-

Brian Hunter Crying Foul

Posted by Eddy Elfenbein on August 8th, 2007 at 10:29 amFrom today’s WSJ:

Brian Hunter, whose bad bets triggered the collapse of hedge fund Amaranth Advisors LLC, says a federal investigation into his possible involvement in an alleged multibillion-dollar manipulation of the natural-gas markets is hurting the start-up of his new fund venture.

Mr. Hunter said Solengo Capital Advisors has been pushed to “the brink of complete disintegration” by a probe by the Federal Energy Regulatory Commission and resulting civil charges against him and his previous employer, Amaranth. The statement was made in documents filed late last week in the federal District of Columbia court as part of a suit against FERC that Mr. Hunter filed in late July.I wonder if the fact that he lost $6 billion in one week is hurting him as well.

-

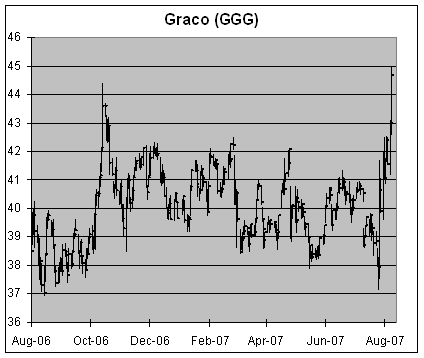

Graco Hits New High

Posted by Eddy Elfenbein on August 7th, 2007 at 5:46 pm

I added Graco (GGG) to the Buy List at the start of this year. So far, it hasn’t been that impressive a stock. The earnings have been blah, and the stock has mostly been stuck in a trading range.

Until today. The shares vaulted past $43 and nearly hit $45. I honestly have no idea what the catalyst was. The next earnings report won’t come for another two months.

Sometimes on Wall Street, you just don’t know what moves a stock. -

Fedipus Rex

Posted by Eddy Elfenbein on August 7th, 2007 at 2:33 pmThe great thing about reading the Wall Street Journal is you never know on what page you’ll find the front page story.

Today’s edition contains an excellent article by Greg Ip and Jon Hilsenrath on the birth and untimely death of the credit boom. Most impressively, the pair got Alan Greenspan to go on the record. This question for any discerning reader (or investor) is, “what’s Mr. Greenspan motive for doing so?“ Well, let’s take a look at what he has to say. Here the maestro defends himself against the charge of bring interest rates too low:

Oh dear lord. This is a completely meaningless answer. We know you face choices, Alan, so does everybody else. The question is, “were those choices correct?” As usual, he refuses to acknowledge his mistake. But that’s not all—and this is the most maddening part. Greenspan now admits that he was the one who was really concerned about a real estate bubble all along. Honest he was.Mr. Greenspan raised vague fears with colleagues over the possibility this policy could create distortions in the economy, but he says today that such risks were an acceptable price for insuring against deflation. “Central banks cannot avoid taking risks. Such trade-offs are an integral part of policy. We were always confronted with choices.”

Looking back, he says today: “We tried in 2004 to move long-term rates higher in order to get mortgage interest rates up and take some of the fizz out of the housing market. But we failed.”

This is a stunning statement. Did it ever occur to him that he failed in large measure to his initial non-mistake? His answer is equal parts disingenuous and disgraceful. First, the Fed has no business managing mortgage interest rates. Yet in 2004, it was Greenspan who urged investors to get adjustable-rate mortgages.

-

Fed Statement

Posted by Eddy Elfenbein on August 7th, 2007 at 2:15 pmNo rate change.

Here’s the statement:The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth was moderate during the first half of the year. Financial markets have been volatile in recent weeks, credit conditions have become tighter for some households and businesses, and the housing correction is ongoing. Nevertheless, the economy seems likely to continue to expand at a moderate pace over coming quarters, supported by solid growth in employment and incomes and a robust global economy.

Readings on core inflation have improved modestly in recent months. However, a sustained moderation in inflation pressures has yet to be convincingly demonstrated. Moreover, the high level of resource utilization has the potential to sustain those pressures.

Although the downside risks to growth have increased somewhat, the Committee’s predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the outlook for both inflation and economic growth, as implied by incoming information. -

Stockbroker Charged With Trying to Kill Canadian Finance Minister

Posted by Eddy Elfenbein on August 7th, 2007 at 2:05 pmWow, I didn’t know Canada even had a finance minister.

Here’s the 411:A stockbroker from Louisiana has been charged with threatening to kill Finance Minister Jim Flaherty and his family.

The U.S. Attorney’s Office alleges that 59-year-old Lloyd Dewitt Tiller, Jr., of Shreveport, La., sent threatening e-mails to the Canadian official late last year and early this year.

Mr. Tiller allegedly claimed he and his clients lost almost $6-million after Mr. Flaherty’s decision to tax income trusts last fall.

In the first e-mail, sent on Nov. 13, he threatened to hurt Mr. Flaherty.

In the second, sent Jan. 18, he “threatened to injure both Mr. Flaherty and members of his family,” the U.S. Attorney for the Western District of Louisiana, Donald Washington, wrote in a statement.

