-

Zynga Lays Off 18%

Posted by Eddy Elfenbein on June 4th, 2013 at 10:39 amYesterday, Zynga ($ZNGA) announced that it’s laying off 520 employees which is 18% of its workforce. I honestly feel terrible about about these types of stories; my first thoughts are with the people who are now out of work. But as an experienced investor, I’m afraid to say that I’m not surprised.

Zynga is reiterating its outlook for this year:

The company reaffirmed its revenue and earnings per share guidance for both the current quarter and the full year. But Zynga now expects a net loss of between $28.5 million and $39 million during the current quarter, worse than the $27.6 million loss analysts surveyed by Thomson Reuters had been expecting.

I get frustrated when I see so many investors taken in by companies with little operating histories. Zynga went public 18 months ago and the IPO was a flop. Still, the shares off got close to $16. That’s simply crazy. The company was never worth half that much.

A good rule for investors is to ignore all money-losing companies. A stock has to demonstrate to me that it can consistently earn a profit. Put it this way: Wall Street’s outlook for Zynga for 2014 is for earnings of $0.00. That’s right — nothing. I’m pretty sure Bed Bath & Beyond ($BBBY) will make more than nothing next year.

Just stay away from the money losers.

-

Morning News: June 4, 2013

Posted by Eddy Elfenbein on June 4th, 2013 at 6:47 amIMF Tells France To Step Up Reforms And Contain Public Spending

Yen Strengthens Again, in Challenge for Abe

Oil Options Volatility Rises as Futures Gain on Stimulus Bets

Spain’s Crisis Fades as Exports Transform Country

RBA Sees Further Rate-Cut Scope as Aussie Remains High

Behind the Rise in House Prices, Wall Street Buyers

General Motors S&P 500 Inclusion Marks Another Step in Recovery

AIG, Prudential Named Systematically Important by Panel

Lenovo Group Confirms Preliminary Joint-Venture Talks

Intel to Invest $100 Million in Voice, Gesture Control

Nissan May U.S. Sales Rise 25%, Triple Industrywide Gain

Zynga Slashes Work Force By A Fifth, Shares Dive

Construction Spending in U.S. Increases on Private Building

Cullen Roche: This Time is Different for Japan, Right?

Credit Writedowns: Weak Income Growth Should Hold Back US Consumer Spending

Be sure to follow me on Twitter.

-

Dividend Stocks Have Been Crushed

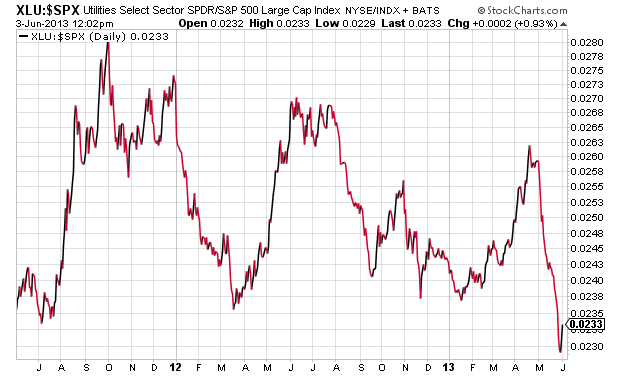

Posted by Eddy Elfenbein on June 3rd, 2013 at 12:05 pmCheck out this chart. It shows the Utility Sector ETF ($XLU) divided by the S&P 500.

Over the last few weeks, the utes have badly lagged the rest of the stock market (though they’re ahead sharply today). It’s not just utes but it’s most stocks that pay rich dividends. Telecoms have struggled as well. The reason is that the market feels — wrongly in my opinion — that the Fed will soon raise interest rates. If that happens, then high-yielding stocks won’t be as important.

-

Stocks Over Bonds Since the Election

Posted by Eddy Elfenbein on June 3rd, 2013 at 10:58 amThe stock market is down just a tad this morning. The ISM report for May was pretty much a bust. In response, gold is up and bonds are down. With stocks, financials are down the most while energy is leading. As I said recently in the newsletter, don’t expect the Fed to taper any time soon.

