Archive for January, 2014

-

CWS Market Review – January 17, 2014

Eddy Elfenbein, January 17th, 2014 at 7:12 am“It is not the crook in modern business that we fear, but the honest

man who doesn’t know what he is doing.” – Owen D. YoungEarnings season is finally here. We’ve already had one good earnings report from Wells Fargo ($WFC). The big bank beat earnings by two cents per share, and after a delayed reaction, the shares broke out to a new 52-week high. This week, I’m raising my buy below on WFC (more on that in a bit).

Things are about to get very busy for our Buy List. Next week, we’re due to have six earnings reports including heavyweights like IBM, McDonald’s and Microsoft. In this week’s CWS Market Review, I’ll preview our upcoming earnings, and I’ll break down the results from Wells Fargo.

Looking at this earnings season, the consensus on Wall Street is that earnings rose 4.9% last quarter. That’s kind of blah, but going into this earnings season, there were some serious concerns. Before earnings season even started, there were 95 earnings warnings in the S&P 500, compared with just 15 good-news surprises. But most of those warnings have been about rather minor adjustments. Actually, the market seems unusually sedate. A few times this week, the Volatility Index ($VIX) dropped below 12, which brought the “Fear Index” to some of its lowest levels in the past seven years. Fortunately, the stock market continues to hold up well, and the S&P 500 reached an all-time high close on Wednesday. We edged out the previous high close of December 31 by 0.00108%.

The economic news continues to be mostly positive, with a few bumps. This week, the Federal Reserve released its Beige Book report, which looks at regional economies across the country. The reports were mostly good, and I think we can expect more tapering when the Fed meets again at the end of this month. Janet Yellen officially becomes the new Fed Chairman on February 1.

This past Tuesday, the Census Bureau released the December retail-sales report, which showed an increase of 0.2%. December is obviously a huge month for retail. While the report wasn’t outstanding, economists were expecting a gain of 0.1%. Also, the big increase for November was revised downward from 0.7% growth to 0.4%.

These are important numbers because consumers drive most of the economy. Also, retail stocks have been hit hard this year. I still like our Buy List retailers, Ross Stores ($ROST) and Bed Bath & Beyond ($BBBY). However, their most recent quarterly reports included sales through November, and not the holiday season. Once the dust settles in the retail sector, I expect our stocks to flourish.

Of course, it’s still very early, but our Buy List is already slightly ahead of the S&P 500 this year. We’ve done that despite a horrible start for Bed Bath & Beyond, which is now down over 16% for the year. Ouch! The lesson here is that diversification works. I should also note that you’ll often see the worst stock in your portfolio dropping more than the gain from your best stock. Stock performance tends to be asymmetrical. In plain English, the bad ones are worse than the best are good. That’s a key insight, and ultimately, it’s what makes value investing so effective. Now let’s look at Wells Fargo.

Wells Fargo Is a Buy up to $50 per Share

On Tuesday, Wells Fargo ($WFC) reported fourth-quarter earnings of $1 per share. That beat Wall Street’s consensus by two cents per share. Strangely, the shares initially dropped after the earnings report (yep, we know how melodramatic traders can be). Then on Wednesday, it was as if rationality and math suddenly dawned on everyone, and the nervous traders got squeezed out. Before the closing bell, WFC had rallied to a new 52-week high.

Lesson: Don’t trust the market’s first reaction. Actually, keep a wary eye on the second and third ones as well.

Now that I’ve had a chance to look at the earnings from Wells, I can say that I’m impressed. Net income for Q4 rose 10% over last year’s Q4. For the entire year, Wells’s net income rose 16% to $21.9 billion. This was their fifth-straight record year. Last year, Wells made more money than JPMorgan Chase (sorry, Jamie).

I was particularly impressed with the efforts of CEO John Stumpf and his team to trim overhead. (Notice how good companies don’t wait to cut costs; they’re always looking for excess fat they can cut.) Quarterly revenue dropped 6% to $20.7 billion. For banks, you want to see where their “efficiency ratio” is. That’s a good measure of how well they’re managing their operations. For Wells, their efficiency ratio actually ticked up a bit last quarter. That’s not bad, coming in the wake of lower revenue.

