Archive for November, 2015

-

Classic Quadrant II Day

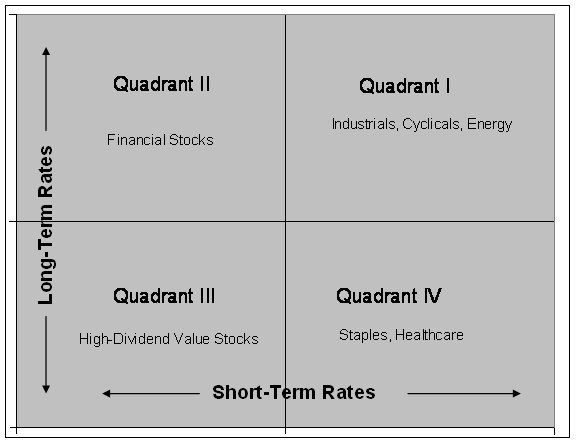

Eddy Elfenbein, November 6th, 2015 at 1:11 pmEarlier this year, I laid out my “Elfenbein Theory to Explain the Entire Stock Market.” It basically describes how interest rates influence the stock market.

Here’s the key matrix:

I would say that today is a classic Quadrant II day. Bank stocks are doing well, but defensive stocks are in the rear. Short-terms are up not down, but my theory is based on their relative impact.

Again, I’ll stress to not take this as a perfect map of what the market does, but it’s a good way of seeing general market relationships.

-

Q3 2015 Earnings Calendar

Eddy Elfenbein, November 6th, 2015 at 11:42 amSeventeen of our 21 Buy List stocks report Q3 earnings in the current reporting season. Here’s a list of reporting dates, Wall Street’s consensus estimates and actual reported results.

Stock Symbol Date Estimate Result Wells Fargo WFC 14-Oct $1.04 $1.05 Signature Bank SBNY 20-Oct $1.82 $1.88 eBay EBAY 21-Oct $0.40 $0.43 CR Bard BCR 22-Oct $2.23 $2.28 Microsoft MSFT 22-Oct $0.59 $0.67 Snap-on SNA 22-Oct $1.94 $1.98 Stryker SYK 22-Oct $1.23 $1.25 Wabtec WAB 22-Oct $1.04 $1.02 AFLAC AFL 27-Oct $1.48 $1.56 Express Scripts ESRX 27-Oct $1.44 $1.45 Fiserv FISV 27-Oct $0.97 $1.03 Ford F 27-Oct $0.47 $0.45 PayPal PYPL 28-Oct $0.29 $0.31 Ball Corp. BLL 29-Oct $0.95 $1.10 Cognizant Technology CTSH 4-Nov $0.76 $0.76 Qualcomm QCOM 4-Nov $0.86 $0.91 Moog MOG-A 6-Nov $0.92 $0.75 What if the Value Premium is Gone?

Eddy Elfenbein, November 6th, 2015 at 11:17 amWhen I was on CNBC last week, I noted the long underperformance of value stocks. The value guys haven’t led the market in a few years. This is unusual because a large body of academic work has shown that value stocks have historically outperformed the market.

Professor Noah Smith wonders if the value premium no longer exists.

As financial markets improved, we may have seen the entrance of more investors who are willing to do the hard work of digging up obscure and boring companies, and who are willing to go against the herd. If the value premium really was a systematic underpricing rather than a true risk premium, then the gradual development of financial markets would be expected to shrink this premium over time.

There are signs that this is happening. Although value stocks did well in the early 2000s, they have dramatically underperformed since the crisis, even though the market has boomed. Of course, that might simply be a particularly long period of underperformance — we might expect to see value bounce back soon enough. But in fact, the decline has been going on for quite a bit longer than that — the value premium has been falling since the mid-1990s. Coincidentally, that is exactly when the Internet and computerized trading systems made it possible to invest in stocks much more cheaply, and to gather information much more easily.

That would mean that markets are getting more efficient — at least, in this one particular way. But it would also mean that market efficiency takes a very long time to establish itself. If big, systematic mispricings such as the value premium can survive for decades before they are finally traded away, it means that other flaws in the market might be equally long-lived. For example, the momentum factor — another mainstay of standard finance theory — might also be a market flaw that will eventually be shown the exits.

If the market is that inefficient, it also means that stock prices are, in some deep sense, “wrong” — that they are not the best available estimate of a company’s value. That would suggest we should be relying on markets less than we do for things like executive compensation. So watch to see if the value premium comes back. If it doesn’t, it means it might never have been about risk in the first place.

