-

Morning News: November 7, 2016

Posted by Eddy Elfenbein on November 7th, 2016 at 6:49 amWall Street Is Expecting Another Down Year for Bonuses

Oil Leaders Meet in Abu Dhabi, Hoping Market Now at Bottom

Saudi Aramco Suspends Egypt’s Oil Shipments Until Further Notice

May’s Indian Outreach Falters as Modi, Tata Play Hard to Get

Ahead of Brexit, Some Banks Quietly Shift M&A Bankers to Frankfurt

Emerging Markets Rebound as Mexican Peso Surges on FBI Statement

Toxic Smog in World’s Most Polluted City May Soon Hit Economy

China’s Internet Controls Will Get Stricter, to Dismay of Foreign Business

Yuan Slumps Most in a Month as Depreciation Pressures Intensify

Can a Media Merger Bring Success? Comcast and NBCUniversal Say Yes

HSBC’s Capital Growth Lifts Buyback Prospects

Nissan Profit Falls 16% on Stronger Yen, Higher Incentives

Beware, iPhone Users: Fake Retail Apps Are Surging Before Holidays

Cullen Roche: The Failing Pursuit of the Truth…

Jeff Miller: Time For Some Clarity?

Be sure to follow me on Twitter.

-

October Jobs Report

Posted by Eddy Elfenbein on November 4th, 2016 at 8:59 amThis morning, the government reported that the U.S. economy created 161,000 net new jobs last month. The NFP number for September was revised higher by 35,000.

The unemployment rate fell 0.1% to 4.9%. In 12 of the last 13 months, the unemployment rate has been either 4.9% or 5.0%. We now have the second-lowest unemployment rate since 2008. The unemployment rate is lower now than it was in every single month from December 1973 to July 1997.

Average hourly earnings rose 0.4% in October, and are up 2.8% in the last year.

Get ready for some charts. Here’s the unemployment rate:

Here’s the change in non-farm payrolls:

Here’s the year-over-year change in average hourly earnings. Note the recent acceleration:

-

CWS Market Review – November 4, 2016

Posted by Eddy Elfenbein on November 4th, 2016 at 7:08 am“There are two times in a man’s life when he shouldn’t speculate: when he can afford to and when he can’t.” – Mark Twain

After being stuck in a trading range for three months, the bears have finally gotten bold enough to take the market down a peg. The S&P 500 has now fallen eight days in a row. That’s the longest losing streak since the heart of the Financial Crisis in the fall of 2008. The index has closed lower in ten of the last eleven sessions. The last time we hit nine in a row was in 1980.

Still, the overall decline has been pretty tame—just 2.9% in eight days. In fact, all eight of the one-day drops have been less than 0.7%. It’s just that we’ve been so steady for so long. The S&P 500 snapped a streak of 82 days in a row of closing in the 2100s. Perhaps we’re riding through some pre-election jitters as the polls appear to be tightening.

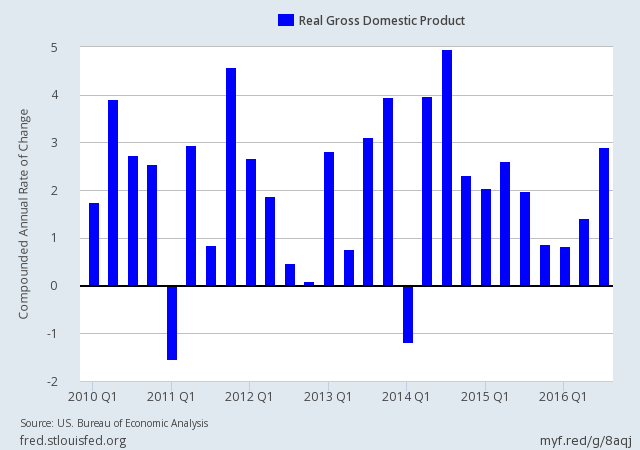

In this week’s CWS Market Review, we’ll look at the recent GDP report. As I’ve been saying for a few weeks, the economy is growing, but at a mediocre pace. The important fact is that we’re not near a recession. I’ll also discuss this week’s Fed meeting. Later on, we’ll look at the earnings report from Cerner. Plus, I’ll preview next week’s earnings report from Cognizant Technology. We also got a nice 16% dividend increase from Snap-on. But first, let’s take a closer look at where the economy now stands.

