-

Morning News: August 22, 2023

Posted by Eddy Elfenbein on August 22nd, 2023 at 7:07 amPressure to Revive Economy Muddies Earnings Outlook for China’s Top Banks

China Ramps Up Fight With Yuan Bears

Why It’s So Hard for China to Fix Its Real Estate Crisis

Commerce Secretary to Visit China Next Week in Bid to Steady Ties

How Hard Should the Fed Squeeze to Reach 2% Inflation?

S&P Joins Moody’s in Cutting US Banks

Becoming a Bank Proves Challenging for Fintechs Seeking Survival

Deepfake Imposter Scams Are Driving a New Wave of Fraud

New U.S. Buyback Tax Hits Companies With $3.5 Billion Burden

Half a Million US Jobs at Risk of Vanishing in Payroll Revision

Sorry, But LinkedIn Is Cool Now

Microsoft Pushes to Get Activision Deal Done With Fresh UK Offer

Goodbye Bathtub and Living Room. America’s Homes Are Shrinking

Some Americans Take On Side Hustles for Fertility Benefits

America’s Farmers Are Bogged Down by Data

A Warlord With a Cocaine Empire Is Saving the Amazon Rainforest

Southern African Bloc Backs $17 Billion Gas Infrastructure Plan

Profit From America’s Manufacturing Renaissance With Rockwell Automation

Gap’s Discount Is Too Big to Ignore

Dick’s Sporting Goods Blames Theft for Profit Woes

Be sure to follow me on Twitter.

-

Morning News: August 21, 2023

Posted by Eddy Elfenbein on August 21st, 2023 at 7:02 amChina Central Bank Cuts Key Interest Rate on Bank Lending

Run It Cold: Why Xi Jinping Is Letting China’s Economy Flail

As China Falls Into Deflation, the Mood Turns Dark

China Is on Edge as Fallout From Its Real Estate Crisis Spreads

Chinese E-Commerce Giants Pivot to Selling Inexpensive Goods

JPMorgan Sees Japan’s Threshold for Yen Intervention at Around 150 Yen per Dollar

The Unbearable Nothingness of Yield Curve Inversion

Why the Era of Historically Low Interest Rates Could Be Over

The Fed Can’t Celebrate at Jackson Hole Just Yet

New York and California Each Lost $1 Trillion When Financial Firms Moved South

Why PayPal’s Stablecoin Is Likely to Succeed Where Facebook’s Libra Failed

Arm Listing Set to Be Turning Point for IPO Market, SoftBank

Bond Bulls at JPMorgan, Allianz Keep Piling Into a Bet Gone Bad

Wall Street All-Stars Including Weinstein, Ackman Bid for Hedge Fund

Borrowers With $39 Billion in Student Loans Finally See Relief

Retailers Are Fleeing Downtown San Francisco. IKEA Is Moving In

Cargill Tests 123-Foot-Tall Sails in Effort to Slash Fuel Burn

Kraft Heinz Sees a $25 Billion Opportunity—in Schools

Meta’s Threads App to Launch Web Version as Rivalry With X Enters New Stage

Be sure to follow me on Twitter.

-

Morning News: August 18, 2023

Posted by Eddy Elfenbein on August 18th, 2023 at 6:29 amHow Brexit Failed England’s Premier Fishing Town

How Geopolitics Is Complicating the Move to Clean Energy

Biden’s Big Green Push Is Driving Enormous Growth

A Sickly Ruble Reveals What Putin Will Not

Turkish Inflation Outlook at Its Worst in 21 Years on Weak Lira

Top US Firms From Apple to Intel Decry India PC Import Curbs

‘Peak China’ (Post-Dynasty Version)

China’s Hidden Financial Dangers Erupt With Shadow Bank Crisis

Evergrande Seeks US Court Nod for $32 Billion Debt Overhaul as China Economic Fears Mount

Investors Fear China’s ‘Lehman Moment’ Is Looming

Bitcoin Plunge Spurs Liquidations as SpaceX’s Token Sale Weighs

Billionaire Steve Cohen Fights a $10 Million Tax Bill to Derail an IRS Plan

Hawaii Fires Turn a Safe Investment into a Big Risk

Hawaii Explores Moratorium on Outsiders Buying Lahaina Properties

Why Child-Care Prices Are Rising at Nearly Twice the Overall Inflation Rate

For Single Women in China, Owning a Home Is a New Form of Resistance

China’s Abandoned, Obsolete Electric Cars Are Piling Up in Cities

The EV Startup Worth More Than GM Had Troubled U.S. Rollout

Ford Swings at Supercars With New $300,000 Mustang GTD

America’s Obsession With Weight-Loss Drugs Is Affecting the Economy of Denmark

Be sure to follow me on Twitter.

