Archive for March, 2016

-

Valeant -44%

Eddy Elfenbein, March 15th, 2016 at 11:46 amAs if Valeant Pharmaceuticals (VRX) weren’t already having a rough time, the stock is down 44% today. That’s on top of a 70% plunge going into today.

The drugmaker slashed its guidance and warned that it faces an “event of default,” if they don’t get their annual report in by next month. It’s already late.

The stock has been the target of shortsellers, and they’ve been proven right. At the other end, Bill Ackman has reportedly lost several hundred million dollars betting on VRX.

What a mess.

-

Morning News: March 15, 2016

Eddy Elfenbein, March 15th, 2016 at 7:13 amBOJ Keeps Policy Steady, Offers Gloomier View on Economy, Inflation

Obama Said to Reverse Atlantic Drilling Policy After Opposition

Stanley Fischer and Lael Brainard Are Battling for Yellen’s Soul

Group Led By Chinese Firm Anbang Bids $12.8 Billion For Starwood Hotels

Valeant Lowers Forecast as Drugmaker’s Woes Weigh on 2016

Don’t Blame the Fed: Bangladesh Seen at Fault for Bank Heist

Renault, Nissan Name Nicolas Maure as New CEO at Russia’s AvtoVAZ

Lyft and GM Roll Out Car Rental Program to Attract More Drivers

Institutional Investors Sue Volkswagen Over Fall in Share Price

Campari Is Buying Grand Marnier in a Quest To Cash in on Classic Cocktails

Goldman Sachs Buys Online Retirement Benefits Business

Redbox Owner Outerwall Boosts Dividend, Seeks Alternatives

Sony to Pay Michael Jackson’s Estate $750 Million for Stake in Music Catalog

Jeff Carter: Simple Mills is Cracking Me Up

Roger Nusbaum: Heavy Handed Central Banks

Be sure to follow me on Twitter.

-

Morning News: March 14, 2016

Eddy Elfenbein, March 14th, 2016 at 6:49 amInflation Target Draws Fire From All Sides

Eurozone Industrial Output Surges in January

How Much Foreign Debt Has China Repaid?

Egypt Adopts More Flexible Exchange Rate After Devaluation

How Saudi Arabia Turned Its Greatest Weapon on Itself

Putin’s $50 Billion Oil Cache Gives Russia Luxury to Ignore ECB

Social Security: The GOP vs. the American People

Inside the Billion-Dollar Dig to America’s Biggest Copper Deposit

Anbang Expands U.S. Hotel Foray With Record $6.5 Billion Deal

China Vanke Seeks to Thwart Possible Takeover Bid

Toyota and Partners Begin Hydrogen Supply Chain Test Project

Top Start-Up Investors Are Betting on Growth, Not Waiting for It

The Final Days and Deals of Aubrey McClendon

Cullen Roche: Passive Investing – I Doth Protest Too Much

Howard Lindzon: Peak ‘Passive’ Investing? …The Rise of Robinhood…and ‘Trade Gen’

Be sure to follow me on Twitter.

-

Closing in on the 200-DMA

Eddy Elfenbein, March 11th, 2016 at 1:02 pmThe S&P 500 is closing in on its 200-day moving average. We haven’t closed above it all year.

-

CWS Market Review – March 11, 2016

Eddy Elfenbein, March 11th, 2016 at 7:08 am“Patterns are the fool’s gold of financial markets” – Benoit Mandelbrot

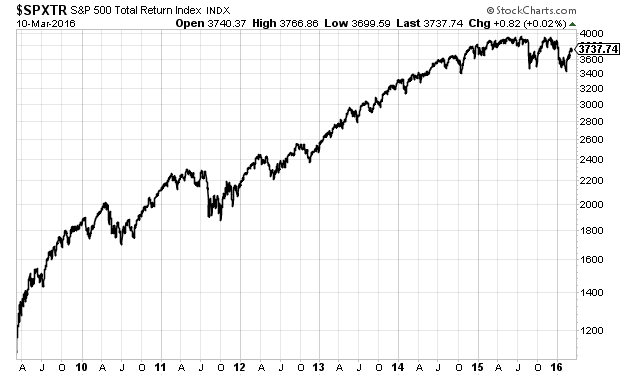

This week marked the seventh anniversary of the start of the great bull market. Of course, we haven’t made a new high in more than nine months, so it’s possible that the bull market may already have ended. Traditionally, that comes with a 20% drop from the old high, which we haven’t hit yet. Still, it’s worthwhile to reflect on how impressive this long rally has been.