It’s an interesting thought. The only thing I would add is that value investing suggests that the market is both right and wrong. It’s inefficient in that values emerge and efficient in that it recognizes the error.

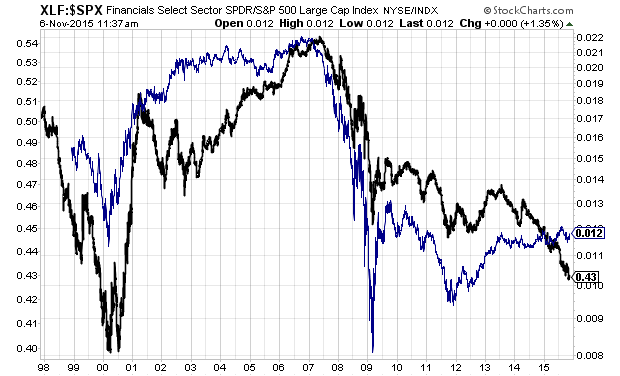

Make that two things. I’m curious how much financial stocks have weighed down value indexes. The sector hasn’t been too strong since, oh, about 2006.

Here’s a look at financial stocks divided by the S&P 500 (in blue) and value stocks divided by the S&P 500 (in black). (I apologize if it looks confusing.)

The point being that the performance of financials seems to be related to the performance of value. Note that that relationship has parted ways in the last two years. Nevertheless, the fallout from the financial crisis may be impacting the long-term performance of value stock indexes.

The Market’s Response

Eddy Elfenbein, November 6th, 2015 at 9:56 amThis is an interesting day as Wall Street digests the impact of today’s strong jobs reports.

The overall market is down a little bit, but there’s a lot going on under the covers. For example, bank stocks are doing very well today. On our Buy List, Signature Bank (SBNY) and Wells Fargo (WFC) are having very good days.

Utility stocks and some defensive areas like Staples and Healthcare aren’t doing so well. Qualcomm (QCOM) is recovering a bit after yesterday’s debacle.

The bond market is moving lower. The 10-year Treasury is up to 2.32%. On October 14, it had closed at 1.98%. Gold is down for the eighth day in a row. Dan Rosenblum informs me that gold is down 15 times in the last 17 sessions.

Check out the reaction in the six-month Treasury.

Very Strong Jobs Report for October

Eddy Elfenbein, November 6th, 2015 at 8:52 amThe October jobs report is out and it’s a good one. The U.S. economy created 271,000 net new jobs last month, and the unemployment rate fell to 5.0%. Wall Street had been expecting 183,000. That’s the lowest jobless number since April 2008.

The payroll number for August was revised higher by 17,000 while the number for September was revised lower by 5,000. That’s a combined increase of 12,000. The number for October was the strongest report this year. Average hourly earnings were up 0.36%.

This most likely means that the Fed is ready to raise interest rates at their December 15-16 meeting.

The markets are shifting to this news. The stock market looks to open lower. The two-year yield is up to 0.91% and the six-month yield is up to 0.35%. These are both multi-year highs.

The odds of a rate hike next month are now up to 73%. The odds for another hike in June have moved up from 53.4% to 64.2%.

CWS Market Review – November 6, 2015

Eddy Elfenbein, November 6th, 2015 at 7:08 am“If the incoming information supports that expectation, then…December would be a live possibility.”

So said Fed Chairwoman Janet Yellen on Wednesday. Central bankers are trained to speak in convoluted econo-babble, so that’s as strong a signal as you’re going to get. But make no mistake, it’s a big deal. This means the Fed is serious about raising interest rates next month.

What’s more important than what an economist says is what the bond market says, and the bond yields have snapped into action. Just this week, the six-month Treasury came within inches of cracking 0.3%. True, that ain’t much of a yield, but it’s the highest we’ve seen in six years. To put that in perspective, one month ago, the six-month was yielding just 0.06%.

But there’s a key difference in the Fed’s outlook this time. Wall Street is starting to realize that the Fed will probably do a one-and-done. In other words, the Fed may raise rates once shortly and then leave rates alone for several months. That’s a strategy the Fed hasn’t done in many years. I’ll break down what it means for investors.

We had two Buy List earnings reports this week. The good news is that both beat expectations. The bad news is that both got punished by the market. Fortunately, the damage at Cognizant Technology Solutions (CTSH) wasn’t too bad, but we can’t say the same for poor Qualcomm (QCOM). The shares got hammered on Thursday for a loss of more than 15%. To quote Charlie Brown, “Ugh!” My apologies to those who suffered from the loss. I’m very disappointed in this stock, and I’ll give you a complete summary below.