-

Morning News: August 17, 2023

Posted by Eddy Elfenbein on August 17th, 2023 at 7:06 amMilei Promises Argentina Can Be Saved With Libertarian Economics

China Told State Banks to Escalate Yuan Intervention

Some Fed Officials Are Turning Cautious about Raising Rates Too High

With Investors on Edge, Fed Minutes Take on New Urgency

Global Yields March to 15-Year Highs as Rate-Hike Worries Build

Goldman Sachs Blames Zero-Day Options for Fueling S&P 500 Selloff

The Legendary, Wildly Profitable QQQ Fund Makes No Money for Its Owner

‘Don’t You Remember Me?’ The Crypto Hell on the Other Side of a Spam Text

More Cyber Companies Announce Layoffs

How a Small Group of Firms Changed the Math for Insuring Against Natural Disasters

The Trillions of Dollars Forgotten When Tracking the Energy Transition

U.S. Plans New Tariffs on Food-Can Metal From China, Germany and Canada

How U.S. Steel Became an Acquisition Target

US Housing Affordability Hits Worst Point in Nearly Four Decades

The Golden Girls Approach: Buying Homes Together Amid High Prices

Almost Half of Americans See Automation Replacing Their Jobs

The Desperate Hunt for the A.I. Boom’s Most Indispensable Prize

BAE Systems Snaps Up Ball Corp’s Aerospace Arm for About $5.55 Billion

Walmart’s Sales and Profits Rise, Fueled by Consumers Looking for Deals

Already Time to Hit the Brakes on VinFast

Nike, Adidas Bet Big on World Cup Football Shirts and Merch

Be sure to follow me on Twitter.

-

Morning News: August 16, 2023

Posted by Eddy Elfenbein on August 16th, 2023 at 7:04 amU.K. Inflation Eases to 6.8% as Energy Prices Fall

Argentina Vote Shock Leaves Investors Dreading the Next Default

Lebanon Freezes Accounts of Former Central Bank Governor

China Asks Some Funds to Avoid Selling Stocks as Markets Sink

Zhongrong Trust’s Missed Payments Trigger Fears Among Chinese Investors

China Scuttles a $5.4 Billion Microchip Deal Led by U.S. Giant Intel

The U.S. Is Turning Away From Its Biggest Scientific Partner at a Precarious Time

Vital Natural Gas Is Being Stashed in Caverns Beneath War-Torn Ukraine

Race to Control Electric-Vehicle Supply Chains Leads to Africa

I.R.S. Says Cash Influx Has Made Agency Bigger and More Digital

Coinbase Gets NFA Approval to Offer Crypto Futures

Goldman CEO’s Most Loyal Deputy Is Tested by Mutinous Partners

Brookfield Chases Rivals for Private Equity’s New Money-Spinner

Billionaire Charlie Ergen Conjures M&A Magic to Save His Empire

Dubai Leapfrogs Lisbon as Best Destination for Globetrotting Executives

A Vietnamese Electric Carmaker is Now Worth More Than Volkswagen and Ford

High-Potency Pot Market Worth Billions Draws Regulator Scrutiny

Estée Lauder’s Big Bet on China Is Looking Not So Pretty

Target Sales Are Punished by Pride Month Backlash

Forget the Office Gym. Welcome to the Gym Office

Be sure to follow me on Twitter.

-

CWS Market Review – August 15, 2023

Posted by Eddy Elfenbein on August 15th, 2023 at 6:33 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

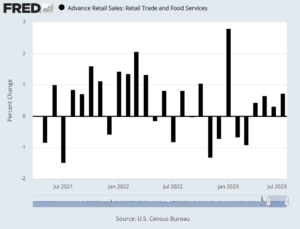

July Retail Sales Rose 0.7%

We had some good news this morning regarding consumer health. The Commerce Department said that retail sales rose by a seasonally-adjusted rate of 0.7% last month. Expectations were for an increase of 0.4%. The figure for June was revised higher by 0.3%, and May was revised upward by 0.1%.

