-

Trump Calls Off Stimulus Before the Election

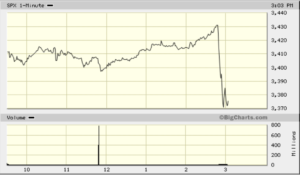

Posted by Eddy Elfenbein on October 6th, 2020 at 3:07 pmPresident Trump has called off on any stimulus before the election.

President Donald Trump said Tuesday he has told his administration’s negotiators to end coronavirus stimulus talks with Democrats until after the Nov. 3 election.

The declaration, if the White House follows through on it, would halt an ongoing push to send trillions of dollars more in relief to Americans as the outbreak rampages through the U.S. and the economy struggles to recover from virus-related shutdowns.

“I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business,” Trump tweeted on Tuesday.

You can probably tell when traders got the news.

-

Eagle Bank Jumps

Posted by Eddy Elfenbein on October 6th, 2020 at 12:12 pmI say this very hesitantly but shares of Eagle Bank (EGBN) have bounced recently. Or more accurately, they’re off a very depressed low.

I feel like a baseball player in the dugout not wanting to mention a no-hitter.

The bank just said it will release its earnings on October 22. That should make it one of the first Buy List stocks to report this earnings season.

The consensus of the five analysts who follow Eagle expect Q3 earnings of 81 cents per share. The bank earned $1.07 per share for last year’s Q3.

-

Morning News: October 6, 2020

Posted by Eddy Elfenbein on October 6th, 2020 at 7:05 amHalf A Billion Travelers Show China’s Economy Moving Past Covid

Top China Critic Becomes Its Defender

Britain Is Getting Ready for Its Space Race

The World’s Biggest Oil Trader Wants to Buy Your Used Car

A Curveball Isn’t an Existential Threat

Let’s Bring Treasury’s Financial Crimes Arm Into the 21st Century

House Panel to Seek Breakup of Tech Giants, GOP Member Says

Big Tech Was Their Enemy, Until Partisanship Fractured the Battle Plans

Regeneron CEO Says Trump’s Use Of Drug Cocktail Puts It In ‘Tough’ Spot

Why Is The United States Trying To Put Huawei Out Of Business?

Cybersecurity Pioneer McAfee Arrested for U.S. Tax Evasion

Johnson & Johnson Settles Baby Powder Lawsuits For $100M

Ben Carlson: The Reach For Yield: Is It Really Worth It?

Joshua Brown: Asymmetry, This Is What IPO Nirvana Actually Looks Like & Whatever Comes After Trump and Biden Will Be Worse

Be sure to follow me on Twitter.

-

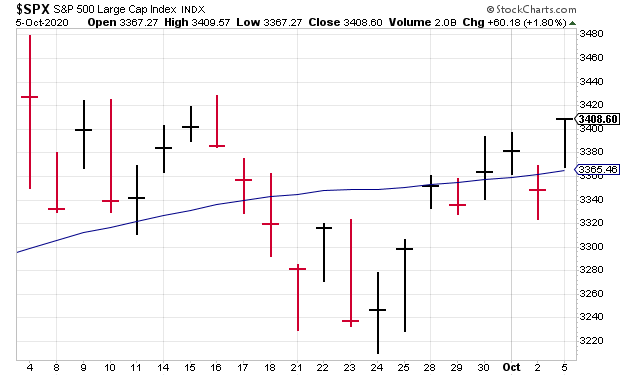

Highest Close in a Month

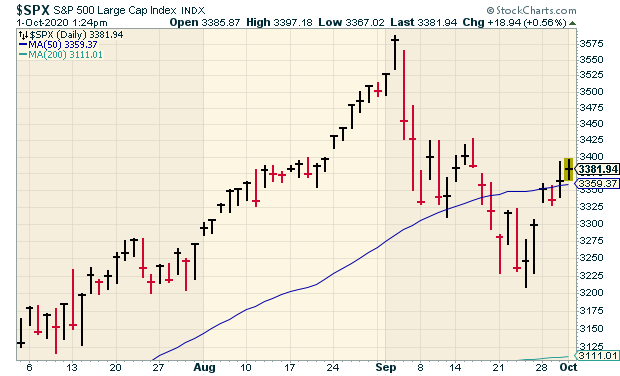

Posted by Eddy Elfenbein on October 5th, 2020 at 4:41 pmStocks opened higher today and gained throughout the day. The S&P 500 closed at its highest level in a month.

