-

Morning News: February 9, 2024

Posted by Eddy Elfenbein on February 9th, 2024 at 7:02 amBarclays to Adopt Fresh Curbs on Oil and Gas Financing

The Oil Was From Iran. The Insurance Was From New York

China’s Property Crisis Is Starting to Ripple Across the World

ECB Warns Banks to Grasp Real Estate Risks or Face Capital Hits

Japanese Stocks Cross New Milestone as Record High Comes Into View

Hedge-Fund Short Sellers Revel in Hidden Cash Perk Like 2007

Barclays Gives Dozens of Bankers Nothing in Grim Bonus Round

How Empty Office Space Became the New Bogeyman on Wall Street

Arm’s Post-Earnings Pop Leaves Stock Trading at Over 100% Premium to Nvidia

Hyundai Picks JPMorgan, Citi to Accelerate $3 Billion India IPO

40% of Lawyers Are Women. 7% Are Black. America’s Workforce in Charts

Some Colleges Are Pivoting as FAFSA Delays Drag On

It’s Easy to Enter the Asian Market During Lunar New Year. It’s Hard to Get it Right

Chocolate: Cocoa Price Hits Record High as El Niño Hurts Crops

PepsiCo Posts an Earnings Beat. Why the Stock Is Falling

Novo Nordisk Has a Weight-Loss Pill But Can’t Make It Yet

Mexican Retailer BBB Tops IPO Goal to Raise $589 Million

NFL Succession Crisis Forces Teams to Let Private Equity In

Super Bowl Broadcast Is a Crossroads for CBS Sports

ESPN’s Pat McAfee Is the Edgy-ish, Brand-Safe Ambassador the NFL Wants

The Goal for Super Bowl Ads This Year: Don’t Offend Anyone

It’s Time to Talk About Those Taylor Swift Super Bowl Bets

Shares of Assassin’s Creed Maker Ubisoft Surge After Confirming Guidance

Hermes Positive on 2024 After Sales Growth

Too Hot to Cuddle? Build-A-Bear’s Adult Line Leaves Some Blushing

Be sure to follow me on Twitter.

-

Morning News: February 8, 2024

Posted by Eddy Elfenbein on February 8th, 2024 at 7:06 amTwo Cases Aim to Cut Off China and Iran From U.S. Technology

A 99% Bond Wipeout Hands Hedge Funds a Harsh Lesson on China

China Deflation Alarms Raised by Falling Prices for Food and Cars

For First Time in 20 Years, U.S. Buys More From Mexico Than China

The Confusingly Strong Economy Told in Three Stories

Risk of Big US Inflation Revision Puts Policymakers, Investors on Edge

Einhorn Says Markets ‘Fundamentally Broken’ By Passive, Quant Investing

The Real Estate Crisis Looming Over Banks

Real Estate Turmoil Leaves German Banks Reliant on Covered Bonds

Big Dreams Come Back to Bite New York Community Bank

NYCB in Talks to Offload Mortgage Risk, Exploring Loan Sales

SoftBank Returns to Health as Silicon Valley and Chip Investments Prosper

McKinsey Places 3,000 Staffers on Review

Maersk Shares Sink Back to Reality

After Its $20 Billion Windfall Evaporated, a Start-Up Picks Up the Pieces

OpenAI’s Secret Weapon Is Sam Altman’s 33-Year-Old Lieutenant

Microsoft Partners with India’s Sarvam AI for Voice-Based GenAI Tools

How Jack Dorsey’s Plan to Get Elon Musk to Save Twitter Went South

Ozempic Maker Novo Gets Calls From ‘Scared’ Food CEOs

Vision Pro Review: Apple’s First Headset Lacks Polish and Purpose

Strong Earnings, and Taylor Swift, Add to Disney’s Defenses

Disney to Invest $1.5 Billion in Fortnite Maker Epic Games

Construction Industry Grapples With Its Top Killer: Drug Overdose

Super Bowl Ads: More Star Power, More Candy and Other Trends in Five Charts

Be sure to follow me on Twitter.