We learned this weekend that DirecTV ($DTV) is one of three outfits that have bid more than $1 billion for Hulu. My feeling is that DTV’s management is pretty conservative when it comes to acquisitions so the odds of them buying Hulu are low. Still, it could happen. Hulu has looked to sell itself in the past but they balked at the offers they got.

Here’s a look at how badly the stock market has beaten the bond market since the election.

In January, I said that Facebook ($FB) was “horribly overpriced.” The stock is down 25% since then. I do believe that the stock market is efficent — it just takes its time.

-

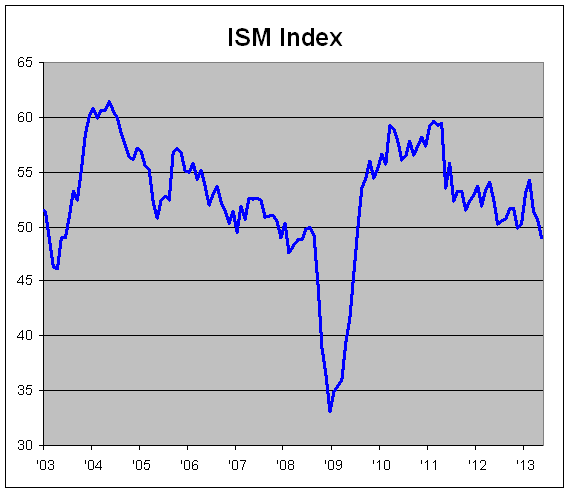

May ISM = 49.0

Posted by Eddy Elfenbein on June 3rd, 2013 at 10:24 amThe May ISM just came in at 49.0. This was the lowest reading in nearly four years.

Today’s report suggests that the economy is weaker than people had thought. Fortunately, we’re still a long way from the danger zone. The economy has come in between 48.0 and 49.9 a total of 65 times. Only eight have been during recessions.

-

Ford Sales Up 14% in May

Posted by Eddy Elfenbein on June 3rd, 2013 at 10:13 amAnother good month for Ford ($F). Sales were up 14% thanks to strong truck sales.

Ford Motor Co. says its U.S. sales rose 14 percent in May as demand for the F-Series pickup hit a six-year high.

Ford sold 71,604 F-Series trucks, the most since March of 2007. F-Series sales were up 31 percent over last May as construction crews and other small businesses drove demand.

Other strong sellers included the Ford Fusion sedan, which gained 10 percent, and the Ford Escape, which was up 26 percent. Ford sold more than 29,000 Escapes, for its best sales month since the small SUV’s introduction 13 years ago.

Sales of the new luxury Lincoln MKZ sedan were up 42 percent.

Ford announced it will increase third-quarter North American production by 10 percent to 740,000 vehicles. Second-quarter production is unchanged at 800,000 cars and trucks.

The stock is currently up 22 cents to $15.90. Ford broke $16 per share on Thursday and Friday but has yet to close over it.

-

Morning News: June 3, 2013

Posted by Eddy Elfenbein on June 3rd, 2013 at 7:09 amDraghi Sees Signs of Stabilization in ‘Challenging’ Economy

Emerging Market Dominoes to Fall as SocGen Sees Rout

Germany Plans One Billion Euros Aid for Spanish SMEs

Gilts Trail in Worst Global Bond Month Since 2004

China Growth Limited by Struggling Small Manufacturers

UAE Creates $15 Billion Aluminum Firm in State Merger

Trial on E-Book Price-Fixing Puts Apple in Spotlight

Bank of America $8.5 Billion Settlement Heads for Court Showdown

Hedge Fund, Under Fire, Braces for Withdrawals

In China, Concern of a Chill on Foreign Investments

Amazon’s Cloud Could Threaten A Whole New Area Of Enterprise Tech, Morgan Stanley Warns

Is This Really The End For The Great Emerging Markets Bull Run?