Energy and Tech led the way while Staples and REITS were up the least. In the last eight sessions, the S&P 500 has gained 5.3%.

The media is ascribing today’s rally to good news on the president’s health and optimism for a stimulus package.

White House Chief of Staff Mark Meadows said on Monday there was still potential to reach an agreement with U.S. lawmakers on more coronavirus relief and that Trump was committed to getting the deal done.

“The stimulus deal is still sitting there, and there’s still communication going on … It looks increasingly like something’s going to get done,” said Jim Paulsen, chief investment strategist at The Leuthold Group in Minneapolis.

-

Stocks Rebound on President’s Health

Posted by Eddy Elfenbein on October 5th, 2020 at 11:55 amThe stock market is up this morning on news of President Trump’s improved health and hopes for a stimulus bill. The S&P 500 has been up as much as 1.5% today.

Sadly, the president’s health can be a concern for the stock market. In 1955, the market plunged on news of President Eisenhower’s heart attack. That was the single-worst day for the market between the Fall of France in 1940 and the 1987 Crash — a span of 47 years.

This morning’s ISM Services report showed an increase to 57.8. This is good news. Whenever the number is above 50, it means the sector is improving.

The cyclical sectors are leading the charge today. Energy, Materials and Finance are up the most. Shares of Cinemark, a former Buy List stock, are down 18% today.

-

Morning News: October 5, 2020

Posted by Eddy Elfenbein on October 5th, 2020 at 7:06 amA Portrait of a Market in India Run Solely By Women

U.S. Stimulus Prospects Buoy Strategists Wary of Trump Prognosis

A Gold Standard Would Be Great But It Would Not Shrink Budget Deficits

Cineworld Brings Down Curtain On U.S., UK Theatres; 45,000 Jobs Hit

What Are Fractional Shares? A Guide to the Cheapest Way to Buy Stock

The Pandemic Depression Is Over. The Pandemic Recession Has Just Begun.

Rhetoric and Reality With Exxon, BP, and the Future of Fossil Fuels

Microsoft to Build Hub for Cloud Services in Greece

Exxon’s Plan for Surging Carbon Emissions Revealed in Leaked Documents

The Short Tenure and Abrupt Ouster of Banking’s Sole Black C.E.O.

Jeff Miller: Weighing the Week Ahead: Should Investors Change Course Because of the POTUS Diagnosis?

Ben Carlson: The U.S. Real Estate Market in Charts

Joshua Brown: Barry Interviews Dave Portnoy

Michael Batnick: Animal Spirits: A Random Talk

Be sure to follow me on Twitter.

-

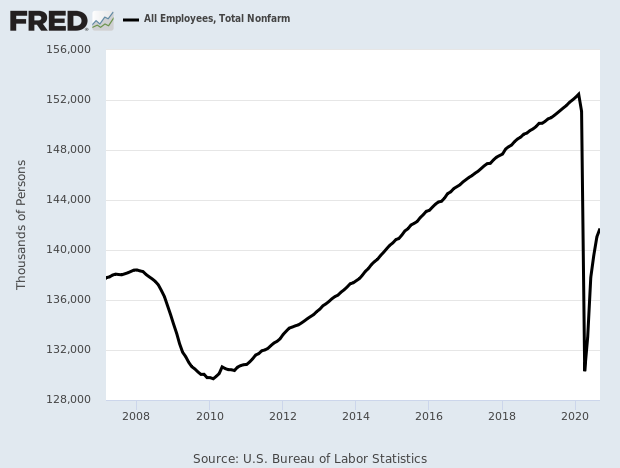

September Jobs Report

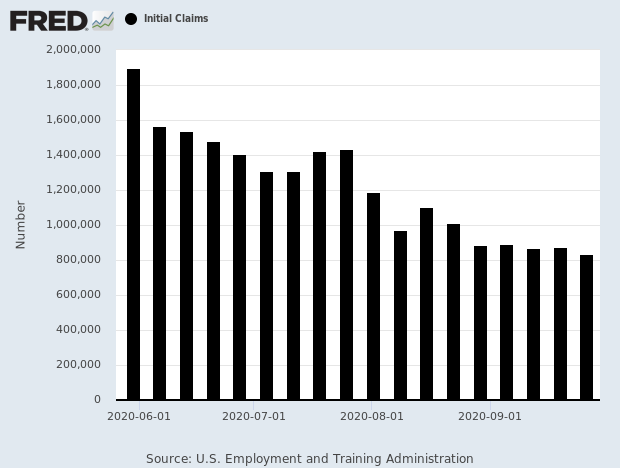

Posted by Eddy Elfenbein on October 2nd, 2020 at 8:37 amThe September jobs report is out. The US economy added 661,000 net new jobs during the month of September. The unemployment rate dropped to 7.9%. Wall Street’s estimate was for 8.2%.

