-

Three Days Left

Posted by Eddy Elfenbein on December 26th, 2006 at 5:21 pmWith just three trading left in 2006, the Buy List is up 10.76% for the year compared with 13.51% for the S&P 500 (this doesn’t include dividends). The Buy List is about 20% more volatile than the S&P 500.

-

Cintas

Posted by Eddy Elfenbein on December 26th, 2006 at 3:27 pmLast week, Cintas (CTAS), the uniform maker, missed its earnings by a penny a share. So the stock is down about 300 pennies. Now we have to ask, should an earnings miss have a p/e ratio of 300? Time will tell.

Shares of CTAS were incredibly popular during the 90s. The stock went up and up and up some more. By the end of the decade, the stock was going for 60 times earnings. Talk about a good company and a lousy stock. This decade, shares of CTAS haven’t done much but the earnings keep climbing.

Check out this chart. Rising earnings, falling multiples and a flat stock.

-

Corporate Profits and the Economy

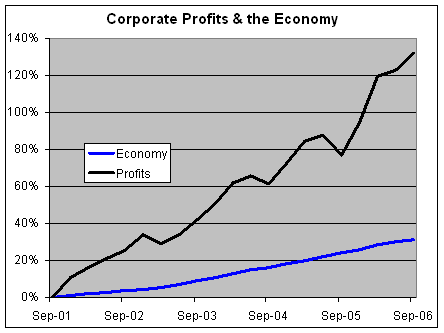

Posted by Eddy Elfenbein on December 26th, 2006 at 9:40 amSince September 2001, the U.S. economy has grown by about 31%, but corporate profits are up by 132%.

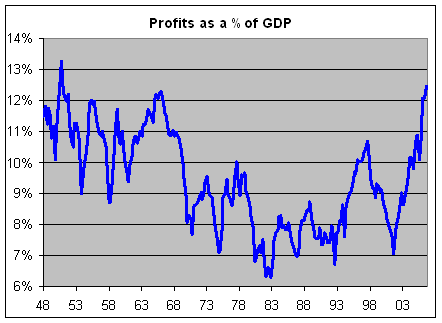

Corporate profits now represent over 12.4% of the national economy, which is the highest level in over 50 years. The average is usually around 9.5%.

Think of this as an economy-wide profit margin. Profits typically grow faster than the economy during a recovery, and fall faster than the economy during a recession. -

Merry Everything!

Posted by Eddy Elfenbein on December 25th, 2006 at 7:36 am

I want to wish everyone a Happy Holiday, and a healthy and profitable New Year.

I also want to thank all my readers for their support. I think I must have the best readers on the Internets. I simply could not run this site without your feedback. In the last 12 months, Crossing Wall Street has received over 800,000 hits. Imagine Woodstock, but everyone with a laptop pointed right here. Scary.

The Buy List is up over 10% for the year, which isn’t too shabby, especially considering all the bearish sentiment we’ve had to put up with. So if you followed my (free) advice, I made you over $1 million (assuming you had $10 million to start with).

I try to make this site as transparent as possible. My picks are here for the whole world to see. I try to be candid about my big winners (like FactSet, Harley and SEI Investments) as I am with my lousy picks (like Dell and UnitedHealth). Let’s hope 2007 will be another “up” year.

There are a few people I want to thank for their support. Barry Ritholtz not only runs a great blog, but he’s been very generous about “spreading the wealth” to me and other bloggers. James Altucher has also linked to me many times through his Daily Blog Watch at TheStreet.com. Also, Abornmal Returns (another great site) has generously linked to me, and so has Charles Kirk at the Kirk Report.

Seeking Alpha has also been a big supporter. John Carney and the gang at DealBreaker run one of my favorite sites, and they’ve been big supporters. I also can’t forget Howard, Lindsay and the crew at WallStrip for keeping investing fun.

Here’s an odd bit of trivia I’ve never revealed before. I came this close to calling the blog Fiscal Graffiti (get it), but I changed at the last minute. Here look, click on www.fiscalgraffiti.com. See! Same thing for Wall Street Crossing.

I’m frequently complimented on the layout and design of this site. I wish I could take the credit, but I had absolutely nothing to do with it. All the credit goes to the very talented Kristin Rule at Callisto Design Studio. Also, Michael Auger is the artist of the little cartoon guy at the top. And lastly, Mark Anderson has been my tireless hoster who has kept this running all year. Thank you all! If you ever need their services, I highly recommend them. Or you can just send them lots of money, they won’t mind.

Finally, I give you this. -

Forbes Profiles W.R. Berkley

Posted by Eddy Elfenbein on December 24th, 2006 at 7:09 pmForbes takes a look at W.R. Berkley (BER), one of my new additions to the Buy List:

From its founding in 1967 commercial property casualty insurer W.R. Berkley (nyse: BER – news – people ) has thrived in a notoriously competitive business by going after underserved niche markets. “We didn’t have the resources to compete head-on with the big players,” says Chairman William R. Berkley. “This evolved into a corporate strategy.”

