-

Morning News: December 9, 2011

Posted by Eddy Elfenbein on December 9th, 2011 at 7:39 amEuro Leaders’ Fiscal Union Pact Leaves Next Step to ECB

Treaty to Save Euro Takes Shape, but Britain Sits Out

EU Leaders Drop Demands for Investor Write-Offs

Moody’s Downgrades Top French Banks

Europe Bank Shares Bounce Back

Stress Test Reveals European Banks Need More Capital

China’s 10-Year Ascent to Trading Powerhouse

China Data Signals Pro-growth Policy Shift

Crude Heads for Biggest Weekly Drop Since September as Europe Disappoints

UBS, Citigroup May Be Penalized in Japan on Tibor Probe

Toyota Lowers Profit Forecast After Floods

Bluntly and Impatiently, Chief Upends G.M.’s Staid Tradition

Texas Instruments Sees Sales Below Estimates

KPMG Warned Olympus in Accounting Fraud, Then Got ‘Careless,’ Probe Finds

Paul Kedrosky: MF Global and the Great Wall St Re-hypothecation Scandal

Edward Harrison: Credit Writedowns Weekly Report, Vol 1 Issue 2: Solutions in Europe?

Be sure to follow me on Twitter.

-

Models and Confidence

Posted by Eddy Elfenbein on December 8th, 2011 at 5:59 pmIndeed, elsewhere Kahneman has told a story of a group of Swiss soldiers who were lost in the Alps because of bad weather. One of them realized he had a map. Only after they had successfully climbed down to safety did anyone discover that it was a map of the Pyrenees. Kahneman tells that story in the context of discussing economic and financial models. Even if those maps are wrong, we still feel better when using them.

-

Can the S&P 500 Hit 1720 Next Year?

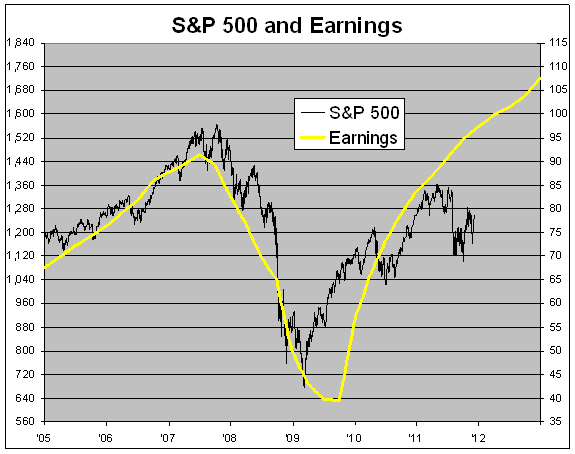

Posted by Eddy Elfenbein on December 8th, 2011 at 3:07 pmI like post titles that are questions rather than statements because it doesn’t require any commitment from me. Still, if we take some reasonable assumptions, we can arrive at very decent numbers for the S&P 500 one year from now.

Right now, Wall Street expects the S&P 500 to earn $97.45 this year and $107.68 for 2012. If we assume an earnings multiple, which is hardly excessive, then we get a year-end target of 1723 for the index.

-

After Five Year Absence, Ford’s Dividend Will Return

Posted by Eddy Elfenbein on December 8th, 2011 at 12:13 pmFord ($F) just announced that it’s going to pay a dividend of five cents per share. The dividend is payable March 1, 2012 to shareholders of record on Jan. 31, 2012.

The Board of Directors of Ford Motor Company today declared a quarterly dividend of 5 cents per share.

“We have made tremendous progress in reducing debt and generating consistent positive earnings and cash flow,” said Bill Ford , executive chairman, Ford Motor Company. “The board believes it is important to share the benefits of our improved financial performance with our shareholders. We are pleased to reinstate a quarterly dividend, as it is an important sign of our progress in building a profitably growing company and our confidence in the future.”

Lewis Booth , Ford executive vice president and chief financial officer, said the company’s strong liquidity and balance sheet improvements provide the underlying financial strength to resume paying a quarterly dividend.

“Building a strong balance sheet that supports our growth plans remains a core part of our One Ford strategy,” said Booth. “We have demonstrated our capability to finance our plans and we are confident that we can begin to pay a dividend that will be sustainable through economic cycles.”

A five-cent dividend is a puny portion of Ford’s annual profit. The company will earn about $1.87 per share this year and it’s expected to earn another $1.62 per share next year.

From 2002 to early 2006, Ford had paid a quarterly dividend of 10 cents per share. Then Ford cut it five cents for one quarter; then they got rid of it entirely.

-

The New Dividend Aristocrats

Posted by Eddy Elfenbein on December 8th, 2011 at 11:31 amS&P follows an index it calls the Dividend Aristocrats which is a group of S&P 500 stocks that have increased their dividends every year for the last 25 years in a row.

S&P just announced that it’s adding 10 new stocks to the Dividend Aristocrats and deleting one. This brings the new list of Aristocrats up to 52.

The new additions are:

Franklin Resources ($BEN)

HCP Incorporated ($HCP)

T. Rowe Price ($TROW)

AT&T ($T)

Colgate-Palmolive ($CL)

Genuine Parts ($GPC)

Illinois Tool Works ($ITW)

Medtronic ($MDT)

Nucor ($NUE)

Sysco ($SYY)The only deletion was CenturyLink ($CTL).

