-

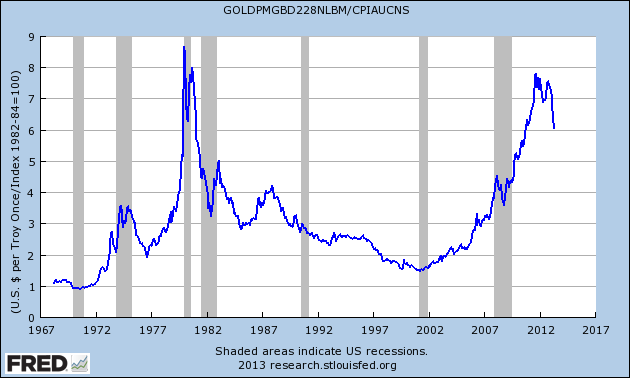

The Price of Gold Adjusted for Inflation

Posted by Eddy Elfenbein on June 25th, 2013 at 1:34 pmI have to confess that I don’t have a major point with this post. I was simply curious as to what a chart of the price of gold divided by the CPI looks like. Here it is. What’s interesting is that the recent inflation-adjusted top is fairly close to the top from 1980.

The drop in gold since the summer of 2011 has been pretty dramatic. Going by gold’s recent history, the metal seems to move in very long bullish or bearish cycles. Was 2011 the end of the bull cycle? I don’t know.

But if it were, I guess it would look like this.

-

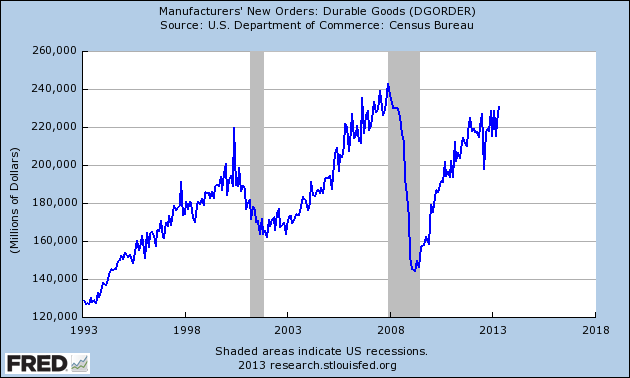

Strong Durable Goods Report

Posted by Eddy Elfenbein on June 25th, 2013 at 10:22 amMore positive economic news:

Durable goods orders increased 3.6 percent as demand for goods ranging from aircraft to machinery rose, the Commerce Department said on Tuesday. Orders for these goods, which range from toasters to aircraft, had increased by a revised 3.6 percent in April.

Economists polled by Reuters had expected orders to rise 3.0 percent after a previously reported 3.5 percent increase the prior month.

Orders excluding transportation rose 0.7 percent after advancing 1.7 percent in April.

Non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, increased 1.1 percent. Orders for the so-called core capital goods had increased 1.2 percent in April and economists had expected a 0.3 percent gain last month.

The durable goods report is interesting to watch. Notice how sharply it fell during the recession.

-

Markets Rally on Strong Housing Report

Posted by Eddy Elfenbein on June 25th, 2013 at 9:38 amAfter a few unpleasant days, the S&P 500 looks to gain back some lost ground today. There’s been growing concern about the credit bubble in China, but the Chinese now seem determined to keep rates reasonable. While the reaction to the Fed’s news from last week has hurt our market, the pain has been much greater in emerging markets. The U.S. market has been the safe haven.

Today’s Case-Shiller report showed that home prices rose more than expected in April. A recovering housing market is obviously good news. The issue for the Fed is that housing is one area of the economy where lower rates can help, but what about other sectors?

-

Morning News: June 25, 2013

Posted by Eddy Elfenbein on June 25th, 2013 at 7:38 amPBOC Ling Says Rise in China Money-Market Rates Temporary

HSBC Considers Quitting Iraq by Selling Dar Es Salaam Bank Stake

Walking Back Bernanke Wished on Too Much Information

Two Fed Presidents Emphasize Stimulus to Persist After QE Taper

Exit from the Bond Market is Turning Into a Stampede

Samsung in Talks to Settle EU Antitrust Case

Microsoft Joins Oracle in Cloud-Computing, Rivalry Thaws

Dell Buyout Battle: Icahn, Southeastern Hit Back Against Michael Dell

Heathrow Flight Showdown Looms as Delta-Virgin Targets NYC Route

CML HealthCare to Sell Itself in Canadian $1.22 Billion Deal

Dallas-based Neiman Marcus Takes the First Step Toward IPO

Western Digital to Buy SSD Maker Stec for $340 Million

Mass Layofffs at a Top-Flight Law Firm

Phil Pearlman: Markets Correct & People Freak Out

Be sure to follow me on Twitter.

