-

Morning News: September 16, 2011

Posted by Eddy Elfenbein on September 16th, 2011 at 5:43 amIndia Raises Rates, Breaks Ranks With BRICs

UK’s Brown: Euro Area Cannot Survive In Present Form

NYSE Owners Lose Big on German Embrace

China Consolidates Grip on Rare Earths

5 Central Banks Move to Supply Cash to Europe

UBS Trader Gets No Miracle as Loss Leads to Arrest

Geithner Presses Euro Zone to Leverage Bailout Fund

Delta One Desks Are Big Moneymakers

Goldman to Close Global Alpha Hedge Fund

Barclays to Open London Precious Metals Vault

Citic IPO to Raise Up to $1.94 Billion; ManU Scores Singapore Listing Approval

Esprit Shares Tumble 20% After Dismal Earnings

Air France Splits $12 Billion Order Between Airbus, Boeing

Silver Lake Is Said to Weigh Buying Yahoo

Paul Kedrosky: Taleb: People Kept Telling Me I Was an Idiot

James Altucher: Ten Scams You Encounter Every Day

Be sure to follow me on Twitter.

-

Morning News: September 15, 2011

Posted by Eddy Elfenbein on September 15th, 2011 at 5:36 amGreece Is to Remain in Euro: Sarkozy, Merkel

European Stocks Gain on Backing for Greece

China Ties Aiding Europe to Its Own Trade Goals

Italy Gives Final Approval to Austerity Plan

Crude Oil a Tad Lower; US Stocks Data, Euro Woes Weigh

Europe Won’t Allow a Lehman-Like Collapse, Geithner Says

Supercommittee to Get Push From Senators to Increase Savings

Automakers and U.A.W. Still Talking

US Orders Bank Of America To Pay $930,000 To Fired Whistleblower

UBS Says It Had $2 Billion Loss From Unauthorized Trading

Groupon Back on Track for Its IPO

Toys R Us Holiday Mantra: In Exclusives We Trust

Jeff Miller: Finding the Best Information about Europe

Stone Street: Financial Regulation: One Step Forward, Twelve Steps Back – FINRA’s Bid for More Power

Be sure to follow me on Twitter.

-

Benford’s Law and Greece

Posted by Eddy Elfenbein on September 14th, 2011 at 9:17 amI’ve written about Benford’s Law before. The law predicts the frequency at which first numbers ought to appear in a random distribution. The law has been used to catch folks who have fudged their data.

Tim Harford highlights some researchers who have turned Benford’s Law on Greece’s economic data:

Manipulated data often fail to satisfy Benford’s Law. A manager who must submit receipts for expenses over £20 may end up filing claims for lots of £18 and £19 expenses – and the data will then contain too many ones, eights and nines. A forensic accountant can easily check this, and while not an infallible check (fraudster Bernard Madoff filed Benford-compatible monthly returns), it’s an indicator of possible trouble.

Which brings us back to the data Greece submitted to the European statistics agency. According to Rauch and his colleagues, Greek data are further from the Benford distribution than that of any other European Union member state. Romania, Latvia and Belgium also have abnormally distributed data, while Portugal, Italy and Spain have a clean bill of health.

Would a Benford-style analysis have helped spot Greece’s problems? In principle, yes. In practice, one wonders whether politics would have trumped statistics. A shame: according to Benford’s Law, Greece’s data were particularly odd in 2000, just before it joined the euro.

(H/T: Jason Zweig)

-

Retail Sales Unchanged

Posted by Eddy Elfenbein on September 14th, 2011 at 8:58 amThe futures indicate that the market will open higher this morning. The surprising news of this morning is that the Democrats lost the by-election to replace Anthony Weiner in New York’s ninth congressional district. This was seen as a relatively safe seat for the Democrats.

The retail sales report for August was unchanged from July. Wall Street was expecting an increase of 0.3% so this was a bit of a surprise. Some economists are concerned that the summer swoon had a larger impact on consumer spending than was first realized. Also, the initial retail sales report for July showed an increase of 0.5%. That was revised down to 0.3%.

