-

Seven Straight Up Days for the Dow

Posted by Eddy Elfenbein on April 10th, 2007 at 11:34 amThe Dow has risen for the last seven sessions. Today could be day #8, but we’re currently down 3.9 points.

The Dow last had an eight-session win streak four years ago, at the beginning of the bull market. The Dow hasn’t had a nine-session win streak in over ten years.

In1987 when the Dow rose for the first 13 trading days of the year. Of course, we know what happened later that year.

The Dow rallied for 12 straight days twice, once in 1929 and again in 1970. The streak in 1929 came right after a six-day win streak for a combined 18-of-19 streak. Again, we know what happened later that year.

The record is from 1897 when the Dow rose for 14 straight days. -

Earnings Preview: Bed Bath & Beyond

Posted by Eddy Elfenbein on April 10th, 2007 at 10:47 amTomorrow, Bed Bath & Beyond (BBBY) reports its fourth-quarter earnings. Like many retailers, the company’s fourth-quarter ends in February so it can take in the entire holiday shopping season. That’s a big time for BBBY. Historically, more than one-third of their profits come during the fourth quarter.

Sales have been growing in the low double-digit rate for the past few quarters, so I’m looking for a top-line number of about $1.9 billion. That works out to about 12.7% growth which should give the company a net earnings figure of about $222 million, or roughly 78 cents a share, which is exactly what the company told us to expect. It could be slightly higher or lower, but either way the company’s results are fairly easy to forecast. Despite what many people think, the slowdown in housing doesn’t affect BBBY that much.

The company has also warned us of a $40 million charge, or about 14 cents a share, to help employees out with the tax consequences of options grants. This came about as the part of the company’s options review.

I also expect BBBY to give us a peak at what they expect for this year. I think the company should be able to make about $2.40 a share this year. Barron’s mentioned earlier this year that if BBBY exceeds its conservative expectations, the stock can go to the upper-$40s, which certainly seems reasonable.

On last quarter’s conference call, the company said that it’s targeting sales and EPS growth of 10% a year. I think they’re obviously low-balling, but that’s how they do things. The other thing to watch is BBBY’s number of outstanding shares. The company has been buying back its stock at a nice pace for the past few years.

For some reason, $43 a share has been like Krypton for this stock. Let’s hope that changes in the next few weeks.

The AP has more. -

Wall Strip Looks at the Refiners

Posted by Eddy Elfenbein on April 10th, 2007 at 9:41 amHere’s a trend I wish I had spotted early on. The oil refinery stocks have been spectacular for the past five years. In today’s Wall Strip, Lindsay looks at two in particularly, Valero Energy (VLO) and Tesoro (TSO).

From its 2002 low, Valero’s stock is up more than tenfold. Tesoro’s rise has been ever more dramatic. In October of 2002, the stock closed as low as $1.33, and it’s currently over $107.

The good times may be coming to an end. Earnings for both stocks are expected to slip this year and next. Also, the price of oil took a big hit yesterday. -

Buffett Goes Off the Rails

Posted by Eddy Elfenbein on April 9th, 2007 at 12:45 pm

Warren Buffett is investing in railroads:Warren Buffett’s company recently invested in three railroads, and in the process, Berkshire Hathaway Inc. became the largest shareholder in the Burlington Northern Santa Fe Corp., according to a company filing and a media report that the company confirmed.

The disclosure sent Burlington Northern shares up more than 7 percent in midday trading Monday.

Omaha-based Berkshire Hathaway revealed in a filing with the Securities and Exchange Commission that it owned 39 million shares of Burlington Northern as of last Thursday. The cable network CNBC reported Buffett said Berkshire had also invested in two other railroads that he declined to name. -

The Solengo Kerfluffle

Posted by Eddy Elfenbein on April 7th, 2007 at 7:40 pmBefore the suits find out, you can download the Solengo Capital marketing piece here.

