-

Hedge Funds Now An Official Cultural Phenomenon Fit to Print

Posted by Eddy Elfenbein on December 8th, 2006 at 6:19 am

So sayeth The New York Times:In October, John Wiley & Sons rolled out its latest how-to book, “Hedge Funds for Dummies.’’ Doug Ellin, the creator of “Entourage” on HBO, is seeking to transplant that show’s successful premise of dudes living large to the world of seeking alpha. And for those who just want to look like a hedge fund manager, Kenneth Cole offers the Hedge Fund — a leather loafer available in black or brown, recently available on its Web site at a clearance price of $119.98.

Hedge funds have become the new cultural shorthand for fast money. In the 1980s, corporate raiders and bond traders, as represented by Gordon Gekko and Sherman McCoy, were models for those seeking to be masters of the universe. The 1990s brought the Internet entrepreneur and the day trader, two variations on the Generation X slacker who made millions without leaving his apartment, using only a computer and his savvy.Read the whole thing. “Wall Street Warriors” makes an appearance.

-

Calls to Shut Down Wall Street

Posted by Eddy Elfenbein on December 8th, 2006 at 6:04 amThe death of Sean Bell has inspired a call to shut down Wall Street for a day:

The December 12th Movement, a human rights group that organised the protest, wants Police Commissioner Raymond Kelly to step down and called for a “Day of black outrage” on December 22 that would “shut Wall Street down”.

-

We’re Surrounded

Posted by Eddy Elfenbein on December 7th, 2006 at 2:16 pm

Starbucks (SBUX) has the White House completely surrounded. I’m not a conspiracy theorist, but this looks like it took some planning.

Are they planning a coup?

Update: Uh oh. -

If I Had No Soul….

Posted by Eddy Elfenbein on December 7th, 2006 at 11:49 am

No, I couldn’t. I just couldn’t.

Let’s pretend this post never happened. -

The Final Days at UNH

Posted by Eddy Elfenbein on December 7th, 2006 at 6:14 amOn the front page of today’s WSJ, James Bandler and Charles Forelle look at how UnitedHealth’s board gradually turned against CEO Bill McGuire during the options back-dating scandal. This is a good story, and I think I’ve misjudged what happened at UNH.

From reading today’s article, I don’t think McGuire believed he had done anything wrong. Of course, intent to break the law isn’t an issue for the courts, but it is an issue for me and how I value a company. I can’t say that UNH was guided by a culture of corruption. If McGuire did break the law—and it appears he did—it was probably a case of negligence and oversight. As far as the company goes, it looks fine. Business is booming.

Obviously, any wrong-doing should be punished, but McGuire never acted as a criminal. Even as the scandal broke, he responded quickly and prudently. Enron, to use an unpleasant comparison, was a criminal enterprise, pure and simple. The company was a fraud and its business was to deceive investors. By contrast, UnitedHealth has been a spectacularly successful company, thanks in large measure to McGuire’s leadership.

As an investor, the more important issue to me is how the board could have authorized such large options grants to their CEO. Look, I’m all for rich people being rich, but…come on. His options were worth over $1 billion. Now that he’s gone, that will no longer be a problem. Plus, it will take a long time to figure out exactly what he’ll be able to keep.

If anything, I’m more inclined to like UNH by seeing how responsibly it behaved during this ordeal. The company now has a new CEO and a (somewhat) clean slate. For the first nine months of this year, EPS has increased by 21.8%, from $1.74 to $2.12. But the stock is almost a mirror image, down 21.1%.

I’m going to unveil the 2007 Buy List next Friday, December 15. Expect to see UNH there. -

Home Depot Back-Dated Options Back to 1981

Posted by Eddy Elfenbein on December 6th, 2006 at 8:13 pmHome Depot’s (HD) internal review found unrecorded expenses of $200 million. Some of it going as far back as 1981.

All options granted since 2002 had an exercise price based on the market price of the company’s stock on that date, Home Depot said today.

Options granted from December 2000 through the end of 2001 had an exercise price based on the market price of the company’s stock on the date of a specific meeting or some other established criteria.

