Posts Tagged ‘DTV’

-

CWS Market Review: May 18, 2014

Eddy Elfenbein, May 18th, 2014 at 8:47 pmAT&T Buys DirecTV for $95 per Share

Great news! AT&T ($T) just announced that it’s buying DirecTV ($DTV) for $95 per share. The news broke Sunday afternoon and I wanted to send you this Flash Alert to let you know the good news.

Here are the details from the press release.

DIRECTV shareholders will receive $95.00 per share under the terms of the merger, comprised of $28.50 per share in cash and $66.50 per share in AT&T stock. The stock portion will be subject to a collar such that DIRECTV shareholders will receive 1.905 AT&T shares if AT&T stock price is below $34.90 at closing and 1.724 AT&T shares if AT&T stock price is above $38.58 at closing. If AT&T stock price at closing is between $34.90 and $38.58, DIRECTV shareholders will receive a number of shares between 1.724 and 1.905, equal to $66.50 in value.

AT&T closed Friday at $36.74 per share. On Twitter, I guessed that the deal would be two shares of AT&T plus $20 in cash for each share of DTV, so I was pretty close.

The collar is a smart move and I’m assuming it came from DTV. To make it easy for you, it’s plus or minus 5% from AT&T’s closing price on Friday. The problem with any deal transacted with stock is what happens if the acquiring company has its stock plunge. The acquired firm gets punished so some protection is a good idea. Still, I doubt the collar will go into effect.

For track record purposes, the cash portion of the deal will be assumed to be used to buy AT&T stock at the same price the stock portion of the deal goes for. In other words, AT&T will replace DTV on the Buy List. We’ll still have 20 stocks on our Buy List.

Here’s more from the press release

This purchase price implies a total equity value of $48.5 billion and a total transaction value of $67.1 billion, including DIRECTV’s net debt. This transaction implies an adjusted enterprise value multiple of 7.7 times DIRECTV’s 2014 estimated EBITDA. Post-transaction, DIRECTV shareholders will own between 14.5% and 15.8% of AT&T shares on a fully-diluted basis based on the number of AT&T shares outstanding today.

AT&T intends to finance the cash portion of the transaction through a combination of cash on hand, sale of non-core assets, committed financing facilities and opportunistic debt market transactions.

To facilitate the regulatory approval process in Latin America, AT&T intends to divest its interest in América Móvil. This includes 73 million publicly listed L shares and all of its AA shares. AT&T’s designees to the América Móvil Board of Directors will tender their resignations immediately to avoid even the appearance of any conflict.

Obviously, there are other issues ahead such as regulatory approval. Expect to see DTV gap up tomorrow, but not all the way to $95 per share. If you own DirecTV, there’s no reason to sell it now. I’m going to raise our Buy Below to $95 per share, but don’t expect to see any significant gains after tomorrow’s open. There’s no need to jump in and buy AT&T. I’ll have more to say about them once the deal is done.

– Eddy

-

CWS Market Review – May 9, 2014

Eddy Elfenbein, May 9th, 2014 at 7:09 am“It never was my thinking that made the big money for me. It always was my sitting.” – Jesse Livermore

Welcome to the Revenge of the Boring Stocks. The stock market’s rotation continues, as former high-flyers have been getting punished, while boring old dividend-payers are suddenly popular. What’s happening is that there’s been a resurgence of rationalism, sobriety and prudent investing. No one saw this coming.

Last week, I said that Friday’s jobs report could be a big one, and I was right. The economy created 288,000 jobs in April. That’s the biggest gain in more than two years. But here’s the odd part: the bond market has rallied ever since. The yield on the 10-year Treasury finally broke below 2.6% this week and touched its lowest point since October. Despite many predictions of its imminent demise, the boring T-bond market is well ahead of the stock market this year.

The big news for our Buy List is that DirecTV officially said they’re looking at a possible merger with AT&T. On Wednesday, shares of DTV gapped up 8% to hit a new all-time high. I think they’re in a position of strength in any merger negotiation. We’re now sitting on a 23.2% gain YTD. I’ll have all the details on DTV in a bit.

In addition to a good earnings report from DirecTV, we also saw good earnings from Cognizant Technology, although traders took the shares down. Not to worry. I’ll explain why CTSH is as strong as ever. I’ll also preview next week’s earnings report from CA Technologies (which now yields 3.4%). But first, let’s look at the market’s rotation and why the cool stocks are finally getting their comeuppance.

The Revenge of Boring Stocks

On the surface, the stock market seems to be pretty tame, and there’s not a lot of volatility. But just below the surface, there’s been a major correction unfolding that’s manifested itself in several different ways.

The best way I can describe this phenomenon is that boring stocks have suddenly become popular, while formerly popular stocks are now hated. I described last year’s market as a massive chilling out. It was a reaction against the earlier flight to ultra-conservative investments. In 2013, investors cautiously moved into riskier assets. That was good for us, but what we’re seeing this year is a reaction against the excesses of last year’s rotation.

As a result, we’re seeing a market that’s frustrated a lot of folks. The guys at Bespoke Investment Group point out that in the last two months, the stocks that analysts like the most are down the most, while the stocks they hate the most are up the most. Goldman Sachs notes that “nearly 90% of large-cap growth mutual funds and 90% of value funds were underperforming their benchmarks year-to-date.”

Let’s look at some examples. On Thursday, shares of Tesla, the electronic-car stock, dropped 11.3% after the company said it beat earnings estimates by 20%. Analysts are worried about rising costs, but my point is that in this market, an earnings beat isn’t enough to help a stock that’s zoomed in the past year. Look at Twitter which lost 18% after its “lock-up” period expired. The company recently reported Q1 earnings of $183,000. That’s about one-thirtieth of a penny per share. That’s not enough to buy even one share of Berkshire Hathaway. Or look at Amazon which is now 30% off its high. It’s all the way down to 489 times last year’s earnings. And it’s not just tech stocks; it’s any hi-flier that’s richly valued. Whole Foods Market is now 40% off its high. The P/E Ratio of the Nasdaq is twice that of the rest of the market.