-

The Dow Dropped 139 Points

Posted by Eddy Elfenbein on June 24th, 2013 at 10:30 pmI was out of the office most of the day but I’ll fill you in on the details: Today was an ugly day for the stock market. This was Day Four post-Fed and the markets are still reeling. The S&P 500 lost -1.21% and it had been much worse earlier in the day. Eighteen of the 20 Buy List stocks were down. Only Oracle ($ORCL) and Microsoft ($MSFT) closed higher. WEX Inc. ($WEX) is finally below my $75 Buy Below price.

There seems to be some organized pushback about the Fed’s policy from last week. Two FOMC members today stressed that the central bank will continue to be very accommodative.

On Friday, Jon Hilsenrath of the WSJ reiterated the dovish angles in the Fed’s current stand. I have to think this was a bit of damage control. The Fed is probably surprised at the strong reaction from the markets.

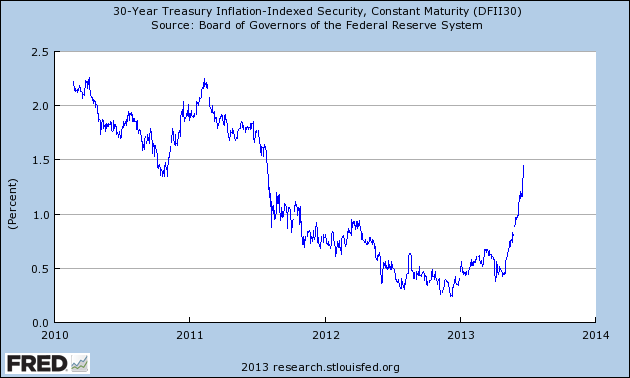

Looking at the markets, I’ve been very surprised that the five-year inflation expectations have dropped so much. In fact, the rise in bond yields seems well correlated with the drop in inflation expectations. I really don’t see how that makes sense, but I tend to give higher weight to the world that is rather than what may be.

Consider that the implied one-year Treasury yield two years from now has risen from 0.9% last Tuesday to 1.35% today.

Look at the jump in the 30-year TIPs yield:

-

The S&P 500 Drops Below 1,570

Posted by Eddy Elfenbein on June 24th, 2013 at 9:56 amThe stock market is taking another hit again this morning, and this time the culprit appears to be China. Financial stocks in China dropped 7% yesterday. The Chinese Fed posted a message on its website which essentially told big banks to deal with tighter money. Just like last week, bonds and gold are down as well.

Today’s move is more classically defensive. The major cyclical areas like materials and energy are down big while the more stable areas like staples and healthcare are down the least.

While the big Fed meeting was last week, there will be seven speeches this week by Fed members. These might provide important clues into the Fed’s thinking. On Wednesday, we get an earnings report from Bed Bath & Beyond ($BBBY).

-

Morning News: June 24, 2013

Posted by Eddy Elfenbein on June 24th, 2013 at 7:42 amChina Yuan Ends Down on PBOC Guidance; May Fall Further

‘Window-Dressing’ Undermines Bank Risk-Weight Trust: BIS

Japanese Shares Retreat Amid Chinese Growth Concerns

German Business Confidence Seen Increasing on Economic Recovery

“Frenkel’s Appointment is Good News for Investors”

Citigroup Venturing Into Iraq Gets Approval for Baghdad Office

Fed Monetary Course Difficult for a Bernanke Successor to Alter

Kabel Deutschland Board Agrees to Vodafone’s €7.7 Billion Cash Offer

Hutchison Whampoa Buys Telefónica’s Irish O2 Business

Tenet to Acquire Vanguard Health Systems for $1.8 Billion

Suntory’s $4 Billion IPO Priced Near Low End of Range

Bitcoin Foundation Gets Cease-And-Desist Letter From California

Jeff Miller: Weighing The Week Ahead: How Will Markets Digest The New Fed Message?

Be sure to follow me on Twitter.