I’ve often referred to this bull market as “the world’s most hated bull market.” This is an important lesson for investors that ultimately, the market will do what it wants, and it can make fools of us all. That’s why, around here, we play for the long game.

The big news this week came from Europe where Mario Draghi decided to bring out the big guns to get the Eurozone economy moving again. There are still a lot of doubters out there. I’ll also preview next week’s Federal Reserve meeting. Don’t expect Janet and her friends on the FOMC to raise rates, but they may provide clues for the game plan for the rest of 2016. I’ll also update some of our Buy List stocks. But first, let’s look at the bull market’s seventh birthday.

The Bull Market Turns Seven: What Have We Learned?

On Monday, March 9, 2009, the S&P 500 closed at 676.53. That was the index’s lowest close in more than twelve years. On the previous Friday, the index reached its devilishly-low intra-day price of 666.79.

At the time, the outlook was very grim. The financial crisis had hit a few months before. The economy was in free fall. That Friday morning, the Labor Department reported that the U.S. economy had shed an astounding 651,000 jobs in February. That was on top of massive losses in December and January. I can’t remember a time when things looked so bleak.

But now, in retrospect, we can see the truth—that this was one of the greatest buying opportunities in decades. That’s not an exaggeration. The numbers bear this out. But think of the courage investors needed to look past the terrible news. More than four months before, Warren Buffett wrote in the New York Times, “Buy American. I Am.” Even Grandpa Capitalism couldn’t spark a rally. The market promptly fell another 28%.

It seemed like there was no end. Investors were still very afraid. I’ll give you two examples. At the market’s low, the Volatility Index was near 50, and the Ted Spread was still over 1%. Yet, despite all the worrying, the market soon started to climb. And climb and climb. Even as more bad news came out, the market still climbed higher. It’s really true; the market does indeed climb a wall of worry.

Here’s another important lesson for investors: At the start of market rallies, it’s common to see the market’s Price/Earnings Ratio rise even though the market is actually very cheap. That’s because the market looks ahead a few months. So even as corporate earnings are still lousy, stock prices anticipate a recovery. The P gets higher even though the E is crashing. I remember many investors shied away from the initial stages of the rally because they expected it to fall apart. Just as it had every other time.

Many pundits deemed the whole thing phony since the market was being propped up by the Federal Reserve. They expected that once the Fed shut off the printing press, the house of cards would soon crumble. Like Linus in the pumpkin patch, they waited and waited for the Great Reckoning.

This week, one experienced market pro said that there’s a 100% chance of a recession in the next 12 months. Not 90% or even 99%, but 100%! Count me as a skeptic, but I’ll give him credit for giving us a time horizon. I’ve always noticed that these doom-and-gloomers are very specific on what will happen (disaster!!) but they’re often quite vague on exactly when (soon I tells ya!!).

But this pattern has been common in Wall Street history—bad headlines are great opportunities. After Pearl Harbor, the stock market didn’t rally. As people realized the immense task before them, the market sank lower. Not until April 1942 did the stock market hit bottom. Interestingly, the market rallied before the Allies racked up major victories on the battlefield. Instead, the market turned on optimism and expectations.

Again we can turn to Mr. Buffett for guidance, “I will tell you the secret to getting rich on Wall Street. You try to be greedy when others are fearful. And you try to be fearful when others are greedy.”

