-

The October Jobs Report

Posted by Eddy Elfenbein on November 4th, 2022 at 8:37 amThe US economy created 261,000 net new jobs last month. That’s the smallest monthly increase since December 2020. Wall Street had been expecting an increase of 205,000.

The unemployment rate rose 0.2% to 3.7%. The Labor Force Participation Rate declined for the second month in a row to 62.25%.

There are 99.9 million Americans who are either unemployed or out of the jobs market entirely.

In the last year, average hourly earnings are up by 4.7%. That’s the smallest increase in over a year.

The civilian labor force participation rate for prime working age people is 82.5%.

Average hourly earnings grew 4.7% from a year ago and 0.4% for the month, indicating that wage growth is still likely to pressure inflation. The yearly growth met expectations while the monthly gain was slightly ahead of the 0.3% estimate.

Health care led job gains, adding 53,000 positions, while professional and technical services contributed 43,000 and manufacturing grew by 32,000.

Leisure and hospitality also posted solid growth, up 35,000 jobs, though the pace of growth has slowed considerably from the gains posted in 2021. The group, which includes hotel, restaurant and bar jobs along with related sectors, is averaging gains of 78,000 a month this year, compared to 196,000 last year.

Heading into the holiday shopping season, retail posted only a modest gain of 7,200 jobs. Wholesale trade added 15,000 while transportation and warehousing was up 8,000.

-

Morning News: November 4, 2022

Posted by Eddy Elfenbein on November 4th, 2022 at 7:03 amChina Stock Frenzy Enters Overdrive on Hopes That Worst Is Over

China Agrees to Approve BioNTech’s Covid-19 Vaccines for Foreigners, German Chancellor Says

The Metals for Your EV Are Stuck in a 30-Mile Traffic Jam

Battle Over Deep-Sea Mining Takes on New Urgency as Trial Run Winds Down

Why Natural Gas Tankers Are Lining Up Off Europe’s Coast

World’s Factories Enter the Long Winter

Five Ways Sanctions Are Hitting Russia

The Messy Unwinding of the New World Order – in Charts

El Salvador’s $300 Million Bitcoin ‘Revolution’ Is Failing Miserably

Workers Expect Fast Inflation Next Year. Could That Make It a Reality?

Trader Arrested in Ibiza Awaits FX Case That’s Dividing Wall Street

Layoffs Hit Tech Sector With Force as Amazon, Lyft Warn of Economic Downturn

Twitter Sued for Mass Layoffs by Musk Without Enough Notice

PayPal Shares Tumble After Forecast Cut, Spending Slowdown Warning

Starbucks Posts Massive Sales Even as U.S. Inflation Soars

DoorDash Shares Surge on Stronger-Than-Expected Earnings

Adidas Dropped Ye, But Sneakerheads Haven’t

Be sure to follow me on Twitter.

-

Morning News: November 3, 2022

Posted by Eddy Elfenbein on November 3rd, 2022 at 7:04 amChina Is Burning More Coal, a Growing Climate Challenge

BOE Hikes by 75 Basis Points But Rejects Market Rate Path

Mystery Whales Baffle Gold Market After Central Bank Purchases

Fed Makes Fourth Jumbo Rate Increase and Signals More to Come

Federal Reserve Chief Tells Markets to Focus on Interest-Rate Endpoint

SEC Pulls In Record Enforcement Haul, Moves to Rewrite Mutual-Fund Rules

Debt Limit Showdown Looms as White House Braces for a Divided Washington

Mortgage Rates Too High? (Blame the Fed, Wall Street and Your Neighbor.)

It’s Harder to Buy a House. This City Fought Back by Outbidding Corporate Landlords

There Has to Be a Better Way to Lose $800 Billion

Elon Musk Takes a Page Out of Mark Zuckerberg’s Social Media Playbook

The Case That Elon Musk Knows Exactly What He’s Doing at Twitter

Albertsons, Despite Debt, Will Hand $4 Billion to Owners Before Merger

Blackstone’s $70 Billion Real Estate Fund for Retail Investors Is Losing Steam

Peloton Drops on Outlook, Even as CEO Says ‘Ship Is Turning’

Pilots Are Frustrated With Airlines, Too

Be sure to follow me on Twitter.