Wells’s mortgage-originations business got shellacked last quarter, but there wasn’t much they could do about that. In that sector, you’re at the mercy of the Mortgage Rate Gods. On the plus side, Wells’s wealth and brokerage business did very well. One big benefit for Wells is that they don’t have the legal bills that many of the other big banks have.

I like Wells Fargo a lot. The bank is going for less than 11 times this year’s earnings estimate. I expect another dividend increase this spring. This week, I’m raising my Buy Below on WFC to $50 per share.

Next Week’s Buy List Earnings Reports

Next Tuesday, two of our big tech stocks, IBM and CA Technologies, report earnings. I want to warn you ahead of time that IBM ($IBM) may fall below expectations. The Street expects $5.99 per share, which could be just a bit too high. I’ll tell you ahead of time not to worry about a slight earnings miss. New additions to our Buy List are often dented merchandise, and Wall Street bears have been out to get IBM. They may not be done just yet. Either way, IBM is a solid value at this price. My take: IBM is a good buy anytime you see it below $195 per share.

Three months ago, CA Technologies ($CA), the shy kid, blew the doors off its earnings report. CA netted 86 cents per share for Q3, which was 13 cents more than estimates. Wall Street expects 71 cents for Q4, which is probably a wee bit too low. There’s also a chance that CA might sweeten its quarterly dividend. CA Technologies remains a solid buy up to $35 per share. I have much love for CA.

Wednesday: Earnings from Stryker and eBay

On Wednesday, we get earnings reports from Stryker and eBay. If you recall, Stryker ($SYK) raised its dividend by 15% last month. The company missed earnings by two cents in its last report. That was mostly due to currency effects, and I said not to worry about SYK. Indeed, the stock just hit another 52-week high. This time around, Wall Street expects $1.22 per share in earnings, but I’m more interested in what they’ll have to say about 2014. Wall Street currently expects full-year earnings of $4.56 per share for 2014. Stryker remains a very good buy up to $79 per share.

eBay ($EBAY)’s earnings tend to be very consistent. So far this year, their earnings are up 14%. If we apply a 14% increase over the Q4 earnings from 2012 (70 cents per share), that gives us 80 cents per share, which is, not surprisingly, exactly what Wall Street expects. eBay is a very good buy up to $58 per share.

Thursday: Earnings from McDonald’s and Microsoft

On Thursday, we get two more blue-chip earnings reports: McDonald’s and Microsoft.

Three months ago, Microsoft ($MSFT) surprised a lot of folks on Wall Street with an outstanding earnings report. The software giant earned 62 cents per share, which was eight cents more than estimates. Sales rose 16% to $18.5 billion. Microsoft generated sales that were $700 million more than expectations. I think people forget that MSFT is a very profitable company, especially with its business clientele. For the December quarter, the expectation is for MSFT to earn 68 cents per share, which is down from 76 cents the year before. That sounds about right. We should remember that in September, MSFT raised its dividend by 22%. Microsoft is very attractive below $40 per share.

Like IBM, McDonald’s ($MCD) has been rather sluggish lately. This one may take some time before we see solid results. The consensus on the Street is for earnings of $1.39, which is only one penny more than last year’s Q4. The burger giant is coming off a lackluster year, but you should never count Ronald and his friends out. McDonald’s is a good buy up to $102 per share.

