-

Dell Hits $25

Posted by Eddy Elfenbein on November 2nd, 2006 at 10:19 amBreifly. That’s the highest price in four-and-a-half months. Goldman upgraded the stock to neutral.

That said, in the absence of Dell restructuring — which we are not modeling into our assessment since there has been no inclination that Dell wants to do that — we think Dell’s choice is ultimately between growth and margins which in our model tops out at 7 percent normalized growth, 17 percent gross margin, and 6 percent operating margin, meaning that this is not the ‘Dell of old.’

-

Fair Isaac and Biomet

Posted by Eddy Elfenbein on November 2nd, 2006 at 9:18 amAfter the bell yesterday, Fair Isaac (FIC) reported earnings of 60 cents a share. That was three cents higher than the Street was expecting. Charges related to stock-based compensation and one-time expenses pushed FIC’s net income down to 35 cents a share.

For the full fiscal year, net income fell to $103.5 million, or $1.59 per share, from $134.5 million, or $1.86 per share. Revenue rose to $825.4 million from $798.7 million.

Looking ahead, Fair Isaac said it expects first fiscal-quarter earnings per share of about 48 cents on revenue of about $210 million. The outlook includes stock-based compensation charges.

Analysts forecast quarterly profit of 59 cents per share on sales of $211.9 million.

For the full fiscal year, Fair Isaac said it expects earnings per share of about $2.10, including stock-based compensation expenses, on sales of about $870 million.

Wall Street expects full-year earnings of $2.44 per share on sales of $873.1 million.

Fair Isaac also said its board authorized a stock buyback program of up to $500 million.The company also announced that its CEO, Thomas G. Grudnowski, has resigned.

The other big story is that Smith & Nephew has said that it’s in preliminary talks with Biomet (BMET) about a possible merger. Both companies have very similar market values. Interestingly, what may have lead Biomet down this path was then Dane Miller, the CEO, suddenly resigned earlier this year. -

Atlas Shrugged

Posted by Eddy Elfenbein on November 1st, 2006 at 8:16 pm

toothpastefordinner.com

Did you know it’s pronounced EYE-n? I did…just wanted to make sure you knew that. -

Gimmicks and the Housing Bubble

Posted by Eddy Elfenbein on November 1st, 2006 at 2:23 pmThe Washington Post looks at sellers are dealing with the fizzling NYC housing market:

“I count 40-plus construction projects in my neighborhood alone,” says Nouriel Roubini, a professor of economics at New York University’s Stern School of Business who lives in Tribeca. “There’s going to be a huge glut in six months here in New York, well above the national average. And unless you see a huge increase in hiring in the financial industry — and that is not going to happen — you have to wonder, who is going to buy all these units?”

One apparent answer: fans of Jade Jagger. Mick’s daughter, a designer and pioneer of something called “pod living,” created the combination kitchen-bathroom modules that sit in the center of the apartments on sale at Jade, a building in Chelsea. To the uninitiated, the pods look like something from the motor home of the future. But the owners calls them “jewel-like lacquered boxes that seem to float in each residence.”

One-bedrooms start at $945,000. -

Economic Puzzle

Posted by Eddy Elfenbein on November 1st, 2006 at 1:14 pmHere’s a puzzle I’ll throw open to the house. I’d welcome any feedback you might have.

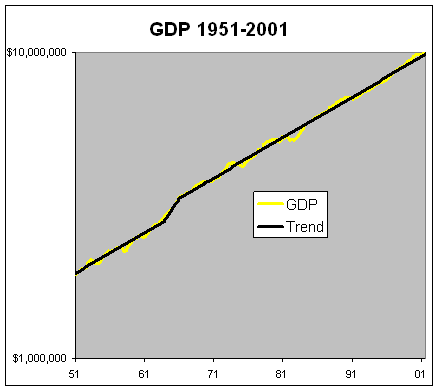

The U.S. economy has grown at a remarkably stable rate for the past several decades. You wouldn’t know it from our political rhetoric, but the economy grows by an average of about 3.1% a year after inflation (or 3.08% to be more exact). Sometime we do better, sometimes worse. But we always come back to that 3.08% trend line.

Remember, the nasty recession of 1981-82, and the Reagan Recovery of 1983-84. From beginning to end…yep, 3.08%. Summer, spring, fall and winter, we always go back to 3.08%.

Except for once. Call it a brief shining moment. In the early-to-mid 1960s, the economy vaulted dramatically upward, and started to revert to a new and higher mean. Why? What happened? And most importantly, can we do it again?

I like this kind of puzzle because it makes you focus on data series and how to analyze them properly.

My first guess would be that it was something like the Fed or perhaps spending on the war in Vietnam. But then, how come we didn’t revert back to the old mean when those went away? Could they have had a one-time up boost, with no downside? Doesn’t seem likely.

The question we have to ask is, what changed for good that could have given us a one-time permanent economic boost. The best answer I can think of is that it’s due to the end of segregation. While I certainly believe that socialist race relations are immoral, I’d be partial to believing that it’s economic retardant. But here, I can’t fully trust myself. I know the world doesn’t work the way I would prefer.

