-

Morning News: November 25, 2011

Posted by Eddy Elfenbein on November 25th, 2011 at 6:56 amIndia’s Sharma Says FDI in Retail to Create 10 Million Jobs

Japan Benchmark 10-Year Yield Completes Biggest Weekly Gain Since January

Bank Of Russia Leaves Rates Unchanged, As Expected

Hungary Credit Rating Cut to Junk at Moody’s

In Debt Crisis, a Silver Lining for Germany

China Starts Probe Into U.S. Renewable Energy-Policy, Subsidies

Renewable Power Trumps Fossils for First Time

“Fair value” Accounting Rule Tweak Raises Concerns

Crude Futures Head for Second Weekly Loss on Europe; Mirae Sees Iran Risk

T-Mobile and AT&T Edge Closer to Scrapping Merger

Gap Says to Triple China Network in 2012

Russian Oil Giant Lukoil’s Quarterly Net Slumps 21% on Output Dip

Hong Kong Jeweler Plans $3 Billion IPO

John Muellbauer: How Germany Could Save the Euro

Howard Lindzon: Venting…Not Vente…AND Humor in Finance

Be sure to follow me on Twitter.

-

Morning News: November 24, 2011

Posted by Eddy Elfenbein on November 24th, 2011 at 6:50 amGerman Business Confidence Unexpectedly Rises

Asian Stocks Outside Japan Rebound from Seven-Week Low on China

Dollar Funding Costs Rise to Three-Year High, Reversing Decline

Oil Climbs From Two-Week Low on U.S. Stockpiles, Saudi Violence

Chocolate Binge Topping $100 Billion Boosts Cocoa

U.S. Rating by Moody’s Imperiled Without $1.2 Trillion in Cuts

Fed Seeks to Bolster Confidence in 31 Largest U.S. Banks With Stress Tests

Black Friday IPod Deals Show Stores Bowing to Buyers Amid 2% GDP

Opening Day for Shoppers Shows Divide

Deere Fourth-Quarter Net Tops Analyst Estimates as U.S. Farm Income Climbs

Microsoft Signs Nondisclosure Agreement With Yahoo

AT&T, T-Mobile Deal Hopes Crumble

Itochu Buys Stake in U.S. Oil-and-Gas Producer Samson

Ex-Olympus CEO Confident About Accounting Probe

Joshua Brown: Media Gruesome Groupon

Marc Chandler: Fiscal Union is the Only Real Solution

Be sure to follow me on Twitter.

-

Morning News: November 23, 2011

Posted by Eddy Elfenbein on November 23rd, 2011 at 6:52 amEuropean Banks Get ‘False Deleveraging’

Bank of Greece: Greece Faces Last Chance to Stay in Euro Zone

Euro Zone Heads for Contraction

Belgium, France Lead Govt Bond Market Losses Wednesday

International Monetary Fund Offers Short-Term Credit as Insurance for Nations

Crude Oil Drops After German Bond Sale Signals Deepening of Euro Crisis

3rd-Quarter U.S. Growth Revised Down to 2 Percent

Financial Finger-Pointing Turns to Regulators

Fed to Test Six Big Banks for Euro Stress

U.S. Postal Service Hires Evercore for Restructuring Advice

F.C.C. Seeks Review of AT&T Merger With T-Mobile

Groupon’s I.P.O. Pop, Now Deflated

Merck to Pay $950 Million Over Vioxx

Black Friday Deals See Stores Bowing to Shoppers

Epicurean Dealmaker: Sovereign Triviality

Paul Kedrosky: Going Public Decreases Innovation

Be sure to follow me on Twitter.

-

Medtronic Earns 84 Cents Per Share

Posted by Eddy Elfenbein on November 22nd, 2011 at 11:23 amBefore the opening bell, Medtronic ($MDT) reported earnings of 84 cents per share which beat expectations by two cents per share. Overall, this was a solid quarter:

Sales increased for the company’s insulin pumps and heart pacemakers. Weakness persisted in its businesses that sell implantable heart defibrillators and products for spinal surgery, which together make up about 40 percent of revenue.

Medtronic Chief Executive Omar Ishrak told analysts on a conference call that he expects the pressure on those units to eventually reverse as macroeconomic conditions improve.

The company also reiterated its estimates for this year which is a diluted EPS ranging between $3.43 and $3.50. The stock is up about 3.5% today.