From the closing low on March 9, 2009, the S&P 500 tripled by November 2014. Measuring from the low to the closing high on May 21, 2015, the S&P 500 gained 215% in a little over six years—and that doesn’t include dividends. The S&P 500 Total Return Index, which includes dividends, gained 259% over that same span.

You may be expecting me to say that our Buy List did even better than the rest of the market. You are correct. Our Buy List dramatically outperformed the market, especially during the early phase of the rally. We beat the market for seven straight years from 2007 through 2013. We did this by concentrating on good stocks, not on trying to pick exact tops and bottoms. It’s an old lesson that has proven itself time and time again. Now let’s look at the latest news from the European Central Bank.

Mario Draghi Goes All In

On Thursday, Mario Draghi, the head of the European Central Bank, ripped out the kitchen sink and threw it at the European economy. That’s a metaphor but it’s not much of a stretch.

The ECB is cutting interest rates again, which are already negative. They’re now even more negativer. The ECB is also stepping up its bond-buying program by 20 billion euros a month. Plus, the bond buying has been expanded to include corporate bonds.

So you’d think the euro would have dropped on world markets, right? That makes perfect sense. But on Planet Wall Street, the euro actually rallied! The fight we’re witnessing in Japan and Europe, and to a lesser extent in the United States, brings up an interesting issue. Perhaps we’ve reached the limit of what a central bank can do. The concern is that banks in Europe are hoarding their cash and they just need some incentive to start lending again.

The reality is that Europe has been behind the U.S. as authorities here responded earlier and more aggressively to an anemic recovery. Bond yields in Europe are already low, and in some cases, they’re absurdly low. One of my favorite stats is that five years ago, the five-year yield in Ireland was going for 17%. Now it’s negative.

I won’t yet pronounce on the wisdom of Draghi’s decision, but I will note that credit conditions have slowly improved in Europe. Later on, I’ll tell you about Ford Motors’ strong sales report from Europe. Ultimately, what Europe needs now is some time to regain consumer and investor confidence. This was a bold move by Draghi, and it might be the one that finally works.

Preview of Next Week’s Federal Reserve Meeting

Keeping with the topic of central banking, let’s switch to our Federal Reserve. On Tuesday and Wednesday of next week, the Fed gets together again in Washington. It’s very unlikely that the Fed will raise interest rates. But when the Fed issues the latest policy statement, the central bank will update its projections for the economy and interest rates. Unfortunately, I have to mention that the Fed’s track record has been bad. Even for economists, they’ve been bad.

Still, what stands out is how much more aggressive the Fed is compared to expectations. Many members of the Fed expect to raise rates a few more times this year. The futures market doesn’t buy it, and neither do I. The futures market expects another rate hike in September. Bear in mind that the U.S. Federal Reserve is the only central bank in the developed world whose last rate change was a hike. Everybody else, without exception, has cut. There are even some folks, including some inside the Fed, who wouldn’t mind a rate cut.

The key to watch is inflation. To reiterate a theme I’ve laid out before, I think it would be very good for the investing climate to see a modest amount of inflation. That would steer the U.S. economy clear of deflation. It would also give the Fed some room to raise rates.

Next week, the government will release the inflation report for February. This will be an interesting report because the core inflation rate for January was the highest since 2006. That may be a one-off, but it could be the start of a healthy trend. On top of that, oil prices have recovered. It’s interesting to note how closely tied oil and the stock market have been. This tells me that stocks aren’t afraid of a little inflation.

The S&P 500 has cracked 2,000 again a few times in this past week. Even though the market is still down for the year, a majority of stocks in the index are positive YTD. This tells us that the market is broadening out. That’s usually a good sign. We’ve also seen defensive sectors like Consumer Staples, Utilities and Telecom touch new 52-week highs. The next level to watch for is 2,020 which is the S&P 500 200-day moving average. We haven’t been above that all year. Now let’s look at some recent news from our Buy List.