-

Today’s Policy Statement

Posted by Eddy Elfenbein on November 2nd, 2022 at 2:09 pmThe Fed raised by 0.75%. Here’s the statement:

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3-3/4 to 4 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; James Bullard; Susan M. Collins; Lisa D. Cook; Esther L. George; Philip N. Jefferson; Loretta J. Mester; and Christopher J. Waller.

I added the bold which slightly hints that the Fed recognized that the rate-hiking cycle will need to come to an end.

-

Morning News: November 2, 2022

Posted by Eddy Elfenbein on November 2nd, 2022 at 7:08 amRussia Agrees to Resume Ukraine Grain Export Deal; Wheat Tumbles

Chinese Stocks Soar as Reopening Talk Fuels Speculative Frenzy

Chinese Property Bonds Set Record Lows as Investors Lose Faith

Fed to Hike Big Again and Open Door to Downshift

The $24 Trillion Market That Predicts and Influences Interest Rates

I Bond Investors Just Got a Surprise Boost

A Mark-to-Market Massacre Is Claiming a $10 Trillion Market

Your Savings Account Rate Is Now Higher Than Millions of Mortgages

As Housing Costs Soar, Co-Living Makes a Comeback

S&P Downgrades Credit Suisse Group, Moody’s Cuts Some Ratings

CVS, Walmart, Walgreens Reach $12 Billion Opioid Settlement

Netflix With Ads Launching as Talks Continue With Studios Over Content

Meta Investors Learn a Hard Lesson About Super-Voting Shares

With Pay Ranges of $2 Million, NYC Transparency Law Is Off to a Glitchy Start

Be sure to follow me on Twitter.

-

CWS Market Review – November 1, 2022

Posted by Eddy Elfenbein on November 1st, 2022 at 6:48 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Best Month for the Dow in 46 Years

The Dow Jones Industrial Average just wrapped up its best month since January 1976. For October, the index gained 14.1% while the S&P 500 was up “only” 8.1%.

It’s true that the Dow isn’t a very good index as stock indexes go. It’s simply 30 stock prices added up and adjusted by a divisor. The Dow doesn’t care how big or small the companies are. They’re weighted solely by price which seems pretty silly. Of course, the major advantage the Dow has is that it’s very old.

Still, it’s an achievement to claim the best of anything since 1976. It also underscores something I’ve been talking about recently which is that I’m more impressed by this latest rally than by the previous head fakes.

Indeed, this rally may also prove to be phony, but there are reasons to suspend judgment. The difference is that there may be actual improvements in the outlook for inflation, and by extension, the Federal Reserve’s campaign to increase interest rates.

I’ll give you an example. Last week, I said that the Q3 GDP report might come in better than expected. I was right. For the third quarter, the U.S. economy grew at an annualized rate of 2.6% (after inflation). That’s not great, but it’s better than a recession. Expectations were for growth of 2.3%.

Along with the GDP report, the government also reported the personal consumption expenditure price index. This is the Fed’s preferred measure of inflation. The latest figures show that headline inflation measured 6.2% in the 12 months ending in September. That’s high, but it was 7% in June. The 12-month core rate is 5.1%.

These numbers may indicate that inflation has peaked. I don’t want to be premature, and we need more data before making a firm judgment, but the trend is promising. Compare us to Europe where inflation is running at more than 10%.

All of this is weighing on Jerome Powell and his buddies inside the Federal Reserve. In fact, The Fed started its two-day meeting today. Tomorrow afternoon, we’ll get the latest policy statement. Spoiler alert: The Fed will increase interest rates by another 0.75%.

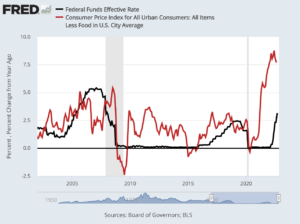

This will be the fourth meeting in a row where the Fed has hiked by 0.75%. This coming rate hike will bring the Fed’s target for short-term interest rates to a range of 3.75% to 4.00%. That means that rates are getting closer to inflation. Soon real rates will actually be positive. That’s something we haven’t seen in a few years.

Here’s the Fed funds rate (black) along with core inflation (red).

With this meeting, I’ll be curious to see if the Fed offers any indication of where it sees interest rates going. After this meeting, the Fed’s outlook will be a lot less clear. The futures market is currently evenly divided on what the Fed will do at its December meeting. Futures traders place about a 50% chance on a 0.50% rate increase and a 50% chance on a 0.75% rate increase. For now, I’d lean towards another 0.75% increase.