Here’s a look at Medtronic’s quarterly results for the past several years:

Quarter EPS Sales in Millions Jul-01 $0.28 $1,456 Oct-01 $0.29 $1,571 Jan-02 $0.30 $1,592 Apr-02 $0.34 $1,792 Jul-02 $0.32 $1,714 Oct-02 $0.34 $1,891 Jan-03 $0.35 $1,913 Apr-03 $0.40 $2,148 Jul-03 $0.37 $2,064 Oct-03 $0.39 $2,164 Jan-04 $0.40 $2,194 Apr-04 $0.48 $2,665 Jul-04 $0.43 $2,346 Oct-04 $0.44 $2,400 Jan-05 $0.46 $2,531 Apr-05 $0.53 $2,778 Jul-05 $0.50 $2,690 Oct-05 $0.54 $2,765 Jan-06 $0.55 $2,770 Apr-06 $0.62 $3,067 Jul-06 $0.55 $2,897 Oct-06 $0.59 $3,075 Jan-07 $0.61 $3,048 Apr-07 $0.66 $3,280 Jul-07 $0.62 $3,127 Oct-07 $0.58 $3,124 Jan-08 $0.63 $3,405 Apr-08 $0.78 $3,860 Jul-08 $0.72 $3,706 Oct-08 $0.67 $3,570 Jan-09 $0.71 $3,494 Apr-09 $0.78 $3,830 Jul-09 $0.79 $3,933 Oct-09 $0.77 $3,838 Jan-10 $0.77 $3,851 Apr-10 $0.90 $4,196 Jul-10 $0.80 $3,773 Oct-10 $0.82 $3,903 Jan-11 $0.86 $3,961 Apr-11 $0.90 $4,295 Jul-11 $0.79 $4,049 Oct-11 $0.84 $4,132 -

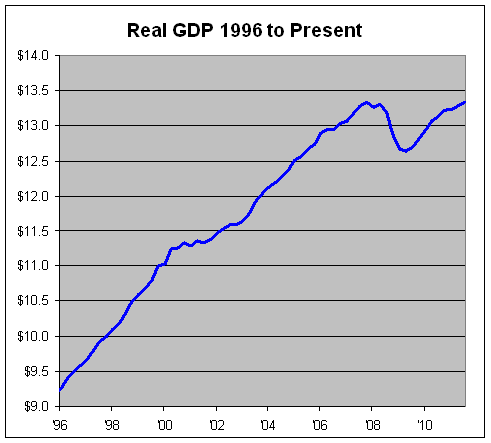

Q3 GDP Revised Down to 2%

Posted by Eddy Elfenbein on November 22nd, 2011 at 10:43 amThe initial estimate was 2.5% but today it was revised down to 2%.

The economy in the U.S. expanded less than previously estimated in the third quarter, reflecting a drop in inventories that points to a pickup in growth as 2011 comes to a close.

Gross domestic product climbed at a 2 percent annual rate from July through September, less than projected and down from a 2.5 percent prior estimate, revised Commerce Department figures showed today in Washington. The median forecast of 81 economists surveyed by Bloomberg News called for no revision. Excluding stockpiles, so-called final sales climbed 3.6 percent, the most since last year’s fourth quarter.

Gains in retail sales, manufacturing and housing this quarter, combined with lean inventories, raise the odds the world’s largest economy will pick up. At the same time, unemployment and stagnant wages mean consumer spending has been fueled by reductions in savings that cast doubt on whether increases will be sustained into 2012, just as the risks from government cutbacks and the European debt crisis intensify.

Here’s your fun stat of the day: Real GDP growth over the last 15 quarters = 0.09%.

-

America’s New Age of Plenty

Posted by Eddy Elfenbein on November 22nd, 2011 at 10:18 amFascinating article from Edward Luce at the Financial Times:

Because of better technology, notably breakthroughs in drilling, the US all of a sudden realises it is sitting on a century’s worth of gas supply. When Mr Obama came to office, the country faced projections of rising natural gas imports from places like Qatar.

The same technology has unlocked ever-growing estimates of once inaccessible “tight” oil lurking beneath America’s rocks. In its immediate neighbourhood, Alberta’s huge expanse of “tar sands” contains oil reserves that rank Canada second only to Saudi Arabia. In Brazil, recent advances in offshore oil drilling will relegate Venezuela into second place in the region.

Without any real input from Washington, windfalls just keep dropping into America’s lap. Welcome to a new age of plenty.

-

Morning News: November 22, 2011

Posted by Eddy Elfenbein on November 22nd, 2011 at 6:39 amFrance’s AAA Status in Tatters as Yields Surge

Ireland Faces $26 Billion Fall in Drug Exports

Spain’s Borrowing Costs Skyrocket

Debt Crisis Lurches Toward Heart of Euro Zone as Rifts Grow

Tokyo Exchange Bid Values Osaka Securities at $1.68 Billion

Gold Rebounds From One-Month Low as Sovereign-Debt Concerns Stoke Demand

Supercomittee Failure Poses Threat to U.S.