-

CWS Market Review – June 21, 2013

Posted by Eddy Elfenbein on June 21st, 2013 at 7:48 am“The best thing that happens to us is when a great company gets into

temporary trouble … We want to buy them when they’re on the operating table.”

– Warren BuffettIn last week’s CWS Market Review, I said there’s an unacknowledged member of the Federal Reserve who has the most important vote of all—the market. On Thursday, Mr. Market got a chance to vote, and he gave a massive thumbs down to the Fed’s most recent policy decision.

In this week’s issue, I’ll explain what happened and what investors should do now. I’ll also review some of our recent Buy List earnings reports. Oracle just gave us a big disappointment. But first, let’s review Thursday’s damage.

The Taper Tantrum

On Thursday, the stock market had its worst day in 19 months. Ugh, it was just ugly. The Dow lost 353 points and the S&P 500 dropped 2.5%. There was no refuge in bonds, either. The yield on the 10-year Treasury jumped to 2.45%. That’s up more than 80 basis points from last month’s low, and it’s the highest yield in close to two years. But stocks and bonds got off easy compared with the super-atomic wedgie gold was given. The contract for June delivery plunged $87.70 on Thursday, or 6.4%. Gold fell below $1,300 for the first time since 2010. Check out this weekly chart going back two years.

So what happened? The Fed held its two-day meeting this past week on Tuesday and Wednesday. The anticipation was that the Fed would discuss scaling back on its asset purchases. I didn’t think they would stop any bond buying just yet, and the post-meeting policy statement proved me right.

But in the post-meeting press conference, Ben Bernanke talked about downsizing the bond buying, and that caught everyone’s attention. He said that the Fed expects to continue buying bonds as long as the unemployment rate is over 7%. More specifically, Bernanke said that if the economy continues to improve, as they expect, the Fed will start to moderate bond purchases later this year and wind down the purchases by the middle of next year. I was a bit surprised that he’s apparently not concerned about inflation trending below his targeted range.

Bernanke was clear that this outline isn’t set in stone, and they’ll keep an eye on the data. The key here is that the Fed sees the economy doing better going forward. Bernanke used the metaphor of a car—they’re taking their foot off the gas, not slamming on the brakes. Incidentally, Bernanke also made it clear that he’s out the door when his term expires this January so he’s not going to be making these QE-ending calls.

On Wednesday and Thursday, the financial markets reacted dramatically. The movement in the five-year Treasury was most interesting. The yield jumped from 1.07% on Tuesday to 1.31% on Thursday. The maturities shorter than that showed almost no change.

I think the markets are making a few mistakes here. First, too many people assume that without the Fed’s help, the stock market is toast. The Fed has obviously helped the market so far, but that started when the economy was flat on its back. That simply isn’t the case now.

The other mistake is thinking the Fed is running away. Not so! Short-term rates are still going to be near 0%. The bond buying is going to continue. It will just be in progressively smaller amounts. Remember that all of this is predicated on pretty optimistic economic projections. In the policy statement, the Fed said that downside risks to the economy have diminished. Let’s hope they’re right.

What To Do Now

In the near term, I think the market will be a bit rough. We had a strong run this year, so it’s natural to take a breather. I don’t think the bulls will be back in charge until the S&P 500 breaks above its 50-day moving average, which is currently at 1,618.

Investors should expect more volatility in the next few weeks. We’ll know a lot more about how our stocks are doing when second-quarter earnings season begins next month. Don’t expect stocks to surge like they did earlier this year. Investors should focus on high-quality stocks like the names on our Buy List.

I should mention that our stocks tend to show their mettle when the rest of the market gets nervous. While the S&P 500 fell -2.50% on Thursday, our Buy List only fell by -1.88%. Obviously, our goal isn’t to be less worse than everyone else but I want to show you how investors gravitate towards high quality when they get nervous.

Some of the names on the Buy List I like right now include Microsoft ($MSFT), Cognizant Technology ($CTSH), Ford ($F) and Wells Fargo ($WFC). Be sure to keep an eye on my Buy Below prices. Now let’s look at some recent earnings news.

FactSet Research Earned $1.15 per Share

On Tuesday, FactSet Research Systems ($FDS) reported fiscal Q3 earnings of $1.15 per share which matched Wall Street’s estimate. This was their 12th-straight quarter of double-digit earnings growth. Revenue rose 6% to $214.6 million, which was a little bit below the Street.

