-

Ford Sales Rise 13%

Posted by Eddy Elfenbein on June 1st, 2012 at 1:43 pmWhile the market is melting down today, Ford ($F) continues to turn out impressive results.

Ford Motor Co. says its U.S. sales rose 13 percent in May on strong demand for its F-Series pickups and SUVs.

F-Series sales rose 29 percent over last May. Ford says demand for trucks has followed an increase in new home construction since the start of this year.

Sales of the Transit Connect commercial van were also up 53 percent over last year. Sales of the Edge crossover rose 24 percent.

Car sales saw smaller gains. Sales of the Focus small car were up 11 percent.

One bright spot in Ford’s car lineup was the Mustang, which saw a 58-percent increase as the summer driving season begins.

Ford is currently under $10.20. Wall Street expects them to earn $1.49 this year and $1.73 next year.

-

CWS Market Review – June 1, 2012

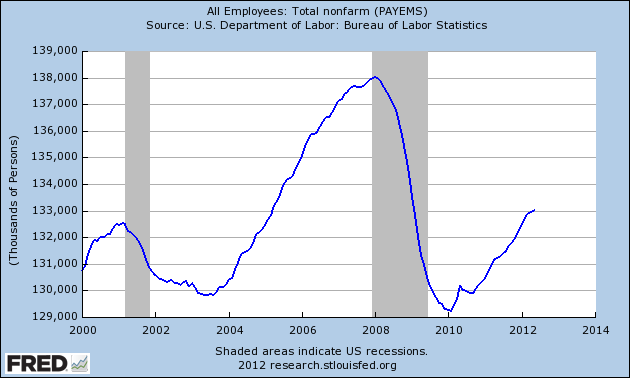

Posted by Eddy Elfenbein on June 1st, 2012 at 9:18 amThis morning, the government reported that the U.S. economy created just 69,000 jobs in May. This was well below expectations, and last month’s numbers were revised downward as well. The national employment rate ticked up from 8.1% to 8.2%. That’s just lousy, and it’s yet more data in a run of below-average economic news.

Before anyone gets too worked up over the jobs numbers, let me remind you that these are very imprecise estimates. The media breathlessly reports these figures as if they were handed down from Mount Sinai, but as Jeff Miller notes, the margin of error for these reports is exceedingly wide. The numbers are also subject to large revisions in the coming months.

Still, we have to adjust ourselves to the reality that the economy isn’t doing as well as most folks believed a few weeks ago. The jobs gains simply aren’t there. The other negative economic news this week included a sharp drop in consumer confidence, a rise in first-time claims for unemployment insurance and a negative revision to first-quarter GDP. The last one is old news since we’re already into the back-end of the second quarter.

Treasury Yields Hit an All-Time Low

I can’t say that I find the sluggish economic news surprising. In the CWS Market Review from two weeks ago, I wrote that economically sensitive cyclical stocks had been badly lagging the market. This is an important lesson for investors because by following the relative strength of different market sectors, we can almost see coded messages the market is sending us. In this case, investors were bailing out of cyclical stocks while the overall market wasn’t harmed nearly as much. Now we see why.

Since February 3rd, the S&P 500 is down by 2.6%, but the Morgan Stanley Cyclical Index (^CYC) is off by more than 11%. Looking at the numbers more closely, we can see that the Energy and Materials sectors have been sustaining the most damage. ExxonMobil ($XOM), for example, lost over $30 billion in market cap in May. The price for oil slid 17% for the month thanks to weak demand from Europe. Interestingly, the Industrials had been getting pummeled, but they’ve started to stabilize a bit in the past few weeks.

Tied to the downturn in cyclical stocks is the amazing strength of Treasury bonds. On Thursday, the yield on the 10-year Treasury bond got as low as 1.54% which is the lowest yield in the history of the United States. The previous low came in November 1945, and that’s when the government worked to keep interest rates artificially low. A little over one year ago, the 10-year yield was over 3.5%. Some analysts are now saying the yield could soon fall under 1%.

Don’t blame the Federal Reserve for the current plunge in yields. While the Fed is currently engaged in its Operation Twist where it sells short-term notes and buys long-term bonds, that program is far too small to have such a large impact on Treasury rates. The current Treasury rally is due to concerns about our economy and the desire from investors in Europe to find a safe haven for their cash. I strongly urge investors to stay away from U.S. Treasuries. There’s simply no reward for you there. Consider that the real return is negative for TIPs that come due 15 years from now. Meanwhile, the S&P 500 is going for 11 times next year’s earnings estimate. That translates to an earnings yield of 9%.

