-

Nicholas Financial Gets Buyout Offer

Posted by Eddy Elfenbein on March 20th, 2013 at 5:20 pmInteresting news from Nicholas Financial ($NICK). The company got a buyout offer. I don’t know the details but NICK has retained Janney Montgomery Scott to help them look at the deal and other possible alternatives.

Long-time NICKers will remember that NICK got a similar offer two years ago but the price was too low. I was very happy NICK shot down that offer. The stock was at $10.08 when that offer was made (pre-dividend) so we were right, NICK would probably have sold itself too soon. Now I’d be more interested in a good price. Also, NICK’s senior management is at the age when most folks think it’s time to retire.

When NICK got the offer in January 2011, the shares jumped 18% the next day. In the current after-hours market, NICK is up to $14.50 which is a 9.5% gain.

Here’s the press release:

CLEARWATER, Fla., March 20, 2013 (GLOBE NEWSWIRE) — Nicholas Financial, Inc. (NICK) announced today that the Board of Directors of the Company has retained Janney Montgomery Scott LLC as its independent financial advisor to assist the Board of Directors in evaluating possible strategic alternatives for the Company, including, but not limited to, the possible sale of the Company or certain of its assets, potential acquisition and expansion opportunities, and/or a possible debt or equity financing.

The Company also announced today that it has received an unsolicited, non-binding indication of interest from a potential third-party acquirer. The Company cautions its shareholders and others considering trading in its securities that its Board of Directors only recently received the indication of interest, and that the process of considering this proposal as well as other possible strategic alternatives for the Company is only in its beginning stages. The Board of Directors will proceed in an orderly and timely manner to consider possible strategic alternatives for the Company and their implications. Accordingly, no assurances can be given as to whether any particular strategic alternative for the Company will be recommended or undertaken or, if so, upon what terms and conditions. The Company currently does not intend to make any further public announcements regarding its Board of Directors’ review of possible strategic alternatives until this evaluation process has been completed.

-

Oracle Earns 65 Cents Per Share

Posted by Eddy Elfenbein on March 20th, 2013 at 4:21 pmFor Q3, Oracle ($ORCL) earned 65 cents per share which was one penny below expectations. Revenue came in at $8.96 billion which was well below consensus of $9.38 billion.

Oracle Corporation today announced that fiscal 2013 Q3 total revenues were down 1% to $9.0 billion. New software licenses and cloud software subscriptions revenues were down 2% to $2.3 billion. Software license updates and product support revenues were up 7% to $4.3 billion. Hardware systems products revenues were $671 million. GAAP operating income was up 1% to $3.3 billion, and GAAP operating margin was 37%. Non-GAAP operating income was down 1% to $4.2 billion, and non-GAAP operating margin was 47%. GAAP net income was unchanged at $2.5 billion, while non-GAAP net income was down 1% to $3.1 billion. GAAP earnings per share were $0.52, up 6% compared to last year while non-GAAP earnings per share were up 5% to $0.65. GAAP operating cash flow on a trailing twelve-month basis was $13.7 billion.

Without the impact of the US dollar strengthening compared to foreign currencies, Oracle’s reported Q3 GAAP earnings per share would have been $0.01 higher at $0.53, up 8%, and Q3 non-GAAP earnings per share would have been approximately $0.01 higher. Total revenues also would have been 1% higher and new software licenses and cloud software subscription revenues would have been 2% higher than reported.

“Our non-GAAP operating margin increased to a Q3 record of 47%, and we expect it to reach an all-time high for the fiscal year,” said Oracle President and CFO, Safra Catz. “Both operating cash flow and free cash flow were at record levels for a Q3, with operating cash flow of $13.7 billion over the last twelve months.”

“The Oracle Cloud is the most robust and comprehensive cloud platform available with services at the infrastructure (IaaS), platform (PaaS) and application (SaaS) level,” said Oracle President, Mark Hurd. “In Q3, our SaaS revenue alone grew well over 100% as lots of new customers adopted our Sales, Service, Marketing and Human Capital Management applications in the Cloud.”

“This month we will begin deliveries of servers based on our new SPARC T5 microprocessor: the fastest microprocessor in the world,” said Oracle CEO, Larry Ellison. “The new T5 servers can have up to eight microprocessors while our new M5 system can be configured with up to thirty-two microprocessors. The M5 runs the Oracle database 10 times faster than the M9000 it replaces.”

Frankly, I was expecting a lot more. The shares are down 6.6% in the after-hours market.

-

Today’s Fed Statement

Posted by Eddy Elfenbein on March 20th, 2013 at 2:02 pmInformation received since the Federal Open Market Committee met in January suggests a return to moderate economic growth following a pause late last year. (No surprise there – EE) Labor market conditions have shown signs of improvement in recent months but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy has become somewhat more restrictive (interesting, they acknowledge the fiscal drag – EE). Inflation has been running somewhat below the Committee’s longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable (same old, same old – EE).