-

Morning News: February 7, 2024

Posted by Eddy Elfenbein on February 7th, 2024 at 7:06 amChina Replaces Top Markets Regulator as Xi Tries to End Rout

A China-U.S. Decoupling? You Ain’t Seen Nothing Yet

A Stock Bailout Won’t Solve China’s Troubles

How Russia Benefits From Libya’s $5 Billion Fuel-Smuggling Trade

ECB Must Be Patient With Rate Cuts, Schnabel Tells FT

Bank of Canada Faces Limits on Addressing Housing Affordability, Macklem Says

NYCB Is Cut to Junk by Moody’s

Joe Lewis’ $7.6 Billion Global Empire Weathers His Biggest Test

Why Most Millionaires Want a Wealth Tax: “There’s a Certain Alarmism Among the Wealthy About Trump”

Why Americans Are So Down on a Strong Economy

Adam Neumann Crashes Into WeWork’s High-Wire Revival Act

Snap Doesn’t Get Its Meta-Moment

Snap Shares Plummet After First-Quarter Guidance Disappoints

Uber Posts First Annual Profit Since Its IPO

How Ford’s F-150 Lightning, Once in Hot Demand, Lost Its Luster

EVs Won Over Early Adopters, But Mainstream Buyers Aren’t Along For The Ride Yet

Alibaba Boosts Stock Buybacks as Profit Slumps

CVS Health Cuts 2024 Guidance, Citing ‘Potential Implications’ of Higher Medical Costs

Hospital CIOs Weigh 5G as Digitized Medicine Pushes Wi-Fi to Its Limits

Vestas Beats Profit, Revenue Views After Record Order Intake

Target Weighs Paid Membership Program Similar to Amazon Prime

Yum Brands Disappoints as KFC, Taco Bell and Pizza Hut Fall Short of Same-Store Sales Expectations

Brazil Mogul Wants to Sell the World’s Best ESG Chocolate

ESPN, Fox and Warner Bros. Join for Sports Streaming Service

Be sure to follow me on Twitter.

-

CWS Market Review – February 6, 2024

Posted by Eddy Elfenbein on February 6th, 2024 at 8:13 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

You Can Forget About That March Rate Cut

Well, maybe the Fed won’t be raising interest rates next month!

Over the last few days, we’ve gotten some important news that’s completely shifted our expectations for what the Fed’s plans are. It looks like the Federal Reserve probably will not be cutting interest rates at its March meeting. This new outlook is having a major impact on Wall Street. In two days, the yield on the three-year Treasury rose from 3.96% to 4.27%.

This change in outlook has impacted the stock market as well. On Friday, the S&P 500 closed at a new all-time high, but it was a very narrow market. By that, I mean that most of the heavy lifting was being done by a few stocks. Facebook, for example, gained more than 20%. Even though the S&P 500 rallied more than 1% on Friday, the average stock in the index was down for the day.

J.C. Parets noted that on Monday, we saw the fewest stocks on the NYSE above their 200-day moving average since early December, and the fewest above their 50-day moving average since mid-November.

The stock market finished just shy of a new all-time close today.

This is a confusing and temperamental market. Let’s breakdown what’s going on. We’ll start with last week’s jobs report.

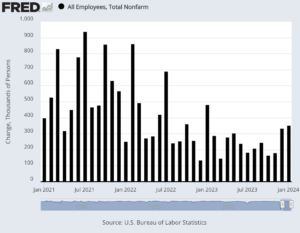

Wall Street got a big shock on Friday when the January jobs report came in much better than expectations. Wall Street had been expecting a gain of 185,000 net new jobs. That wasn’t even close. Instead, the Labor Department said that the U.S. economy added 353,000 new jobs last month.

Who would have guessed that an aggressive interest rate policy from the Fed seems to have had little impact on the labor market? Not me.

Wall Street had been expecting the unemployment rate to rise to 3.8%. Instead, it stayed at 3.7%. If you work out all the decimals, then the current unemployment rate is lower than it was during every single month in the 1970s, 80s, 90s and 00s. All the way through 2018. (To be fair, the methodology hasn’t remained consistent over that time.)

We’re also seeing a pickup in wages. In January, average hourly earnings grew by 0.6%. That doubled Wall Street’s forecast. Over the last year, wages are up by 4.5%. The problem is that any previous wage growth had largely been eaten up by inflation. That’s not so much the case anymore.