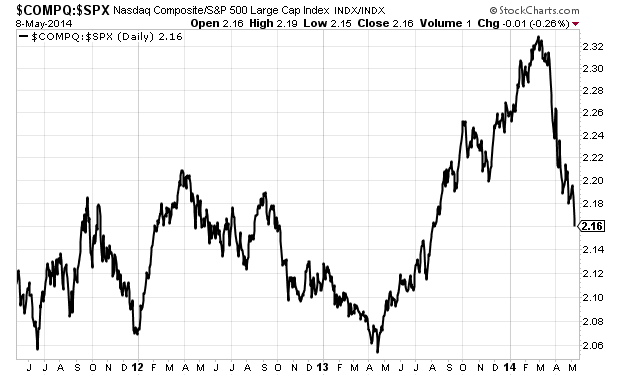

Check out this chart which shows the Nasdaq Composite divided by the S&P 500. You can see how the Nasdaq creamed the S&P 500 last year but has been flattened by it lately.

This anti-pricey-stock sell-off has distorted market perceptions because it’s affected the stocks that individual investors love so much. The boring stocks have been doing just fine, especially if they pay a dividend.

James Saft at Reuters notes that “according to Societe Generale data, the single most important characteristic driving equity returns in the past month has been dividend yields.” That makes sense. Utilities, for example, have been doing very well this year. The Utility ETF ($XLU) is up 13% YTD, and the Vanguard REIT ETF ($VNQ) is up 15% this year. Bespoke gives us another great factoid: The 300 stocks in the Russell 1000 that don’t pay a dividend are down 7.21% since March 5, while the 300 highest-yielding stocks are up 2.11%. The dividend is the difference.What’s also interesting is that the market’s breadth has badly deteriorated. At recent market peaks, the number of stocks making new 52-week highs has gradually fallen. In other words, a smaller and smaller group of stocks is doing the heavy lifting. If you glance at a list of stocks reaching new 52-week highs, it’s likely to be almost entirely oil stocks, with DirecTV and Apple thrown in. The average stock in the Russell 1000 is now down 11.4% from its 52-week high, even though the entire index is down 1.5% from its high.

Another area where we can see the rotation is in small-caps, which have badly underperformed. On Tuesday, traders were rattled when the Russell 2000 closed below its 200-day moving average. That hasn’t happened in more than 17 months. Half of the stocks in the Russell 2000 are more than 20% off their highs. In contrast, the mega-caps in the Dow 30 have barely budged.

This rotation isn’t done yet. Investors should make sure they have high-quality dividend stocks in their portfolios. Some of our Buy List stocks with rich yields include Microsoft (2.8%), CA Technologies (3.4%), McDonald’s (3.2%) and Ford (3.2%). Now let’s look at our star stock of the week.

DirecTV Soars on Possible Merger News

In last week’s CWS Market Review, I mentioned how shares of DirecTV ($DTV) jumped on news that AT&T had been talking with DTV about a possible merger. This week, it got much more serious. Shortly before the closing bell on Wednesday, news broke that DirecTV is working with Goldman Sachs to look at such a deal. If Goldie’s involved, you can be sure it’s serious.

Ever since the Comcast/Time Warner Cable deal was announced, a response deal between AT&T and DirecTV has made a lot of sense. I suspect that until now, DTV hasn’t been terribly interested in a merger. In business, of course, everyone has a price. I won’t predict whether something will come about, but I’ll add that a deal would certainly help out AT&T at a crucial time for them. The good news for us is that DirecTV is in the position of strength. The only worry is that they don’t get too greedy as regards price because DISH is waiting in the wings.

On Tuesday, DirecTV reported another solid quarter. The satellite-TV operator earned $1.63 per share for Q1. That beat estimates by 15 cents per share. The company added 361,000 subscribers in Latin America, which was far more than analysts’ estimates of 227,000. DirecTV now has 20.3 million subscribers in the U.S. (You can see why AT&T wants that.)

DirecTV has been our top-performing stock this year, up 23.2% YTD. This week, I’m raising our Buy Below on DirecTV to $89 per share. What a great stock.

Cognizant Technology Raises Full-Year Guidance

On Wednesday, Cognizant Technology Solutions ($CTSH) reported Q1 earnings of 62 cents per share. That’s pretty good. Three months ago, the IT-services company told us to expect earnings of 59 cents per share. Quarterly revenue rose 19.9% to $2.42 billion.

For Q2, Cognizant sees revenues coming in between $2.50 billion and $2.53 billion, and EPS of 62 cents. The Street had been expecting 63 cents per share. For all of 2014, Cognizant projects revenue of at least $10.3 billion and earnings of at least $2.54 per share. Three months ago, CTSH had disappointed investors when they projected 2014 earnings of at least $2.51 per share, while the Street had expected $2.54 per share. In other words, the estimate is back where we started.

Gordon Coburn, Cognizant’s president, said, “We remain confident in the overall demand environment and in our ability to deliver our previously stated revenue guidance of at least $10.3 billion for 2014, up at least 16.5% over 2013.”

Even though these numbers were pretty good, the stock dropped 4.4% after the earnings report. That’s partly a reflection of the turn against growth companies (CTSH doesn’t pay a dividend). Fortunately, on Thursday, CTSH made back about half of Wednesday’s loss. Granted, it’s a pricey stock. The current price is about 19 times earnings, but their business is growing rapidly. Cognizant remains a very good buy up to $52 per share.

CA Technologies Is a Buy up to $34 per Share

CA Technologies ($CA) reported blow-out earnings in January. The company earned 84 cents per share for their fiscal Q3, which was 14 cents better than estimates. CA said they see full-year earnings ranging between $3.05 and $3.12 per share. Since they’ve already made $2.48 for the first three quarters, that forecast implies 57 to 64 cents per share for Q4. Wall Street expects 58 cents per share.

As I highlighted earlier, CA pays a generous quarterly dividend of 25 cents per share. In fact, I think they could afford to bump that up to 30 cents per share. The stock has been meandering lower recently. On Wednesday, CA touched its lowest point since mid-October. Thanks to the lower share price, CA’s yield is up to 3.4%, going by Thursday’s close. Earnings are due to come out on Thursday morning, May 15. This is an excellent stock for income-oriented investors. CA Technologies remains a good buy up to $34 per share.