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will proceed at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee continues to see downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective (glad they admitted that – EE).

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative (we’re seeing that – EE).

The Committee will closely monitor incoming information on economic and financial developments in coming months. The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Charles L. Evans; Jerome H. Powell; Sarah Bloom Raskin; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.

Here’s the Fed’s economic forecast. Fifteen of the 19 members see the Fed raising rates in 2015.

-

Happy Fed Day!

Posted by Eddy Elfenbein on March 20th, 2013 at 10:33 amToday is Fed Day! The central bank will release its policy statement this afternoon and Ben Bernanke will meet the press. I don’t expect to hear any significant changes to their policy. Traders, however, will be paying close attention for any hint that rates are about to go higher. They’re not, but that’s never stopped traders before.

The mess in Cyprus is getting more complicated. The parliament massively shot down the bailout deal. Now there’s talk of a Plan B, or the Cypriots may strike a deal with the Russians. I really don’t know what will happen. The fear is what will happen once the banks open on the island: will there be a massive run? I do think that the issues of Cyprus are far too small to impact investors in the U.S.

The S&P 500 is currently up to 1,557 and we’re again close to the record close from October 9th, 2007 (1,565.15). The S&P 500 fell for the last three days in a row so we’re on track to break that streak. Oracle ($ORCL) is due to report earnings after the close. I think the company can earn 70 cents per share, or more.

-

FactSet’s Outlook for Fiscal Q3

Posted by Eddy Elfenbein on March 20th, 2013 at 8:56 amFrom Seeking Alpha, here are some key bits from FactSet’s ($FDS) earnings call:

Now let’s turn to our guidance for the second quarter — for the third quarter of fiscal 2013. Revenues are expected to range between $213 million and $216 million. The midpoint of this range would mean revenue growth of 5% in Q3. We are anticipating continued weakness in sell-side ASV and no immediate uptick in buy-side purchasing behavior.

Operating margins are expected to range between 33% and 34%. GAAP diluted EPS should range between $1.14 and $1.16. The midpoint of the range represents 10% growth over last year’s third quarter.

Our annual effective tax rate should range between 29.5% and 30.5%. We continue to expect that capital expenditures for the full 2013 fiscal year should range between $20 million and $28 million, net of landlord contributions.

To provide a little extra color on our revenue guidance, I’d also like to take a moment to look at general views of the market over the past quarter. Despite optimism expressed by the global equity markets, we’re still facing the effects of significant job cuts at many of the largest global investment banks. Some estimates put the number of headcount reductions at 11,000 jobs at bulge bracket banks since November 2012. Those cuts have been driven by increasing regulation, lower trading volumes and the continuation of the economic crisis in some parts of the world.

Although we’re impacted by user reductions, it’s important to note that many of the areas hardest hit are not those typically serviced by FactSet. Our market on the sell-side, which accounts for only 18% of our revenues, is still in a very difficult and contracting environment. The good news is that our primary user groups are not enduring new structural changes. Though they’re still tightening, equity research has been under tight expense [ph] management for many years, and M&A deal flow has always had some cyclicality, but is essentially the same business model as before the global financial crisis.

The bad news is that when large sell-side firms struggle, even in departments we do not cover, it impacts near-term ASV for all vendors in our industry.

The news is somewhat brighter for the buy-side. Coming off double digit equity returns in almost all global markets in 2012, equity returns in 2013 have been solid thus far. AUM for our clients and prospects have also been augmented by year-to-date inflows, too. These inflows are from idle cash and not from fixed income strategies. So there is potential for more AUM inflows, if managers decide to allocate away from fixed income and back to equity. Despite this change in the macro environment, we still do not see evidence yet that buy-side firms have begun to expand their employee base.

To wrap it up, our business model continues to show its resilience. Again this quarter, we have shown that, even in a tough environment for 18% of our clients, we continue to grow our market share. We have put up another double-digit quarter of EPS growth and our 3-year average return on equity has increased to 33%.