Bernanke at Princeton Offers Seniors Advice From Love to Money

Joshua Brown: Smart and Stupid Arguments for Active Management

Jeff Miller: Weighing The Week Ahead: Will The Interest Rate Surge Continue?

Be sure to follow me on Twitter.

-

Johnny Cash – I’ll Fly Away

Posted by Eddy Elfenbein on May 31st, 2013 at 8:09 pm -

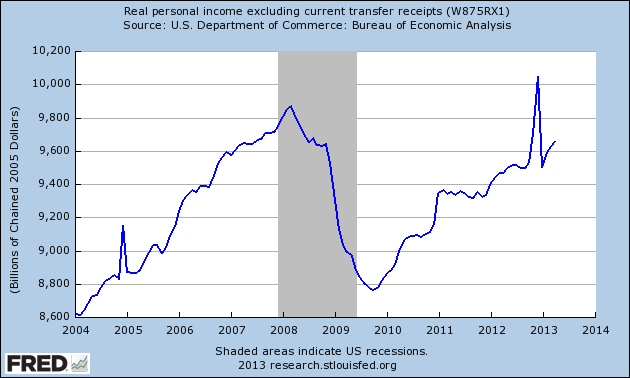

Personal Income Unchanged for April

Posted by Eddy Elfenbein on May 31st, 2013 at 10:08 amThe government reported this morning that personal income was unchanged in April. Economists were expecting an increase of 0.1%. So far, the market doesn’t seem terribly interested.

The stat in the personal income report that I find most interesting is real personal income after transfer payments. That’s a mouthful but it’s one of the better gauges for how the economy is performing. It rose by 0.3% in April.

Here’s a look at the data series:

The big jump at the end of last year was due to the dividend payouts. What I find interesting is that, looking past the December spike, the rising trend is continuing.

-

CWS Market Review – May 31, 2013

Posted by Eddy Elfenbein on May 31st, 2013 at 7:05 am“As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.”

– John Maynard KeynesLast Wednesday, May 22nd, the stock market experienced a very rare event. The indexes jumped up early in the day, hit a new intra-day high, then turned around and closed lower by more than 1% (see the chart below). That may not sound like much, but it totally freaked traders out, and they’re an irritable crew to begin with.

Why did this put everyone on edge? Because the last two times this happened were just before the market crashes of 2000 and 2007. Despite the big intra-day swing, the stock market is still holding up well, and I’m surprised at the number of folks who are convinced that we’re headed for an imminent downturn. Let’s look at the evidence.

Is a Market Crash Imminent?

As usual, I’m not going to bother with trying to predict what the herd will do. As investors, we need to accept reality on reality’s terms. The fact is that the bears have not been treated well by this market. As long as the S&P 500 stays above its 50-day moving average (right now about 1,598), I think we’re mostly safe. As always, I urge all investors to take a conservative approach and focus on high-quality stocks like the ones you see on our Buy List.

Speaking of our Buy List, it’s been red hot lately. I probably shouldn’t mention it, as it might jinx us, but our Buy List has finally caught up to the overall market. Since April 18th, our Buy List is up 10.43%, which is ahead of the S&P 500’s 7.32%. Ten of our Buy List stocks are up more than 20% for the year, and Microsoft ($MSFT) is up 31% this year.

Ford Motor ($F), in particular, has been a rock star for us. Did anyone else notice that Ford finally broke $16 per share on Thursday? Good, me too. As impressive as Ford’s run has been, the stock is far from expensive. Ford currently trades at less than 10 times next year’s earnings estimate. I’m looking forward to another good earnings report in late July. This week, I’m raising my Buy Below on Ford to $18 per share.

Several of our financial stocks have also been performing very well. On Thursday, both of our large banks, JPMorgan Chase ($JPM) and Wells Fargo ($WFC), hit new 52-week highs. I’ve been cautious on raising my Buy Below prices, but this week, I’m going to raise my Buy Below on WFC to $46 per share. Last week, I mentioned that Nicholas Financial ($NICK) looked especially attractive below $13.70. The sale didn’t last long. On Thursday, NICK jumped up to $14.82. I’ve also been very impressed with AFLAC ($AFL) recently. The stock came close to breaking $57 on Thursday. I still think AFL is a bargain.