Not only was January a good month for job growth, but the Labor Department also revised higher its numbers for November and December. The original estimate for December was for a jobs gain of 117,000. Now the Labor Department says it was 333,000. The number for November was revised upward by 9,000.

Here are some more details from the jobs report:

Job growth was widespread on the month, led by professional and business services with 74,000. Other significant contributors included health care (70,000), retail trade (45,000), government (36,000), social assistance (30,000) and manufacturing (23,000).

The broader U-6 rate increased to 7.2%. Also, the labor force participation rate stayed the same at 62.5%. If we look at the labor force participation rate for prime-working age folks (25 to 54), that rose to 83.3% which isn’t far from a 20-year high.

One interesting bit in the jobs report is that hours worked declined even though wage is holding up well. That may suggest that employers are opting to reduce hours instead of cutting jobs. It’s hard to say if this is a trend just yet, but it’s worth watching.

The jobs report came one day after the strong Q4 GDP report. That report said that the U.S. economy grew at a real annualized rate of 3.3% during the final three months of 2023. That’s quite good. The Atlanta Fed’s GDPNow model just raised its forecast for Q1 GDP growth from 3.0% to 4.2%.

With the economy growing and creating new jobs, why is the Fed in such a rush to raise interest rates? Well, it turns out that the Fed isn’t in a hurry to raise interest rates.

Fed Chairman Jerome Powell was interviewed on 60 Minutes. The interview aired on Sunday. In it, Powell said that although he’s pleased with the direction in inflation, he and the FOMC aren’t fully convinced that the battle is over.

PELLEY: You’ve avoided a recession. Why not cut the rates now?

POWELL: Well, we have a strong economy. Growth is going on at a solid pace. The labor market is strong: 3.7% unemployment. And inflation is coming down. With the economy strong like that, we feel like we can approach the question of when to begin to reduce interest rates carefully.

And, you know, we want to see more evidence that inflation is moving sustainably down to 2%. We have some confidence in that. Our confidence is rising. We just want some more confidence before we take that very important step of beginning to cut interest rates.

PELLEY: What is it you’re looking at?

POWELL: Basically, we want to see more good data. It’s not that the data aren’t good enough. It’s that there’s really six months of data. We just want to see more good data along those lines. It doesn’t need to be better than what we’ve seen, or even as good. It just needs to be good. And so, we do expect to see that. And that’s why almost every single person on the, on the Federal Open Market Committee believes that it will be appropriate for us to reduce interest rates this year.

I added the boldface. In short, Powell wants to see more good data, and the FOMC thinks rates need to be cut sometime this year.

In the trading pits, Wall Street traders think there’s only a 20% chance that the Fed will cut at its next meeting. That’s a big change in a short amount of time. Just one month ago, the odds of a March cut were at 64%.

The odds of a cut in May were at 95%. Now they’re at 67%.

We’re still in the thick of Q4 earnings season. Frankly, the results haven’t been that great. The first batch of earnings were weak, but the numbers have gotten a bit better.

According to the most recent numbers, 46% of the stocks in the S&P 500 have reported results. Of that, 72% have beaten on earnings and 65% have beaten on revenue. That’s actually not that good. (On Wall Street-istan, you’re expected to beat expectations.) The five-year average is a 77% beat rate for earnings and a 68% beat rate for revenue.

The old Wall Street formula is to lower the expectations bar so low that you can easily step over it. Then declare victory.

Earnings are tracking growth of 1.6%. The average report is 2.6% above estimates. That’s below the five-year average of 8.5%.

Follow-Up on the WillScot/McGrath Deal

Last week, I told you about WillScot Mobile Mini Holdings (WSC) and its offer to buy out McGrath RentCorp (MGRC).

I bring it up again because the behavior of both stocks has been unusual. Normally, the acquirer’s stock falls, but not this time. Shares of WSC have rallied. Meanwhile, McGrath has rallied well above its cash buyout price.

Here’s how it’s supposed to work. The deal is 60% cash and 40% stock. McGrath shareholders have a choice. For each share of MGRC they own, they can either get $123 in cash or 2.8211 shares of WillScot Mobile Mini, but MGRC closed today at $128.71 per share. That’s well above the cash offer price. Meanwhile, WSC closed today at $50.13 per share. That values MGRC at $141.42 per share which is 10% above the current share price, and 15% above the cash price.

