-

The Bond Market Selloff

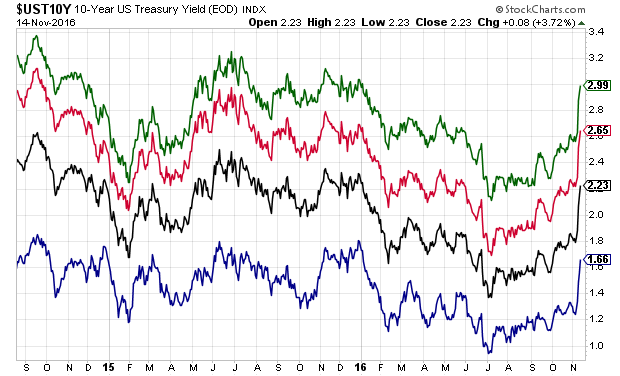

Posted by Eddy Elfenbein on November 15th, 2016 at 12:54 pmThe long-end of the bond market is experiencing one of its most dramatic selloffs in years. One measure that technicians use is called RSI. For the 10-year, the RSI flashed its highest reading since 1990.

It’s hard to show graphically just how steep this selloff has been. I gave it a shot with this oddly colorful chart below.

From the bottom, the four lines are the five-, ten-, 20- and 30-year US Treasury yields. Note the pronounced upticks on the right. Interestingly, the rise in yields appears to be roughly similar for the different maturities.

-

October Was a Strong Month for Retail Sales

Posted by Eddy Elfenbein on November 15th, 2016 at 9:19 amToday’s retail sales report showed that October sales rose by 0.8%. That was 0.2% more than expectations. The number for September was revised up to 1%. Over the last year, retail sales are up 4.3%.

“A strong October following a strong September is encouraging,” Tom Simons, a senior economist at Jefferies LLC, said before the report. “The labor market continues to be strong, and wage growth appears to be accelerating.”

Sales improved in 11 of 13 major categories for a second straight month in October, the report showed. That included the biggest advance in five months at Internet retailers and the strongest month for apparel chains since February.

Furniture outlets and restaurants were the only major categories registering a decline in October sales.

Auto purchases remained robust, climbing 1.1 percent after a 1.9 percent increase.

That’s consistent with industry data that showed the torrid demand is continuing. Purchases of cars and light trucks grew at a 17.9 million annualized rate, the strongest pace since November of last year, after 17.7 million the previous month, according to Ward’s Automotive Group.

We’ll get an earnings from Ross Stores (ROST) on Thursday.

-

Bank Stocks Soar as the Sectors Rotate

Posted by Eddy Elfenbein on November 15th, 2016 at 7:55 amImagine if someone told you earlier this year that both Brexit and Donald Trump would win, and the market’s reaction to both would be a big bank stock rally. It sounds crazy, but that’s what exactly happened. A populist pulled off a surprising upset and shares of Goldman have rallied!

Check out this graph of four major banks since Brexit:

On our Buy List, shares of Wells Fargo haven’t done nearly as well, but Signature Bank has gained 28.3% in the last four weeks. The Dow has now rallied for six days in a row. Also, the Russell 2000 just touched its first all-time high in 17 months.

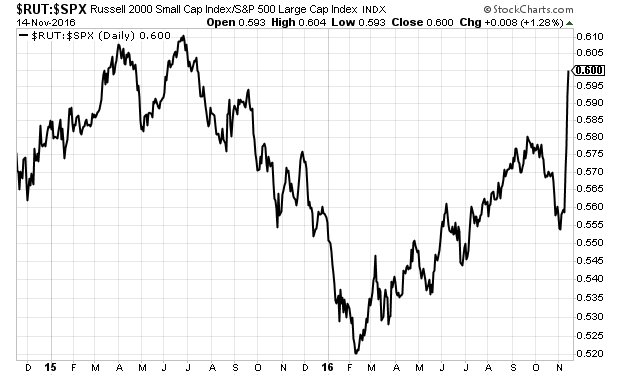

Here’s a look at the Russell 2000 divided by the S&P 500. You can see just how sharply the market has turned its attention to smaller-cap stocks.