The Economy Is Finally Accelerating

Last Friday, the government reported that the U.S. economy grew in real terms by 2.9% during the third quarter. Historically, that’s pretty average, but it’s not so bad compared with the last few years. It was the fifth-best quarter of the last 19 quarters.

The details were pretty good. Exports rose by 10% thanks to, believe it or not, big gains in soybean exports. Business investment needs to improve, but a lot of that weakness was driven by lower oil prices. Consumer spending rose by 2.1% in Q3. That’s not bad, but it’s lower than some recent quarters. Overall, we can say that the economy is accelerating, but that’s coming off tepid growth.

Earlier this week, we learned that personal spending rose by 0.5% in September, the final month of Q3. Personal income rose by 0.4%. Wall Street had been expecting increases of 0.4% for both. The ISM Manufacturing report for October rose to 51.9. The manufacturing sector has now risen for 89 months in a row.

I’m writing this to you on Friday morning, ahead of the big October jobs report. For September, the government said the economy created 156,000 jobs. The consensus on the Street for October is for a gain of 178,000 jobs. That sounds about right to me—maybe a bit too high. As important as the number of jobs is, I also want to see more gains in wages. There’s been some improvement here, but we need to see more. You can be sure Janet Yellen and her friends at the Federal Reserve will be paying close attention to the jobs report (as will some politicians).

Expect a Fed Rate Hike Next Month

The Federal Reserve held another meeting this week. Since we’re so close to the election, I didn’t expect them to make any changes to interest rates. The Fed did indeed decide to do nothing, but traders closely looked for any signs of what will happen next month.

I think it’s pretty clear that the Fed is going to raise rates in December. The fact is that the economy is creating new jobs. Wages are slowly rising, and financial markets are mostly stable. The Fed has been plenty patient. At the start of the year, the Fed anticipated raising rates four times this year. They haven’t done it once.

Of course, the FOMC is a committee, so it’s not always easy to pinpoint exactly where the majority currently lies. I thought it was interesting that the last policy statement had three dissensions. Those folks wanted to raise rates immediately. This week’s statement, however, only had two dissents. Eric Rosengren was the one who switched sides. I’m guessing that’s due to the election, but we can’t say for sure.

In the policy statement, the Fed said, “The Committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives.” In recent years, the Fed has done a better job of telegraphing their intentions to Wall Street. Given the language they’re using, plus the recent dissents, I think all the signs point to a December rate hike.

For guessing what the Fed will do, I like to look at the two-year Treasury. At the start of the year, when the Fed looked like it was about to get busy, the two-year was yielding over 1%. But as those plans unraveled, the two-year slowly dropped down to 0.56% by the middle of the year. Now it’s back over 0.80%.

But what comes after that? That’s hard to say, but I suspect the Fed may hold steady for a few months, or possibly one increase. I don’t believe this is the start of a tightening cycle a la 2004-2006, when the Fed raised rates at 17 consecutive meetings.

For investors, low rates are good for stocks. The only danger is when the temptation from fixed income is so strong that it lures money away from stocks. We’re far from that happening. Until that time, investors should be focused on a portfolio of fundamentally superior stocks such as those on our Buy List.

Cerner Drops on Earnings Miss

Third-quarter earnings season is starting to come to a close for our Buy List. We had one earnings report this week, from Cerner (CERN), and we have one more next week, from Cognizant Technology Solutions.

Three months ago, Cerner told us to expect Q3 earnings ranging between 59 and 61 cents per share. On Tuesday, the healthcare IT company reported earnings of 59 cents per share. While that was within the company’s range and up 9% from last year, it was a penny below Wall Street’s consensus.

”While Cerner’s third-quarter results were slightly below our expectations, they were still solid and included the second- highest level of bookings in our history,” said Zane Burke, Cerner President. “Our competitiveness remains strong and has been bolstered by over $2 billion of investments in research and development over the past four years. We believe these investments have strengthened our clinical, revenue cycle and population health solutions and position us for strong growth going forward.”

Quarterly revenue came in at $1.18 billion, which was below Cerner’s guidance of $1.20 billion to $1.28 billion. For Q4, Cerner expects 60 to 62 cents per share and revenue between $1.225 billion and $1.300 billion. Wall Street had been expecting 65 cents per share. Cerner also gave preliminary guidance for next year of $2.50 to $2.70 per share. The Street was at $2.69 per share.

Cerner also said it will offer another set of buyouts for employees who qualify. They had a similar offer last year.

“This should not be viewed as a layoff or a sign that we don’t expect to grow,” Naughton said. “We’ve grown our head count by over 2,000 people this year and expect to grow head count next year as well.”