The latest swing in opinion seems to believe that Greece will give staying in the euro another shot. It’s hard to say what will happen since we have new elections in two weeks. Still, I think the country will at least try to keep the euro. The reason is that Greece’s economy is very small compared to the rest of Europe. If it leaves the euro, the headaches involved will be too much to bother with.

The real issue confronting Europe is Spain’s trouble which can’t so easily be swept under the rug. Their banking system is a mess. Think of us as reliving 2008 with Greece being Lehman Brothers and Spain being AIG. The major difference with this analogy is that Europe may not be able to bail out Spain even if it wanted to. So far, the Spanish government is putting up a brave front and is strongly resisting any form of a bailout. The politicians there obviously see how well that played out with public opinion in Greece.

In Germany, the two-year yield just turned negative (ours is still positive by 27 basis points). While much of Europe is in recession (unemployment in the eurozone is currently 11%), and China’s juggernaut is slowing down (this year may be the slowest growth rate since 1999), there’s still little evidence that the U.S. economy is close to receding. We’re just growing very, very slowly.

The stock market performed terribly in May. The Dow only rose five times for the month which is the fewest up days in a month since January 1968. The S&P 500 had its worst month since last April. But we need to remember that the U.S. dollar was very strong last month. It’s probably more correct to say that the dollar is less weak than everybody else, but that still translates to high prices for dollars. So in terms of other currencies, the U.S. equity market didn’t do so poorly.

Jos. A. Bank Clothiers Disappoints

We had one Buy List earnings report this past week: Jos. A. Bank Clothiers ($JOSB). The company had already told us that the quarter was running slow, so that muted my expectations. For their fiscal Q1, Joey Bank earned 53 cents per share which missed Wall Street’s consensus by nine cents per share. Quarterly revenue rose by 4.2% to $208.91 million. But the important metric to watch is comparable stores sales, and that fell by 1%. That’s not good.

Shares of JOSB dropped on Wednesday and stabilized some on Thursday. I’m not happy with how this company is performing and it’s near the top of my list for names to purge from the Buy List for next year. Still, I won’t act rashly. The company has said that this quarter is off to a good start: “So far the second quarter has started out much better than the first quarter. For May, both our comparable store sales and Direct Marketing sales are up compared to the same period last year, continuing the positive trend established in the last five weeks of the first quarter. However, Father’s Day, the most important selling period of the quarter, is still ahead of us.” I’m lowering my buy price from $52 to $48 per share.

Shares of Bed Bath & Beyond ($BBBY) broke out to a new all-time high this past week. On Tuesday, the stock got as high as $74.67. It’s our #1 performer for year and is up nearly 25% YTD. The stock is an excellent buy below $75 per share, but I won’t move the buy price until I see the next earnings report which is due out on June 20th.

Two other Buy List stocks I like right now are Ford ($F) and Oracle ($ORCL). Ford has been doing so well that it’s actually having a hard time keeping up with demand. I’m expecting a strong earnings report from Oracle later this month. The May quarter, which is their fiscal fourth, is traditionally their strong quarter. Oracle is an excellent buy under $30 per share.

Before I go, let me say a quick word about Facebook ($FB). In last week’s CWS Market Review, I told you to stay away from the stock, and I was right as the shares have continued to fall. The stock got as low as $26.83 on Thursday. I don’t think Facebook is an attractive stock to own until it reaches $17 to $20 per share. Until then, keep your distance!

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 1, 2012

Posted by Eddy Elfenbein on June 1st, 2012 at 7:36 amEuro-Area Unemployment Reaches Record 11%, Led by Spain

A Terse Warning for Euro States: Do Something Now

Merkel’s Isolation Deepens as Draghi Criticizes Strategy

Formula One May Delay $3 Billion I.P.O. in Singapore

China Manufacturing Slows Sharply, Data Show

Macau Gambling Revenue Rose 7% in May

Emerging Stocks Extend Monthly Rout on Asia

U.S. and European Union Agree on Air Cargo Security

BP Russian Partners Say They Made Offer for BP’s TNK Stake

Liberty Tells Regulators It Wants Control of Sirius

Wal-Mart Joins Companies Cutting Ties With ’Free-Market’ Group

After Facebook, Silicon Valley Warily Eyes Square

Student Debt Rises by 8% as College Tuitions Climb

Jeff Miller: May Employment Preview

Epicurean Dealmaker: As Long as the Right People Get Shot

Be sure to follow me on Twitter.