The PPI report showed that wholesale inflation was flat last month which is welcome news for inflation hawks. The “core rate” rose by just 0.1%.

There’s more bad news for French banks this morning. These banks had the most exposure to the problems in Greece. Moody’s has downgraded the long-term debt of two major French banks, Société Générale and Crédit Agricole. Additionally, BNP Paribas is under review for a downgrade. Actually, some investors think Moody’s action could have been harsher.

-

Morning News: September 14, 2011

Posted by Eddy Elfenbein on September 14th, 2011 at 5:32 amRisk Rises at ECB as Europe Banks Lose Deposits

From Europe, Mounting Pressure Over Greece’s Debt

French Banks Downgrade Revives Euro Debt Fears

European Shares Turn Positive on Euro Bonds Hopes

Asia Corporate Sentiment Slides on Global Worries

World Must Cut Deficits, Not Rely on China: Wen

Gold Declines as Stocks, Commodities Drop on European Debt Risk

Crude Oil Drops From Six-Week High on Concern Economic Recovery to Falter

Geithner Takes Tougher Tone on Europe

Banks Brace for a Season of Fall-Offs

RIM Poised to Miss Tablet Estimates as IPad Wins

Demand at Target for Fashion Line Crashes Web Site

Soaring U.S. Poverty Casts Spotlight on ‘Lost Decade’

Joshua Brown: Short Interest Explodes, Face-Ripper™ Coming?

Phil Pearlman: If It Weren’t for the Sales Tax Break, Amazon Would be Getting Crushed By Best Buy

Be sure to follow me on Twitter.

-

The Power of Momentum

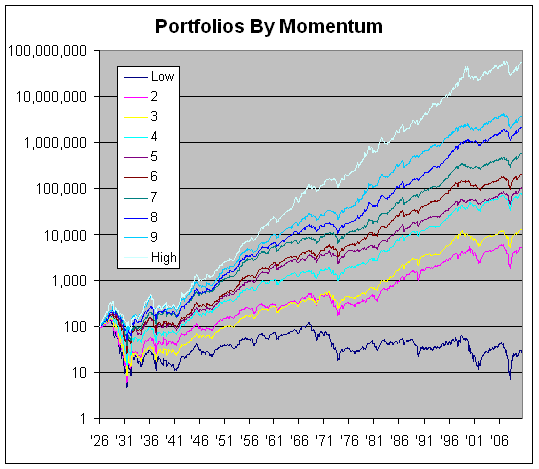

Posted by Eddy Elfenbein on September 13th, 2011 at 7:49 amIn a post yesterday, I criticized some sloppy analysis which tried to make overly broad statements based on long-term stock data. Here’s a good example of how long-term data ought to be used. The chart below shows the historical performance of stocks ranked by momentum decile (meaning 10% slices).

I took the numbers from Ken French’s data library. The reason why this is a more sound method is that we’re using long-term data to isolate one particular aspect of stock performance.

It turns out that stocks that are in motion have a very long record of continuing to stay in motion. Just to be clear, momentum is defined by performance over the 11-month period starting 12 months ago and ending one month ago. The month directly prior to each period is excluded. At the end of the month, the whole thing is repeated.

The deciles are perfectly ranked by momentum. The portfolio with the highest momentum did the best. The second-best came in second and so on, all the way down to the worst momentum which came in last.

Decile Gain Low -1.58% 2 4.73% 3 5.85% 4 8.09% 5 8.46% 6 9.38% 7 10.68% 8 12.35% 9 13.11% High 16.72% Morning News: September 13, 2011

Posted by Eddy Elfenbein on September 13th, 2011 at 5:00 amMore Job Cuts Loom for European Banks With Fixed Pay