The bottom line is that the US economy is still adding jobs but at a slower rate than it had been before. The private sector added 877,000 net new jobs last month.

The labor force participation rate fell to 61.4% for September. Average hourly earnings rose by 0.1%.

Wall Street is also digesting the news of President Trump’s positive test for the coronavirus. Right now, the Dow futures looks to open down 414 points and the S&P 500 looks to open down by 53 points.

Here’s a chart of nonfarm payrolls:

-

CWS Market Review – October 2, 2020

Posted by Eddy Elfenbein on October 2nd, 2020 at 7:08 am“Time is on your side when you own shares of superior companies.” – Peter Lynch

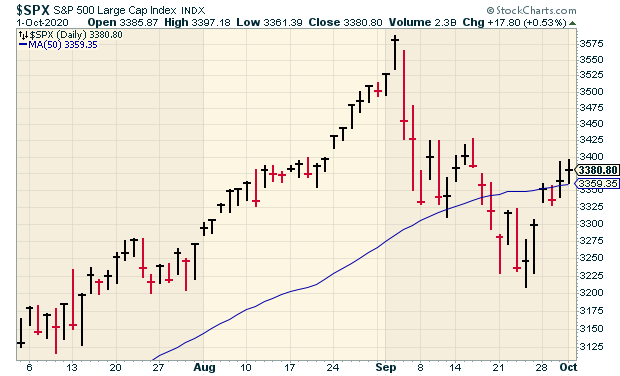

The bulls have apparently returned to Wall Street. The S&P 500 has closed higher in five of the last six sessions. The index has even closed above its 50-day moving average. So, is the coast clear? Frankly, I’m skeptical. Not a full-throated bear, but a skeptic.

Let me explain. The stock market got dinged for a quick loss in early September. The high-fliers were hit especially hard. In one week, Tesla lost one-third of its value. The recent rebound softened some of the damage from September. Still, the S&P 500 recorded its first monthly loss since March.

I have some concerns ahead. Q3 earnings season begins in two weeks, and the economy is still in rough shape. The labor market appears to be cresting. Much of the economy is still on lockdown. Disney just announced massive layoffs. Of course, the U.S. election is only a month away.

In this week’s issue, I’ll preview next week’s earnings report from RPM International. I expect the company to announce its 47th consecutive annual dividend increase. I’ll also cover Sherwin-Williams’s big boost to its full-year guidance. Plus, Eagle Bank said it’s resumed buying back its shares. In the last six sessions, Eagle is up 7.6%. But first, let’s take a closer look at the economy.

The Rebound in the Jobs Market Is Slowing Down

In last week’s issue, I discussed the upcoming Q3 earnings season. For the first time in a long time, earnings estimates have actually moved higher, but it will be a rough earnings season for many companies. The economy is far from its status quo ante.

I’m writing this to you a few hours ahead of Friday’s jobs report. We’ve seen growing evidence that the rebound in the jobs market has started to wane. That’s to be expected. On Thursday, the initial-jobless claims report fell to 837,000. That’s another post-lockdown low, but it’s fairly close to the numbers we’ve seen for the past few weeks. Contrast that with May and June, when we often saw weekly drops of 200,000 or 300,000.

On Wednesday, ADP said that the economy created 749,000 private-sector jobs last month. That’s pretty good, and it beat expectations. But the ADP report doesn’t always track well with the government’s numbers. Here is ADP’s jobs chart. You can see we’ve rebounded but we’re still well below the high:

This week, the government revised its Q2 GDP growth report up to -31.4%. It’s odd to think of that terrible number being an upward revision, but it was. Later this month, we’ll get the first report on Q3 GDP. The Atlanta Fed’s GDPNow estimates Q3 GDP growth of 34.6%. That would be great. (Bear in mind that a 30% gain after a 30% drop doesn’t bring you back to even.)

There are other areas of optimism. This week’s consumer-confidence report showed the largest gain in 17 years. While the gain was impressive, the absolute level of confidence is still quite low.