That’s all for now. The stock market will be closed on Monday in honor of Dr. Martin Luther King’s 85th Birthday. Next week will be all about earnings. In fact, there’s not much in the way of economic reports. An important note: With these earnings reports, we want to pay attention to forward guidance as much as to the actual results. I think a lot of traders are nervous about this year, especially with the Fed’s tapering plans, so any optimism from companies will go a long way. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: January 17, 2014

Eddy Elfenbein, January 17th, 2014 at 6:30 amU.K. Retail Sales Exceed Forecasts With 2.6% Christmas Surge

RBS to Face Review of Business Lending by External Consultants

Advocates for Workers Raise the Ire of Business

Bernanke Likens 2008 Financial Crisis to Car Crash

Numerous Retailers Said Hit by Data Hacking Attacks

Best Buy Reports Disappointing Holidays; Stock Dives

Shell Warns of “Significant” Profit Miss

AmEx Posts Higher 4Q Profit, Revenue

Taiwanese PC maker Acer Q4 Loss Worse than Expected at $245 Million

IBM Commits $1.2 Billion to Cloud Stack

Goldman Sachs Shares Decline as Trading Revenue Drops

Why People Love Working at Goldman Sachs—It’s Not Just the Money

Nu Skin’s Big Strategic Mistake

Joshua Brown: Tonight’s Must-Read: Howard Marks’ Memo on Luck

Cullen Roche: The Most Interesting Aspect of Bitcoin as Money…

Be sure to follow me on Twitter.

-

Spotting a Turnaround

Eddy Elfenbein, January 16th, 2014 at 2:25 pmWhen you’re a value investor, you often look at stocks that are far off their highs. The problem is that a stock that’s down only means it’s down from where it was, and not necessarily where it ought to be.

The thing with business is that turnarounds are very, very hard. Yes, they happen, but it ain’t easy. Business isn’t like sports where a team that’s leading will play very conservatively, and a trailing team has a shot of getting back in it. In business, success often breeds success (though it can breed complacency as well). Imagine a basketball game where the team that makes a basket gets to take the ball out again. That’s the business world.

J.C. Penney ($JCP) has gotten crushed lately and the company is in a world of hurt. So does that means it’s a value? Possibly, but I’m staying away. Target ($TGT), on the other hand, is down as well, but I like Target a lot more (though I’m not willing to call it a buy just yet).

Here’s the important lesson: There are some key differences between a stock that’s down (like JCP), and a stock that’s down and could be a good buy (like TGT). For me, the first sign is looking at the dividend. JCP doesn’t pay one but TGT does. That’s a major distinction. The second is cash flow. JCP is hemorrhaging money. They’ve been losing money, are losing money and will most likely continue to lose money for some time.

Target, meanwhile, is in rough shape but it’s making money — more dollars are coming in than are going out. Their earnings this fiscal year will be down from a year ago. What happens next year, however, is a question mark. If the company resumes its growth rate, it’s very likely that Target is a very good buy here.

So remember that just because a stock is down doesn’t mean it’s a good buy. You need to look for key anchors like cash flow and dividends to tell you if the decline is (probably) transitory.

-

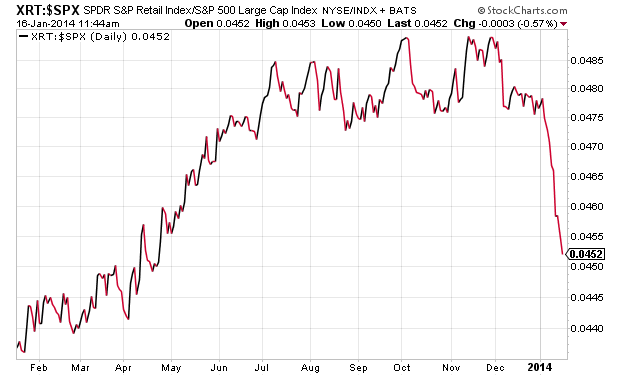

Tough Times in Retail

Eddy Elfenbein, January 16th, 2014 at 11:49 amIt’s not just Bed Bath & Beyond. The entire retail sector has been hurting (Target, JC Penney, Best Buy, etc). The Retail ETF ($XRT) has trailed the market for eight of the last nine days. Check out the XRT’s relative strength.

Many of the big retailers have quarters that end in January so it will be interesting to see how they report in February.