Wary Investors Start to Shun European Banks

I.M.F. Chief’s Change of Tune on Bank Capital

Italian Bonds Decline Before Debt Auction; German Bunds Fall

Gold Rebounds 1% on Persistent Euro Zone Worries

Nikkei Rises From 2 1/2-Year Low as Trichet Eases Europe Worry

Treasury Yield 8 Basis Points From Record Low on Debt Concerns

HP Extends $11.2 Billion Autonomy Offer

Microsoft May Disappoint With 19% Payout Boost

Detroit Sets Its Future on a Foundation of Two-Tier Wages

Broadcom’s Chip Valuation Signals 39% Gain for Cavium

Obama Team Backed $535 Million Solyndra Aid as Auditor Warned on Finances

Outsiders’ Ideas Help Bank of America Trim Jobs and Costs

More College Grads Defaulting on Student Loans

Todd Sullivan: Lehman and Used Car Sales

Howard Lindzon: Momentum Monday (09/12/11)…Why Visibility is Dead and Why Apple and Amazon Love It!

Be sure to follow me on Twitter.

Goldman Breaks Below $100

Posted by Eddy Elfenbein on September 12th, 2011 at 2:54 pmShares of Goldman Sachs ($GS) dropped below $100 very briefly today. This is an enormous drop off from the start of the year when the stock was at $168. Bear in mind that Goldman earned over $22 per share in 2009.

From the Department of Silly Analysis

Posted by Eddy Elfenbein on September 12th, 2011 at 12:59 pmE.S. Browning’s “Abreast of the Market” column today features a very bullish forecast made by Professor Richard Sylla of NYU.

Using 10-year averages of annual market returns, including dividends and adjusted for inflation, Prof. Sylla and his colleagues found that U.S. stocks have risen and fallen in surprisingly consistent waves for more than 200 years. The pattern has become even steadier since World War II.

I think this sort of analysis is highly superficial yet (and?) it seems to be very popular. First, looking at very long-term market performance is interesting from a historical perspective but much of this data is far from rigorous. The stock market was a minor speck of the American economy in 1790. Equity markets in a modern sense didn’t develop until the 1920s. Plus, the markets were not very efficient through the 1960s. I like to look at long-term data as well, but it’s a mistake to draw precise conclusions from it.

If the market sticks to its long-term pattern, Prof. Sylla says, the Dow Jones Industrial Average could climb to 20250 by the end of 2020, up 84% from today. The Standard & Poor’s 500-stock index might hit 2300, up 99% from Friday’s close of 1154.23.

It’s one thing to say that stocks are below their long-term average. I’m fine with that and it’s something you can easily show. But as with many in the art of pseudo-forecast, Professor Sylla is hedging his call beyond reason.

Now a recovery with 6.5% average annual returns, equal to the historical inflation-adjusted average, would fit, he says. He isn’t saying stocks will rise that much each year, just that this could be the average.

Prof. Sylla does see a 25% chance that the next decade could fall well short of that.

Sorry–this is where you lose me. A 25% chance isn’t exactly small. Making any forecast and giving yourself a one-in-four chance of being WAY off the mark makes the other 75% totally worthless.

Greece Gets Ready to Default

Posted by Eddy Elfenbein on September 12th, 2011 at 12:20 pmThe stock market is down yet again today. The S&P 500 got as low as 1,141.53 today so it’s still above the August 8th closing low of 1,119.46. One interesting aspect of today’s sell-off is that gold is also down today.

The financial markets are beginning to adjust to the reality that Greece is going to default. Forbes writes: “Last week five-year Greek credit-default swaps indicated a 92% chance that the country would miss its debt payments.” This is having major spillover effects. The euro has been clobbered against the dollar and many other currencies. Now it looks like French banks are in serious trouble as Moody’s is considering downgrading them.

The National Association for Business Economics today cuts its forecast for U.S. GDP growth. They see the economy growing by 1.7% this year and 2.3% next year. That’s down from their earlier estimates of 2.8% for this year and 3.2% for 2012.

The Financial Sector ETF ($XLF) bounced off $12 per share. If it breaks below $12, I think it will be an outstanding buy. I also see that Nicholas Financial ($NICK) dropped below $10 per share which is less than its book value of $10.18.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His