Frankly, this was a good quarter but not a great one. I’m not disappointed at all by FactSet’s results but I think traders were expecting a little more. That’s why the stock pulled back after the earnings report. But the shares are basically where they were at the start of the month.

For Q4, FDS sees earnings ranging between $1.18 and $1.21 per share. The Street had been expecting $1.18 per share. FactSet is doing just fine. FDS continues to be a solid buy up to $108 per share.

Oracle Is a Buy Up to $35

The big disappointment for us came from Oracle ($ORCL) after the close on Thursday. This is especially frustrating for me because I was expecting a big earnings beat from them.

For their fiscal fourth quarter, Oracle earned 87 cents per share which matched the Street’s expectations. Three months ago, they told us to expect earnings to range between 85 and 91 cents per share. For the whole year, Oracle made $2.68 per share which was up from $2.46 per share last year. The trouble spot was at the top line. Quarterly revenue rose to $10.9 billion, which was the same as last year, and $200 million below expectations. New software sales rose by just 1% which traders didn’t like at all. This is the second quarter in a row that Oracle has disappointed investors with their software sales.

The company said weak sales in Asia and Latin America were to blame. This is where it gets tricky because Oracle claims the problems are economic, and the market is starting to think it’s about competitiveness. For Q1, Oracle said new software sales will rise between 0% and 8%, and earnings will be between 56 and 59 cents per share. That guidance isn’t particularly strong. The consensus on Wall Street was for 58 cents per share.

Interestingly, Oracle said they’re leaving the Nasdaq stock market and heading over to the NYSE. The ticker symbol will stay the same, and ORCL will start trading on the NYSE on July 15th. Perhaps the best news is that Oracle doubled the quarterly dividend to 12 cents per share. The stock still doesn’t yield very much, but it’s a sign of confidence from the company. In Thursday’s after-hours trading, Oracle dropped down to $30 per share. I apologize for the volatility. I know it’s no fun, but I’m still an Oracle fan. I’m lowering my Buy Below to $35 per share.

Medtronic Raises Dividend for 36th Year in a Row

Before I go, I wanted to highlight a small but important bit of news. Medtronic ($MDT) raised their dividend for the 36th year in a row. The quarterly dividend will rise two cents to 28 cents per share. That’s an increase of 7.7%. Naturally, this isn’t the kind of news that grabs the attention of traders. But as disciplined investors, we should acknowledge how remarkable a streak this is. Well done, MDT! Medtronic is an excellent buy up to $57 per share.

That’s all for now. Next week is the final week of Q2. Can you believe the year is nearly halfway done? Earnings season isn’t far away. On Tuesday, we’ll get an important report on durable goods. Then on Wednesday, the government will revise the Q1 GDP report. Bed Bath & Beyond ($BBBY) will report fiscal Q1 earnings on Wednesday. The company said to expect earnings to range between 88 and 94 cents per share. I think results will be at the high end of that range. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 21, 2013

Posted by Eddy Elfenbein on June 21st, 2013 at 7:15 amChina Central Bank Holds Line On Shadow Banking As Rates Spike

EU Finance Ministers Aim for Progress on Banks

Rosneft To Boost Oil Flows To China In $270 Billion Deal

Treasuries Rise on Bets This Week’s Yield Increase Is Excessive

Fed Seen by Economists Trimming QE in September, 2014 End

Dollar Dictates In Bernanke’s Twilight Zone

Oracle Sales Miss Estimates in Cloud Shift; Dividend Doubled

Yahoo! Completes Acquisition of Tumblr

Delta Wins EU Approval to Buy 49% Virgin Atlantic Stake

To Match Its Rivals, Facebook Adds Video Sharing

Olive Garden Parent Darden Quarterly Sales Beat Wall Street

Next Fifteen to Shine BlackBerry Image After Cisco Boost

Credit Writedowns: Serious Turbulence In Emerging Markets As Assets Re-Price Globally

Jeff Miller: Should Investors Be Scared Witless?

Be sure to follow me on Twitter.

-

The Post-Bernanke Sell-Off

Posted by Eddy Elfenbein on June 20th, 2013 at 2:36 pmThe market is reacting strongly to yesterday’s Fed meeting. The Dow is now down 300 points. The S&P 500 has broken down to 1,593.

Gold is getting crushed. The yellow metal is at a 2-1/2 year low. It’s currently at $1,283 per ounce which is a loss of 6.6%

The yield on the 10-year is up to 2.45% which is the highest yield in nearly two years.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His