But first, let’s look at the latest goings-on for the economy and what a “one-and-done” strategy means for us.

The Fed May Raise Rates Once and Pause

On Wednesday, Janet Yellen testified before Congress about the state of the economy and about when would be an appropriate time to lift interest rates off the barroom floor, where they’ve been since 2008.

She said that the Fed’s December 15-16 meeting is a “live possibility,” but was quick to temper that with the usual caveat that the Fed will monitor incoming data. Bill Dudley, the top dog at the New York Fed, agreed with Yellen: “It is a live possibility, but let’s see what the data show.”

This outlook comports with the Fed’s most recent policy statement. As I discussed last week, the key factor for a December rate hike will be the labor market. While it’s true that unemployment has fallen, the number of people in the jobs market is frustratingly low, and wage gains have been modest.

The market is starting to adjust. According to futures prices, Wall Street now thinks there’s a 58% chance that rates will rise next month. But what’s interesting is that the traders think rates won’t go up again until next June, and even there, the odds are only 50-50.

When Alan Greenspan raised interest rates in 2004 thru 2006, he did so 17 times over 17 consecutive meetings, each time by 0.25%. This experience has led investors to believe that once a rate hike cycle has begun, it will stay that way; but that’s not the case.

So the Fed may be setting itself up for a one-and-wait more than a one-and-done. The fact is that the jobs market and inflation aren’t quite strong enough to generate a round of rate hikes, but I doubt a single increase would do much harm. On Wednesday, Yellen said that the economy is “pretty strong and growing at a solid pace.”

With somewhat higher rates and an improved economy, this ought to boost the overall stock market. The earnings outlook is expected to improve this quarter, and we should see steady profit growth into 2016. We’re obviously a long way from interest rates posing a threat to equity yields. In particular, the new climate will favor consumer spending and finance. This means companies like Ford Motor (F) and Ross Stores (ROST). By the way, Ford reported another good month for sales. Last month was their best October in 11 years.

The resurging economy will also help many industrial stocks, particularly some bargain names. On our Buy List, that means names like Wabtec (WAB), which has been weak lately. I also like Snap-on (SNA) here, but be careful not to chase it above my $169 Buy Below price.

Another big change for investors is that the U.S. dollar has leveled off after its big run-up. That means we won’t see the big dent that currency translation did to some of our earnings reports like AFLAC (AFL) or Oracle (ORCL). The overall outlook for stocks is still positive, but investors should play it safe. Focus on dividends and stocks with strong balance sheets. As always, check out the names on our Buy List. Now let’s look at this week’s earnings reports.

Cognizant Unexpectedly Meets Expectations

On Wednesday, before the opening bell, Cognizant Technology Solutions (CTSH) reported Q3 earnings of 76 cents per share and revenue of $3.19 billion. If you recall, the IT outsourcer had forecast earnings of “at least” 75 cents per share on revenue of “at least” $3.14 billion. Last week, one keen market observer wrote, “Guess what? They’ll beat both numbers.” Indeed, that guy was correct.

The hitch is that CTSH has a nice track record of creaming Wall Street’s (and their own) expectations. Bear in mind that on Planet Wall Street, you’re expected to beat expectations. If you only meet expectations, well…that’s not expected. But don’t be fooled: Cognizant had a solid quarter. Quarterly revenues rose 23.5%.

“Our balance sheet remains very healthy. Cognizant recorded another quarter of strong cash generation, resulting in an increase of almost $500 million in cash and short-term investments,” said Karen McLoughlin, Chief Financial Officer. “Additionally, during the quarter, we repaid the $100 million balance of our revolving credit facility and repurchased over $156 million of shares under our existing stock-repurchase program. Year-to-date, we have repurchased 5.3 million shares for $334 million, reflecting the confidence in our business, commitment to drive shareholder value and ability to generate strong cash flows.

I like their business strategy. After Obamacare passed, Cognizant made a shrewd move into Healthcare, and that’s paid off for them. Last year, they bought TriZetto for $2.7 billion. Last quarter, Healthcare revenue was up nearly 30%.

Now let’s look at guidance. For Q4, Cognizant sees earnings of at least 77 cents per share. Wall Street had been expecting 77 cents per share. Cognizant also expects full-year earnings of at least $3.03 per share. That’s an increase from the previous guidance of at least $3 per share.