The shares dropped about 7% after the earnings report. Cerner is one of those companies I’m not terribly worried about if they miss earnings. The company is still fundamentally strong. The business is growing, just slightly less rapidly then they had expected. This week, I’m dropping my Buy Below price on Cerner down to $61 per share.

Earnings Preview for Cognizant Technology Solutions

On Monday, Cognizant Technology Solutions (CTSH) will be our final Buy List stock to report third-quarter earnings. Hanging over this report is the recent news that a Cognizant internal investigation revealed that they may have violated the U.S. Foreign Corrupt Practices Act. Cognizant notified the SEC and DOJ. The same day, the company’s president resigned.

The stock plunged sharply on the news but has since regained some lost ground. There’s no news to add, so I think traders fear the worst. I’m relieved that at least the company reported its own possible violations.

Still, we need to focus on CTSH’s operations. In August, the company had a good earnings report. The IT outsourcer earned 87 cents per share. That was a nickel better than expectations. Quarterly revenue jumped 9.2% to $3.37 billion, which matched consensus. Interestingly, the British pound’s fall post-Brexit knocked off about $40 million in revenue.

Cognizant’s guidance for Q3 was noticeably conservative. Francisco D’Souza, the CEO, said, “While our revised guidance reflects the impact of near-term macroeconomic headwinds, our longer-term outlook and underlying business fundamentals remain strong. We continue to see an expanding market opportunity ahead and are well positioned to capitalize on the digital transformations taking place among enterprises around the world.”

Cognizant sees Q3 coming in between 82 and 85 cents per share, whereas Wall Street had been expecting 86 cents per share. On the plus side, Cognizant reiterated its full-year guidance range of $3.32 to $3.44 per share.

On the revenue side, Cognizant sees Q3 ranging between $3.43 billion and $3.47 billion. Wall Street had been expecting $3.54 billion. The company also changed its full-year guidance range for revenue from $13.65 billion – $14.0 billion to $13.47 billion – $13.60 billion. Wall Street had been expecting $13.75 billion.

I’ll be curious to hear any guidance for next year and any updates regarding the investigation. I’m still quite optimistic about Cognizant.

Before I go, I have a few quick updates on our Buy List stocks. Ford Motor (F) said that its sales fell last month by 11.9%, although the Lincoln brand did well. Ford had a lot of fleet sales last month which tend to go for a lower sales price. The stock now yields 5.3%, based on Thursday’s close.

Shares of Bed Bath & Beyond (BBBY) recently dropped below $40 per share for the first time in six years. Since early 2015, the stock has been cut in half. Bed Bath needs to make changes to keep up. I’m lowering my Buy Below price to $43 per share.

On Thursday, Snap-on (SNA) increased its dividend by 16.4%. The quarterly payout will rise 10 cents, to 71 cents per share. The shares yield 1.86% based on Thursday’s close. The company had an excellent earnings report two weeks ago.

That’s all for now. Next week’s news will be dominated by some sort of electoral event on Tuesday. You may have heard about it. In any event, there will be more earnings reports as well. On Wednesday, the Commerce Department will report on wholesale inventories. Then on Thursday, we’ll get initial jobless claims, plus an update on the Federal budget. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: November 4, 2016

Posted by Eddy Elfenbein on November 4th, 2016 at 6:56 amJobs Report: No News Is Good News

Cracking Down on Immigration Doesn’t Boost Wages

Wells Fargo Faces Scrutiny for Black Marks on Ex-Employee Files

Goldman’s New Hedge Fund ETF Offers Big Ideas And Crowded Trades, But No Hedge

Dick Clark Productions to Be Sold to Dalian Wanda for $1 Billion

Starbucks Reports Annual Record Profit

GoPro Is Betting This Slick Drone Will Save the Day

Air France Plans No-Frills Airline to Serve Asia, U.S.

Sands Sees Boost From New Macau Resort as Wynn Disappoints

CBS’s Moonves Sounds More Open to Viacom Reunion

Shell, Total CEOs Question Solar in Room Full of Solar Investors

News of Charges in Price-Fixing Inquiry Sends Pharmaceuticals Tumbling

Takata Mulls Bankruptcy For U.S. Unit, Filing Will Take Time

Roger Nusbaum: Calls For Poor Returns or a Call To Action?

Be sure to follow me on Twitter.