Buy List Updates

Before I go, I want to update you on some of our Buy List stocks. I’m ready to pound the tables for Bed Bath & Beyond ($BBBY). The stock has sunk down to a very attractive price. The last earnings report and guidance for fiscal Q2 have convinced me that they can bounce back. The store has a solid balance sheet, and earnings of $5 per share are very doable. I’m lowering my Buy Below to $66 per share, but if you’re able to get BBBY below $61, then you got a very good deal.

Another retailer I like here is Ross Stores ($ROST), which will be reporting fiscal Q1 earnings on May 22. Wall Street’s consensus is for $1.15 per share. The discount retailer also said that Barbara Rentler will become their new CEO on June 1. She’ll become the 25th female CEO in the Fortune 500. I’m keeping my Buy Below on ROST at $76 per share.

In January, shares of Moog ($MOG-A) got hit hard after they lowered their full-year guidance. At the time, I wrote, “While this news is disappointing, it doesn’t change my fundamental opinion of the company.”

This is why we like high-quality stocks. They bend but rarely break. I’m happy to say that Moog has bounced back. Yesterday, the stock got as high as $69.57 per share, which is a 22% gain from its February low. Last week, I raised our Buy Below to $69, and this week, I’m upping it to $72 per share. Moog is a solid, boring stock. Last year, that was an insult. This year, it’s a compliment.

At this week’s Ford ($F) shareholder meeting, CEO Alan Mulally got a standing ovation. Not many corporate executives get that nowadays, but Mulally has delivered the goods. In the last five years, Ford has made $42.3 billion.

The automaker just announced a $1.8 billion share-buyback program. The goal is to reduce share count by 3%. Ford also reported that sales in China were up 29% in April and are up 41% YTD. Ford is a still a very good buy up to $18 per share.

That’s all for now. Next week, we get important economic reports on retail sales and industrial production. The government will also report on consumer and wholesale inflation. So far, inflation has been tame, but I’ll be curious to see if there’s any indication of higher prices. Also, stay tuned for earnings from CA Technologies, which will come out Thursday morning, May 15. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – March 28, 2014

Eddy Elfenbein, March 28th, 2014 at 8:28 am“Time is your friend; impulse is your enemy.” – Jack Bogle

On the surface, the stock market was fairly subdued this week. The S&P 500 meandered lower, but the overall loss wasn’t so bad. On Thursday, the index closed a hair below 1,850, but let’s not forget that one week ago, we touched an all-time intra-day high.

Beneath the surface, however, there’s been a big shake-up in the market. Specifically, momentum names have faltered while value stocks have taken the lead. This is an important development, and investors need to understand what’s happening. High-profile sectors like biotech have gotten hammered, and former market darlings have been in a world of hurt lately.

Anyone remember a company called Netflix? That stock dropped 14 times in a 15-day span. Since March 4, NFLX is off by 20%. Stocks like Tesla and Priceline are getting dinged as well. Bespoke Investment Group recently noted that the best-performing stocks from last year are the worst performers this year.

In this week’s CWS Market Review, I’ll break down the market’s change of leadership and tell you what it means for our stocks. Speaking of our stocks, we had more good news for our Buy List stocks. DirecTV soared 8% on Wednesday after news of a possible merger with DISH. I’ll have more on that in a bit. Also on Wednesday, the stress testers at the Fed said they have no objections to Wells Fargo’s capital plan, which includes a hefty 16.7% dividend increase.

I’m pleased to see that our Buy List tech stocks are doing well. Oracle and Qualcomm are near new long-time highs, and even slumbering IBM has perked up. Big Blue just touched its highest point in six months, and I think we’ll get a dividend increase next month. But first, let’s look at the big internal shakeup on Wall Street.

The Market’s Big Shift towards Value

An important lesson with investing is that the stock market swings in cycles, and this is not just the overall market, but also within the market. For example, economically cyclical stocks will lead for a few years and then lag for a few more. Financial stocks will blossom, and then another year it will be dividend stocks that blossom. There’s a loose relationship between these cycles, and it’s always dangerous to read too much into the market’s notoriously fickle mood.

In the last month, value stocks have started to lead the market, and growth stocks have been the big losers. What’s interesting is that this has happened during a mostly bullish time for stocks. Typically, we would expect value stocks to do well when the overall market is suffering. Then, as the bull market starts to age, we would expect growth stocks to come into their own. If you recall, that’s what happened during the late 1990s. What was so arresting about that market wasn’t that value stocks merely lagged—it’s that they got crushed even though growth stocks soared. Back then, the Growth/Value divergence was a yawning chasm.

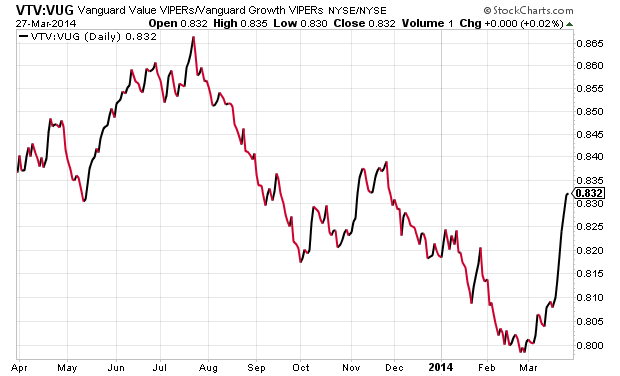

Another interesting aspect about this recent shift to value has been how sharp it’s been. For my Growth proxy, I like to follow the Vanguard Growth ETF ($VUG), and for Value, I look at the Vanguard Value ETF ($VTV). They’re like twin brothers always fighting over mom’s attention. VUG is flashier and has more popular names, while VTV is the quiet, dutiful student. The typical Value/Growth cycle has been distorted in the last few years because the value indexes have been filled with so many toxic financial stocks. (Here’s a chart of the VTV divided by VUG.)

The last Value cycle topped out in mid-2006, and Growth has been in the driver’s seat ever since (with a few false starts for Value). This means that Value underperformed during both the bear market and the bull market. That’s quite a feat. A lot of people have anticipated a Value resurgence, but each attempt has failed. Or I should say each attempt so far.