Normally, the buyout target wants the cash portion of the deal so they’re protected from a sudden plunge in the acquirer’s stock. This time, it seems that the cash side of the deal is an anchor. I won’t be surprised if the details of this deal are refined in the coming weeks. WillScot will report its Q4 earnings on February 20, and McGrath reports the next day.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: February 6, 2024

Posted by Eddy Elfenbein on February 6th, 2024 at 7:03 amXi to Discuss China Stocks With Regulators as Rescue Bets Build

China Is Pumping Money Into Stocks and Markets Are Loving It

Wall Street Snubs China for India in a Historic Markets Shift

Yellen Says Stable Financial System Is Key to U.S. Economic Strength

Banks Sue Regulators Over Anti-Redlining Rule

JPMorgan to Open More Than 500 New Bank Branches Over Next Three Years

UBS Restarts Buyback as Ermotti Slogs Through ‘Pivotal’ Year

NYCB’s Tense Talks With Watchdog Led to Moves That Rocked Market

Brookfield Wants $15 Billion for Real Estate Bet After Stumbles

Facebook’s First Dividend Stands to Make a Few Very Rich

Alibaba’s 80% Loss May Extend on Competition Worries

Summer Has Long Stressed Electric Grids. Now Winter Does, Too

BP Joins Oil Majors With Resilient Profit Beat; Lifts Buyback

F.A.A. Chief Plans to Pledge ‘More Boots on the Ground’ at Plane Factories

Boeing’s Next Crisis: Aerospace Workers Demanding 40% Pay Raise

TSMC to Build Second Chip Plant in Japan

Toyota Cashes In on Booming Hybrid Sales

KDDI Plans to Acquire Further Stake in Japan Convenience-Store Operator Lawson for $3.3 Billion

Lilly’s Zepbound Debut Drives Sales, Pushing Shares Even Higher

Spotify Beats Forecasts for Subscriber Growth; Shares Gain

Who’s Who in the Battle Over Disney’s Board

Blackstone’s $80 Trillion Opportunity

How Loud Billionaires Convert Their Wealth Into Power

Inside a Private Jet Club Where Everything Went Wrong

$7 Million for 30 Seconds? It’s Worth It at the Super Bowl

Be sure to follow me on Twitter.

-

Morning News: February 5, 2024

Posted by Eddy Elfenbein on February 5th, 2024 at 7:03 amEastern Europe’s Richest Woman Pivots $43 Billion Empire West

China Tightens Some Trading Restrictions for Domestic and Offshore Investors

China Stocks Post More Wild Swings After Beijing Stability Vow

China Real-Estate Projects Set to Receive Loans Under ‘Whitelist’ Program

Top U.S. Treasury Officials to Visit Beijing for Economic Talks

Gold Prices to Hit $2,200 and a ‘Dramatic’ Outperformance Awaits Silver in 2024, Says UBS

Powell Tells ‘60 Minutes’ Fed Is Wary of Cutting Rates Too Soon

Why Are Americans Wary While the Economy Is Healthy? Look at Nevada

How Nevada Is Pushing to Generate Jobs Beyond the Casinos

Morgan Stanley and Goldman Spoil Private Credit’s Record Deal

Why NYC Apartment Buildings Are on Sale Now for 50% Off

What Business Leaders Are Saying About the Red Sea Attacks

McDonald’s Sales Growth Slows as Mideast War Hurts Results

Big Oil’s Optimism Faces Reality Check in Tech-Obsessed Market

Why Is Big Tech Still Cutting Jobs?

Merck to Buy Elanco’s Aqua Business for $1.3 Billion

Apple Vision Pro’s First Test: Will People Wear It in Public?