These rate hikes are what have hurt the stock market this year. The higher rates have also crushed so many of the former stock market stars. Have you seen Meta Platforms (META) recently? The Zuck has torched an astounding amount of shareholder value. From peak to trough, META has dropped from $384 to $93. That’s a drop of nearly $900 billion.

What’s happened is that higher rates have forced investors to be more conservative. That’s been very good news for our Buy List. Even though it’s been a difficult market, our Buy List has consistently outperformed the S&P 500 since the spring.

At some point, the rate hikes will have to end. That’s good for stocks. It will be clear that the rate hikes are hurting the economy more than inflation. We’re already seeing that in the housing market and with the strong dollar. In Australia, the central bank there recently increased rates by only 0.25%, down from their earlier increases of 0.5%.

The details of the GDP report clearly show what’s happening. Consumer spending is up, but not by a lot. Trade has been quite good, but due to the strong U.S. dollar, that probably won’t last. The most noticeable part of the GDP report is that the housing market is a big drag on the U.S. economy. Housing all by itself knocked 1.4% off of Q3 GDP growth.

I can’t say I’m surprised. Home sales recently posted their longest streak of declines in 15 years. Consumers are getting squeezed by higher prices and slow wage growth. During Q3, Americans saved 3.3% of their after-tax income in the third quarter. That’s the lowest rate in 15 years.

There’s clear evidence of weakness ahead for the economy. Interestingly, Jerome Powell is not a big fan of the 2/10 Spread. Instead, the chairman likes to follow the difference between the three-month Treasury and its implied yield in 18 months. That’s close to inverting. The spread dropped as low as 0.2% recently.

Today we learned that the ISM Manufacturing Index fell to 50.2 last month. That’s barely in the positive range. It means that the manufacturing sector of the economy is still expanding, just very slowly. That’s down from 50.9 in September.

At Bloomberg, they have a model which gauges the odds of a recession starting in the next 12 months. The latest numbers show the odds at 100%. Well, that seems pretty certain. They also polled some economists and they put the odds of a recession at 60%.

The next big test for the market will come this Friday. That’s when the government will release the jobs report for October. In September, the jobless rate was just 3.5% which is low by historical standards. The consensus on Wall Street is to see an increase of 205,000 nonfarm payrolls. However, one weak point is that wages aren’t rising as fast as inflation. The real question is how much the tight labor market is to blame for inflation or, rather, if inflation is due more to supply-chain issues and the war in Ukraine. We’ll find out soon.

Stock Focus: Celanese

This week, I want to look at Celanese (CE), which is one of the more interesting companies around. The company is the world’s leading maker of acetic acid. That’s one of those things that few people even think about, but it’s used in dozens of applications.

Each year, Celanese makes about two million tons of the stuff. That’s about 25% of the world’s supply. The company is based in Irving, Texas and they have manufacturing facilities all around the world. Celanese is also the world’s leading maker of vinyl acetate. That’s a key ingredient in furniture glue. They also make 25% of the world’s supply.

The important fact is that Celanese dominates the market in important things. This is what you think of when Warren Buffett talks about companies that have a strong “moat.” That means that it’s not so easy for a competitor to come along and knock them off their perch.

That’s why I wasn’t surprised when Warren Buffett said that he added Celanese to his portfolio earlier this year. The stock jumped more than 7% on the news. Celanese really is a classic Berkshire kind of stock. The company generates tons of free cash flow.

The big news for Celanese this year is that it agreed to buy the Mobility and Materials division from DuPont for $11 billion in cash. The deal was announced in February, and it was completed today.

The unit had sales last year of $3.5 billion. From the press release, “As part of the transaction, Celanese has acquired a broad portfolio of engineered thermoplastics and elastomers, industry-renowned brands and intellectual property, global production assets, and a world-class organization.”

Celanese has been around for over 100 years. In the 1980s, they spun off their pharmaceutical business, and that’s Celgene. In 1987, Celanese merged with Hoechst to become Hoechst Celanese. That lasted for a few years until Hoechst spun off Celanese. After that, Blackstone bought out Celanese and then quickly IPO’d it in 2005.

There are two important facts to mention about Celanese. The first is that the stock has been a terrible performer lately. In June, the shares were over $160. Lately, it’s been as low at $87. The stock is lower than where it was four years ago.

When I see that a good stock has been behaving badly lately, that scares most people off. It’s natural to judge a stock on its recent performance. Still, I like to find good stocks that have gotten beaten up. The difference is that high-quality companies often bounce back.