It’s hard to have a recession when people are out there shopping!

If we exclude autos, then July’s sales were up by 1%. Bear in mind that these numbers are not adjusted for inflation. Here are some details.

July’s numbers were boosted by a 1.9% jump in spending at online retailers, while sporting goods and related stores increased 1.5% and food service and drinking places rose 1.4%.

On the downside, furniture sales slumped 1.8% and electronics and appliance stores reported a 1.3% drop. Gas station sales rose just 0.4% on the month despite rising prices at the pump.

The report adds to the narrative that the U.S. economy may be able to avoid a much-predicted recession brought on by a series of Federal Reserve interest rate hikes aimed at controlling inflation.

These numbers are important to watch because consumer spending accounts for roughly two-thirds of the U.S. economy which is now $27 trillion.

The Federal Reserve doesn’t meet again for another month, but the emerging conventional wisdom is that the Fed will pause again and hold interest rates at 5.25% to 5.50%. Short-term rates are at their highest level in more than 20 years.

The outlook for the economy has changed a great deal over the last few months. Not too long ago, markets were expecting the Fed to have started cutting rates by now. What a difference a few months can make.

After September, the futures market thinks there’s a one-in-three chance that the Fed will hike again at its November meeting. Frankly, I’m skeptical but if the data changes, then it’s a strong possibility.

Over the last 12 months, retail sales have increased by 3.2%. That sounds impressive until you realize that that’s the same rate of inflation. Another report today said that import prices increased by 0.4% last month. That was double expectations.

Earlier today, the Atlanta Fed’s GDPNow forecast for Q3 GDP growth jumped to 5.0%. That’s up from 4.1% from last week. That’s a very strong number.

Obviously, this is just a model and we’re only halfway through Q3. Looking at the details, consumer spending added 3% to Q3 GDP growth, and the change in inventories added 1.17%.

That’s very impressive and it’s more evidence that the most widely-expected recession in decades is still taking its sweet time. A lot of well-paid economists were very, very wrong.

Argentina’s Fed Hikes Rates to 118%

In the United States, people are worried about high interest rates. Since March 2022, the Federal Reserve has increased interest rates 11 times to a range of 5.25% to 5.50%. That’s (finally) higher than the rate of inflation.

But that’s nothing compared with our friends in Argentina. Their central bank just hiked rates by 21% to 118%. The country is on the brink of its sixth recession in the last decade.

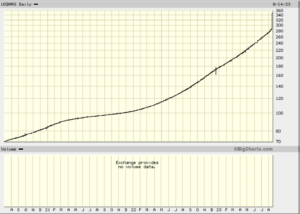

Here’s a look at the peso versus the dollar. Notice the jump at the end.

This is due to the fallout of Sunday’s stunning primary win by Javier Milei, a libertarian economist. Milei won 30% of the vote in the presidential primary which was far more than expected.

I should explain that Milei isn’t exactly your typical presidential candidate. Milei isn’t merely a small-government conservative; he’s a full-throated anarcho-capitalist. Two of his dogs are named Milton and Murray, in honor of Friedman and Rothbard.

I don’t want to give you the impression that Milei is somehow odd or unusual. For example, he wants to legalize the selling of organs and children. He also refuses to comb his hair. Additionally, he’s a tantric sex instructor. After that, things frankly start to get a little odd.

Still, none of this held back voters. Milei won by far the largest share of the vote. This is only the first round of voting. Any candidate who got more than 1.5% will be able to compete in the next round in October. There may also be a runoff in November. Still, it’s obvious that Milei is the leading contender.

The real story here is less Milei’s triumph, though that is important, and more that things are so bad that voters are willing to give politicians outside the mainstream, like Milei, a hearing. This is when you find out that outside the mainstream is now the mainstream. Of course, we’ve had similar outcomes in our elections.

For a land of such beauty and promise, Argentina seems to go from one self-induced crisis to the next. Yet it’s that frustration that’s driving Milei’s popularity. You think 9% inflation is bad in America? It’s projected to hit 140% in Argentina. In the last decade, Argentina has had five recessions and a sixth may soon be here.