The housing market is doing well, and it’s no secret why. We’re currently seeing some of the lowest mortgage rates on record. This week’s pending home-sales report jumped 8.8% to reach an all-time high. Sales were up 24% over August last year. This is good for stocks like Trex (TREX) and Danaher (DHR).

On Wednesday, the ISM Manufacturing Index was 55.4. That’s pretty good, although it’s a decline from the previous reading of 56.0 for August. The Census Bureau said that construction spending fell 1.4% in August. Also in August, personal income fell by 2.7%, while spending rose by 1%.

I’m still concerned that the Value-Growth rotation hasn’t fully played itself out. In early August, the S&P 500 Growth Index fell much more than the Value Index. That reversed itself in the middle of the month, but I think it’s very likely that Growth will soon lag again.

With interest rates and bond yields so low, stocks with yields over 2% become much more attractive. In a bit I’ll mention that Eagle Bancorp has resumed its share-buyback program. The bank is making it clear that it has plenty of money to reinvest in itself. Going by Thursday’s close price, the bank yields close to 3.3%. That’s about five times the yield you can get with a 10-year Treasury.

Make sure your portfolio has plenty of dividend-payers. Most importantly, don’t let your concerns about the election scare you out of stocks. The third-quarter earnings season will begin soon, and I expect to see very strong results from our stocks. Now let’s look at our Buy List earnings report for next week.

Earnings Preview for RPM International

RPM International (RPM) is due to report its earnings on Wednesday, October 7. This will be for its fiscal Q1, which ended on August 31.

RPM had a difficult time during Q4. The good news is that the company managed to get a nice profit of $1.13 per share, which beat estimates by 12 cents per share. I’m not too worried about RPM’s survival. The company has a strong balance sheet and plenty of liquidity.

For the full year, RPM made $3.07 per share. That’s an increase of 13.3% over last year. The economic lockdown clearly took a toll. Before the virus hit, RPM had been expecting full-year earnings to range between $3.30 and $3.42 per share.

For fiscal Q1, RPM expects net sales growth “in low single digits and adjusted EBIT growth of 20% or more.” The consensus on Wall Street is for $1.19 per share. For last year’s Q1, RPM made 95 cents per share. RPM hasn’t provided any full-year guidance yet.

The stock has nearly doubled from its March low. Along with next week’s earnings report, I expect to see RPM hike its quarterly dividend. That’s not exactly a bold prediction on my part. RPM has raised its dividend every year since 1973.

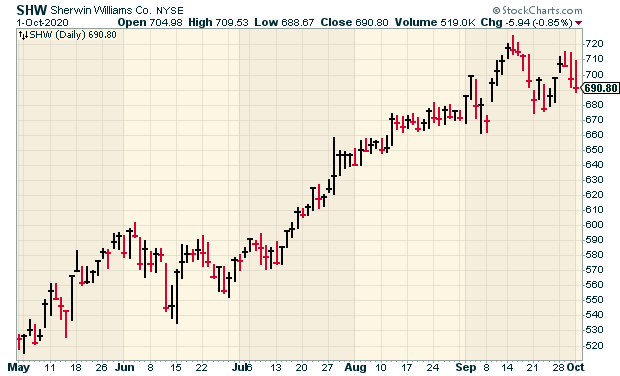

Sherwin-Williams Raises Guidance

On Tuesday, Sherwin-Williams (SHW) raised its sales guidance for the third quarter, and its sales and earnings guidance for the full year.

Previously, the paint people said they expected Q3 sales growth to be “up or down a low-single-digit” over last year. Now, Sherwin expects an increase of 3% to 5%.

For all of 2020, Sherwin expects sales to be flat to up slightly over last year. The previous guidance was for flat sales growth.

Now for the really good news, which is earnings. For full-year earnings, Sherwin sees a range of $20.96 to $21.46 per share. That’s a hefty increase over the previous range which was $19.21 to $20.71 per share. That figure includes $2.54 per share in an acquisition-related amortization expense.

Sherwin’s business has three segments. The Americas Group expects Q3 sales to be up a little. Performance Coatings is expected to be flat to down a little. Consumer Brands is expected to be up in the low-20% range.

CEO John G. Morikis said:

“Demand for architectural coatings has been stronger than expected in the third quarter, led by our DIY, residential repaint and new residential segments. Demand on the industrial side of our business has also improved, led by continued strength in packaging and emerging momentum in other segments, most notably in automotive refinish and industrial wood. As a result, our sales expectations for the third quarter and full year 2020 have improved. We now expect our full-year 2020 adjusted diluted net income per share to increase 12.5% at the midpoint of the range compared to the prior year.”