Since February 27, VTV is up 1.08%, while VUG is down 2.73%. That may not sound like much, but within the ongoing battle between Value and Growth, that’s a major short-term move, and it may continue for some time. VTV has beaten VUG for the last seven days in a row, and 10 of the last 11.

So What Does This Value Shift Mean?

When the market moves towards Value, it typically means that investors are nervous and seeking safety in cheaper names. This time around, it’s not so much that investors want Value. No, it’s that they’re fleeing Growth. An orderly exit is turning into a mad dash. Probably the best example of this has been with biotech stocks. The main Biotech ETF ($IBB) has dropped sharply over the past month. Since February 25, the IBB is off by 13.6%, and a lot of biotech names are down much more than that. Of course, we have to remember that biotech had been in an astounding rally over the past two years.

“So the last shall be first, and the first last” is a quote from the Bible, but it also could serve as a recent stock market report. Look at Tesla ($TSLA), a high-flyer which could do no wrong. The stock went from $35 one year ago to as high as $265 last month. But the past few days have been a different story. Tesla is currently 22% off its high. On the flip side, look at boring Long-Term Treasuries ($TLT). They’re supposed to be dead money, right? But the TLT is at its highest level in eight months. When the current shifts, it can be rough.

I also think the market’s shift towards Value is a reflection of what I talked about last week—investors are getting prepared for the probability of higher short-term interest rates. Last week, the bond market woke up to this idea, and the shift to Value is the stock market’s turn.

Overall, the renewed emphasis on Value is a benefit for our Buy List. In the short term, some of the prominent growth stocks like Cognizant Technology ($CTSH) have suffered in the backlash. I don’t expect that to last. Now let’s take a look at some recent Buy List news.

Wells Fargo Raises Dividend 16.7%

Last week, the Federal Reserve said that Wells Fargo ($WFC) aced its most recent stress test. I had no doubts they’d pass. It’s hardly a secret that WFC is one of the best-run big banks around.

The second part of the Fed’s test came this week to see if they’d approve their capital plans. Once again, Wells Fargo easily passed. The Federal Reserve said they had no objections to WFC’s capital plans. That includes a 16.7% increase in their dividend. The quarterly payout will rise from 30 to 35 cents per share. Last week, I said that I was expecting an increase but only of two cents. Shows what I know!

The shares jumped after the announcement. Using the new dividend and going by Thursday’s close, Wells now yields 2.85%. The board also approved a 350 million-share increase in their buyback plan.

By the way, this stress test wasn’t a cakewalk. Zion’s failed, and Citigroup’s dividend request was shot down. Six years after Bear Stearns collapsed, Citi still pays a quarterly dividend of one penny per share even though Wall Street expects them to earn $5.78 per share next year. Citigroup is still a mess, and I’m glad we have a top-tier name like Wells Fargo. Look for another good earnings report in two weeks. WFC remains a very good buy up to $54 per share.

Will DirecTV Merge with Dish?

On Wednesday afternoon, news broke that the CEO of Dish Network ($DISH) had spoken to the CEO of DirecTV ($DTV) to talk about a possible merger. Honestly, this isn’t a big surprise. Folks have talked about a merger between the two for years. In fact, they tried to merge 12 years ago, but the Federales blocked it. Today, I think DTV is the stronger company, but I have to give credit to Dish for holding its own.

Clearly, the recent merger announcement between Time Warner Cable and Comcast has changed the game, and the two satellite guys have to start thinking seriously about their future. A merger makes sense, but at what price? That’s hard to say. I think DirecTV holds the upper hand here, and it’s interesting to note that Dish’s CEO made the call. Still, DirecTV would be wise to consider an offer. DirecTV has 20 million subscribers, while DISH has 14 million (check out the amazing growth of DTV below).

A lot of this will depend on how regulators rule on the Comcast/TWC deal. If the Feds say yes to that, it will be hard for them to say no to the Direct/Dish deal. DirecTV’s CEO, Mike White, has seemed hesitant about a deal, but he hasn’t ruled it out. I think that’s the right attitude. Frankly, I think these two will get together at some point. I just don’t know when.

The immediate benefit of the merger talk is that shares of DTV jumped as much as 8% on Wednesday, although the stock pulled back as the excitement wore off. DirecTV remains an excellent buy up to $84 per share.

New Buy Below Prices

I want to update a few of our Buy Below Prices. IBM ($IBM) has been doing well lately. This week, the shares got above $195 for the first time since September. I’m expecting a dividend increase from Big Blue sometime next month. I’m raising my Buy Below to $197 per share.

On Thursday, Qualcomm ($QCOM) closed at another multi-year high. The company raised their dividend by 20% just a few weeks ago. This week, I’m bumping up my Buy Below to $83 per share.

CR Bard ($BCR) has been one of our top performers this year. I’ve already raised my Buy Below on BCR a few times, and I’ve purposely held off in the past few weeks. With the Q1 earnings season just around the bend, I feel more confident in BCR’s outlook. Bard has beaten earnings for the last six quarters, and I think they’ll do it again. I’m raising my Buy Below on BCR to $147 per share.

I’m keeping my Buy Below for Microsoft ($MSFT) at $43 per share, but I wanted to highlight the CEO’s plans for the company. For the first time in years, investors are optimistic for MSFT. Keep watching this story – it’s going to get better.

Two of our tech stocks have had a rough month: CA Technologies ($CA) and Cognizant Technology Solutions ($CTSH). I still like both stocks, but I want my Buy Below to better reflect the market’s current judgment. I’m lowering my Buy Below on CA to $34 per share, and I’m lowering Cognizant to $52 per share. Going by Thursday’s close, CA’s dividend works out to 3.28%. Both stocks are very good buys.

That’s all for now. The first quarter ends on Monday; after that, we’ll get our regular beginning-of-the-month reports. ISM comes out on Tuesday. The ADP jobs report comes out on Wednesday. Then on Friday, the government releases the big jobs report for March. With the Fed committed to tapering, I actually think the monthly jobs reports aren’t quite as important as they were last year. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – March 7, 2014

Eddy Elfenbein, March 7th, 2014 at 8:53 am“The best stock to buy is the one you already own.” – Peter Lynch

I can’t remember a week that started off so scary yet ended so optimistically. The U.S. stock market dropped sharply on Monday on the news that Russian troops had moved into the Crimea, or as our government worded it, made “an uncontested arrival.” Soon there was talk of a possible invasion of eastern Ukraine.