I also like the steady dividend. Celanese’s quarterly dividend has gradually increased from four cents per share in 2010 to 70 cents per share this year. At Celanese’s current price, the dividend yields close to 3%.

The other important fact is that Celanese’s profit tends to be very volatile. That’s not necessarily a bad thing. It’s simply the nature of some businesses. Last year, Celanese earned $18.12 per share. That gives the company a trailing Price/Earnings Ratio of about five. Wall Street sees CE’s earnings falling to $17.59 per share this year, and $14.28 per share next year.

It can be a challenge to value a company with such wildly changing numbers. With a consumer staple, it’s pretty easy, but a chemical entity can be frustrating. A better way to look at its earnings is by comparing longer cycles to each other instead of each year.

For Q2, Celanese earned $4.99 per share. Sales were up 13% over last year’s Q2. The company has been able to navigate well with price increases. Having pricing power is also a key ingredient of a business with a wide moat. For the quarter, Celanese had operating cash flow of $495 million and free cash flow of $368 million.

Celanese will report its Q3 earnings on Friday. The company said it expects earnings at the low end of its range of $4.00 to $4.50 per share. Wall Street expects $3.98 per share. CEO Lori Ryerkerk said, “we expect to deliver 2022 adjusted earnings per share approximately in line with our 2021 adjusted earnings per share performance.”

Celanese’s stock is down, but that may not last long.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

-

Morning News: November 1, 2022

Posted by Eddy Elfenbein on November 1st, 2022 at 7:09 amBrazil Truckers Block Roads as Bolsonaro Maintains Silence

2-Minute Showers and a Flotilla of Gas Shipments: Europe Braces for Winter

Saudi Aramco Reports $42 Billion in Profit as Cash Rolls In

Biden Accuses Oil Companies of ‘War Profiteering’ and Threatens Windfall Tax

U.S. Sets Timeline for Oil Price Cap Enforcement

Higher Interest Rates Fuel Losses at the Federal Reserve

Bonds Rally With Powell’s Favored Curve Poised for Inversion

Credit Suisse Is Not For Sale, Chairman Says

Food Prices Soar, and So Do Companies’ Profits

The Fed’s Problem With the Job Market

F.T.C. Accuses Ed Tech Firm Chegg of ‘Careless’ Data Security

New Biden Rule Speeds Up Student-Loan Forgiveness for Defrauded Borrowers

Foreign Students Say Canada Is Exploiting Them for ‘Cheap Labor’

Elon Musk Is Forming Circle of Advisers as He Reimagines Twitter

Delta Air Pilots Vote to Authorize Strike

Penguin Random House Blocked From Acquiring Rival Publisher Simon & Schuster

What Does the End of Yeezy Mean for the Sneakerverse?

Victoria’s Secret to Buy Lingerie Brand Adore Me for $400 Million

Entrepreneur Tinkov Renounces Russian Citizenship Over Ukraine War

The Highest-Paid Dead Celebrities Of 2022—A Writer Earns Half-A-Billion From The Great Beyond

Be sure to follow me on Twitter.

-

Ross Stores to Open 40 More Stores

Posted by Eddy Elfenbein on October 31st, 2022 at 8:39 amMore Buy List news today. Ross Stores (ROST) said it’s opening 40 new locations. Specifically, that’s 28 Ross Dress for Less stores and 12 dd’s Discount stores. Ross now runs 2,019 stores. These new locations complete the Company’s store growth plans for fiscal 2022 with the addition of 99 new stores.

“This fall, we opened our 2,000th store and continued to expand Ross and dd’s footprints across our existing markets as well as in our newer states. In addition to openings in California, Florida, and Texas, Ross strengthened its presence in Ohio while dd’s bolstered its store base in Illinois,” said Gregg McGillis, Group Executive Vice President, Property Development. “Looking ahead, we remain confident in our expansion plans and continue to see plenty of opportunity to grow to at least 2,900 Ross Dress for Less and 700 dd’s DISCOUNTS locations over time.”

Ross should report fiscal Q3 earnings in about three weeks. Wall Street expects 80 cents per share.

-

Thermo Fisher Scientific Buys Binding Site

Posted by Eddy Elfenbein on October 31st, 2022 at 8:19 amJust after reporting a big earnings beat, Thermo Fisher Scientific (TMO) said it’s buying British specialty diagnostics firm Binding Site. The deal is worth £2.25 billion ($2.6 billion).

