CWS Market Review – February 1, 2013

“There are two times in a man’s life when he shouldn’t speculate:

when he can afford to and when he can’t.” – Mark Twain

Remember the panic about the Fiscal Cliff? And the Debt Ceiling? And the Sequester? And about a dozen other things the financial media told us—insisted—that we simply had to worry about?

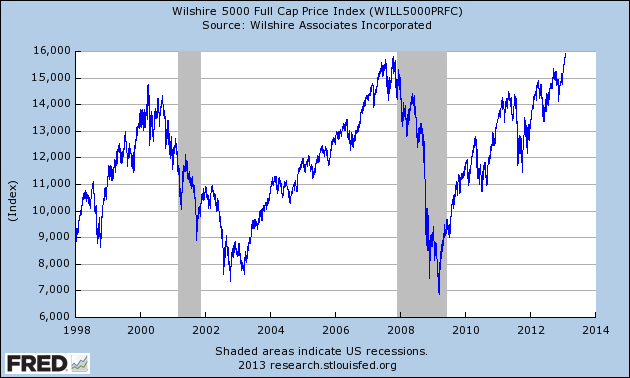

Well, here we are a few weeks later. The Dow Jones Industrial Average just closed out its best January in 19 years. The Wilshire 5000, the broadest measure of the U.S. stock market, is just below its all-time high.

Fortunately, we stuck by our strategy and ignored the noise-making scaremongers on TV. What’s perhaps more impressive is how low the market’s volatility has been. Consider this: On Wednesday, the S&P 500 had a rather minor loss of just 0.39%, and that was its worst loss of the year! Between January 9th and January 25th, the S&P 500 rallied 12 times in 13 sessions, and the only downer was a miniscule 0.09% drop.

But I have to be frank. The rally is beginning to look a little tired. For example, the S&P 500 tried to break 1,510 a few times this week and wasn’t able to bust through. That’s not a good sign. I think it’s very possible the bears may take back control of Wall Street in February. Nothing too serious, mind you, but just enough to scare the bulls away.

This was a mixed week for our Buy List stocks. The earnings reports were quite good, but some of our stocks, like Ford Motor ($F) and Harris ($HRS), didn’t respond well. That’s frustrating, but as you know, we’re in this game for the long haul.

We also had a negative GDP report for Q4, and that spooked a lot of folks. As odd as it may sound, the negative report really wasn’t that bad. When you look past the plunging military spending, the economy is better than it looks, and we’re poised for decent growth in 2013. The other big news this past week was the Fed meeting. We learned that Bernanke & Co. are firmly committed to keeping the money spigots going for a while longer. Some folks misread the December minutes, believing that the Fed was going to pull back soon. Sorry, not a chance.

Now let’s take a look at some of our recent Buy List earnings reports.

Ford Is a Buy up to $15 per Share

In last week’s CWS Market Review, I told you to expect a big earnings beat from Ford Motor ($F). Technically, I was correct. The company earned 31 cents per share, which was 24% higher than the 25 cents per share that Wall Street was expecting.

Despite the earnings beat, Ford warned that its losses in Europe this year would be worse than it had anticipated. Traders overreacted (of course, or they wouldn’t be traders) and brought the stock back below $13 per share. Let me be clear that Ford’s business is doing very well, especially in North America. Their pre-tax earnings in North America soared 110% from Q4 of 2011.

The New York Times described Q4 as a “microcosm of Ford’s recent overall performance.” In other words, strong America, weak Europe. But Ford’s strength in North America didn’t come about quickly. It was part of a painful restructuring process that’s only now paying dividends (literally, as Ford doubled its payout three weeks ago). Ford is employing that same turnaround strategy in Europe today, and the good news is that they’re far ahead of General Motors.

Don’t worry about the pullback in Ford. If you don’t already own it, the stock is a very good deal, especially if you can get it below $13. Thanks to the higher dividend, Ford currently yields 3.1%. I rate Ford a solid buy up to $15 per share.

Lower Guidance from Moog and Harris

On Tuesday, Harris ($HRS), the communications equipment company, reported earnings of $1.25 per share for the December quarter, which is the company’s fiscal Q2. This was five cents ahead of Wall Street’s consensus. Quarterly revenue dropped from $1.31 billion to $1.29 billion.

While Harris’s results were good, the news that has me concerned is that the company lowered its full-year guidance. I find that I often tell investors not to worry about this, or don’t worry about that. But lower guidance is indeed something to worry about. (By the way, I’m very glad we ditched JoS. A Bank from this year’s Buy List. The stock got pounded for a 15% loss on Monday after it gave an ugly earnings warning.)