For annual option grants and certain quarterly grants from 1981 through November 2000, the company regularly reviewed closing prices for a given period and selected a date with a lower stock price, Home Depot said.

Backdating occurred “at all levels of the company” and involved managers who have since left, Home Depot said.At least they were faithful to tradition.

-

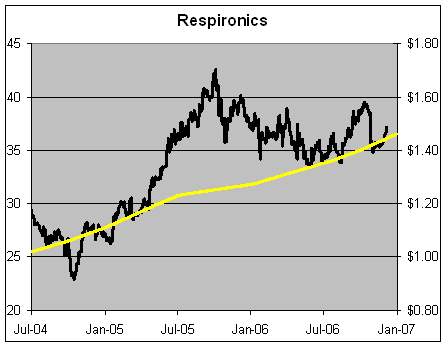

A Closer Look at Respironics

Posted by Eddy Elfenbein on December 6th, 2006 at 11:55 amMany years ago, when I got my first job in finance, I worked for a sleazy brokerage firm in Boston. This place was truly rock bottom. I was just out of school and it was the only job I could get. This firm made the Boiler Room look like Goldman Sachs.

All day long, I cold called people in and around Boston. I guess with the advent of cell phones, cold calling has gone away. But that’s all I had to go on. I didn’t even have my own desk. Several of us where bunched around a table loaded with phones, and we had stacks of Boston white pages. Even thinking about it is giving me chills.

The place was more like a frat house than a place of business. I finally had enough so I applied for a job in the research department. The head of the department told me to write a report on Respironics (RESP). So I rolled up my sleeves and got to work. I collected everything on the company I could find. I read up on sleep apnea. I read all of the company’s SEC filings. I read other companies reports. I called experts. For several days, I did nothing but eat and sleep Respironics.

When I finally wrote my report, I concluded that Resprionics’ stock was fairly valued. That was my big mistake. Well, I was right—the stock was fairly valued. But I soon learned that it was research director’s absolute favoritest stock in the whole wide world. As you can imagine, he hated my report and I didn’t get the job. So much for open-minded Wall Street research.

Ever since then, Respironics has had a special place in my heart. After I wrote my report, the stock flatlined for several months. Just as I thought, it was fairly valued. But in the long run, the research director was right, it’s been a very good stock.

For the past year, however, Respironics hasn’t done much. Here’s a look at the stock’s performance:

The yellow line (right scale) is the company’s earnings-per-share. The two scales are aligned 25 to 1, so when the lines cross, the P/E ratio is 25. -

The Worst CEO of the Year

Posted by Eddy Elfenbein on December 6th, 2006 at 9:45 amHerb Greenberg offers the award of 2006’s Worst CEO to Ilia Lekach of Parlux (PARL). Parlux is the company behind Paris Hilton’s perfume. Need we say more. Patrick Byrne of Overstock.com (OSTK) came in second. Once again, need we say more.

Congratulations to all our contestants. Better luck next year! -

Depressing Fact of the Day

Posted by Eddy Elfenbein on December 5th, 2006 at 12:24 pmFrom John Fund:

Last year, of the 25 largest initial public offerings in the world, only one took place in America. This year, Hong Kong is likely to end up as the No. 1 market for stock offerings world-wide.

-

Happy Birthday Irrational Exuberance

Posted by Eddy Elfenbein on December 5th, 2006 at 10:22 amIt was 10 years ago today that Alan Greenspan made his famous “irrational exuberance” speech. Here’s the money paragraph:

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy? We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs, and price stability. Indeed, the sharp stock market break of 1987 had few negative consequences for the economy. But we should not underestimate or become complacent about the complexity of the interactions of asset markets and the economy. Thus, evaluating shifts in balance sheets generally, and in asset prices particularly, must be an integral part of the development of monetary policy.

It doesn’t seem that dramatic, but at the time, it was taken very seriously. The next day, the Dow dropped 55 points. Since then, the market has more than doubled. The S&P 500 has gone up about 90%, plus there’s another 17% from dividends. Inflation is up about 28%.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His