Thermo Fisher Scientific Inc. (TMO), the world leader in serving science, today announced that it has entered into a definitive agreement to acquire The Binding Site Group (“The Binding Site”), a global leader in specialty diagnostics, from a shareholder group led by European private equity firm Nordic Capital, in an all-cash transaction valued at £2.25 billion, or $2.6 billion at current exchange rates.

Serving clinicians and laboratory professionals worldwide, The Binding Site provides specialty diagnostic assays and instruments to improve the diagnosis and management of blood cancers and immune system disorders. The Binding Site’s Freelite® offering is widely recommended for multiple myeloma diagnosis and monitoring across all stages of the disease by major clinical guideline publications.

Headquartered in Birmingham, United Kingdom, The Binding Site has more than 1,100 employees globally and is an active and influential contributor to the broader scientific community. As an established leader in a fast-growing segment in which patient care has shifted towards early diagnosis and monitoring via regular testing, The Binding Site has an attractive financial profile. Its business has been growing approximately 10% annually and is on track to deliver more than $220 million of revenue in 2022. The strong clinical value of The Binding Site offering enables doctors across the globe to support millions of patients every year.

“This transaction perfectly aligns with our Mission and is an exciting addition to our existing specialty diagnostic offerings. With extensive expertise and a large and dedicated installed base in cancer diagnostics, The Binding Site will further enhance our specialty diagnostics portfolio,” said Marc N. Casper, chairman, president and chief executive officer of Thermo Fisher. “The Binding Site is extremely well-respected by researchers and clinicians alike for its pioneering diagnosis and monitoring solutions for multiple myeloma. We also know early diagnosis and well-informed treatment decisions for multiple myeloma can make a significant difference in patient outcomes. We are excited by the opportunity to enable further innovation in this area for the benefit of patients and look forward to welcoming The Binding Site team to Thermo Fisher.”

Stefan Wolf, chief executive officer of The Binding Site, said, “This announcement marks the beginning of a new and exciting chapter for The Binding Site and is a testament to our team’s singular commitment to improving patient lives through the development and delivery of innovative solutions. The Binding Site has long been at the forefront of medical diagnostics and by joining the world leader in serving science, we will be even better positioned to accelerate scientific discovery and expand our product offering for the benefit of our colleagues, customers and, most importantly, the patients we serve.”

The transaction, which is expected to be completed in the first half of 2023, is subject to customary closing conditions, including regulatory approvals. Upon completion, The Binding Site will become part of Thermo Fisher’s Specialty Diagnostics segment and is expected to be accretive to adjusted earnings per share by $0.07 for the first full year of ownership.

Thermo Fisher also said it plans to buy back $1 billion worth of shares in the fourth quarter of 2022. This will bring the amount of money spent on buybacks for this year to $3 billion.

-

Morning News: October 31, 2022

Posted by Eddy Elfenbein on October 31st, 2022 at 7:05 amChina’s Factory Slowdown Worse Than Expected Under Weight of Covid Policies

Three Top Bankers Pull Out of Hong Kong’s Global Finance Summit

U.N., Turkey Race to Save Ukraine Grain Deal

Eurozone Inflation Reaches 10.7 Percent as Economies Slow Down

Frackers Jockey With Potash Miners for Space to Grow in Top U.S. Oil Field

Jerome Powell Is Popular. His War on Inflation Could Change That

The Fed’s Problem With the Job Market

The Fed May Have to Blow Up the Economy to Get Inflation Under Control

Bitcoin’s Proponents Promise a Future That It Cannot Provide

Affirmative Action’s End Will Crush the Diversity Talent Pipeline

Using Superheroes to Sell, This Time to Adults

Credit Suisse Hires 20 Banks for $4 Billion Capital Increase

China’s IPhone Sales Drop May Mean Bigger Problems for Apple

Twitter Is Drafting Broad Job Cuts in Whirlwind First Weekend Under Elon Musk

Can Elon Musk Make the Math Work on Owning Twitter? It’s Dicey.

Wilderness Trail Bourbon to Be Sold to Italy’s Campari at $600 Million Valuation

Taylor Swift’s ‘Midnights’ Breaks Album Sales Records in First Week

TuSimple Probed by FBI, SEC Over Its Ties to a Chinese Startup

Be sure to follow me on Twitter.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His