9………………44.1………………1.1

May………………51.4………………48.7………………0.1

Feb………………50.5………………49.5………………-0.2

Jun………………50.0………………50.0………………0.4

Sep………………40.9………………59.1………………-1.2 -

Scholars Link Success of Firms To Lives of CEOs

Posted by Eddy Elfenbein on September 5th, 2007 at 11:06 amGive economists enough data and they’ll try to find links everywhere:

Should shareholders in a company care if the chief executive’s child dies? What if the mother-in-law passes away?

Such things don’t normally figure in investment decisions. But maybe they should, according to a recent study by three finance professors. Mining a trove of Danish government data on thousands of businesses, they were able to track links between CEO-family deaths and the companies’ profitability over a decade.

It slid by about one-fifth, on average, in the two years after the death of a CEO’s child, and by about 15% after the death of a spouse. As for an executive’s mother-in-law, the old jokes seem to hold: The researchers found that profitability, on average, rose slightly after her demise.

The study is part of an emerging — and controversial — area of financial research that delves into the lives and personalities of executives in search of links to stock prices and corporate performance. The trend is an outgrowth of the tendency to lionize CEOs as critical to the businesses they lead. If their performance is so vital, the researchers say, investors should want to know anything that could affect it. -

Donaldson Reports 18th Straight Record Year

Posted by Eddy Elfenbein on September 4th, 2007 at 4:44 pmDonaldson (DCI) just reported a great fiscal fourth quarter. Earnings came in at 53 cents a share, five cents more than estimates. This is the company’s 18th straight record year. Donaldson expects a 19th straight record year with EPS between $1.92 and $2.01.

Here’s the streak:

Year………….Sales……………..EPS

1990…………$422.9……………$0.19

1991…………$457.7……………$0.21

1992…………$482.1……………$0.23

1993…………$533.3……………$0.26

1994…………$593.5……………$0.30

1995…………$704.0……………$0.37

1996…………$758.6……………$0.42

1997…………$833.3……………$0.50

1998…………$940.4……………$0.57

1999…………$944.1……………$0.66

2000…………$1,092.3…………$0.76

2001…………$1,137.0…………$0.83

2002…………$1,126.0…………$0.95

2003…………$1,218.3…………$1.05

2004…………$1,415.0…………$1.18

2005…………$1,595.7…………$1.27

2006…………$1,694.3…………$1.55

2007…………$1,918.8…………$1.83

2008…………$2,100.0…………$1.92 to $2.01 (est) -

A Demon of Our Own Design

Posted by Eddy Elfenbein on September 4th, 2007 at 3:27 pm

Barry Ritholtz was able to get Wiley’s permission to post the first chapter of Richard Bookstaber’s A Demon of Our Own Design: Markets, Hedge Funds, and the Perils of Financial Innovation.

It’s a fascinating account of one man’s experience in the convoluted world of high-stakes derivatives trading. Here are the opening two paragraphs:While it is not strictly true that I caused the two great financial crises of the late twentieth century—the 1987 stock market crash and the Long-Term Capital Management (LTCM) hedge fund debacle 11 years later—let’s just say I was in the vicinity. If Wall Street is the economy’s powerhouse, I was definitely one of the guys fiddling with the controls. My actions seemed insignificant at the time, and certainly the consequences were unintended. You don’t deliberately obliterate hundreds of billions of dollars of investor money. And that is at the heart of this book—it is going to happen again. The financial markets that we have constructed are now so complex, and the speed of transactions so fast, that apparently isolated actions and even minor events can have catastrophic consequences.

My path to these disasters was more or less happenstance. Shortly after I completed my doctorate in economics at the Massachusetts Institute of Technology and quietly nestled into the academic world, my area of interest—option theory—became the center of a Wall Street revolution. The Street became enamored of quants, people who can build financial products and trading models by combining brainiac-level mathematics with -massive computing power. In 1984 I was persuaded to join what would turn out to be an unending stream of academics who headed to New York City to quench the thirst for quantitative talent. On Wall Street, too, my initial focus was research, but with the emergence of derivatives, a financial construct of infinite variations, I got my nose out of the data and started developing and trading these new products, which are designed to offset risk. Later, I managed firmwide risk at Morgan Stanley and then at Salomon Brothers. It was at Morgan that I participated in knocking the legs out from under the market in October 1987 and at Solly that I helped to start things rolling in the LTCM crisis in 1998.You can read the entire first chapter at Barry’s site. Also, here’s the Amazon link.

-

What to Name Your Tech Startup

Posted by Eddy Elfenbein on September 4th, 2007 at 10:04 amEven if you could say Abazab or Eefoof without snickering, would you want to do business with them?

Would you feel OK owning Wakoopa shares in your 401(k)? Telling potential in-laws you met on Frengo? Relying on Ooma to call Grandma?

Silicon Valley is in the midst of a great corporate baby boom. Venture capitalists have pumped $2.5 billion into 400 young Internet companies since the beginning of 2006, compared with $1.3 billion into 236 companies during the previous two years, according to research firm Dow Jones VentureOne.

These entrepreneurial brainchildren have short life expectancies, destined to fight for revenue with the likes of Google, Yahoo and eBay. But still they are being born — and they need names.