-

The $2.3 Trillion Gap

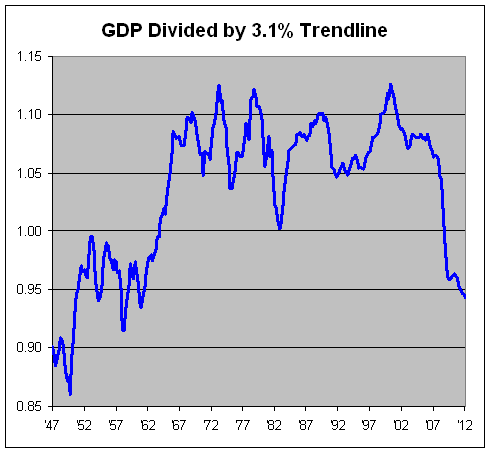

Posted by Eddy Elfenbein on May 31st, 2012 at 11:06 amHere’s an unusual chart, but I think it explains a lot. This is real GDP divided by a trendline growing at 3.1%. So when the line is rising, the economy is growing faster than 3.1%. Conversely, when the line is dropping, the economy is growing by less than 3.1%.

For a 40-year stretch, from 1966 to 2006, the economy grew at a 3.1% annualized pace and it didn’t stray too far from that trend. The 1981-82 recession was severe, but the Reagan Recovery brought us back into trend.

The Great Recession, however, is a dramatic departure from the 40-year trend. That’s the key point I think the chart highlights. In the last six years, the economy has exceeded 3.1% growth in just four quarters. If the economy had kept pace with the 3.1% trend, it would be $2.3 trillion larger today in nominal terms.

-

Q1 GDP Revised Down

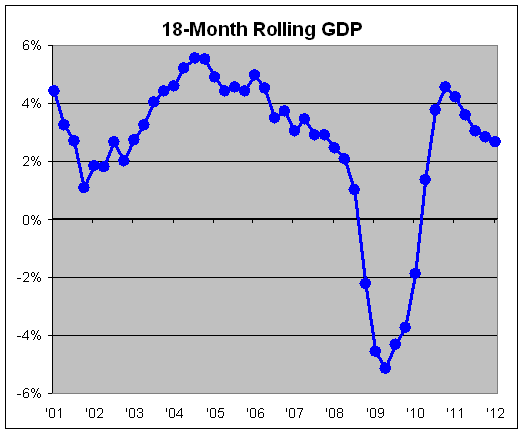

Posted by Eddy Elfenbein on May 31st, 2012 at 9:44 amThe government revised its estimate for first-quarter GDP growth this morning and it was bad news. Instead of growing by 2.2% as was initially reported one month ago, the government now says that the economy grew by just 1.9% for the first three months of the year.

This means that the economy is barely above its peak from late 2007. Over the last 17 quarters, the U.S. economy has grown by just 1.24% in real terms.

The report also showed that after-tax corporate profits dropped for the first time in three years.

A modest downward revision to consumer spending, which accounts for about 70 percent of economic activity, and stronger import growth also accounted for the weaker first-quarter output. Economists polled by Reuters had expected growth would be revised down to a 1.9 percent pace.

Business inventories increased $57.7 billion, instead of $69.5 billion, adding only 0.21 percentage point to G.D.P. growth, compared with 0.59 percentage point in the previous estimate.

While the small inventory buildup held back growth in the January-March quarter, restocking of shelves, retreating gasoline prices and an improving housing market should bolster output in the second quarter.

I’m not sure why this is, but looking at the rolling six-quarter growth of the economy gives you the clearest appearance of a trend. The six-quarter growth rate has now trended downward for five quarters in a row.

Before the Great Recession, economists spoke of the Great Moderation. This refers to the fact that the booms and busts of the economy from 1982 to 2007 were much smaller than what we saw before.

But the moderation may still be with us, just at a lower level. The standard deviation of quarterly GDP growth for the last seven quarters is among the lowest ever recorded.