(Hat Tip: Gary Weiss). -

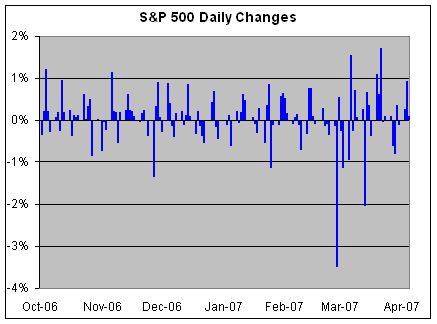

Volatility Returns! Then Leaves

Posted by Eddy Elfenbein on April 5th, 2007 at 2:26 pmRemember how volatility finally returned on February 27? Well, it turns out that it didn’t stick around for too long.

Following 2/27, the S&P 500 had three +1% days and one -2% day, but in the last two weeks, the market has gone back to being as dull as usual.

For the last ten days, the S&P 500 has had an average daily swing of 0.49%, which is just about what it did for the six months prior to 2/27.

The Volatility Index (^VIX) is back below 13 today. -

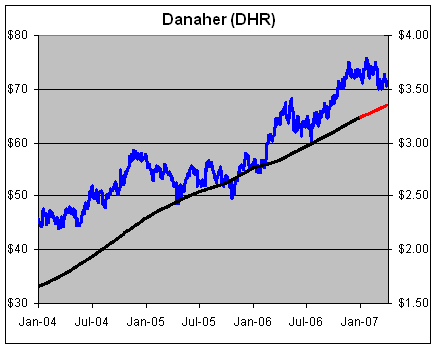

Danaher (DHR)

Posted by Eddy Elfenbein on April 5th, 2007 at 12:45 pmI’m surprised more people don’t know about Danaher (DHR), especially considering how many people pay 2/20 to hedge fund managers who don’t have a prayer of beating DHR.

Earnings will come out two weeks from today. The company has already given us a range of 75 to 77 cents a share, which probably means 77 or 78 cents a share.

For last year’s first quarter, Danaher made 66 cents a share, so were talking about pretty good earnings growth. S&P just reported that earnings growth for the S&P 500 officially came in below 10% for fourth quarter, the first time that’s happened in 18 quarters.

Here’s a chart of Danaher (blue line is price, black is EPS and red is the forecast):

The right and left axes are scaled at 20-to-1, so when the lines cross, the stock has a P/E ratio of 20. -

The Real Estate Roller Coaster

Posted by Eddy Elfenbein on April 4th, 2007 at 10:17 pm -

Is It Too High or Too Low?

Posted by Eddy Elfenbein on April 4th, 2007 at 10:16 amHere’s something to consider. This is a chart of Apple‘s (AAPL) stock for the first five years after its IPO.

In June 1983, the stock ran up to $7.84 a share (adjusted for three 2-for-1 splits), then plunged about 75% to less than $1.82 a share. So it was overpriced at $7.84, right?

But if you were unlucky enough to have bought it at the exact top, the stock is still up about 1,100% since then compared with 775% for the S&P 500. Including dividends, the S&P 500 would still come out ahead, but it’s interesting to think about “too expensive” means. -

Subprime Homsick Blues

Posted by Eddy Elfenbein on April 4th, 2007 at 9:37 amJames Surowiecki looks at the subprime mess:

The backlash against the subprime lenders is understandable, since their business practices were often reckless and deceptive. Instead of responding to the slowdown in the housing market by cutting back their lending, they pressed their bets—last year, six hundred billion dollars’ worth of subprime loans were issued. Many of the lenders hid their troubles from investors, even as their executives were dumping stock; between August and February, for instance, New Century insiders sold more than twenty-five million dollars’ worth of shares. And there’s plenty of evidence that some lenders relied on what the Federal Reserve has called “fraud” and “abuse” to push loans on unwitting borrowers.

For all that, “predatory lending” is a woefully inadequate explanation of the subprime turmoil. If subprime lending consisted only of lenders exploiting borrowers, after all, it would be hard to understand why so many lenders are going bankrupt. (Subprime lenders appear to have been predators in the sense that Wile E. Coyote was.) Focussing on lenders’ greed misses a fundamental part of the subprime dynamic: the overambition and overconfidence of borrowers.It’s seems that subprime lenders are in a never-ending cycle. If their standards are too loose, they’re accused of being predatory. If their standards are too tight, then they’re accused of “redlining.”

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His