I bring this up not to discuss politics, but I do want to focus on an important dynamic, and that’s how the reaction of financial markets impacts policy. The worry is that a Milei win will cause investors to flee Argentina. Argentina’s bond and currency markets are in freefall.

That happened in France after Mitterrand’s stunning socialist victory in 1981. A lot of French money quickly found a new home in New York.

Liz Truss faced a similar crisis last year, leading her to resign after just seven weeks as U.K. Prime Minister.

In the 1990s, James Carville famously said, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” He’s right.

Argentina’s central bank responded to Milei’s showing by devaluing the peso by nearly 18%. The bank said it would hold the peso at 350 to the U.S. dollar until October. The central bank also hiked interest rates by 21% to 118%.

If he wins, Milei said he wants to cut taxes and implement large spending cuts. He also wants to ditch the central bank and “dollarize” the economy. Milei claims that replacing the peso with the dollar would help calm inflation.

A Milei presidency could have a major impact on global commodity markets. Of course, Argentina is famous for its beef, but it’s also the world’s fastest-growing lithium producer.

Milei won big in the country’s farm belt, and he’s promised to take the axe to farm taxes. That could make Argentina’s agricultural sector more competitive. The country also has major deposits of copper and shale oil.

There are 15 Argentina-based stocks that trade on the U.S. exchanges. Most of the companies are financial or energy stocks, with a few utilities. These stocks had a rough day on Monday. Banco Macro and Grupo Financiero Galicia were both down over 6%. Grupo Supervielle was down over 7%.

I’m far from an expert on Argentine politics, but I would take Milei’s showing as a sign of how fed up voters are with business as usual. I’m skeptical that he can get so much of his program passed. Still, it’s another indication that voters aren’t happy with high inflation and corruption.

If he wins, Milei will be able to go as far as the bond and currency markets let him. They can intimidate everybody.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: August 15, 2023

Posted by Eddy Elfenbein on August 15th, 2023 at 7:03 amRoaring Back From Pandemic, Japan’s Economy Grows at 6% Rate

Taiwan’s Election Is All About War

Argentine Shops Hit With 20% Overnight Price Hike After Election

Uganda Cuts Rate for First Time in Two Years on Easing Inflation

Russia’s Emergency Rate Hike Fails to Lift Ruble After Crash

China Slashes Rates, Suspends Youth Jobless Data as Economy Signals Sharper Downturn

The Fed’s Interest-Rate Debate Is Shifting

How (Many) Economists Missed the Big Disinflation

Binance Files for Protective Order Against SEC

FDIC to Propose Comprehensive Changes to Regional US Bank Living Wills

Fitch Warns It May Be Forced to Downgrade Multiple Banks, Including JPMorgan

Steve Schwarzman Is Pushing Blackstone Growth to Get its Act Together

Suncor Energy’s Quarterly Profit Halves on Lower Oil and Gas Prices

Home Depot Beats Earnings Estimates, But Sales Slide As Consumers Pull Back on Big-Ticket Buys

Target’s Struggles Are Only Getting Worse

Streaming Prices Are Up Nearly 25% in a Year. That’s Part of the Plan

Using a Credit Card? At These Restaurants It’ll Cost You.

More Americans Are Ending Up Homeless—at a Record Rate

Serve a Drink, Then Save a Life: This Is Restaurant Work During the Opioid Epidemic

The Airport Is an Increasingly Dangerous Place to Work

Be sure to follow me on Twitter.

-

Morning News: August 14, 2023

Posted by Eddy Elfenbein on August 14th, 2023 at 7:07 amThe Economic Losers in the New World Order

Russia’s Ruble Hits a 17-Month Low to the Dollar as the Ukraine War Bites

Yen Breaches 145 Mark Against the Dollar, Prompting Expectations of BOJ Intervention

China Finance Giant’s Missed Payments Alarm Regulators, Markets

China’s Worsening Economy Is Hurting Corporate America

After Pulling Inflation Down, Gasoline and Food Threaten to Nudge It Up

The Fed Is Playing a Waiting Game to Try to Avoid a Recession

Binance Shows Why Your Fears of Fed ‘Tightness’ Are Unfounded

Yellen Warns of Risks of Over-Concentration of Clean Energy Supply Chains

US Steel Shares Soar After It Rejects $7.25 Billion Cliffs Bid

Texas Oil Executives Net $122 Million in Bankruptcy-to-Exxon Journey

Two Towns, Two Factories: How a $500 Billion Boom Exposes American Failures

San Francisco Prices Are Sinking, and Property Owners Want a Tax Cut

Can San Francisco Save Itself From the Doom Loop?