As Layoffs Rise, Stock Buybacks Consume Cash

Hewlett’s Profit Falls 91%, But It Beats Expectations

Netflix Stock Plunges, After Rental Giant Sells $400 Million in Stock, Debt

KKR Near $7 Billion Deal to Buy Most of Oil and Gas Producer Samson

U.S. Trustee Faults MF Global Customer Committee Proposal

A Blow to Pinstripe Aspirations

Roger Nusbaum: Is The Market Frustrated?

Jeff Miller: Investors’ Guide to the Supercommittee Failure

Be sure to follow me on Twitter.

-

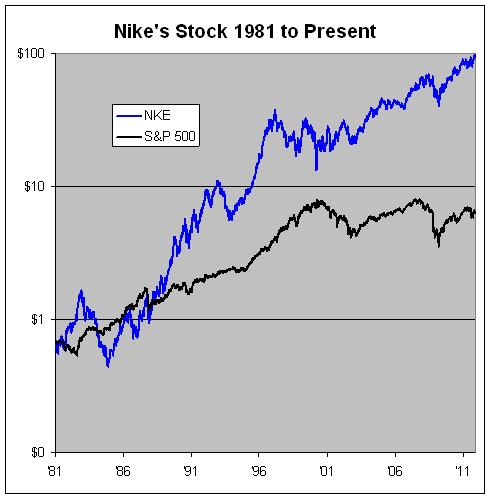

Nike’s Incredible Track Record

Posted by Eddy Elfenbein on November 21st, 2011 at 3:28 pmNike ($NKE) is one of those great stocks that doesn’t get nearly as much credit as it deserves. In 1984, the shares were going for less than 50 cents each (split adjusted).

Just a few weeks ago, NKE hit an all-time high of $97.68. That’s a gain of more than 21,000% in 27 years which is about 22% annualized. Not many hedge funds can do that. The S&P 500 is up about 610% over the same time span.

I should add that those numbers don’t include dividends and Nike just raised its dividend by 16% to 36 cents per share. The new dividend works out to a yield of 1.6%.

In early 1997, Nike got to be super-expensive — over $36 per share (again, split adjusted). Three years later, when the market was peaking, Nike was down to just $13. Still, Nike has managed to rebound and outperform the market even when we measure from its early 1997 peak.

I like the company a lot but the stock is rather pricey. I think NKE would be a much better buy if it dropped down to $70.

The chart below shows Nike’s stock along with the S&P 500. For comparison, I’ve given the S&P 500 the same starting base as Nike.

-

Medtronic Earnings Preview

Posted by Eddy Elfenbein on November 21st, 2011 at 1:36 pmFrom the AP:

Medtronic Inc., the world’s largest medical device maker, reports fiscal second-quarter earnings Tuesday morning, as investors continue to monitor weak demand, pricing pressures and other issues hurting the entire medical device industry.

WHAT TO WATCH FOR: Last quarter Medtronic reported declines for its two leading franchises, heart defibrillators and spinal implants, as tighter hospital budgets, reduced patient procedures and safety concerns led doctors to scale back use of the devices.

Industry competitors like Boston Scientific Corp. reported weaker-than-expected earnings last month, with noticeable declines in sales of defibrillators, which are heart-zapping implants used to treat heart failure. Leerink Swann analyst Rick Wise estimates the market for the devices declined 14 percent in the first nine months of the year, compared with 2010.

WHY IT MATTERS: Medtronic relies on defibrillators and spinal implants for more than 50 percent of its total sales. Medtronic and other device makers have seen profits drop since the Department of Justice began investigating alleged overuse of defibrillators in January.

Then in June Medtronic’s spinal business took a major publicity blow after a medical journal alleged that the company downplayed the risks of its InFuse spinal repair protein. According to reports in Spine Journal, Medtronic also failed to disclose millions of dollars in payments to the authors who wrote the initial studies of InFuse. The implant, which is approved to treat degenerative spinal disk disease, accounted for 85 percent, or $750 million, of Medtronic’s total spinal business last year.

Leerink’s Rick Wise said the ongoing pressure could lead Medtronic to scale back its full-year earnings guidance.

“Though Medtronic seems well positioned to benefit from recent and upcoming product launches, incremental volume declines in both ICDs (implantable cardioverter defibrillators) and spine, with no clear signs of improvement, could prompt management to take an even more cautious stance on fiscal year 2012 guidance,” Wise wrote in a note to investors. Medtronic has stated it expects fiscal year earnings per share between $3.43 and $3.50.

WHAT’S EXPECTED: Analysts polled by FactSet expect earnings per share of 82 cents on revenue of $4.07 billion for the company’s fiscal 2012 second-quarter.

LAST YEAR’S QUARTER: In the second quarter last year Medtronic Inc. earned 82 cents per share on an adjusted basis on revenue of $3.9 billion.

-

Gilead Deal on CNBC

Posted by Eddy Elfenbein on November 21st, 2011 at 10:34 am

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His