Google and Yahoo Are Cracking Down on Inbox Spam. Don’t Expect Less Email Marketing

Samsung’s Leader Acquitted in Stock and Accounting Fraud Case

Yandex Owner to Sever Ties to Russia With $5.2 Billion Sale

Wegovy Maker to Boost Production Capacity With Multibillion-Dollar Deal

Team Cow or Team Soy: The Milk Wars Roiling America

How Much for Thin Mints? Some Girl Scouts Raise Cookie Prices

What Happens to Chinatown When the Sports Teams Leave

World Cup 2026 Final Goes to NYC-Area in Victory Over Dallas and LA

N.F.L.’s Rapid Embrace of Gambling Creates Mixed Signals

Be sure to follow me on Twitter.

-

Morning News: February 2, 2024

Posted by Eddy Elfenbein on February 2nd, 2024 at 7:02 amIndia’s Quiet Push to Steal More of China’s iPhone Business

China Criticizes IMF’s Growth Outlook, Calls to Boost Confidence

Homebuyers in Canada Are So Frenzied They Won’t Wait for Rates to Go Down

Commercial Real Estate’s Slow-Motion Crisis Explained

A New Perk for Some Student Loan Borrowers: A 401(k) Match

US Jobs Report to Show Slower Hiring Pace After Annual Revisions

Biden Takes Aim at Grocery Chains Over Food Prices

Missing Chinese Banker Resigns After Investigation

What’s Really Going On with Bank Stocks

BofA’s Hartnett Says Stock Markets Are Behaving Like Dot-Com Era

US Equity Funds Draw Inflows Amid Positive Economic and Inflation Data

JPMorgan’s Trades Threaten to Take Privacy Out of Private Credit

US Regional Bank Stocks Brace for Final Trading Session of Painful Week

Meta, Amazon Surge by $279 Billion After Cuts Boost Profit

Amazon Enters Chatbot Fray With Shopping Tool

Exxon, Chevron Surpass Forecasts as Shale Drilling Lifts Output

Tesla Runs Afoul of Font-Size Rule in 2.2 Million Electric Cars

China’s New Energy Vehicle Sales Are Softening in Early 2024

A Year After Bankruptcy Concerns, Carvana is Leaner and Ready for its Wall Street Redemption

AbbVie Sees Signs of Post-Humira Growth in Positive 2024 Outlook

Bristol Sees New Drugs Fueling Upbeat 2024 Profit Outlook

Dual Mission for Macy’s New Chief: Revive Stores and Fend Off Takeover

Barbie Owner Mattel Draws Activist Seeking Changes at Toy Maker

Be sure to follow me on Twitter.

-

Morning News: February 1, 2024

Posted by Eddy Elfenbein on February 1st, 2024 at 7:13 amBeijing Pledges More Fiscal Support as Economy Stumbles

A $560 Billion Property Warning Hits Banks From NY to Tokyo

ECB’s Lane Sees Profits and Wages Important for Inflation Path

BOE Raises Prospect of Rate Cuts in 2024 If Inflation Eases

NY Community Bancorp Plunges as Real Estate Risks Jolt Market

Deutsche Bank to Cut 3,500 Jobs and Reward Shareholders

BNP Paribas Delays Profit Target in Shock to Investors

A New Global Tax Is About to Raise Billions. The U.S. Is Missing Out.

Risky Borrowers Storm Loan Market for Once ‘Unthinkable’ Savings

The Fed Is Taking It Slow. But the Markets Want More

Powell Navigates ‘Toxic’ Politics of Rate Cuts as Election Nears

US Firms’ Hiring Announcements Ease to Slowest January on Record

Employed But Unhappy: What’s in Store for US Workers in 2024

Generative A.I.’s Biggest Impact Will Be in Banking and Tech, Report Says

Can This A.I.-Powered Search Engine Replace Google? It Has for Me

A.I. Fuels a New Era of Product Placement

U.S. Makes Initial Offers in Medicare Drug Price Negotiations

In Year Since Ohio Crash, Railroads Barely Move Needle on Safety

Wind Farms Are Overstating Their Output — And Consumers Are Paying For It

Shell Hikes Dividend as Gas Trading Business Boosts Bottom Line Amid Turn Away from Renewables

‘Your Product Is Killing People’: Tech Leaders Denounced Over Child Safety

Volvo, An Early Electric Car Adopter, Cuts Off Funding For Its EV Affiliate

Musk Moves Ahead With Plan to Shift Tesla Domicile to Texas

The Lawyer—and Drummer—Who Felled Elon Musk’s $55.8 Billion Compensation Package

Amazon Could Soon Be on Hook for Safety of Third-Party Products It Sells and Ships

Be sure to follow me on Twitter.