While Vladimir Putin was ignoring Western leaders, he may have been paying attention to the financial markets. On Monday, the Russian ruble was the worst-performing currency in the world. The ruble, which is already down 10% this year, plunged to its lowest level ever against the dollar. In order to defend its currency, the Russian Fed jacked up interest rates by 150 basis points, from 5.5% to 7.0%. That’s a huge move, and it has a cost.

We don’t know for sure, but it’s estimated that the Russian central bank shelled out somewhere between $10 billion and $12 billion to defend the ruble. For now, Russia’s foreign currency reserves are large enough to take the hit, but they can’t keep it up forever. On Monday, the Russian version of the Dow Jones, the Micex Index, plunged 11% for its worst loss in more than five years. Interestingly, Bloomberg estimates that several Russian oligarchs lost billions of dollars due to the Crimean incursion. In other words, perhaps this arrival wasn’t entirely uncontested.

Well, somebody felt the heat, because on Tuesday we heard that Putin had ended Russia’s military exercises in western Russia. Everyone breathed a huge sigh of relief. Even though the Crimean crisis is still an issue, it doesn’t look like it will become something bigger and far more unpleasant. The S&P 500 celebrated on Tuesday by shooting above 1,870 to a new all-time high. It didn’t end there. On Thursday, the S&P 500 closed at yet another new all-time, 1,877.03. This is the index’s 50th record close in the past year. Since February 3, the S&P 500 has tacked on more than 7.7%.

In this week’s CWS Market Review, I’ll bring you up to speed on the big debate on Wall Street: How much is poor weather really to blame for the soggy economic news? I’ll also share more good Buy List news with you. Qualcomm announced a 20% dividend increase, DirecTV cracked $80 per share (it’s already a 16% winner in the year for us) and eBay is at a 14-year high. Not bad. But first, let’s look at why all the weather excuses may have been correct.

The Bad Weather Excuse Has Won the Argument

Over the last few weeks, there’s been a debate raging on Wall Street about the soft economic data. The last two jobs reports weren’t so hot. The bears have said that the economy is soft and getting softer. The bulls have blamed the weak numbers on lousy weather. So who’s right?

This is a hard debate to resolve, which is probably why it’s intensified. This week, however, we got some more data that indicates that the poor-weather thesis was probably correct. This is good news for investors, and it may suggest that 2014 will be the best year for the economy since the recession. In fact, in President Obama’s latest budget quest, he forecasts real growth of 3.1% for this year. That would be the fastest growth rate in nine years. Not only that, the president sees growth accelerating to 3.4% in 2015.

Of course, those are just forecasts, and worse yet, forecasts from politicians. But let’s look at some hard numbers. On Monday, the ISM Manufacturing Index, a report I follow closely, came in at 53.2, which was above the Street’s expectations of 52.3. Any number above 50 indicates an expansion, while one below 50 signals a contraction. This was an important report because the ISM for January was a dud—just 51.3. That report came out on February 3, which marked the S&P 500’s recent low. Now that we’ve seen a healthy rebound, I think it’s safe to say that the January report wasn’t the start of a new trend.

That’s not the only evidence. We also learned on Monday that real personal-consumption expenditures rose by 0.3% in January after a 0.1% pullback in December. On the other side of the ledger, consumer spending rose by 0.4% in January after a contraction of 0.1% the month before. The January spending was led by a 0.9% increase in services. That was the biggest jump in 13 years, and it was most likely due to a greater demand for utilities. In other words, folks were trying to keep warm. Another check mark for bad weather.

But the biggest evidence to support blaming the bad weather was this week’s Beige Book, which is a collection of regional surveys done by the Federal Reserve. Eight of the 12 districts reported modest economic improvement. New York and Philadelphia had slight declines, which they blamed on the weather. Kansas City and Chicago said they were stable. Consider this stat: The December Beige Book mentioned “weather” five times. That jumped to 21 times in January. In February, “weather” was mentioned 119 times.

The next big economic report will be the February jobs report. I’m writing this early Friday morning, and the jobs numbers come out at 8:30 ET, so you may already know the results (be sure to check the blog). As I mentioned earlier, the last two jobs reports were rather weak. The economy created 75,000 net new jobs in December and 113,000 jobs in January. That’s not so hot. Put it this way: The economy averaged more than 205,000 new jobs each month for the year prior to that. If we see a big increase in non-farm payrolls for February—say, over 200,000—then it would be another signal that the economy suffered a minor weather-related blip.

We got a sneak preview of the jobs report on Wednesday when ADP, the private payroll firm, said they counted 139,000 new jobs last month. However, the ADP report doesn’t always sync up with the government’s figures. But another promising number came out on Thursday: The number of Americans filing first-time jobless claims fell to 323,000, which is a three-month low.

Lately, a number of Wall Street firms have pared back their growth forecasts for Q1 GDP. Just a few weeks ago, Goldman Sachs had expected 3% growth. Now they’re at 1.7%. JPMorgan just cut their forecast from 2.5% to 2%. I don’t have a firm view just yet, but I’m beginning to think those forecasts are too pessimistic. Either way, we’ll get our first look at Q1 GDP in late April.

The bottom line is that a lot of the market’s resiliency this week was due to more than just the calming effect in Ukraine. Investors are beginning to realize that this might be a very good year for economic growth. Let me add another point about the current market. I caution you that I’m not a technical analyst, but many chart-watchers have been impressed by the breadth of this market. In other words, a rising tide is lifting a heckuva lot of boats. It’s not a rally led by a small number of monster-sized winners like we saw during the Tech Bubble. Now let’s look at how our Buy List has been faring.

Qualcomm Raises Its Dividend by 20%

The good news for the market has been even better news for our Buy List. We’ve beaten the S&P 500 for six of the last seven days. Through Thursday’s close, our Buy List is up 2.22% for the year, which is more than the S&P 500’s gain of 1.55%. This is a pleasant turnaround for us. Less than one month ago, we were trailing the index by close to 1%. I’ve also been impressed that our systemic risk (that’s beta for you smart kids) is less than the overall market’s.