-

Morning News: May 31, 2012

Posted by Eddy Elfenbein on May 31st, 2012 at 7:27 amBankia Vortex Risks Dragging Spain to Bailout as Costs Mount

An ECB Rate Cut: A Matter of When Not If

Swiss Economic Growth Quickens

Polish Economic Growth Slowed as Euro Turmoil Hurts Exports

India Growth Slows to Nine-Year Low as Rupee Drops to Record

Japan Industrial Output Gains Slow, Stirring Recovery Doubts

Malaysia Launches $3 Billion IPO with Eye on Poll

Gold Advances in London as Weaker Dollar Bolsters Demand

U.S. Steps Up Pressure on Europe to Resolve Euro Crisis

Microsoft Recruits Designers in Race for Windows Apps

RIM Shares Trade Lower After CEO’s Warning

JPMorgan CIO Swaps Pricing Said to Differ From Bank

Lions Gate Records Surprise Loss on Summit, ‘Hunger Games’ Costs

Jeff Carter: Repurposing Public Spaces For the Knowledge Economy

Edward Harrison: What Record Low 10-Year Rates Tell Us About The Toxic Effects Of Permanent Zero

Be sure to follow me on Twitter.

-

10-Year Yield Hits New Low

Posted by Eddy Elfenbein on May 30th, 2012 at 10:33 amThe yield on the 10-year Treasury fell to 1.65% today which is another multi-decade low.

The 10-year TIPs yield is now down to -0.4%. In February 2011, the TIPs yield was +1.4%.

-

Joey Bank Bombs

Posted by Eddy Elfenbein on May 30th, 2012 at 9:51 amJos. A. Bank Clothiers ($JOSB) just reported horrible earnings for its first quarter. The company earned 53 cents per share which was nine cents worse than expectations. To be fair, the company had told us that this quarter looked weak but we didn’t know exactly how weak until now. Quarterly revenue rose 4.2% to $208.91 million, although comparable stores sales dropped by 1%.

The stock is getting nicked this morning but this is cause for optimism. JOSB has said that this quarter is off to a good start: “So far the second quarter has started out much better than the first quarter. For May, both our comparable store sales and Direct Marketing sales are up compared to the same period last year, continuing the positive trend established in the last five weeks of the first quarter. However, Father’s Day, the most important selling period of the quarter, is still ahead of us.”

-

Morning News: May 30, 2012

Posted by Eddy Elfenbein on May 30th, 2012 at 7:28 amEuro-Area Economic Confidence Falls to 2 1/2 Year Low

Euro Bonds With Strings Are Europe’s Best Way Forward

Greek Exit From Euro Seen Exposing Deposit-Guaranty Flaws

Worries About Spain Weigh on Euro Zone

ECB Rate Cut Hopes Push Euribor To 2-Yr Lows

India’s Economy Slows, With Global Implications

Young and Global Need Not Apply in Japan

Global Carbon Market Value Hits Record $176 Billion

Challenges Mount for Chinese Makers of Electric Cars

Dragon Oil Awarded Iraqi Exploration Block

A Facebook Phone: Ambitious Leap or Fatal Mistake?

Dunkin’ Brands Looks to Emerging Markets

Allstate Leads Insurers to Best Start Since 2003 on Storm Costs

Visa Beats JPMorgan as Cards Wage War on Cash: Riskless Return

Roger Nusbaum: A Not So Lazy Portfolio

Pragmatic Capitalism: Housing Recovery: Hope and Reality

Be sure to follow me on Twitter.

-

Home Prices Cheapest in 10 Years

Posted by Eddy Elfenbein on May 29th, 2012 at 9:47 amThis morning’s Case-Shiller reports that U.S. home prices are the cheapest they’ve been since mid-2002.

Home prices hit new post-bubble lows in March, according to a report out Tuesday.

Average home prices were down 2.6% from 12 months earlier, according to the S&P/Case-Shiller home price index of 20 major markets. Home prices have not been this low since mid-2002.

“While there has been improvement in some regions, housing prices have not turned,” said David Blitzer, spokesman for S&P.

Although five cities – Atlanta, Chicago, Las Vegas, New York and Portland – saw average home prices hit new lows, that’s an improvement from last month’s report, in which nine cities notched new lows, Blitzer noted.

Overall, the 20-city composite is down about 35% from its peak in 2006.

Experts say affordable mortgages, combined with much lower home prices, should help to bolster the housing market.

“It’s probably the best time to buy a home in decades,” said Pat Newport, an analyst for IHS Global Insight.

“But the problem is that unless you have good credit, you are probably going to have trouble qualifying for a loan,” he added referring to overly tight lending conditions.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His