-

Morning News: January 16, 2014

Eddy Elfenbein, January 16th, 2014 at 6:26 amGlobal Economic Growth Is Expected To Speed Up This Year

Euro-Zone Inflation Rate Weakens in December

Job Slump Sends Aussie Lower as Rate-Cut Bets Revived

Senators Question Fed’s Review of U.S. Banks’ Commodities Units

Obama Names L.A.’s Maria Contreras-Sweet to Head SBA

Skeptics Question Banks’ Bottom Lines

Wall Street Sees Bitcoin’s Legacy as Payment System

Amazon Employees Reject Forming Company’s First Union in U.S.

TSMC Net Profit Beats Expectations

Yahoo’s No. 2 Is Out After Clash With CEO Mayer

AOL Gives Up Control of Money-Losing Local News Division Patch

Richemont Reports Sales-Growth Slowdown as China Performance Weakens

J.C. Penney to Cut 2,000 Jobs While Closing 33 Stores

Jeff Miller: Boost Your Dividend Yield

Roger Nusbaum: Gold Fight, Who Wins, Who Loses, What’s Really Important About Gold

Be sure to follow me on Twitter.

-

The Delayed Reaction to Wells

Eddy Elfenbein, January 15th, 2014 at 5:31 pmI wanted to make a brief comment on the recent price action of Wells Fargo ($WFC), and this is typical of how Wall Street behaves. The bank topped expectations by two cents per share yet the stock dropped yesterday morning after earnings.

But after a day passed, the market suddenly changed its made and decided that the earnings were good. WFC rallied today and hit a fresh 52-week high.

Let me be clear: There was no important info that came out between the earnings report and today. Nothing. The market simply reacted first with fear, and then became more rational.

-

Investing Is a Bottom-Up Activity

Eddy Elfenbein, January 15th, 2014 at 7:56 amThe longer I’ve worked as an investor, the more I’ve come to realize that successful investing is a bottom-up process. By bottom-up, I mean it starts with the very basics of a company (its products and markets) and gradually works upwards from there (i.e., balance sheet, cash flow, valuation ratios).

The problem is that most people are strongly averse to this approach. I don’t know exactly why, but there’s a natural propensity to view the investing world top-down. This clouds nearly every investment discussion. Heck, I’m guilty of it myself.

Here’s how it works. An investment discussion (particularly in the media) invariably starts with the Federal Reserve and the macro economy. Then it works its way down to partisan politics: the budget, taxes and the debt. Throw in a discussion of EMH and how bad hedge funds are (curiously, we’re never told the flip side of EMH—that it’s impossible to lose to the market consistently before fees), and maybe touch on CAPE. Then if we’re lucky, one or two comments about Apple. And we’re done.

This is a huge disservice to readers, and almost none of it matters to being a good investor. The skill set one needs to be a shrewd stock picker doesn’t involve complex math or defending your political party. Rather, it’s closer to that possessed by an investigative reporter or a private eye. Don’t laugh. Whenever I’m in a department store, I’ve gotten in the habit of asking the kid behind the counter, “What’s popular?” He’ll tell you. In fact, he’ll tell you a lot. Just by doing this, you can learn a lot more than what a stock screener will tell you.

Look, I love financial ratios as much as anyone, but the information they give you is very limited. I’ve long called the Balance Sheet the overlooked cute sister of the 10-Q report, but even that only says so much. Here’s an important generality in corporate finance: a good company isn’t usually transformed into a bad one by taking on too much debt. Sure, it’s possible, and certainly it has happened before. But what really happens is that companies take on too much debt precisely because they’re bad. They have a growing need to mask their deficiencies.

A few years ago, I stumbled across Nicholas Financial (NICK). I’ve probably written about this stock more than any other. NICK isn’t followed by any analyst. It rarely generates news. I visited a branch office and later called up the CFO. He patiently answered my many questions. With a little bit of work, I probably knew more about them than anyone outside HQ.

I remember when NICK dropped below $1.64 per share five years ago. It’s really hard to believe in efficient markets when your stock is trading at one-fifth book value and roughly one times earnings for the year after next. The market was offering me dollars for dimes, and I bought them. (NICK just agreed to be bought out at $16 per share.) Inflation, Obamacare, the euro—none of that mattered. To be fair, the Fed’s low rates played a role in helping NICK, but connecting that policy to being a NICK bull would be a stretch.