-

Josh Brown: “Authorities Break Up Active Management Cell”

Posted by Eddy Elfenbein on November 3rd, 2016 at 2:13 pmJosh Brown has the scoop:

(Boston, MA) – Local police, working closely with Federal pension fund authorities, arrested three men on Thursday morning while breaking up an active management cell that was on the verge of deviating from the index. Based on early reports from S&P Dow Jones Indices, it could have been the costliest attack on American soil in months.

The men – all Wharton Business School nationals working in Boston’s downtown financial district — allegedly belong to a group with ties to the active management community, according to Morningstar Intelligence.

“At the moment the cell was broken up, its members were fully radicalized and in a phase of total assimilation and commitment to the value investor ideology – demonstrating their full disposition to carry out non-correlated strategies with high tracking error” the Department of Portfolio Conformity said in a statement.

The joint task force acted because the cell’s members were allocating unpredictably and “had shown full willingness to carry out security selection and research,” according to the agency.

The three men, who are between the ages of 26 and 29, were being interrogated in custody, a Department representative said. Authorities can hold them for up to five days before pressing for full redemption.

Read the whole thing.

-

Morning News: November 3, 2016

Posted by Eddy Elfenbein on November 3rd, 2016 at 7:06 amU.K. Services Strength ‘Marred’ by Accelerating Inflation

Brexit Will Need U.K. Parliamentary Vote After Court Ruling

Egypt Free Floats Pound, Raises Lending Rates to Spur Economy

Fed Gives Subtle Nod on December Hike

U.S. Commerce Chief Warns Against China Semiconductor Investment Binge

Facebook Profit Soars, but Growth Concerns Emerge

Credit Suisse Drops as One-Time Gain Fuels Quarterly Profit

Microsoft Puts Slack in Cross Hairs With New Office Chat App

Fitbit Forecasts Dismal Holiday Quarter, Shares Sink

John Mackey Will Be Sole CEO of Whole Foods Market

Delta Turns to Apartment-Sharing Service Airbnb For More Business

Adidas to Restructure Reebok Brand

Air France Plans New Long-Haul Arm as Janaillac Takes Charge

Josh Brown: Kings Lose Crowns, But Teachers Stay Intelligent

Howard Lindzon: Leaving Tel Aviv and Next Year’s FinTech and Falafel Conference

Be sure to follow me on Twitter.

-

Today’s Fed Statement

Posted by Eddy Elfenbein on November 2nd, 2016 at 2:03 pmHere’s today’s Fed statement. They somehow went from three dissents to two. Eric Rosengren changed camps, possibly due to the closeness of the election.

I still think it’s clear the Fed is going to hike next month.

Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and growth of economic activity has picked up from the modest pace seen in the first half of this year. Although the unemployment rate is little changed in recent months, job gains have been solid. Household spending has been rising moderately but business fixed investment has remained soft. Inflation has increased somewhat since earlier this year but is still below the Committee’s 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation have moved up but remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will strengthen somewhat further. Inflation is expected to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The Committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action were: Esther L. George and Loretta J. Mester, each of whom preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.

-

Small-Cap Stocks Slide

Posted by Eddy Elfenbein on November 2nd, 2016 at 10:45 am -

Morning News: November 2, 2016

Posted by Eddy Elfenbein on November 2nd, 2016 at 7:17 amU.S. Election Angst Spreads as Stocks Drop, Bonds Rise With Gold

Oil Majors Join Forces in Climate Push With Renewable Energy Fund

German Joblessness Falls to Record Low as Economy Ploughs On

YouTube Agrees to Pay Royalties, Ending German Music Dispute

For Helping Immigrants, Chobani’s Founder Draws Threats

Maersk Shares Sink After Profit Hit by Weak Freight Rates, Oil Prices

Square Celebrates Full Year On The Public Market With Earnings Beat

China Cautions Germany Over Aixtron-Deal Halt

Geely, Volvo Have New Luxury Car

Alibaba-Backed Lazada Buys Singapore Online Grocer

Gannett Abandons Effort to Buy the Newspaper Publisher Tronc

Allergan Revenue Rises 4.4%; Company Expands Buyback

Wells Fargo to Pay $50 Million to Settle Home Appraisal Charges

Cullen Roche: Have We Reached Peak Robo Advisor?

Jeff Carter: Success Begets Easier Recruitment

Be sure to follow me on Twitter.

-

Emerging Markets and Election Risk

Posted by Eddy Elfenbein on November 1st, 2016 at 9:05 pm

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His