-

Morning News: November 15, 2016

Posted by Eddy Elfenbein on November 15th, 2016 at 6:51 amYuan Slides to Lowest Level in Nearly Eight Years

British Inflation Falls To 0.9% – Competition Might Stop Predicted Higher Rates Arriving

Weak Investment Knocks German Economy

Inside Merkel’s Dilemma in World of Trump

Japan Watches Samsung Chip Away at Its Car Makers

Singles’ Day Sales Scorecard: A Day In China Now Bigger Than A Year In Brazil

Oil Prices Up 2% on Hopes of OPEC Output Cut

Mary Jo White to Step Down as S.E.C. Chief

EasyJet to Set Up Operating Company in Another EU State

Reynolds Said to Reject BAT’s $47 Billion Acquisition Proposal

Vodafone Loss Widened by Hefty India Write-Down

Apple Stock Extends Losses After China Warning About Trump

Dirty Linen: A Bed Sheets Scandal Hits the Cotton Industry

Howard Lindzon: A Trillion Here a Trillion There…Welcome to Trump University (Stock Market Class)

Josh Brown: We Got It From Here… Thank You 4 Your Service

Josh Brown: QOTD: “No One Has Ever Seen Anything Like This.”

Be sure to follow me on Twitter.

-

Our Buy List Rallies

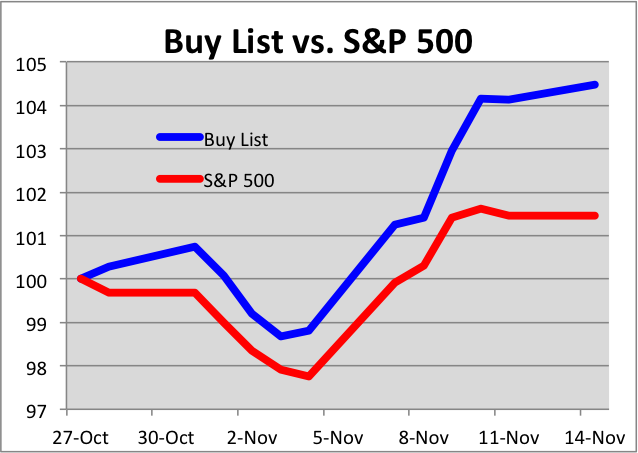

Posted by Eddy Elfenbein on November 14th, 2016 at 4:53 pmThis will go down as one of the best years for our Buy List. With 1-1/2 months to go, our Buy List is trailing the S&P 500, -0.06% for us to 5.86% for the S&P 500, not including dividends.

The good news is that we’ve done very well in the past three weeks. In fact, this period is one of our best periods relative to the market in quite some time.

Since October 27, our Buy List is up 4.47% to the S&P 500’s gain of 1.46%. That’s a big move for a diversified portfolio.

I’m not trying to sugarcoat a year which has been quite challenging. I’m merely pointing out that our Buy List is still holding its own.

-

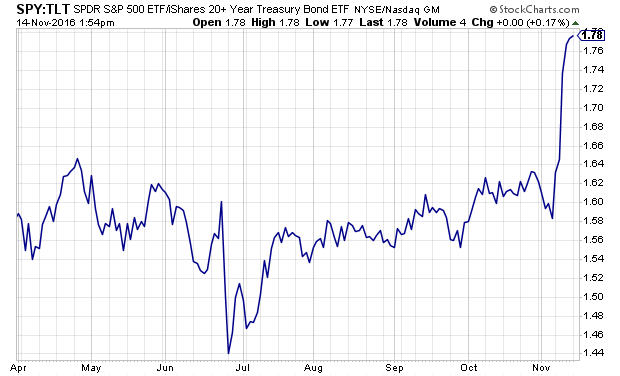

Stocks Divided by Bonds

Posted by Eddy Elfenbein on November 14th, 2016 at 1:57 pmThis simple chart tells you the story — stocks are up and long bonds are down.

-

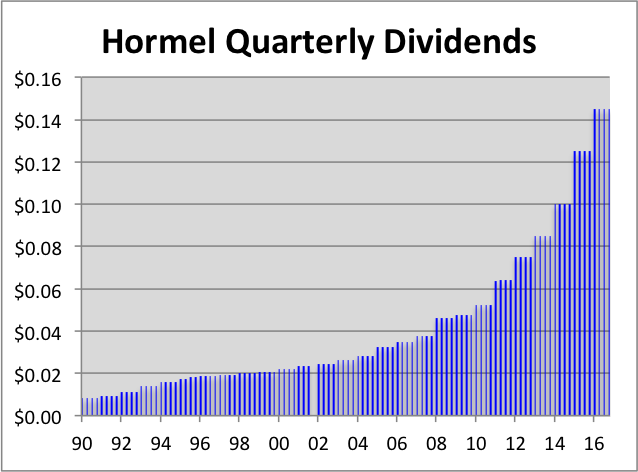

Look for a Dividend Increase from Hormel

Posted by Eddy Elfenbein on November 14th, 2016 at 1:32 pmIn Friday’s CWS Market Review, I said that it’s not important for investors to predict the future. Our strategy around here is to predict things with very, very, very high odds.