Buy List Updates

On Tuesday, Cerner (CERN) announced that its board had approved a $300 million share buyback. The company estimates that it will repurchase 1.7% of their outstanding shares. Personally, I’d rather see that money paid out to shareholders as dividends. Still, it’s good to see shareholders get rewarded in any form. Cerner remains a good buy up to $58 per share.

This week, Goldman Sachs downgraded Ross Stores (ROST) from buy to neutral. Don’t be too concerned by this downgrade. Wall Street firms frequently change their ratings on stocks. The move is more a reflection of how well Ross has done. Remember that the deep discounter fell 23% last fall. We held on. Not only did Ross make up all the lost ground, but the stock broke out to another 52-week high on Monday, prior to the downgrade. Ross Stores remains a good buy up to $60 per share.

When you have a diversified Buy List, you never know which stock is going to go on a run. Consider the case of Stryker (SYK). The orthopaedics company raised its full-year guidance three times last year. In December, they raised their dividend by 10%. Yet the stock didn’t do much during the latter part of 2015.

SYK fell from a high of $105 in August down to $86 by January. Lately, that’s changed. The stock broke $104 this week, and it’s very close to making a new high. This week, I’m increasing my Buy Below on Stryker to $105 per share.

On Thursday, Ford Motor (F) reported very good European sales results for February. Sales in Europe rose by 17% compared with last year. The automaker increased its market share to 7.3%. The company has wisely been focusing on less-expensive models that sell better in Europe. Ford is a buy up to $13 per share.

That’s all for now. The Federal Reserve meets next week on Tuesday and Wednesday. The policy statement will be released on Wednesday afternoon. The meeting will be followed by a press conference by Janet Yellen. Also on Wednesday, we’ll get the inflation report for February. The last core inflation report was the highest in nearly ten years. I’m curious to see if this is the start of a stronger trend. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: March 11, 2016

Eddy Elfenbein, March 11th, 2016 at 7:02 amStocks Turn With Bonds and Euro as Draghi Plan Gets Second Look

Draghi Defines His Era With Stimulus Measures Locked Into Next Decade

China Said to Plan New Rules Facilitating Debt-to-Equity Swaps

U.S., Canada Pledge To Lower Methane Emissions In Oil And Gas Sectors

IEA Sees Signs Oil Prices Might Have Bottomed Out

Market Hubris and the Bond Bubble

Deutsche Bank Sees 2016 Industrywide Trading Revenue Drop

Twitter Bets on Payouts to Rein In Talent Flight

Yahoo Labors to Carry On With Core Business While Exploring Sale

Slovakia Is a Natural First Stop For the Hyperloop – No Joke

TransCanada Seen Eyeing Path to U.S. Shale Gas in Deal Talks

Professor to Wall Street: You’re Doing Swaps Accounting Wrong

Josh Brown: The Fiduciary Debate Crosses Over Into The Mainstream

Roger Nusbaum: No, You Don’t Need $20 Million to Retire

Be sure to follow me on Twitter.

-

Why Do Stocks Beat Bonds?

Eddy Elfenbein, March 10th, 2016 at 11:24 amCullen Roche, one of my favorite financial bloggers has a post up about one of my favorite topics: Why do certain asset classes perform the way they do?

One of the lessons gleaned from long-term studies is that stocks have historically outperformed bonds. Not necessarily over the course of a year, or even a decade. But over the long run, stocks have beaten bonds.

Why is this? The answer is simple. If a lender agrees to lend his money to someone at, say, 5%, then they probably have a strong belief that the borrower can return better than 5% with it. Not only that, but the borrower believes that as well. In the aggregate, it makes sense that both parties will be right. It’s win-win. While it’s true that the lender would be fine with the money not coming from future cash flow, they’d probably feel a lot better that it does.

This comes back to my point about the differencw between equity and assets. An asset is just a thing like gold or copper or even a house. But equity is a working business that takes assets to make a product. Copper is just a rock (ok, ok, an element). It just sits there. In 1,000 years, it’s still the same thing. Only when people come along can copper be employed to do something useful.