What Do Higher Long-Term Rates Mean for Us?

At the end of September 2012, analysts on Wall Street were expecting 2013 earnings for the S&P 500 of $114.96. Today, the consensus is down to $109.53, yet the S&P 500 has gained more than 14% over that time. What’s changed is that the earnings multiple has slowly expanded. One dollar in earnings, or expected earnings, is worth more than that same dollar a few months ago. Every day, it seems like investors become less and less nervous. Interestingly, this week we learned that consumer confidence rose to a five-year high. (Just once, I’d love to see a rise in consumer confidence reported as a drop in consumer humility.)

The odd aspect of this rally is how gradual it’s been. It’s also as if we go up by a small amount each day. The S&P 500 has only had one 2% down day all year. But the interesting action lately hasn’t been in the stock market—it’s been in the bond market. After hearing warnings of this for months, long-term interest rates have finally started to rise. On Tuesday, the yields for the middle part and long end of the yield curve had their highest rates in more than a year. Bear in mind, of course, that interest rates are still very low. Uncle Sam can borrow for five years at a measly 1%. At the beginning of May, the five-year fetched 0.65%.

The move in the bond market is being mirrored by a similar move in the stock market. The difference is that stocks aren’t going down; they’re going up, but the more defensive names are trailing. Remember last week, when I talked about the Garbage Stock Rally? This is how it’s playing out.

We can really see evidence of this by looking at the weakness of utility stocks. Investors like to buy boring utilities, so they’re protected from sudden downdrafts. Yet we’ve had a bull market, and utes have gotten clobbered anyway. From April 29th to May 30th, the Utilities Sector ETF ($XLU) dropped nearly 9%. What’s happening is that investors are choosing growth over dividends. Interestingly, Warren Buffett just made a big purchase in the utility sector. Berkshire Hathaway’s MidAmerican Energy said it’s buying NV Energy for $5.6 billion.

Whenever bonds start to fall, there’s often a fear that we’re entering a debt crisis. This time around, these fears are simply nonsense. For one, stocks are rallying from the down turn in bonds. While this rally has seen cyclicals do well (like Ford), the real strength has come from financials (as I mentioned earlier). Twenty months ago, the Financial Sector ETF ($XLF) dropped below $11. On Thursday, it closed at $20.17. Last December, I tweeted, “I still think buying XLF, sitting back and cracking a beer will be a tough strategy to beat in 2013.” Indeed it has. The XLF is up 23% on the year.

This leads me to think that higher long-term rates signal growing optimism for the economy. The U.S. dollar has also been doing well. Remember that financial markets tend to lead the economy by a few months, so the strength for the economy hasn’t shown up just yet.

For now, I encourage investors not to be rattled by any short-term moves. We’ve had a long stretch of low volatility, and those don’t last forever. Get used to seeing higher interest rates. Mortgage rates have been climbing as well. I don’t believe the Fed is close to shutting off the stimulus. This is a very good time for stocks. Investors should focus on quality and be careful not to chase any stocks. Wait for good stocks to come to you. One stock that looks especially good right now is Oracle ($ORCL). The company is due to report earnings in about three weeks. I’m raising my Buy Below on Oracle to $38 per share.

Before I go, I want to make two more adjustments to our Buy Below prices. I’m raising CA Technologies’ ($CA) Buy Below to $29, and I’m dropping Cognizant‘s ($CTSH) down to $70 per share.

That’s all for now. There are a few important economic reports next week. On Monday, we’ll get the ISM report for May. The ISM has come in at 49.9 or better for the last 46 months in a row. Let’s see if the streak stays alive. For the latter half of the week, the focus will be on jobs. On Wednesday, ADP will release its monthly jobs report. The initial claims report comes out on Thursday. Then the all-important May jobs report comes out on Friday morning. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His