-

Morning News: January 31, 2024

Posted by Eddy Elfenbein on January 31st, 2024 at 7:04 amChina’s Censorship Dragnet Targets Critics of the Economy

Pro Take: Foreign Creditors Face Challenge in Reaching China Evergrande’s Assets

Saudi Arabia Eyes Reviving Multibillion Dollar Aramco Share Sale

Oil Traders Won Ecuador Deals With $70,000 Watch and Bags of Cash

A New Solution for CO2 Emissions: Bury Them at Sea

Europe Regulates Its Way to Last Place

Unlikely Allies Want to Bar a Brazilian Beef Giant From U.S. Stock Markets

Will a Hiring Slowdown Push the Fed to Cut Rates Soon?

Fed to Hold Interest Rates Steady But Start Considering Cuts

There Are No ‘Price Controls,’ There’s Just Scarcity

Pimco Squares Up for a Bareknuckle Fight in Private Credit

A Pre-I.P.O. Gift to Company Executives: ‘11th-Hour Options Discounting’

Wall Street Punishes Alphabet and Microsoft Despite Earnings Beats After Stocks Hit Record

Microsoft Has Three Trillion Reasons to Keep the Heat on Google

Boeing Pulls Guidance to Show Investors That Safety Comes First

Novo Nordisk Smashes Past $500 Billion Value on Wegovy Frenzy

Novartis Shares Fall After Earnings Miss Hopes, Outlook Disappoints

GSK Bets on Further Growth After Shingles and RSV Vaccines Boost Sales

Byron Allen Makes $14 Billion Offer for Paramount Global

Musk’s $55 Billion Pay Package Voided, Threatening World’s Biggest Fortune

Who Is Most Likely to Get Fired? Remote Workers, Middle Managers

H&M Replaces CEO After Another Lackluster Year

PGA Said to Approve $3 Billion Investment From Fenway-Led Group

N.C.A.A. Inquiry Takes On Growing Role of Booster Groups

Universal Music Group Poised to Stop Licensing Music to TikTok

Be sure to follow me on Twitter.

-

Morning News: January 30, 2024

Posted by Eddy Elfenbein on January 30th, 2024 at 7:02 amIMF Lifts World GDP Outlook on US Strength, China Fiscal Support

Evergrande Liquidation to Leave Little for Creditors to Claim

China’s Real Estate Crisis ‘Has Not Touched Bottom’

Global Clean Energy Spending Surges to $1.8 Trillion. It’s Not Enough

Saudi Aramco Drops Expansion Plan, Raising Demand Questions

The Billionaire Sultan Set to Gain Even More Power in Malaysia

Eurozone Economy Flatlines, Raising Concerns About Falling Behind

Germany’s Economy Shrank at End of 2023 as Gloomy Sentiment Persists

Global Deal Activity on Course to Rebound This Year

Fewer Workers Are Quitting. Here’s What That Means for the Economy

Why Cut Rates in an Economy This Strong? A Big Question Confronts the Fed.

Banks Are Hawking US Recession Hedges Tied to Both Stocks, Bonds

JPMorgan Quants Warn of Dot-Com Style Concentration in US Stocks

Scandal-Hit Trading Desk Turns Into Money Spinner at Wells Fargo

Toyota Remains World’s Top-Selling Automaker; Chairman Apologises Over Scandals

GM Sees Higher Profits Ahead as 2023’s Problems Recede

BYD Shares Fall as China’s Auto Price War Weighs on Bottom Line

As Demand for Fast Deliveries Surges, the Industry Struggles on EV Transition

Truck Makers Team Up to Push for Electric Vehicle Chargers

Companies Hire ‘Robot Wranglers’ to Corral Lost and Confused Cyborgs

Walmart Hopes New Flashing Lights Will Help Shoppers Find Stuff

The World’s Biggest Jeweler Now Only Sources Recycled Metals

How Do You Make a Weed Empire? Sell It Like Streetwear

Joel Embiid Wants the African Diaspora to Flourish Onscreen

Be sure to follow me on Twitter.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His