A bond is an asset as well. Remember that a stock can buy a bond, but a bond can’t buy a stock. You can form a company that does nothing but buy bonds, and then float stock to fund your operations. You can use the dividends from the bonds to buy even more bonds. In fact, you can take it one step further and borrow money to buy more bonds. Of course, you’d want to borrow at the lowest possible rate (in the short term) and invest at the highest possible rate (the long term).

Another name for this bond-business is called a bank.

My point is that equity is completely different from other classes of investments. It’s the only one that captures human ingenuity, which is the ultimate asset.

-

Ford’s Sales Rise 17% in Europe

Eddy Elfenbein, March 10th, 2016 at 10:52 amOn top of today’s ECB news, Ford Motor (F) announced that their sales in Europe rose by 17% last month.

Across all of its 50 European markets, Ford sold 104,500 vehicles during the month. Growth at Dearborn, Mich., auto maker outpaced industry growth, the company said, and Ford saw its market share increase by 0.4 percentage points to 7.3%. In its 20 main markets, the auto maker sold 91,700 vehicles, an 18% increase over last year.

Ford has planned to stop making some less-lucrative models and refocus on higher-profit cars and sport-utility vehicles to compete better in Europe, a market long burdened by overcapacity and price wars, The Wall Street Journal has reported.

The company plans to launch several new and refreshed vehicles this year, such as the new Kuga and Edge SUVs, a Focus RS performance hatch, and a freshened Ranger pickup.

Ford’s business is largely about trucks and North America, but it’s encouraging to see better news from abroad. The shares got as high as $13.86 on Friday. Right now, they’re around $13.10.

-

Market Jumps on ECB Rate Cut

Eddy Elfenbein, March 10th, 2016 at 10:25 amThe stock market is up about 0.5% this morning on the news that the European Central Bank is cutting interest rates. The ECB is also stepping up its bond buying.

In a change to its usual communication practices, the ECB announced all of its measures at its rate call, rather than waiting for Mr. Draghi’s news conference.

It cut the level it charges on excess deposits by 0.1 percentage point to minus 0.4%. This means that banks have to pay even more now to leave excess funds with the central bank overnight. It also cut its main interest rate, the rate it charges on regular bank loans, to an all-time low of zero percent from 0.05% where it was previously.

The ECB said Thursday that it would up the monthly volume of its bond buying program to €80 billion ($87 billion), from €60 billion previously.

It also decided to add investment-grade euro-denominated bonds issued by nonbank firms established in the euro area to the list of eligible assets that it can buy.

“This is an extremely aggressive signal, since it shows that the ECB is willing to take on potentially significant credit risk in order to fulfill its mandate to raise inflation to its target,” said Bill Adams, an economist at PNC Financial Services Group.

The euro initially dropped then surged.

-

Morning News: March 10, 2016

Eddy Elfenbein, March 10th, 2016 at 7:08 amNegative Rates Dig a Hole for Bank of Japan

Chinese Inflation Accelerates to 2.3 Percent

China Car Sales Hit the Brakes in February

Your Guide to Understanding Today’s ECB Decision

Bonds Gain and Euro Weakens as Markets Pivot on Central Banks

Mutual Funds Resist S.E.C. Plan to Pump Up Buffer Against Cash Flight

U.S. Investment Banks Drive Revenue Share to New High

China’s Alibaba Says Agrees $3 Billion 5-Year Loan

Boeing Gives United A Smoking Deal On 737s To Block Bombardier From Gaining Traction

Amazon Finds Air Freight Partner

If Jack Dorsey Has a Problem Child Among His 2 Companies, It Isn’t Square

China’s CRRC Lands $1.3 Billion Chicago Rail Car Project

The Shale Reckoning Comes to Oklahoma

Howard Lindzon: Snapchat Slides into My Homescreen

Jeff Carter: Free Markets Vs. Centralized Bureaucracies

Be sure to follow me on Twitter.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His