-

I’m Glad I Don’t Own This Stock

Posted by Eddy Elfenbein on December 24th, 2006 at 2:57 pmA letter to the editor in today’s Washington Post:

The largest employer in the world announced on Dec. 15 that it lost about $450 billion in fiscal 2006. Its auditor found that its financial statements were unreliable and that its controls were inadequate for the 10th straight year.

Oh wait, I guess I do own this stock.

-

The ‘Wow’ Factor

Posted by Eddy Elfenbein on December 24th, 2006 at 12:44 pmEleven months ago, Ford (F) unveiled its “The Way Forward” restructuring plan. Today, George Will takes a look at how things are going:

Mulally’s vision for Ford is forward-looking nostalgia. He wants to restore Ford to the role it had in “the middle America that we grew up with.” But to “spiff up the blue oval” — Ford’s trademark — he must market cars designed on the assumption that gasoline prices “are staying up.” He talks about the need to “take the hard decisions” and “rationalize our product family” with a “simplified product portfolio.” He stops short of talking — yet — about scrapping brands. But why is the company still making the Mercury, the average age of whose buyers is 55? Perhaps because it cost General Motors $1 billion — payments to dealers, etc. — to eliminate the Oldsmobile brand.

Mulally says production efficiencies can solve half the company’s economic problem. That will not suffice unless Ford efficiently produces exciting products. Mulally, a quick study, already has a rudimentary grasp of Detroit-speak: He says Ford must develop new products “with curb appeal — the ‘wow’ factor.”

But in 2001, with much fanfare, Ford rolled out a new version of a 1950s success, the Thunderbird. It was underpowered, handled badly and is no longer in production. Recently, the company heavily advertised the Lincoln Zephyr. But now it is called the MKZ. Why? This is the behavior of a company whose left hand does not know what its other left hand is doing. -

CEO Tells Truth, Apologizes

Posted by Eddy Elfenbein on December 22nd, 2006 at 1:23 pmSeagate CEO: I help people “watch porn”

We begin counting, now. One, two, thr…

Seagate CEO apologizes for porn remark -

Dow Flirts with 12,500, Gets Number, Never Calls

Posted by Eddy Elfenbein on December 22nd, 2006 at 10:51 amYawn. Talk about light volume, not a trader is stirring. The market is down again today after coming oh-so-close to breaking the elusive 12.5K barrier on Wednesday.

Walgreen (WAG) is up on an impressive earnings report. I like WAG a lot. It’s a great company, but I think the shares are a bit pricey here. The stock pulled back earlier this year, and it seems to have bounced off $40. Ideally, I’d like to see it go lower before I’d be interested.

I strongly considered adding Progressive (PGR) to the Buy List, but in the end, I went with WR Berkley (BER). I’m happy with my choice, but make no mistake, Progressive is another great company. But I’m not so positive on the company’s outlook for this year. Either way, this is one to keep an eye on.

In case you missed it, here’s my Buy List for 2007:

AFLAC (AFL)

Amphenol (APH)

Bed Bath & Beyond (BBBY)

Biomet (BMET)

Donaldson (DCI)

Danaher (DHR)

FactSet Research Systems (FDS)

Fair Isaac (FIC)

Fiserv (FISV)

Graco (GGG)

Harley-Davidson (HOG)

Jos. A Bank Clothiers (JOSB)

Medtronic (MDT)

Nicholas Financial (NICK)

Respironics (RESP)

SEI Investments (SEIC)

Sysco (SYY)

UnitedHealth Group (UNH)

Varian Medical Systems (VAR)

WR Berkley (BER)

I’ll start tracking these stocks on the first day of trading of 2007. -

“Cramer” on WallStrip

Posted by Eddy Elfenbein on December 22nd, 2006 at 10:19 amLindsay has a special guest audition.

“Shirt on.”

Here’s another Cramer outtake. -

The Stock Market in 3D

Posted by Eddy Elfenbein on December 22nd, 2006 at 7:43 am

From Information Aesthetics:an artistic 3D visualization of New York stock exchange data. “I Deal Solution” uses the spiral metaphor for its ability to translate 1-dimensional data into 3-dimensional space. in practice, the sphere size corresponds to the stock price, color to change, vibration to relative change, sphere position on spiral to volume, & sound to total percentual change. “the point is not to transmit a particular meaning but rather to express the power of energy concentrated in space information”.

Plus, it weirdly aligns with the Wizard of Oz.

-

Coastal Financial Soars on Buyout

Posted by Eddy Elfenbein on December 21st, 2006 at 1:36 pmAs long-time readers know, periodically I’ll write about little-known stocks that have strong businesses, but are unheard of on Wall Street. I’ve never understood why everyone wants to own the next Google or Apple, instead of investing in proven, well-run businesses.

Last year, I mentioned three micro-cap financial stocks; NewMil Bancorp, Northern Empire Bancshares (NREB) and Coastal Financial (CFCP). These are all great stocks, just no one knew about them.

Well, someone found out. In April, NewMil was bought out for a 41% premium. Then in September, Northern Empire agreed to a buyout for a 22% premium. The only one left was little Coastal. I was still a fan. A few weeks ago, I even mentioned CFCP as a contender for the 2007 Buy List.

Today Costal announced that it’s being bought by BB&T (BBT) for $395 million or $17.04 a share. That’s an 18% premium to yesterday’s close. -

Random Thoughts

Posted by Eddy Elfenbein on December 21st, 2006 at 1:05 pmI watch CNBC in my office with the sound muted. Strangely, even with no sound, I can always understand what Rick Santelli is saying.

Also, if you’re looking for high CD yields, check out Bank Deals. This is a cool site. It lists high-yielding bank rates all around the country. Many require branch visits or in-state residency to qualify (though not all). Check it out, there might be a six-percenter near you.

And finally, Lenny Dykstra—all-star centerfielder, all-star options trader. -

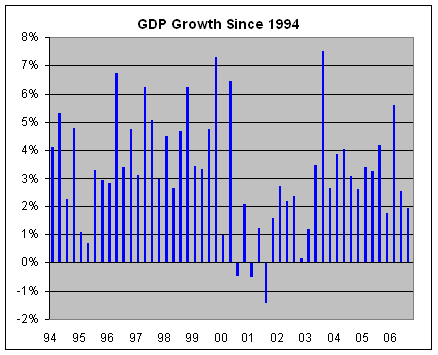

3Q GDP Revised to 2.0%

Posted by Eddy Elfenbein on December 21st, 2006 at 10:11 amThis morning, the government revised third-quarter GDP growth to 2.0%. The initial estimate was for 1.6%. Then it went to 2.2%, and now it’s back to 2.0%.

Here’s a look at GDP growth going back to 1994:

-

Sarkozy Calls Shareholders Hooligans

Posted by Eddy Elfenbein on December 21st, 2006 at 9:45 amFrom Nicolas Sarkozy, a candidate for president of France:

Our country has to get organised to stop the actions of shareholders who… aren’t entrepreneurs but who behave like hooligans….

As a proud shareholder hooligan, I almost take offense. By the way, Sarkozy is running as the free-market reformer.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His