-

This Just In

Posted by Eddy Elfenbein on June 20th, 2007 at 9:57 am -

A Good Run Doesn’t Mean a Stock is Too Expensive

Posted by Eddy Elfenbein on June 20th, 2007 at 9:53 amA quick note on FactSet (FDS). This is a good reminder that just because a stock is up doesn’t mean it’s too expensive. FactSet was on last year’s Buy List and it rose 37.2% making it our second-best performer. I decided to keep it on this year’s Buy List and it’s up 20.6% so far, again our second-best performer.

Also, just because a stock is down doesn’t mean it’s cheap. I’ve often heard people say, “how much lower can it go?” The answer is, a lot. A whole lot. I remember my finance professor explaining how low zero is. A $100 stock can drop 90%, then another 90%, then another 90% and it’s still not at zero. In fact, it can drop 90% infinitely and still not be at zero. Zero is really, really, really, REALLY small, and that’s how low it can go. -

Oh Dear Lord

Posted by Eddy Elfenbein on June 19th, 2007 at 5:08 pm -

The Vietnam War Is Officially Over

Posted by Eddy Elfenbein on June 19th, 2007 at 4:04 pmMr. Carter added that he was looking forward to the day the first Vietnamese company lists on the NYSE.

Suck on that, hippies.

-

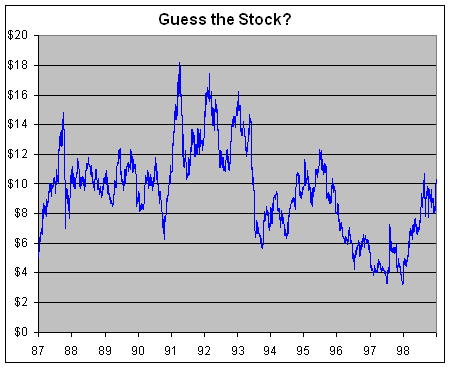

Guess the Stock

Posted by Eddy Elfenbein on June 19th, 2007 at 3:27 pmHere’s a 12-year chart:

Give up? Answer is after the jump. -

When Wall Street Couples Cash Out

Posted by Eddy Elfenbein on June 19th, 2007 at 11:38 amFrom the LA Times:

The flood of cash into so-called hedge fund communities in New York, Connecticut and California has proved fatal to many marriages — and a windfall for lawyers, psychiatrists and forensic accountants who specialize in the superrich.

“There is no question that a huge infusion of wealth to relatively young people has a disastrous effect on the marriage’s stability,” says Bern Clare, a Manhattan divorce lawyer.

Divorce hedge fund-style often means the judges involved must cope with pre- and post-nuptial agreements, years of fights over access to hedge fund accounts and monetary demands well into eight and nine figures.

“When you are dealing with the uber-wealthy, you are dealing with the uber-lawyers,” says Kevin Tierney, the presiding judge of the family division in the Stamford-Norwalk district of Connecticut, where many hedge fund families live. “They have accountants and paralegals and dueling experts.”

Further complicating matters is that the value of the assets involved, unlike real estate or jewelry, is highly variable, depending on the gyrations of the stock market and other investments.

“You can have an asset change by $1 million while a witness is on the stand,” Tierney says. -

FactSet Beats Estimates

Posted by Eddy Elfenbein on June 19th, 2007 at 8:58 amFactSet Research Systems (FDS) just reported very good earnings. After charges, the company earned 52 cents a share, a penny higher than forecasts. Sales rose 23% to $121.1 million. FDS also said it expects sales this quarter of $126 million to $130 million while analysts were expecting sales $125 million.

-

Town Has Its Own Currency

Posted by Eddy Elfenbein on June 19th, 2007 at 8:44 amNot only is the dollar losing support overseas, it’s not even doing well in Massachusetts.

“I just love the feel of using a local currency,” said Trice Atchison, 43, a teacher who used BerkShares to buy a snack at a cafe in Great Barrington, a town of about 7,400 people. “It keeps the profit within the community.”

There are about 844,000 BerkShares in circulation, worth $759,600 at the fixed exchange rate of 1 BerkShare to 90 U.S. cents, according to program organizers. The paper scrip is available in denominations of one, five, 10, 20 and 50.

In their 10 months of circulation, they’ve become a regular feature of the local economy. Businesses that accept BerkShares treat them interchangeably with dollars: a $1 cup of coffee sells for 1 BerkShare, a 10 percent discount for people paying in BerkShares.Interesting idea. My only problem is the fixed exchange rate. No exchange rate is truly fixed, as the users of BerkShares will one day learn.

-

Breaking: Terry Semel Resigns

Posted by Eddy Elfenbein on June 18th, 2007 at 4:42 pmTerry Semel is out at Yahoo (YHOO). The stock is up in the after-hours market. Susan Decker has been named president.

Two months ago, I wrote:I say that Decker will replace Terry Semel before the summer is over.

Even I was too optimistic since summer doesn’t start for a few more days.

-

The Lula Rally

Posted by Eddy Elfenbein on June 18th, 2007 at 6:53 amYale’s Robert Shiller looks at the Brazilian stock market. Since Lula took over in 2002, the stock market is up over 300%.

Stock-market movements are certainly hard to explain, but there are reasons to believe that Brazilians might be rationally exuberant. Corporate earnings in Brazil have gone up roughly as fast as stock prices. With the price/earnings ratio remaining stable and moderate, the stock-market boom does not appear to reflect mere investor psychology.

On the contrary, the real question is why the increase in stock prices has not outpaced growth in corporate earnings.Apparently, leftists are having a love affair with the stock market. Or at least, a good stock market.

Well, maybe not all leftists. Hillary’s gone 100% cash:Given her history — recall her preposterous cattle future windfall — Mrs. Clinton is bound to be sensitive about her financial dealings. But in recent history, few candidates have felt compelled to go to an all-cash asset allocation to avoid potential conflicts. Al Gore, who in 2000 made a point of saying he avoided all stock-market investments, is a notable exception, if not one Mrs. Clinton should be eager to emulate. His populist campaign riff was a bust.

But in retrospect, wasn’t Gore’s timing pretty good? (Also, going by the numbers, I’m not sure his campaign was a bust.)

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His