-

Morning News: March 20, 2013

Posted by Eddy Elfenbein on March 20th, 2013 at 6:17 amEurope Weighs Cyprus’s Fate After Lawmakers Reject Deal

Cyprus Boosts Moscow as City Eyes Cash

Protecting Their Own, Russians Offer an Alternative to the Cypriot Bank Tax

Cameron Evokes Black Wednesday as Pound Weakens 7%

DeMarco Pushes Housing Finance Reform as Fannie Profits Soar

Getting Past America’s Bad Case of Retirement Blues

Adobe Shares Rise as Profit Tops Estimates on Web-Software Sales

Blackstone Said to Mull Outbidding Silver Lake for Dell

EBay Simplifies Listing Fees, Going After Amazon

JetBlue Says AMR Should Cut Washington Flights After Deal

IATA Raises Profit Outlook For World’s Airlines

In a New Aisle, Energy Drinks Sidestep Some Rules

Real Fur, Masquerading as Faux

Roger Nusbaum: Cypriot Possibilities

Cullen Roche: Experiements in Negative Real Rates Tend to Lead to Excess…

Be sure to follow me on Twitter.

-

There’s a Wide Spread Between Stocks and Government Bonds

Posted by Eddy Elfenbein on March 19th, 2013 at 5:52 pmStocks are close to the least expensive ever versus government bonds, using a valuation method favored by former Fed Chairman Alan Greenspan that compares earnings with interest payments. S&P 500 companies currently generate profit equal to 6.5 percent of their share prices, about 4.5 percentage points more than yields on 10-year Treasuries. The average spread in the past 10 years was about 2.5 percentage points, data compiled by Bloomberg show.

-

Cyprus Says No

Posted by Eddy Elfenbein on March 19th, 2013 at 4:24 pmThe Dow closed up 3.76 points while the S&P 500 closed down 3.76 points.

The big news today was that the parliament in Cyprus shot down the bailout deal. It didn’t get a single vote. But our stock market got a bump later in the day when the ECB said they’ll provide liquidity for banks in Cyprus. Still, things will be ugly there when banks eventually open. Whenever that is.

The deposit tax idea strike me as something similar to the mint the coin idea that was floating around a few weeks ago. The idea makes some sense and it’s better than a lot of alternatives. The problem is that it seems to the average person on the street to be not merely flawed policy but outright immoral. You just don’t go around confiscating wealth. Good citizens are the ones who are supposed to be saving their money in the bank.

The Fed began a two-day meeting today. Tomorrow we’ll get a look at their policy statement and Ben Bernanke will meet the press.

-

Cylicals Continue to Lead

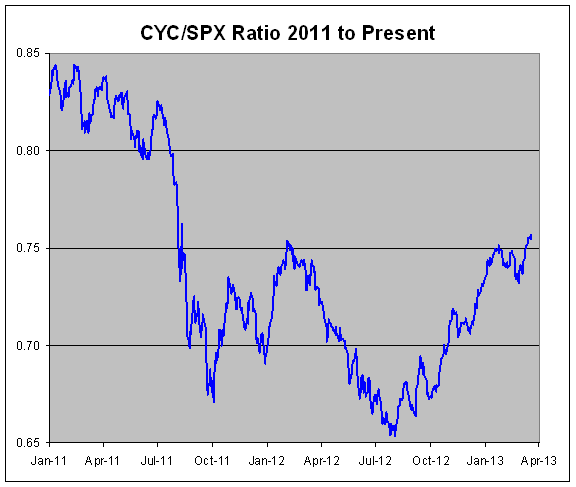

Posted by Eddy Elfenbein on March 19th, 2013 at 2:07 pmHere’s a look at the ratio of the Morgan Stanley Cyclical Index (^CYC) divided by the &P 500. The ratio just hit a 19-month high. The ratio has turned around strongly over the last seven months.

I think this is an omen that the economy is better than many believe.

-

Goldman and Morgan Stanley Raise S&P 500 Forecasts

Posted by Eddy Elfenbein on March 19th, 2013 at 11:59 amNow that the S&P 500 is close to an all-time high, what do prominent bears do? They turn bullish.

Goldman Sachs Group Inc.’s chief U.S. equity strategist, David Kostin, raised his target today for the benchmark stocks gauge by 3.2 percent to 1,625 from 1,575. Adam Parker of Morgan Stanley boosted his 2013 estimate by 12 percent to 1,600 from 1,434. They join strategists at Deutsche Bank AG, Credit Suisse Group AG and Jefferies Group LLC in increasing their targets for U.S stocks in the last week.

“The 2013 U.S. equity market story is becoming one of improving business activity accompanied by increased CEO confidence,” Kostin wrote in a report. “Recent economic data has been strong as employment growth, ISM surveys and retail sales have all posted positive surprises. The ‘sequester’ has begun, and the federal government is still functioning.”

The rally in U.S. equities has pushed bearish strategists to capitulate in 2013 after being conservative last year, when stock seers forecast the smallest gain in seven years for the S&P 500. Kostin and Parker estimated the S&P 500 would fall in 2012 to 1,250 and 1,167, respectively, making them the two most bearish strategists among the 14 surveyed by Bloomberg. The equity index surged 13 percent to 1,426.19 in 2012.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His