They also raised their revenue guidance to at least $12.41 billion. That would be a 21% increase over last year. Not too shabby. This is the third time this year CTSH has raised its revenue guidance.

The shares pulled back about 2% on Wednesday, but I’m not at all bothered. Cognizant is an excellent stock, and it’s our third-best performer on the year with a YTD gain of 27.6%. I rate Cognizant Technology Solutions a buy any time you see it below $70 per share.

Qualcomm Plunges 15% on Weak Outlook

On Thursday, Qualcomm (QCOM) was the single worst-performing stock in the S&P 500. The shares plunged more than $9 to close at $51.07. At one point, stock dipped below $50. The day’s loss came to 15.25%. Ouch.

This has been a terrible stock for us this year. I don’t hide from my mistakes. Instead, I face them and absorb the lesson. Long-time readers know that I’ve been down on the stock for some time. In fact, in last week’s earnings preview, I wrote “Frankly, I’m not expecting much.” Yep, that’s what we got.

Now let’s look at the ugly details.

Qualcomm reported fiscal-Q4 earnings of 91 cents per share. That actually beat Wall Street’s estimates by five cents per share. The company had said to expect earnings between 75 and 95 cents per share. Quarterly revenue fell 18.5% to $5.46 billion.

For the entire fiscal year, Qualcomm made $4.66 per share. That’s a hefty drop from last year’s total of $5.27 per share. The company seems to have already written off 2015.

“Our fiscal-fourth-quarter revenues and EPS were at the high end of our expectations, with stronger-than-expected MSM chipset shipments offsetting slower-than-expected progress concluding new license agreements in China. We executed a major increase in our capital-return program in fiscal 2015, returning a record $14 billion of capital to stockholders,” said Steve Mollenkopf, CEO of Qualcomm Incorporated. “We are encouraged by customer reaction to our flagship Snapdragon 820, are on track to deliver on our fiscal 2016 cost-reduction targets and expect to exit fiscal 2016 on an improving financial trajectory.”

For Q1, Qualcomm sees earnings of 80 to 90 cents per share on revenue of $5.2 billion to $6.0 billion. That’s way below expectations. The Street had been expecting Q1 earnings of $1.08 per share on revenue of $5.74 billion. For last year’s Q1, Qualcomm earned $1.34 per share and had revenue of $7.1 billion. That gives you an idea of how poor the outlook for them is.

I feel bad for Qualcomm. In the last year, the company has been attacked from all sides—it’s been a perfect storm of bad news. Qualcomm has faced anti-trust battles. They had to write a big check to the Chinese government to make one headache go away. Some of their key customers have started making their own chips. On top of that, an activist shareholder is demanding that the company be broken up.

I had mistakenly believed that Qualcomm’s downside was somewhat limited. After all, in March the company bumped up its dividend by 14% and announced a $15 billion buyback. The market didn’t care. With the lower share price, QCOM now yields close to 3.8%. This week, I’m dropping my Buy Below on Qualcomm to $50 per share.

You may be wondering if a case like Qualcomm would ever cause me to abandon the rules of the Buy List and ditch a stock before the end of the year. It’s certainly tempting, but the answer is no.

For one thing, it’s very difficult to predict what the market will do in the short term. Lots of good stocks suffer painful downturns only to rebound later on. I can’t predict those moves and I don’t pretend that I can.

Last year, Cognizant was in a sour mood. The stock dropped 12.6% in one day and I had people asking me if it was time to dump it. I said I was still a fan, and I’m glad we held on. Since then, CTSH is up more than 50% for us. Just a few weeks ago, eBay dropped sharply, but in the last 11 days, the shares are up 21%. As the great Jesse Livermore said, “It was never my thinking that made the big money for me; it always was sitting.”

The rules of the Buy List are there to show investors that you don’t need to be glued to your portfolio 24 hours a day. Over-trading is the curse of the investor class. Sure, you’ll get a dud every so often, but a diversified portfolio of high-quality stocks will serve you well.

I have to make a correction. In last week’s newsletter, I said that Moog (MOG-A) was due to report earnings last Friday. That was an estimate based on their previous earnings reports. It turns out I was off by one week. The company has since issued a press release saying it will report on Friday, November 6, which is later today. (Dear Moog people, if you’re reading this, please let us know a little earlier!) The report hasn’t come out yet, but you can check the blog for the latest.

