-

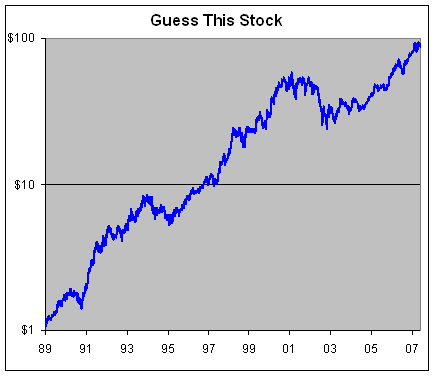

Guess This Stock

Posted by Eddy Elfenbein on May 22nd, 2007 at 2:04 pmHere’s a blatant ripoff of a feature at the Kirk Report: Can you guess what stock this is?

Here are some clues:

It’s up nearly 100-fold in the last 19 years (plus another seven-fold with dividends).

The stock currently pays a 4% dividend.

It’s based in the U.S., but half the company is owned by a French company.

Give up? The answer is… -

The Science of Central Banking

Posted by Eddy Elfenbein on May 22nd, 2007 at 12:12 pmHere’s a very odd story. The Bank of China recently raised interest rates by 18 basis points and its one-year deposit rate by 27 basis points. Strange that both numbers are divisible by nine. Strange, but no accident. You see, in China, all interest rates set to multiples of nine. Would you believe it has to do with the abacus?

No, really. -

Putin Wants Oil Revenue for Stock Market

Posted by Eddy Elfenbein on May 22nd, 2007 at 10:45 amHere’s an unpleasant headline:

Putin wants oil revenue to go into Russian stock market

President Vladimir Putin urged the Russian government Monday to bolster the country’s flagging equity market by pumping surplus oil revenue into stocks.

The government should consider buying Russian blue chips with excess oil revenue instead of foreign securities, Putin said at a cabinet meeting in Moscow that was broadcast on NTV television.

Chris Weafer, chief strategist at Alfa Bank in Moscow, said, “You would expect to see that money going into companies like Rosneft, Gazprom and VTB Group rather than the broader market.” Weafer added, “The danger is trying to achieve a valuation target, which would only be a short-term fix.”It could be worse. The last time Russia had surging revenue from the high price of oil, the country put it to work. In Afghanistan.

-

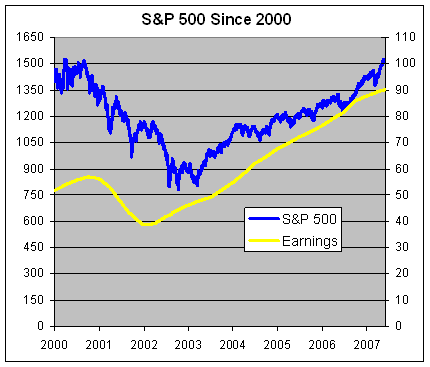

Earnings Since 2000

Posted by Eddy Elfenbein on May 22nd, 2007 at 9:37 amHere’s the S&P 500, along with its earnings, since 2000. The earnings line is in gold and it follows the right scale. The left and right scales are at 15-to-1, so when the lines cross, the market’s P/E ratio is 15. Since the market peaked seven years ago, earnings are up 70%.

-

It’s Official: CBS Snags Wallstrip

Posted by Eddy Elfenbein on May 22nd, 2007 at 9:36 am -

The Hottest Billionaire Heiresses

Posted by Eddy Elfenbein on May 21st, 2007 at 4:17 pmForbes looks at the Hottest Billionaire Heiresses.

(Wait a sec. Doesn’t Steve Forbes have five daughters?) -

Close, but No

Posted by Eddy Elfenbein on May 21st, 2007 at 4:03 pmThe S&P 500 closed today at 1525.10, just shy of the record close of 1527.46.

(Hey, we’ve been waiting seven years. What’s a few more days?) -

The Nasdaq Goes Fibonacci

Posted by Eddy Elfenbein on May 21st, 2007 at 1:22 pmBrace yourself: The Nasdaq Composite is currently stuck at 2,584.

Why is that important? Because it’s a Fibonacci number!

(Shaking You Furiously)

OK, so why’s that important? Er, I have no clue. But other people seem to think it’s important so I’m running with it.

Here’s a look at the Nasdaq with Fibonacci Numbers in blue.

If the you divide a Fibonacci Number by the one directly below it, you get the Golden Ratio.

(Seriously, did that just blow your fucking mind??) -

Shanghai Update

Posted by Eddy Elfenbein on May 21st, 2007 at 1:16 pmSpeaking of the Chinese market. Remember how everyone panicked where the Shangai market plunged? Measuring from the 9% correction on February 27, the Shangai Composite is up 45%.

I think we all know how this story ends. -

The Stock and Bond Market Part Ways

Posted by Eddy Elfenbein on May 21st, 2007 at 1:09 pmAs the stock market keeps chugging higher, the bond market is starting to leave it behind. As a very general rule, the bond market leads the stock market by a few months. In the chart below, I’m using the BTTRX mutual fund as my bond proxy. Note how the bond market (the gold line) started fall behind the stock market before the Shanghai Surprise in February.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His