Last week, we got a 17% dividend increase from Ross Stores ($ROST). This week, we got a 20% dividend increase from Qualcomm ($QCOM). I like this stock a lot. Their quarterly payout will rise from 35 cents to 42 cents per share. The board also approved a $5 billion increase to their buyback authorization. That brings the total authorization to $7.8 billion.

If you recall, just a few weeks ago, the company handily beat Wall Street’s earnings estimates and bumped up its full-year guidance. Qualcomm also announced that Steve Mollenkopf will take over as CEO and Paul Jacobs will become the executive chairman. On Thursday, QCOM broke $77 for the first time in 14 years. Qualcomm remains a very good buy up to $79 per share.

Last week, I mentioned the public feud between Carl Icahn and eBay’s board. It got even nastier this week. The immediate positive for us is that the brawl has helped the stock. Shares of eBay ($EBAY) nearly cracked $60 this week.

Honestly, this fight is rather tedious, but I’ll boil it down for you. What happened is that eBay had bought Skype, but it didn’t do much for them, so they sold it for $2.75 billion to an investor group led by Mark Andreessen’s company (he serves on eBay’s board). Two years later, Microsoft bought all of Skype for $8.5 billion. Andreessen said that everything he did was above board and fully disclosed at the time.

Icahn ain’t buying it. In fact, he said that he’s “never seen worse corporate governance than eBay.” Really, Carl? Icahn’s goal isn’t a secret; he wants eBay to sell off PayPal, but the board has zero interest. Don’t get me wrong: I’m an Icahn fan. We need more people putting pressure on corporate boards, but even I concede that he can take things too far. Don’t expect a PayPal spinoff anytime soon. The board has made it clear that that’s a non-starter. My take: Ignore the bickering and concentrate the business. eBay remains a solid buy up to $62 per share.

More Buy List Updates

Several of our Buy List stocks have rallied strongly lately. Warren Buffett recently disclosed in his yearly Shareholder Letter that Berkshire Hathaway continues to have a big stake in DirecTV ($DTV). Buffett owns 22.2 million shares in DTV, which is 4.3% of the company. Last month, the satellite-TV crushed earnings by 23 cents per share. I also like that they’re really reducing share count with their buybacks. DTV is up 16% this year, and it’s our top-performing stock on the Buy List. This week, I’m raising our Buy Below price to $84 per share.

In January, Moog ($MOG-A) became our first dud of the year. The maker of flight-control systems missed earnings by a penny per share and guided lower for the year. The stock was clobbered and fell as low as $57 per share. But this is why we like high-quality stocks—they tend to rebound. (We just don’t know when.) Or as Peter Lynch put it in today’s epigraph, “the best stock to buy is the one you already own.” Moog shot up more than 5% on Tuesday and closed at $64.21 on Thursday. Moog continues to be a good buy up to $66 per share.

On Thursday, Wells Fargo ($WFC) got to a new high, as did Express Scripts ($ESRX). Remember it was only a few days ago that ESRX fell after its earnings report. Now it’s at a new high!

Also on Thursday, Oracle ($ORCL) came within 15 cents of hitting $40 per share. Larry Ellison’s baby last saw $40 in October 2000. The company will release its next earnings report after the closing bell on Tuesday, March 18. On the last earnings call, Oracle said to expect fiscal Q3 earnings between 68 and 72 cents per share.

I also want to remind you that Cognizant Technology Solutions ($CTSH) will split 2 for 1 on Monday. This means that shareholders will now own twice as many shares, but the share price will be cut in half, so don’t be surprised when you see the lower share price on Monday. The stock has recovered very impressively from its January sell-off. CTSH is currently up more than 20% from last month’s low. I’m raising my Buy Below on Cognizant to $112 per share, which will become $56 per share on Monday. This is a great stock.

That’s all for now. Next week will be a slow week for economic news. I’ll be curious to see the retail-sales report which is due out on Thursday. This will give us a clue as to how strong consumer spending is. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – February 21, 2014

Eddy Elfenbein, February 21st, 2014 at 7:18 am“Someone will always be getting richer faster than you. This is not a tragedy.” – Charlie Munger

Frankly, there wasn’t much important news on Wall Street this week. The markets were closed on Monday for Presidents’ Day, and earnings season is just about over.

But there’s a lurking danger whenever there’s a dearth of news. Traders don’t like a news vacuum, and that creates an environment where routine events are greatly hyped beyond their true importance. Traders need something to trade on, and if someone doesn’t give it to them, they’ll invent it. It’s either that, or watch curling.

What we saw this week was that everyone, it seemed, had an opinion on a series of mega-deals. Last week, Comcast said it’s hooking up with Time Warner Cable. Later we heard that Apple’s M&A people were talking with Tesla (dream on!). Then came the blockbuster deal: Facebook is buying WhatsApp for $16.4 billion (possibly as much as $19 billion if you include restricted stock).

WhatsApp has a grand total of 55 employees, and last year they brought in $20 million in revenue (not profits—revenue). Five years ago, WhatsApp’s CEO, Jan Koum, applied for a job at Facebook. He was rejected. Now he’s a billionaire several times over.

Is all this crazy? In my opinion, probably, but it’s added some mid-winter excitement, that’s for sure. After the deal was announced, Facebook’s stock opened lower, then rallied throughout the day, and ultimately closed higher by more than 2%.

Now some professional scolders are saying that these crazy deals are the signs of a frothy bull market. While some of these deals are hard to justify, I don’t think the entire market can be judged a bubble.

Sure, there are some trouble spots. The Q4 earnings season was decent, but it was hardly spectacular. The crummy weather has hurt a lot of retailers. Even Walmart, the big daddy of retailers, missed earnings by 25 cents per share. You don’t see that a lot. Plus, there are still troubles in many emerging markets. The news out of China is disappointing, and of course, the violence in Ukraine is heart-wrenching.

In this week’s CWS Market Review, I want to cover some of the overlooked news. The minutes from January’s Fed meeting came out this week, and if you look past the talking heads, it’s clear they’re talking about ditching the Evans Rule. That’s a big deal, and I’ll explain what that means in a bit.