Previously, Harris saw full-year earnings ranging between $5.10 and $5.30 per share. The company lowered that range by 10 cents per share at both ends. Harris now sees earnings ranging between $5.00 and $5.20 per share. So really, the guidance isn’t that much lower. We have to put this in context of a stock that closed the day on Thursday at $46.20, which is about nine times earnings.

Harris now sees 2013 revenue dropping by 2% to 4%. The previous range was flat to negative 2%. The company blamed the lower guidance on “slower government spending resulting from growing budget uncertainty.” It’s still early in the year, so I’m not giving up on Harris, but I want to see some improvement later this year. Harris remains a good buy up to $53.

Moog ($MOG-A) also joined the lower-guidance club, and like Harris, the news is disappointing but hardly dire. Last Friday, Moog lowered its full-year guidance from a range of $3.50 to $3.70 per share to $3.50 to $3.60 per share.

John Scannell, Moog’s CEO, noted that the company is off to a slow start this year, “The weakness in the major economies around the world is affecting our industrial business. On the other hand, the aircraft market is strong. We have moderated our forecast for the year slightly, but we are still projecting growth in both sales and earnings in 2013, despite the headwinds in our industrial markets.” Interestingly, Scannell’s comment reflects the same news about lower defense spending that we saw in the GDP report.

Moog’s quarterly revenues were up 3% to $621 million. Net earnings dropped 6% to $34 million. On a per-share basis, Moog made 75 cents last quarter. Since no one follows them, I can’t say if that beat or missed expectations. The stock still looks good for the long-term. Moog is a good buy up to $46 per share.

Profit Machine at Nicholas Financial Continues to Hum

On Wednesday, Nicholas Financial ($NICK), our favorite used-car loan company, reported quarterly earnings of 37 cents per share. But the results were distorted by taxes on their ginormous dividend late last year. Not including that, Nicholas earned 43.6 cents per share. Frankly, that’s a bit lower than I was expecting (around 45 cents per share), but not by much. I’m not a fan of NICK’s escalating operating costs, and I hope that doesn’t become a problem.

Our larger thesis for NICK still holds: that the company can rather easily churn out 45 cents per share every quarter. As long as rates are low and the economy is improving, NICK will do well. The math is pretty straightforward. Any company that’s pulling in, say, $1.80 per share per year should be going for at least $15, and possibly closer to $17. I think investors see NICK as a shaky subprime play. It’s not. In fact, NICK has gotten more conservative over the past few years. Like Ford, NICK pulled back below $13. Again, don’t be alarmed. NICK is a solid buy up to $15.

One more late earnings report. After the close on Thursday, CR Bard ($BCR), the medical technology firm, reported earnings of $1.70 per share, which beat consensus by three cents per share. Bard made $6.57 per share for all of 2012, which is up from $6.40 per share in 2011. I like that kind of growth. The downside is that Bard warned that 2013 will be rough, but they see extra-strong growth coming in 2014 and beyond. For now, I’m lowering my Buy Price on Bard to $102.

More Buy List Earnings Next Week

We’re now heading into the back end of earnings season, and the results have been good so far. The latest numbers show that of 237 companies in the S&P 500 that have reported, 74% have beaten earnings expectations, and 66% have beaten sales expectations.

Next week, we have four more Buy List earnings reports due: AFLAC ($AFL), Cognizant Technology Solutions ($CTSH), Fiserv ($FISV) and WEX Inc. ($WXS). I’m curious to hear what AFLAC has to say. Three months ago, they told us that Q4 earnings will range between $1.46 and $1.51 per share. That means full-year 2012 earnings between $6.58 and $6.63 per share. The problem is that AFLAC’s bottom line has probably been squeezed by the low yen. The question how is, how much? AFLAC has said to expect 2013 earnings to rise by 4% to 7%, but that’s on a currency-neutral basis. I like AFL up to $57.

Cognizant publicly said they expect earnings of 91 cents per share, and their forecast is usually very close. For this year, I think they can make $4 per share. I’m looking to see what kind of guidance they provide for 2013. CTSH remains a good buy up to $83.

Two weeks ago, Fiserv guided lower for Q4 but higher for all of 2013. I think this stock has some room to run. Fiserv is a good buy up to $88. Before I go, I wanted to highlight Microsoft ($MSFT). The shares are an especially good buy if you can get them below $28.

That’s all for now. Stay tuned for more earnings reports next week. We’ll also get important reports on factory orders and productivity. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Our old friend Russell Wasendorf, Sr. was just sentenced to 50 years in prison for massive fraud. Here’s our post from this summer on ol’ Russ, and tips for how you can spot financial fraud.

Posted by Eddy Elfenbein on February 1st, 2013 at 7:20 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His