Naming a company is far more difficult than naming a child. The name needs to sound snappy, separate its young company from the pack and provide a unique Web address.

Having two Ethans and three Madisons in a kindergarten class can create confusion, even embarrassment, but giving your startup a name that’s already taken guarantees a legal fight you can’t win.Blogs aren’t any easier. I spent days trying to come up with this one. I was THIS close to going with Fiscal Graffiti, but I figured the Led Zep reference might not be a good idea.

Still, I snagged the URL. (See.) -

Feldstein Warns of Recession

Posted by Eddy Elfenbein on September 4th, 2007 at 9:50 amI’m back! I hope everyone had a great Labor Day weekend. Since I’m labor too, I enjoyed my nice long three-day break.

Anyway, I wanted to share with you this article I noticed on Harvard economist Martin Feldstein’s rather dire view of the economy. At the Fed’s annual Jackson Hole shindig, Feldstein said the Fed should cut rates by a full 1%.Lowering interest rates may result in a “stronger economy with higher inflation than the Fed desires,” a situation that Feldstein described as the “lesser of two evils.”

“If that happens, the Fed would have to engineer a longer period of slow growth to bring the inflation rate back to the desired level,” said Feldstein, 67, president of the National Bureau of Economic Research. Some investors speculated that Feldstein was a candidate for Fed chairman before Bernanke was picked to succeed Alan Greenspan.

Bernanke wasn’t in the room for Feldstein’s speech, though most other Fed officials were, along with central bankers and economists from around the world who traveled to the annual mountainside conference hosted by the Kansas City Fed bank.In other words, this isn’t just Trump and Cramer talking about cutting rates.

-

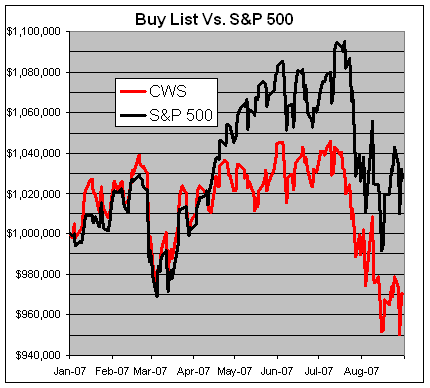

Buy List Update

Posted by Eddy Elfenbein on August 30th, 2007 at 5:06 pmNow that 2007 is nearly two-thirds over, let’s have a look at how our Buy List is doing.

So far, the 20 stocks on the Buy List are down 2.95% (not including dividends) while the S&P 500 is up 2.78%. The Buy List has been 8.7% less than volatile than the S&P 500.

Here’s how the Buy List has performed:

-

Dell’s Earnings

Posted by Eddy Elfenbein on August 30th, 2007 at 4:36 pmDell (DELL) just reported surprisingly good earnings of 32 cents a share.

Dell, like competitors Hewlett-Packard and Apple, profited from lower costs for computer components amid a supply glut. But profit was reduced by payments to its former CEO and 400 employees for stock options that could not be exercised during the company’s internal audit, which found that executives adjusted accounts to meet financial targets.

The big problem is that these aren’t official results. Dell hasn’t filed with the SEC for over a year. Here are the numbers, but bear in mind that they’ll be changed.

Quarter…..Sales….Oper. Income…..EPS

1-97………$2,588………$198………..$0.0675

2-97………$2,814………$296………..$0.0725

3-97………$3,188………$346………..$0.085

4-97………$3,737………$397………..$0.10

1-98………$3,920………$429………..$0.11

2-98………$4,331………$483………..$0.12

3-98………$4,818………$539………..$0.14

4-98………$5,173………$595………..$0.15

1-99………$5,537………$600………..$0.16

2-99………$6,142………$694………..$0.19

3-99………$6,784………$650………..$0.18

4-99………$6,801………$513………..$0.16

1-00………$7,280………$625………..$0.19

2-00………$7,670………$736………..$0.22

3-00………$8,264………$818………..$0.25

4-00………$8,674………$589………..$0.18

1-01………$8,028………$588………..$0.17

2-01………$7,611………$545………..$0.16

3-01………$7,468………$544………..$0.16

4-01………$8,061………$594………..$0.17

1-02………$8,066………$590………..$0.17

2-02………$8,459………$677………..$0.19

3-02………$9,144………$758………..$0.21

4-02………$9,735………$809………..$0.23

1-03………$9,532………$811………..$0.23

2-03………$9,778………$840………..$0.24

3-03………$10,622…….$912………..$0.26

4-03………$11,512…….$981………..$0.29

1-04………$11,540…….$966………..$0.28

2-04………$11,706…….$1,006……..$0.31

3-04………$12,502…….$1,089……..$0.33

4-04………$13,457…….$1,187……..$0.37

1-05………$13,386…….$1,174……..$0.37

2-05………$13,428…….$1,173……..$0.38

3-05………$13,911…….$944………..$0.39

4-05………$15,183…….$1,246……..$0.43

1-06………$14,216…….$949………..$0.33

2-06………$14,094…….$605………..$0.22

3-06………$14,383…….$824………..$0.30

4-06………$14,402…….$801………..$0.30

1-07………$14,622…….$947………..$0.34

2-07………$14,771…….$896………..$0.32

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His