Sherwin is up 18% for us this year. The earnings report is due out on October 27.

Eagle Bancorp Resumes Buying Back Shares

Eagle Bancorp (EGBN) said it’s reinstating its share-buyback program. During Q1, the bank halted all share buybacks. Eagle wasn’t alone. A lot of companies did this at the start of the pandemic.

Now that things have cooled off, I’m glad to see Eagle willing to spend its money on itself. As I’ve said, I’m not a big fan of share buybacks. However, I understand why companies do it. Also, it’s probably a good investment, considering how cheap Eagle is according to most conventional valuation metrics.

Through the end of this year, management has been authorized to buy as much as 5% of Eagle’s outstanding shares. As of Jun 30, Eagle had 460,000 shares remaining under the buyback authority.

All things being equal, I’d prefer that a company pay dividends. Eagle had paid a dividend but stopped during the financial crisis. Eagle eventually resumed its regular dividend in June 2019. The current quarterly dividend is 22 cents per share. That works out to a yield of 3.27%. The next earnings should be out around October 21.

Buy List Updates

This week, Becton, Dickinson (BDX) said that its rapid Covid-19 test has been approved for Europe. This is a great time for that news, because the region has had trouble keeping up with the need for tests.

Becton’s test doesn’t need a lab. Also, it can be done with a portable device. The FDA approved it this summer. Becton hopes to roll it out for Europe by the end of the month.

Becton hopes to be running eight million tests per month by the end of October and twelve million by the end of March.

Disney (DIS) has done an admirable job of keeping as many workers as it can, but the coronavirus has pushed it to the edge. This week, the entertainment giant announced 28,000 layoffs. Most of the layoffs will happen at U.S.-based theme parks.

About two-thirds of the layoffs will be part-time hourly employees. Disney World re-opened over the summer, but Disneyland has yet to re-open. Even so, attendance at Disney World has been pretty sluggish. (Hugs from Mickey are verboten.)

Gradually, the rest of Disney’s business is coming back online. We now have live sports, and movie production has returned. Actual movie releases are another matter. Of course, the Disney+ streaming service has been doing very well.

The next earnings report should be in early November.

That’s all for now. The September jobs report is due out later this morning. We’ll get a few more key economic reports next week. On Monday, the ISM Services Index is due out. On Wednesday, the Fed will release the minutes from the last meeting. There were two dissents at the meeting, so it will be interesting to hear more details. Then on Thursday we’ll get another initial-jobless-claims report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: October 2, 2020

Posted by Eddy Elfenbein on October 2nd, 2020 at 7:02 amHow One Piece of Hardware Took Down a $6 Trillion Stock Market

Stocks Slide After Trump Diagnosed With Coronavirus

With The Feds Circling, Google Is Starting To Play Nice With Smaller Rivals

Wall Street’s Biggest Banks Are Muscling Into Small Deals

Despite Billions in Fees, Banks Predict Meager Profits on P.P.P. Loans

New Layoffs Add to Worries Over U.S. Economic Slowdown

U.S. Auto Sales Fall 9.7% In Q3, But The News Isn’t All Bad

Dough! Subway Sandwich Bread Isn’t Legally Bread, Irish Court Rules

Amazon Can’t Be Held Responsible For Teen’s Powdered Caffeine Death, Court Rules

He Thoroughly Changed How We Think: RIP George Melloan

The Climate Crisis is the Story of the Century

Ben Carlson: Some Money & Investing Stuff I’ve Changed My Mind About

Michael Batnick: Luck and Success

Howard Lindzon: The Creator Economy and The API Economy

Be sure to follow me on Twitter.

-

Employment Gains Appear to Be Slowing

Posted by Eddy Elfenbein on October 1st, 2020 at 1:25 pmThe market is up again today. This could be the S&P 500’s fifth gain in the last six sessions. The S&P 500 is now back over its 50-day moving average.

The ISM Manufacturing Index usually comes out on the first day of each month. This morning’s report came in at 55.4. That’s pretty good although it’s a decline from the previous reading of 56.0 for August.

The initial claims report fell to 837,000. It seems that the gain in employment has either stopped or slowed down noticeably. It’s still the lowest report in six months.

The Census Bureau said that construction spending fell 1.4% in August. Also in August, personal income fell by 2.7% while spending rose by 1%.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His