But still, it’s intuitively makes sense. Using state power to hold people back isn’t just evil, it’s got to be costly. Unfortunately, I don’t have the GDP data broken down by each state. My other concern is Zodiacing. Perhaps, I’m looking to see a pattern that just isn’t there.

Here’s the data so you can judge for yourself.

This is GDP from 1951 to 2001. The yellow is GDP. The black is the trend line. The trend line increases at the same rate before and after the 1963-1966 “gap up.”

Here are the two lines divided by each other:

-

Guy Kawasaki

Posted by Eddy Elfenbein on October 31st, 2006 at 8:48 pmAmanda Congdon has a fascinating interview with Guy Kawasaki, a Silicon Valley venture capitalist. The interview has a light-hearted tone, but his answers are very interesting.

Here’s part two. -

The Biggest Secret on Wall Street

Posted by Eddy Elfenbein on October 31st, 2006 at 1:10 pmHere’s an investing secret that many Wall Street professionals know about, but few individual investors are in on. Promise not to tell anyone.

OK, here goes. Most investors think the succesful investing is about buying shares in some company that’s about to invent the Eight Dimension. Sure, we all know the story about our neighbor’s aunt’s best friend who knew this guy who went to high school with one of the Google guys, and now he’s like totally loaded. Goody for him, but that’s not what investing is really about.

In reality, some of the best profits can be made in the dullest of industries. In my view, the duller the better. A great example is insurance. For those who don’t know it, insurance can be insanely profitable. It’s disgusting, really (I love it!). Think about it: Insurance is a low-risk business, it has tacit state protection (try driving a car without car insurance) and it can’t easily be replaced.

Here’s how some insurance stocks have performed over the last 30 years:

Progressive (PGR)………………………………………….95,548%

WR Berkley (BER)…………………………………………..30,069%

AFLAC (AFL)…………………………………………………..23,184%

Loews (LTR)…………………………………………………..12,597%

Cincinnati Financial (CINF)………………………………..8,490%

American International Group (AIG)……………………7,916%

Selective Insurance Group (SIGI)……………………….7,444%

Protective Life (PL)…………………………………………..4,617%

First American (FAF)………………………………………….4,055%

Old Republic International (ORI)…………………………3,947%

Meanwhile, the S&P 500 is up about 1,230%.

I should add that I don’t mean all insurance stocks are great investments. But the cream of the industry is about the best you can do.

Oh, and I nearly forgot to mention Warren Buffett. Insurance forms the basis of his entire fortune. Over the last 30 years, Berkshire is up nearly 160,000%. -

Playboy Stock-Picking Contest

Posted by Eddy Elfenbein on October 31st, 2006 at 10:47 amWith the end of October, I’d thought I’d update the 2006 Playboy Stock-Picking Contest. Right now Courtney Culkin, Miss April 2005, is in the lead. Her portfolio is up 47.01% for the year. Courtney’s best stock is Steven Madden (“one of my favorite dress shoe brands”) which is up over 120%.

Amy Sue Cooper, the Cyber Girl of the Year, is in second at 28.96%. What impresses me about Amy’s portfolio is that she actually gives good arguments for her selections.Amgen (AMGN), the world’s largest biotechnology company, and Abgenix (ABGX), a company specializing in the discovery, development and manufacture of human therapeutic antibodies, announced that they have signed a definitive merger agreement under which Amgen will acquire Abgenix for approximately $2.2 billion in cash plus the assumption of debt. This merger could possibly benefit this company tremendously. I am a nurse so this only makes sense.

That’s beats a screaming bald man.

Here’s how the other contestants stack up. If I were participating, I’d be on top of Lindsey Vuolo and underneath Kara Monaco:

Courtney Culkin……………….47.01%

Amy Sue Cooper………………28.96%

Deanna Brooks………………..21.44%

Kara Monaco…………………..15.17%

Me………………………………….8.47%

Lindsey Vuolo……………………4.6%

Pennelope Jimenez……………-0.41%

Christine Smith…………………-1.78%

Jillian Grace……………………..-3.56%

Pilar Lastra………………………-5.16%

Amy McCarthy………………….-32.74%

Amy McCarthy is Jenny’s younger sister. -

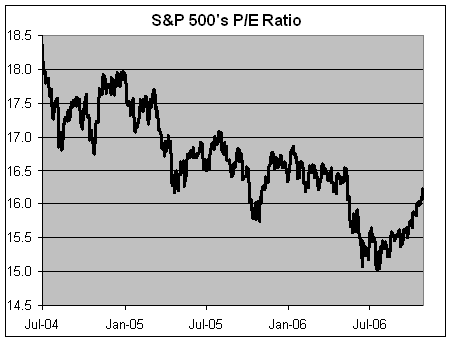

Does This Look Irrational to You?

Posted by Eddy Elfenbein on October 30th, 2006 at 3:37 pmNot to me.

-

Sysco’s Earnings

Posted by Eddy Elfenbein on October 30th, 2006 at 10:45 amSysco (SYY) reported earnings today of 37 cents a share, which beat Wall Street’ consensus by a penny a share. Due to some accounting charges, net earnings fell to $189 million, or 30 cents per share.

Also, Lindsay & Co. at Wall Strip take a look at Harley-Davidson (HOG). The stock is up about 40% from its June low.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His