Howard Silverblatt of S&P passes on some dividend facts (via Michael Aneiro):

* Year-to-date (YTD) dividend payers in the S&P 500 have returned 1.72%, compared to the non-payers loss of 4.63%

* The actual dividend payment YTD is up 16.2%

* The indicated dividend rate (based on the current rate) is up 16.8% YTD, but still off 4.9% from the June 2008 high

* From 1995 the S&P 500 indicated dividend yield has averaged 43% of the U.S. 10-year Treasury note, the current rate is 105%

* 215 issues have a current yield higher than the 10-year Treasury

Now that Medtronic and Sysco are Dividend Aristocrats, this makes six of our Buy List stocks that are Aristocrats. The other four are AFLAC ($AFL), Abbott Laboratories ($ABT), Becton, Dickinson ($BDX) and Johnson & Johnson ($JNJ).

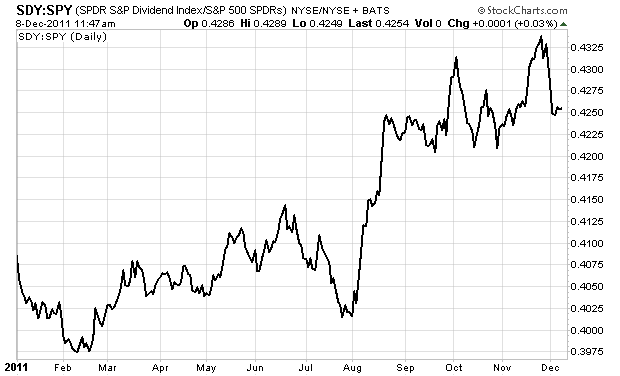

The Dividend Aristocrats have had a decent year. Here’s a look at the Dividend Aristocrats ETF ($SDY) divided by the $SPY:

-

A Turnaround for Financials

Posted by Eddy Elfenbein on December 8th, 2011 at 10:48 amI’ve been pretty down on financials for the past several months, but I think the sector is finally a good buy. Two months ago, I said that the Financial Sector ETF ($XLF) would be a good speculative buy if it fell below $12 per share. Eventually it did. On October 3, the XLF got as low as $10.95. I think it has a reasonable shot of hitting $16 within the next 12 months. In early 2007, the ETF came close to $37.

-

Morning News: December 8, 2011

Posted by Eddy Elfenbein on December 8th, 2011 at 5:21 amEuropean Stocks Tentatively Higher

ECB May Dig Deeper Into Crisis Toolbox

Franco-British Alarm of 1989 Comes True as Merkel Prevails

Draghi Courts Bundesbank in Bid to Avoid Trichet Fate

Asian Central Banks Hold Rates on Euro Uncertainty

Entrepreneur’s Rival in China: The State

New China Life Said to Raise $1.9 Billion in Stock Offering

India Suspends Plan to Let in Foreign Retailers

Japan “Mulls $13-19 Billion Bailout” of Nuclear Operator

China’s “Best Buys” Scramble to Tap E-commerce Boom

Crude Oil Rises From One-Week Low Before European Debt Meetings

First Solar Rises on Sale of Topaz Project to Buffett

Matthew Winkler: Why We Should Welcome Bernanke’s Complaints

James Altucher: Stop Listening!

Phil Pearlman: The Relative Negativity of a Flattish Open

Be sure to follow me on Twitter.

-

Stryker Raises Dividend By 18%

Posted by Eddy Elfenbein on December 7th, 2011 at 2:13 pmThe market is down so far today but it’s not too bad. The S&P 500 is currently at 1,255 though we’re up about 10 points from today’s low. The defensive sectors are doing the best today while the cyclicals are pulling up the rear.

There’s not much action today on the Buy List though I want to highlight a few items.

The best news is that Stryker ($SYK) is raising its quarterly dividend from 18 cents per share to 21.25 cents per share. That’s an 18% increase. The new 85-cent annual dividend translates to a yield of 1.75%.

My advice to investors is to not overlook moves like this. We want to look at the overall trends of a business. Bear in mind that Stryker raised its dividend by 20% last year. These things add up.

The other news is that Moody’s may downgrade Leucadia ($LUK), and Gilead ($GILD) just priced $3.7 billion in unsecured notes. That just reminds me of how much I hate the Pharmasset deal.

-

70 Years Ago Today

Posted by Eddy Elfenbein on December 7th, 2011 at 7:48 amOn Google Earth:

21° 21′ 53″ N 157° 57′ 00″ W

The USS ArizonaYou can see the whole ship underwater. You can even see the oil slick coming from the boat. I used the “Measure” function under “Tools.” It’s 590 feet long. That’s the “Lady Mo” to the southwest, and the sunken USS Utah is about 0.8 miles to the northwest, on the other side of Ford Island.

-

Morning News: December 7, 2011

Posted by Eddy Elfenbein on December 7th, 2011 at 5:21 amMerkel’s Path: Brinkmanship for Debt Crisis

New European Bank Chief Takes a Bold Approach

‘Buy French’ Becomes Crisis Battle Cry in France

China Growth Calls Ease as Export Outlook Darkens

India Suspends Foreign Retail Plan on Protests

Geithner Backs French-German Plan for Tighter EU

Geithner: Europe ‘Will Succeed’

Separating Fact From Fiction on the Fed’s Loans

Fed Lashes Out at ‘Errors’ in Reporting

Prudential Sells Real Estate Brokerage, Relocation Business to Brookfield

Daimler Losing to BMW as Pure Luxury Wins

Limited Choices for Yahoo, Each One With Its Own Risks

Olympus Report Seeks Purge of ‘Yes Men’ Who Failed to Act

Joshua Brown: Should You Follow Tom DeMark?

Jeff Miller: Weighing the (rest of the) Week Ahead: The Eurozone Summit

Be sure to follow me on Twitter.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His