Before I go, I want to raise my Buy Below prices on two of our Buy List stocks. I’m bumping eBay’s (EBAY) Buy Below up to $32 per share. I’m also raising Microsoft’s (MSFT) to $56 per share. Both companies had good earnings reports recently, and both have gapped higher for us.

That’s all for now. Not only is Moog’s earnings report due later today, but so is the big October jobs report. It may already be out by the time you’re reading this. If the numbers are good, the odds of a December rate hike will rise. There’s nothing big in the way of econ reports next week, but earnings season is winding down. Soon we’ll get our October-cycle earnings reports (Ross Stores and Hormel Foods). Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: November 6, 2015

Eddy Elfenbein, November 6th, 2015 at 6:38 amDollar at Three-Month High as Payrolls Paralysis Sets In

U.S. Employment Seen Raising December Rate Hike Chances

U.S. Charges Scottish Man Over Fake Tweets That Hurt Stocks

Square Sets IPO at 27 Million Shares and Sees Price at $11-$13 per Share

AstraZeneca to Buy ZS Pharma for $2.7 Billion

Sanofi Inks $435 Million Diabetes Deal With South Korea’s Hanmi

ArcelorMittal Is Latest Victim of China’s Steel-Export Glut

Maersk Oil Profit Sank 86% Last Quarter as Prices Plunge

DreamWorks Animation Results Beat Expectations on TV Growth

A Bunch of Hedge Funds Got Burned by Valeant

Exxon Mobil Investigated for Possible Climate Change Lies by New York Attorney General

SeaWorld Sinks in Wake of Killer Whale Outcry

Cullen Roche: Private Sector Saving is Not Saving Net of Investment

Be sure to follow me on Twitter.

Qualcomm Bombs

Eddy Elfenbein, November 5th, 2015 at 11:46 amI honestly didn’t think Qualcomm‘s (QCOM) earnings and guidance were that bad. Nevertheless, the shares are taking a beating today. QCOM is currently down $8.41 to $51.85. That’s a loss of 14%. Ouch!

At the current price, QCOM yields 3.7%. And remember that they increased their dividend by 14% in March.

Morning News: November 5, 2015

Eddy Elfenbein, November 5th, 2015 at 7:08 amIn Pacific Trade Deal, Vietnam Agrees to U.S. Terms on Labor Rights

BOE Stays Cautious on Rate-Hike Timing as Inflation Outlook Cut

Bonds Tumble Around the Globe as Fed Rate Odds Climb Past 50%

Bitcoin Surges, Emerging From a Lull in Interest

Puerto Rico’s Debt Crisis and the 1975 Law Complicating Matters

Regulators Ramp Up Debt-Collection Crackdown

Toyota to Spend Record $6.6 Billion on Buybacks as Profit Climbs

Facebook Sales Top Estimates, Fueled by Mobile Advertising

Media Stocks Dip After Time Warner Cuts Profit Expectations

Kraft to Slash 2,600 More Jobs, Close Seven Plants

Sanofi, Hanmi Seal Diabetes License Deal For Up To $4.2 Billion

Denver-Based Molson Coors Nearing Deal for MillerCoors

Qualcomm Forecasts Show Struggle for License Deals in China

Cullen Roche: Private Sector Saving Is Not Saving Net of Investment

Roger Nusbaum: Does 60/40 Need to Evolve?

Be sure to follow me on Twitter.

Qualcomm Earns 91 Cents per Share

Eddy Elfenbein, November 4th, 2015 at 4:14 pmAfter the closing bell, Qualcomm (QCOM) reported earnings of 91 cents per share. That was five cents more than estimates. This was for their fiscal fourth quarter.

For the full year, Qualcomm earned $4.66 per share which is a big drop from the $5.27 they made last year.

“Our fiscal fourth quarter revenues and EPS were at the high end of our expectations, with stronger-than expected MSM chipset shipments offsetting slower than expected progress concluding new license agreements in China. We executed a major increase in our capital return program in fiscal 2015, returning a record $14 billion of capital to stockholders,” said Steve Mollenkopf, CEO of Qualcomm Incorporated. “We are encouraged by customer reaction to our flagship Snapdragon 820, are on track to deliver on our fiscal 2016 cost reduction targets and expect to exit fiscal 2016 on an improving financial trajectory.”

For Q1, they sees earnings of 80 to 90 cents per share on revenue of $5.2 billion to $6.0 billion. That compares with earnings of $1.34 per share and revenue of $7.1 billion in last year’s Q1.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His