Private Equity Firms Are Slow to Sell Holdings Amid Higher Rates

Carl Icahn Should Be Sailing Into the Sunset. Instead, He’s Scrambling to Save His Empire

iPhone Maker Foxconn Beats Expectations. Apple Stock Edges Higher

The Dream Was Universal Access to Knowledge. The Result Was a Fiasco

Everyone Has An Idea For How to Fix Disney. Does Bob Iger?

Banned in Kuwait, ‘Barbie’ Sparks Delight, and Anger, in Saudi Arabia

Be sure to follow me on Twitter.

-

Morning News: August 11, 2023

Posted by Eddy Elfenbein on August 11th, 2023 at 7:05 amTurkey Finally Stamps Out Credit Oddity as Hikes Lift Loan Rates

Meloni-Style Capitalism is Reshaping Corporate Italy

Adani Ports Auditor Deloitte to Resign After Flagging Concerns

Biden Calls China’s Economy a ‘Ticking Time Bomb’

Interest Rates on Loans Hit 790% in Latin America’s Big Fintech Shakeout

New U.K. Alcohol Taxes Cut Beer Costs In Pubs, But Other Drink Prices Will Rise

Hard Landing Is Here for Trade, Roiling World Export Champs

CFOs Are More Optimistic on Side-Stepping a Recession

UBS Ends Taxpayer Backstop Granted for Credit Suisse Rescue

Consulting Firms Are Paying Undergrads $25,000 to Do Nothing

Regulators Give Green Light to Driverless Taxis in San Francisco

UPS Pay Hikes for Package Handlers Raise Pressure on FedEx

Airline Passengers Will Be Forced to Pay for $5 Trillion Carbon Cleanup

Before Joining Federal Safety Program, Freight Railroads Push to Change It

Goldman’s C.E.O. Is Stuck, Without a Clear Lifeline

Outrage as Chinese Real Estate Giant Wobbles and Its Stock Dives

The Summer Women Flexed Their Spending Power

Diamonds Are on Sale. They Won’t Be Forever

Amazon Cuts Dozens of House Brands as It Battles Costs, Regulators

Colleges Spend Like There’s No Tomorrow. ‘These Places Are Just Devouring Money.’

Paul Krugman on AI, Superconductors, and Why Alien Invasions Are Inflationary

Be sure to follow me on Twitter.

-

Morning News: August 10, 2023

Posted by Eddy Elfenbein on August 10th, 2023 at 7:04 amECB Is on Back Foot and For Once It’s Down to Germany

Turkey Inflation: Erdogan’s Policy U-Turn Tests Patience

US Set to Unveil Long-Awaited Crackdown on Real Estate Money Laundering

The US Is Pushing Guns on a Country It Labels Violent and Corrupt

Biden Orders Ban on New Investments in China’s Sensitive High-Tech Industries

Lessons From a Law Firm’s Decision to Leave China

China Relies on U.S., Allies for Hundreds of Products

Heat, War and Trade Protections Raise Uncertainty for Food Prices

How Long Will Companies Keep Raising Prices on Consumer Goods?

What to Watch in July’s CPI Report: Why an Uptick in Annual Inflation Might Not Worry the Fed

US Consumer Prices Data Set to Show ‘Wave of Disinflation’

Moody’s Warning on US Banks a Wake-Up Call for Sanguine Investors

In Wall Street’s Hottest CEO Race, Morgan Stanley Hopes for Drama-Free Handoff

For Disney, Streaming Losses and TV’s Decline are a One-Two Punch

Disney to Launch Cheaper Ad-Supported Service in UK

Studios Are Raking in Profits While Actors and Writers Are on Strike

Retailers Say Organized Theft Is Biting Into Profits, but Internal Issues May Really Be to Blame

The $1.4 Billion Corporate Sponsorship Hole in the Women’s World Cup

Lyft to Expand Its Ad Business as New CEO Eyes a Turnaround

Coach Owner Creates US Luxury Giant with $8.5 Billion Deal for Michael Kors Parent

Be sure to follow me on Twitter.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His