We also had an outstanding earnings reports from DirecTV. The satellite-TV stock crushed estimates by 23 cents per share. The shares raced 3% higher on Thursday to hit a new all-time high. I have my new Buy Below for you (you can see our complete Buy List here. We also got good earnings reports from Medtronic and Express Scripts. I’ll also preview next week’s earnings report from Ross Stores. But first, let’s take a closer look at what’s on the Fed’s mind.

The Debate Raging within the Federal Reserve

There’s a debate raging within the Federal Reserve as to what to do about the “Evans Rule.” This was guidance adopted by the Fed, at the urging of Chicago Fed President Charles Evans, as to what specific metric would cause the Fed to raise short-term interest rates. The Fed said that it would use an unemployment rate of 6.5%. Previous Fed Chairman Ben Bernanke was careful to warn that this was a threshold and not a trigger.

The problem is that unemployment has already declined to 6.6%, and no one’s even close to raising interest rates. Most FOMC members don’t see a rate increase happening until 2015 or 2016. There are even some folks who say that low rates are here to stay and the Fed’s use of Quantitative Easing will become its primary tool to fine-tune the economy. That’s probably too extreme, but it’s being talked about.

The minutes released this week covered the Fed’s January meeting. Interestingly, the Fed`s members were surprised at the economy’s strength. That obviously contributed to the decision to gradually pare back their massive bond-buying program. But what’s interesting is that the central bank is showing no signs of backing away from taper plans, even though the last two jobs reports weren’t so hot.

Strangely, the Fed is as undecided about when to raise short-term rates as it is stubborn about tapering. In fact, the Fed may even back away from using a specific number, like Evans had suggested, and fall back on using garbled econo-speak. The plus is that this doesn’t lead the markets to false expectations. Some FOMC members favor this direction but it adds a layer of opaqueness to the Fed’s deliberations.

The Fed may elect to lower the threshold. Narayana Kocherlakota, the president of the Minneapolis Fed, wants to go down to 5.5%. I think some voting members want to get rid of a precise number altogether. As I said, markets will find something to fret about. Of course, all of this is complicated by the Fed`s having a new boss in Janet Yellen. The Fed’s next meeting, and the first one under Yellen, will be on March 18 and 19.

What this means for investors: The Fed is still clearly on the side of investors. Quantitative Easing is with us, and will be for several more months. The pace of stimulus, however, will gradually decline. The curveball about QE is that it impacts the long end of the yield curve, while traditional Fed stimulus is at the short end. Higher long-term rates could impede sectors like housing, but I doubt we’ll see much impact, although we’ve seen mortgage financing take a hit. The simple fact is that housing inventory is lean, and the market needs more homes. Bad weather may delay that fact, but it won’t change it.

This is good news for the economy and for the stock market in general. I think it’s very likely that 2014 will be one of the strongest years for economic growth in a long time. I won’t go so far as predicting a bond market sell-off, but I do think the long end of the curve is a bad place for investors. The yields are just too measly, and the math is squarely on the side of stock “longs.” Continue to focus your portfolio on high-quality stocks such as our Buy List. If the Evans Rule is altered or dropped, it could propel the market much higher. Now let’s look at some of our Buy List earnings from this week.

Medtronic Is a Buy up to $61 per Share

On Tuesday, Medtronic ($MDT) reported fiscal Q3 earnings of 91 cents per share, which matched expectations. In last week’s CWS Market Review, I said that was my estimate as well. Quarterly revenues rose by 3.4% to $4.16 billion, which was $10 million more than forecast. Medtronic is one of those stable-growth companies. It’s not blistering growth, but it’s steady.

Medtronic also narrowed its full-year guidance from $3.80 – $3.85 per share to $3.81 – $3.83 per share. Note that their fiscal year ends in April. For the first three quarters of this fiscal year, MDT earned $2.70 per share, so that implies fiscal Q4 earnings of $1.11 – $1.13 per share. Wall Street had been expecting $1.12 per share.

Overall, this was a good quarter for Medtronic. Sales of their diabetes products rose by 16%. The medical-devices company was particularly strong in emerging markets, where sales rose by 10%. MDT expects to do even better in EM in the coming quarters.

Even though these results were almost exactly what I had expected, the stock dropped nearly 3% after the report came out, then rallied the rest of the week. By the closing bell on Thursday, the shares were 40 cents higher than they were before the report. Naturally, this makes no sense, but it’s what markets do (remember what I had said about Facebook earlier). In any event, Medtronic remains a high-quality buy up to $61 per share.

DirecTV Smashes Wall Street’s Earnings Estimate

In last week’s CWS Market Review, I said that Wall Street’s consensus was too low on DirecTV’s ($DTV) earnings. I was right about that. On Thursday, the satellite-TV company reported Q4 earnings of $1.53 per share, which was 23 cents better than expectations.

This was an outstanding quarter for DTV. The shares gapped up 3% on Thursday to a new all-time high. Latin America continues to be a growth powerhouse. Last year, revenues there were up 10%, and they added 1.2 million net subscribers. This is especially good since the macro picture is, shall we say, less than clear in some parts of Latam. The company plans to add another one million new Latin American subscribers this year.

The U.S. wasn’t so bad either. DTV added 93,000 new American subscribers. Analysts were expecting an increase of just 21,000. DirecTV also announced a buyback program of $3.5 billion. I’ve long been a critic of shareholder repurchases, but DTV is one of the few companies that do it right. They actually reduce their overall share count. Imagine that! Over the last seven years, DTV’s share count is down by 57%. Working out the math, a $3.5 billion buyback is roughly 9% of DTV’s market cap. I’m raising our Buy Below on DirecTV to $80 per share.

Express Scripts Is a Buy up to $83 per Share

On Thursday, Express Scripts ($ESRX) reported that it earned $1.12 per share for the fourth quarter. That also hit expectations on the nose. This really wasn’t a major surprise, since in October, the pharmacy-benefit manager told us to expect Q4 earnings to range between $1.09 and $1.13 per share.

I was especially curious to hear what ESRX had to say in the way of guidance. For all of 2014, they see earnings ranging between $4.88 and $5 per share. Those are very good numbers, and it gives the stock a reasonable valuation. The Street’s consensus had been for $4.93 per share. In a press release, Express Scripts said it’s “targeting annual earnings per share growth of 10 per cent to 20 per cent for the next several years.”