In February, a plainclothes guard was assigned to Mr. Flaherty after investor anger over the Conservatives’ income-trust tax. The minister’s office at the time refused to discuss whether a death threat prompted the extra security measures.

Global News reported Monday night that Mr. Tiller allegedly wrote that “I am going to cut your … throat … you can’t hide, I will find you,” and “You have killed my business as a stockbroker … you have ruined my life and many of my clients life (sic) and I hear you think it is funny.”You realize that sending a death threat by email would make the shortest Law & Order episode ever.

-

Curious Merger Math

Posted by Eddy Elfenbein on August 7th, 2007 at 9:53 amThis is an interesting article from Business Week on the unusual math that surrounds corporate mergers:

For six years private equity firm Thomas H. Lee Partners tapped the credit markets to buy one consumer-products brand after another and roll them all up into United Industries Corp. But even though United’s total debt jumped from $375 million to $860 million by 2005, its leverage—one measure of a deal’s riskiness—didn’t move much.

How could that be? Part of it was the magic of merger math, a naturally occurring phenomenon that has helped drive $1 trillion in buyouts since the boom began in 2004. It’s a pretty simple illusion that happens when a company with a lot of leverage buys one with less. That combined debt load is then spread across all the assets of the new corporate entity. So some key measures of leverage often remain the same or even drop, making it appear from one angle as though there were no additional risk. That can be true even if the acquirer pays the seller a premium, which is usually the case. -

Hilary Kramer on Danaher

Posted by Eddy Elfenbein on August 7th, 2007 at 9:10 am(Via Altucher). I’m often surprised that Danaher (DHR) isn’t better known. Here’s Hilary Kramer’s view:

A leader in the industrial sector, Danaher Corp. (NYSE:DHR) designs, makes and markets brand name products, services and tech across three categories: Professional Instrumentation (electronic testing, environmental, and medical technologies); Industrial Technologies (motion and product Identification; aerospace and defense, power quality, and sensors and controls); and Tools & Components (which include mechanics’ tools and general tools under brand names such as Craftsman.)

It is a leader in many of its classes, with names like Fluke (handheld electronic and network test equipment), Gilbarco Veeder-Root (retail petroleum dispenser market), and Hach/Lange (water analytics). A huge company in the industrial sector can sometimes seem overwhelming (what ARE all of these things, after all? you might ask…), but the thing to know first is that Danaher is solid as they get, with great margins, good management, and is well positioned for continuing growth, particularly through acquisitions.

On July 19, after DHR’s excellent second quarter earnings report, Goldman Sachs wrote that Danaher was “well-positioned” for the 2H2007 upside. Time to get in now, its report suggested, and I agree. It set a nice price target of $90. With low operating risk, and consistent growth of revenue, Danaher is a safer pick. Plus, as the Goldman report points out, it is “a leader in defensive growth markets like water, electronic test, and medical,” making its price less susceptible to the recent jitters in the market.

Type of Stock: An industrial designer, manufacturer, and marketer, Danaher is a leader in its class in many areas, and has demonstrated solid growth in areas less likely to suffer by market instability.

Price Target: Trading now at $75.80, I agree with the Goldman target of $90 and feel Danaher is well positioned to even exceed this. -

“He Has No Idea How Bad It Is Out There”

Posted by Eddy Elfenbein on August 6th, 2007 at 9:09 amVia B-Riz: Jim Cramer pleads for a Fed rate cut.

Barry’s site has more complete with remix. -

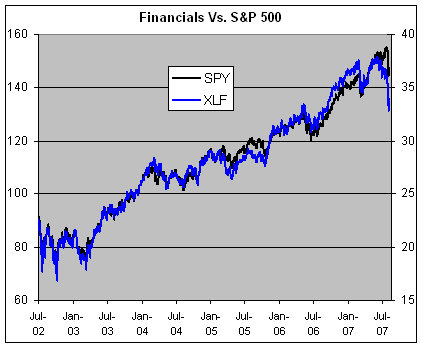

Financial Stocks Sink

Posted by Eddy Elfenbein on August 3rd, 2007 at 11:27 amHere’s an interesting chart. This shows the performance of the S&P 500 Spyders (black line, left scale) compared with the Financial Spyders (blue line, right scale). These include dividends.

This is an interesting chart because it shows two things. First, you can see how closely the financial sector tracked the overall market for the last five years. It never really overperformed or underperformed.

The second part is that you can see how much that relationship has broken down in the past few weeks. Financial stocks have been getting clobbered far worse than the market. -

The Global Economy

Posted by Eddy Elfenbein on August 3rd, 2007 at 9:53 amHere’s one way of looking at it:

At the start of July, Tunisia hired Daiwa Securities SMBC Co. and Nikko Citigroup Ltd. to help its central bank sell yen- denominated bonds. By the time the fund raising finished this week, Tunisia’s borrowing costs had risen by almost a quarter of a percentage point.

So the taxpayers of an African nation suffer because Joe Blow in Detroit can’t pay his mortgage.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His