I also have a growing distrust and outright aversion to the tiresome bull-bear debate (Barry Ritholtz has led the charge on this for years). It’s a fun parlor game, but again, how does it help investors? Not much.

Another favorite game of the top-down view is to find a sector that ought to be big in the future. I know! Green Energy! Robotics! Biotech! China! Chinese robots producing green energy biotech!!

A basic fact about business is that money can be made just about anywhere. Your objective shouldn’t be finding the next so-and-so. You should try to find superior ROE. No top-down approach would lead anyone to Danaher (DHR), but it’s been one of the best-performing stocks of the last few decades. Their stable of businesses is pretty ordinary. That’s what they do, and they do it well.

My advice to investors is to grant yourself a healthy distance from those who view investing from 30,000 feet. It’s easy to wave your hand and say everything’s overpriced and the Dow could go to 1,000. Instead, if you’re interested in a company, start at the ground level and found out why it’s successful.

-

Morning News: January 15, 2014

Eddy Elfenbein, January 15th, 2014 at 6:30 amWorld Bank Is Expecting Widespread (if Still Possibly Turbulent) Growth for 2014

EU Lawmakers Seal Deal on Financial Market Rules Overhaul

German Economy Grows at Modest Pace

China Bank Lending Slows as PBOC Walks Policy Tightrope

Why Trying to Hurt China in the Trade Game Could Backfire

Japan Approves Tepco Turnaround Plan

Tullow Finds More Kenyan Oil Boosting East Africa Export Plans

Senate Hearing Set to Press for Quicker Commodity Bank Curbs

What Stanley Fischer Did at the IMF

China’s Huawei Profit Jumps on Smartphones, U.S. Asks Hua-Who?

Charter Woos Time Warner Cable Holders

Bernard Madoff Haunts JPMorgan’s Earnings

General Motors to Resume Paying Dividend After 6 Years

Edward Harrison: Privacy and the Ubiquity of Embedded Technology

Epicurean Dealmaker: A Fine Disregard for the Rules

Be sure to follow me on Twitter.

-

Babcock & Wilcox

Eddy Elfenbein, January 14th, 2014 at 11:33 amOne of these days, I should start a Boring Portfolio of good stocks that are as dull as dirt. Sometimes I really wonder if people understand that the stock market is more than Google, Apple, Facebook and Twitter.

The truth is there are lots of great companies out there, and many of them barely make a peep. Some of them like Moog ($MOG-A) make it on to the Buy List. Harris ($HRS), a former member, is another good example. If you’ve read me for a while, you may recognize other boring standouts like ACE Limited ($ACE) or Raven Industries ($RAVN). International Flavors & Fragrances ($IFF) is another good example.

Here’s another boring stock to put on your radar, Babcock & Wilcox ($BWC). BWC has a noble history going back nearly 150 years. They developed boilers that were used on early steamships and Teddy Roosevelt’s Great White Fleet. They also helped develop the first nuclear-powered subs.

BWC was eventually forced into bankruptcy as a result of asbestos litigation. The company eventually merged from bankruptcy and was spun-off by McDermott International. BWC started trading on the NYSE three years ago.

Here’s the company’s profile via Yahoo Finance:

The Babcock & Wilcox Company operates as a specialty constructor of nuclear components for various customers in the power and other steam-using industries worldwide. Its Power Generation segment designs, engineers, manufactures, supplies, constructs, and services utility and industrial power generation systems, including boilers used to generate steam in electric power plants, pulp and paper making, chemical and process applications, and other industrial uses. This segment also offers technologies to control nitrogen oxides, sulfur dioxide, fine particulate mercury, acid gasses, and hazardous air emissions; and construction services to steam generation or environmental equipment projects, and cogeneration and combined cycle installations, as well as provides environmental equipment and components, and related services. The companys Nuclear Operations segment manufactures naval nuclear reactors for the U.S. Department of Energy/National Nuclear Security Administration’s Naval Nuclear Propulsion Program, which in turn supplies them to the U.S. Navy for use in submarines and aircraft carriers. Its Technical Services segment offers services to the U.S. Government comprising uranium processing, environmental site restoration services, and management and operating services for various U.S. Government-owned facilities. The companys Nuclear Energy segment fabricates pressure vessels, reactors, steam generators, heat exchangers, and other auxiliary equipment. This segment also offers engineering services, such as structural component design, 3-D thermal-hydraulic engineering analysis, weld and robotic process development, and metallurgy and materials engineering. In addition, it provides power plant construction, management, and maintenance services; and services for nuclear steam generators and balance of plant equipment, as well as nondestructive examination and tooling/repair solutions. The company was founded in 1867 and is headquartered in Charlotte, North Carolina.

The company also has zero long-term debt and trades at 14 times next year’s earnings.

-

Wells Fargo Earns $1 Per Share

Eddy Elfenbein, January 14th, 2014 at 9:45 amFourth-quarter earnings are out for Wells Fargo ($WFC). The big bank earned $1 per share which beat estimates by two cents per share. For Q4 of 2012, Wells earned 91 cents per share. For the quarter, net income was up 10% and for the year, it was up 16% to $21.9 billion.

Chief Executive Officer John Stumpf, 60, is trimming staff and expenses as rising interest rates curtail demand for home refinancings. Wells Fargo had vowed to reduce overhead after expenses surged above its target in the previous three months.

(…)

Revenue slid 6 percent in the quarter to $20.7 billion from a year earlier and 3 percent for the full year to $83.8 billion, while profit before taxes and provisions fell 5 percent. Non-interest expense dropped 6 percent and the efficiency ratio, which measures costs as a percentage of revenue, improved to 58.5 percent from 59.1 percent in the third quarter and 58.8 percent a year earlier.

Segment Results

Profit rose in all three operating segments, with the greatest percentage gains coming in wealth, brokerage and retirement, the unit run by David Carroll. Mortgage originations fell to $50 billion, a 38 percent decline from the third quarter, and mortgage-banking income fell by almost half from year-earlier levels to $1.57 billion.

Net interest margin, the difference between what the bank makes on lending and pays for funds, fell to 3.26 percent from 3.38 percent in the third quarter.

The annual profit represents the fifth straight record year for the lender, which doubled its size with the 2008 purchase of Wachovia Corp. It was the first year since 2009 that profit surpassed New York-based JPMorgan Chase & Co., the biggest U.S. lender by assets, which earned $17.9 billion for all of 2013 — a 16 percent drop.

Wells Fargo, which ranks fourth by assets, gained 33 percent in New York trading last year, trailing the 35 percent return for the 24-company KBW Bank Index. The stock closed at $45.56 yesterday and declined to $45.43 at 8:19 a.m. in New York.

(…)

Wells Fargo, responsible for about 1 in 5 U.S. mortgages last year, has profited from Federal Reserve policies that lowered mortgage rates and sparked a refinancing wave. As rates have risen, applications have slowed and cut into originations. Rates on 30-year mortgages averaged 4.51 percent last week, up from 3.35 percent in early May, according to Freddie Mac.

Stumpf announced 5,300 job cuts in the third quarter, and another 925 in October. The impact began to take effect in the fourth quarter, according to a Nov. 7 presentation and may reduce costs by as much as $750 million annually, Deutsche Bank AG analysts wrote in a Jan. 3 report.

The bank is also facing fewer costs tied to litigation and legal expenses than its peers. Through the first nine months of 2013, those expenses fell 1.2 percent to $413 million, according to regulatory filings.

Legal settlements and other costs related to mortgage lending and sales should continue to decline, Stumpf said during a Dec. 10 investor conference. The bank began an internal ethics review this month that could last as long as two years, with plans to examine standards for how employees should act and procedures for handling conflicts of interest across more than 80 business lines.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His