The Greenwich, Conn. company is now the ninth-largest commercial property casualty insurer in the U.S., operating in all 50 states. It has a five-year average annual earnings-per-share growth of 39% and a 24% return on equity for the past 12 months. Of the company’s 31 operating units, 25 were built from scratch internally; 6 were made through acquisitions.

Last year Berkley opened five new businesses, including one that specializes in aviation liability insurance for small regional airlines. That came after hiring a group of experienced aviation insurance experts. “Business opportunities lie in finding good people,” says Berkley.

Each operating unit runs autonomously and is based as close as possible to its customers. A Maine subsidiary, for example, sells liability insurance to fishing fleets and lumber companies. An Iowa unit insures grain elevators and farm supply stores.

Berkley, 61, says he has no plans to retire, but is grooming his son, W. Robert Berkley Jr., 34, to take over eventually. Meantime, the boss disdains complacency: “It’s a constant process of being dissatisfied with the status quo,” he says. -

I’m Glad I Don’t Own This Stock

Posted by Eddy Elfenbein on December 24th, 2006 at 2:57 pmA letter to the editor in today’s Washington Post:

The largest employer in the world announced on Dec. 15 that it lost about $450 billion in fiscal 2006. Its auditor found that its financial statements were unreliable and that its controls were inadequate for the 10th straight year.

Oh wait, I guess I do own this stock.

-

The ‘Wow’ Factor

Posted by Eddy Elfenbein on December 24th, 2006 at 12:44 pmEleven months ago, Ford (F) unveiled its “The Way Forward” restructuring plan. Today, George Will takes a look at how things are going:

Mulally’s vision for Ford is forward-looking nostalgia. He wants to restore Ford to the role it had in “the middle America that we grew up with.” But to “spiff up the blue oval” — Ford’s trademark — he must market cars designed on the assumption that gasoline prices “are staying up.” He talks about the need to “take the hard decisions” and “rationalize our product family” with a “simplified product portfolio.” He stops short of talking — yet — about scrapping brands. But why is the company still making the Mercury, the average age of whose buyers is 55? Perhaps because it cost General Motors $1 billion — payments to dealers, etc. — to eliminate the Oldsmobile brand.

Mulally says production efficiencies can solve half the company’s economic problem. That will not suffice unless Ford efficiently produces exciting products. Mulally, a quick study, already has a rudimentary grasp of Detroit-speak: He says Ford must develop new products “with curb appeal — the ‘wow’ factor.”

But in 2001, with much fanfare, Ford rolled out a new version of a 1950s success, the Thunderbird. It was underpowered, handled badly and is no longer in production. Recently, the company heavily advertised the Lincoln Zephyr. But now it is called the MKZ. Why? This is the behavior of a company whose left hand does not know what its other left hand is doing. -

CEO Tells Truth, Apologizes

Posted by Eddy Elfenbein on December 22nd, 2006 at 1:23 pmSeagate CEO: I help people “watch porn”

We begin counting, now. One, two, thr…

Seagate CEO apologizes for porn remark -

Dow Flirts with 12,500, Gets Number, Never Calls

Posted by Eddy Elfenbein on December 22nd, 2006 at 10:51 amYawn. Talk about light volume, not a trader is stirring. The market is down again today after coming oh-so-close to breaking the elusive 12.5K barrier on Wednesday.

Walgreen (WAG) is up on an impressive earnings report. I like WAG a lot. It’s a great company, but I think the shares are a bit pricey here. The stock pulled back earlier this year, and it seems to have bounced off $40. Ideally, I’d like to see it go lower before I’d be interested.

I strongly considered adding Progressive (PGR) to the Buy List, but in the end, I went with WR Berkley (BER). I’m happy with my choice, but make no mistake, Progressive is another great company. But I’m not so positive on the company’s outlook for this year. Either way, this is one to keep an eye on.

In case you missed it, here’s my Buy List for 2007:

AFLAC (AFL)

Amphenol (APH)

Bed Bath & Beyond (BBBY)

Biomet (BMET)

Donaldson (DCI)

Danaher (DHR)

FactSet Research Systems (FDS)

Fair Isaac (FIC)

Fiserv (FISV)

Graco (GGG)

Harley-Davidson (HOG)

Jos. A Bank Clothiers (JOSB)

Medtronic (MDT)

Nicholas Financial (NICK)

Respironics (RESP)

SEI Investments (SEIC)

Sysco (SYY)

UnitedHealth Group (UNH)

Varian Medical Systems (VAR)

WR Berkley (BER)

I’ll start tracking these stocks on the first day of trading of 2007. -

“Cramer” on WallStrip

Posted by Eddy Elfenbein on December 22nd, 2006 at 10:19 amLindsay has a special guest audition.

“Shirt on.”

Here’s another Cramer outtake.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His