For example, I’m going to predict that Hormel Foods (HRL) will soon raise their dividend. This is not due to a genius insight on my part. Rather, it’s that Hormel has raised their dividend for the last 50 years in a row. I feel safe predicting #51. Also, their dividend announcements usually come just before Thanksgiving.

Here’s a look at Hormel’s dividends over the last 26 years.

-

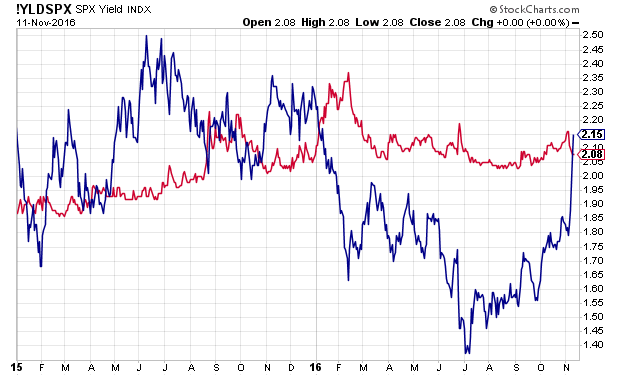

Bond Yields Are Now Higher than Stock Yields

Posted by Eddy Elfenbein on November 14th, 2016 at 10:15 amSince the election, the long end of the yield curve has sold off. That means long-term interest rates have risen, so much so that bonds now yield higher than stocks.

This isn’t necessarily bad for stocks.

This shift would appear to be negative for stocks, but some say there is a substantial silver lining. After all, bond yields do appear to be rising on short-term growth expectations, and if the economy manages to pick up, that would clearly be bullish for equities.

“It’s not a valuation story, it’s an economically optimistic story,” Eddy Elfenbein, editor of the Crossing Wall Street blog, told CNBC on Friday. And even when it comes to dividends alone, “there’s probably a good reason to think dividends will grow into 2017 and 2018.”

In other words, the old, odd situation gave stocks a reason to rise, but now that the situation has been reversed, there is an even meatier catalyst for a continued move higher.

Here’s the yield of the S&P 500 in red along with the 10-year yield in blue.

-

Morning News: November 14, 2016

Posted by Eddy Elfenbein on November 14th, 2016 at 7:01 amWhy Japan’s Economy Posted Surprisingly Strong Growth

Cash Bet Could Make or Break Modi

Trump Trade Stance With Mexico Could Press Gas Prices

U.S. Dollar Rally Finds New Life Under Trump

U.S. Two-Year Yield Tops 1% as Pimco Says Rates May Be Bottoming

Goldman Sees the Possibility of Stagflation Under Trump Presidency

Samsung to Buy U.S. Auto-Parts Supplier Harman for $8 Billion

Siemens to Buy U.S. Software Maker Mentor for $4.5 Billion

Chinese Metals Manufacturer Takes Shine to Hollywood

Naver Takes a $43 Million Gamble

Toyota in $3.4 Billion Settlement Over Corrosion in Some Trucks and SUVs

American Apparel Just Filed for Bankruptcy Protection Again

Cullen Roche: Curating a Social Media Feed to Make Better Decisions

Jeff Miller: Time for a Portfolio “Transition?”

Be sure to follow me on Twitter.

-

The Post-Election Market

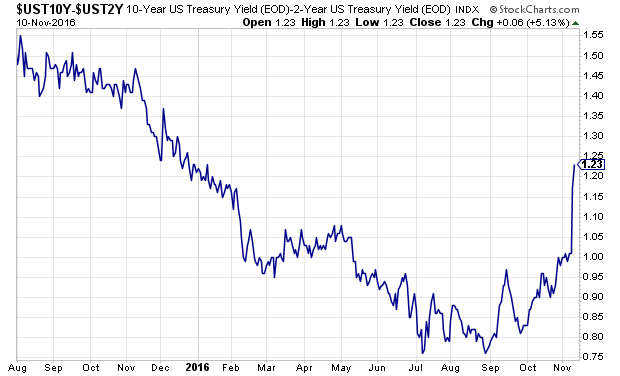

Posted by Eddy Elfenbein on November 11th, 2016 at 10:36 amThe market’s reaction to the election has been quite dramatic. Long-term bonds have sold off sharply, meaning yields have risen.

Here’s the daily high/low/close of the Long-Term Bond ETF (TLT).

Gold looked like it was going to spike up, but it has drifted downward and is close to its lowest point in several months.

The Two/Ten Spread is getting wider.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His