Previously, I said I wanted to see the earnings report before I decided to alter our Buy Below price. Now I see it, and I’m pleased with what I see. This week, I’m raising our Buy Below on ESRX to $83 per share.

Preview of Ross Stores, and a Few New Buy Below Prices

We have one earnings report due next week, from Ross Stores ($ROST). I like Ross a lot; it’s one of my favorite deep-discount retailers. That’s why I was so surprised when they gave a dour outlook for Q4 earnings. Ross said to expect fourth-quarter earnings (their Q4 covers November-December-January) to range between 97 cents and $1.01 per share. Wall Street had been expecting $1.09 per share.

Wall Street didn’t like that at all. ROST dropped from a high of $82 just prior to Thanksgiving to less than $66 in early February. The question is, how much of this is due to Ross, and how much is due to a lousy environment for retail? Like I said, even Walmart is having trouble. It appears that lousy weather has hurt shopping across broad stretches of the country.

Ross is due to report earnings next Thursday, February 27. I think investors are looking past the Q4 numbers and want to see any guidance for 2014. I’m inclined to think that ROST’s problems are sector-related and not specific to them. Ross Stores continues to be a good buy up to $74 per share.

Before I go, I want to make a few Buy Below adjustments. Stryker ($SYK) continues to do very well for us. A few weeks ago, the company beat earnings and guided higher. The stock hit another 52-week high this week. Remember that after the earnings report, the stock fell, which should tell you all you need to know about the market’s short-term judgment. This week, I’m raising our Buy Below on Stryker to $87 per share.

Two weeks ago, I lowered the Buy Below on Fiserv ($FISV) after the stock missed earnings by a penny. I’ve mulled this over, and I think I acted too rashly. FISV is a dependable stock, and it’s rallied for six of the last seven days. I’m lifting my Buy Below on Fiserv to $60 per share.

I’m pleased to see CR Bard ($BCR) rebound so well. Since February 3, shares of Bard have rallied 12%, and the stock just hit a brand-new 52-week high. Look for another dividend increase this spring. I’m raising our Buy Below on BCR to $144 per share.

Finally, I’m keeping our Buy Below for Cognizant Technology ($CTSH) at $104 per share, but remember that it’s going to split 2 for 1 in early March. Our Buy Below will split along with it. Until then, CTSH remains a very good buy up to $104 per share, and $52 per share post-split.

That’s all for now. Next week is the final trading week of February. On Tuesday, the Consumer Confidence report comes out. Thursday is the Durable-Goods report, and after the bell, we’ll hear Q4 earnings results from Ross Stores. On Friday, the government will revise the Q4 GDP report. The initial report said the economy grew by 3.2% during the last three months of 2013. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

DirecTV Earnings Miss

Eddy Elfenbein, August 1st, 2013 at 11:19 amWe had one disappointment today with DirecTV ($DTV). For the second quarter, DTV earned $1.18 per share which was 16 cents below expectations. Revenues rose 6.6% to $7.7 billion which was slightly below forecasts.

The big problem for the satellite-TV company was Latin America. Analysts were expecting the Latam subscriber count to rise by more than 420,000. Instead, it rose by just 165,000. To put this into context, last year, DTV added 645,000 new subscribers in that region. The company said that macroeconomic conditions were partly to blame, especially in Brazil. In the U.S., subscriber count fell by 84,000.

The stock is currently down about 3% today

-

CWS Market Review – July 12, 2013

Eddy Elfenbein, July 12th, 2013 at 7:06 am“I guess I should warn you, if I turn out to be particularly clear,

you’ve probably misunderstood what I’ve said.” – Alan GreenspanWhat a difference six days make. The S&P 500 has rallied for the last six days in a row, and on Thursday, the index reached an all-time high close, although we’re still a bit short of the all-time intra-day high. The small-cap Russell 2000 is at an all-time high and the Nasdaq Composite is at its highest point in 13 years. Check out how poorly the S&P 500 has performed compared with the Russell 2000.

What’s the cause for the about-face? It all comes down to the Federal Reserve—or more specifically, people’s expectation of what the Fed is thinking. After throwing a minor temper tantrum, Wall Street has apparently reconciled itself to the fact that the Fed will start tapering its bond purchases in September.

In this week’s CWS Market Review, we’ll take a closer look at what this means and how it impacts our portfolios. We’ll also take a look at some upcoming earnings reports for our Buy List. Speaking of which, our Buy List has been en fuego lately. Just look at Cognizant Technology ($CTSH). Two weeks ago, I spotlighted CTSH as an especially good buy, and the stock is up 13% since then. I’m raising my Buy Below for Cognizant to $76 per share. Thanks to the rally, I have several more updated Buy Below prices. Before we get to those, let’s look at why the markets are so happy this week.

Bernanke Calms the Market’s Panic Attack—Which He Created

In last week’s CWS Market Review, I said traders were on the lookout for this week’s release of the minutes from the Fed’s June meeting. It was in June that Ben Bernanke’s post-meeting press conference sent the stock market into a quick dizzy spell.

Traders read far too much into the Fed’s caution that their bond buying program will, at some point, slowly wind down. Ever since that press conference, the central bank has been hard at work trying to calm the market down. Ben and Friends want to make it absolutely clear that they’re not going to pull the rug out from the economy.

One piece of encouraging news came last Friday when the government reported that the economy created 195,000 new jobs in June. That was 30,000 more than expected. How’s this for consistency: According to the government, 199,000 jobs were created in April, and 195,000 were created in May. These are decent numbers, though there’s a lot of room for improvement. Still, we had a seven-month run last year where every report was less than 170,000.

An improving labor market is important for several reasons. It obviously means more folks drawing paychecks who are eager to buy more things. While Corporate America has done a great job cutting back on expenses, you can’t improve profit margins forever. At some point, you need more bodies in the door.

Mr. Bernanke has often pointed out that helping the jobs market is part of the Fed’s mandate, and he’s pledged to add monetary stimulus until there’s substantial improvement in the economy. In a Q&A on Wednesday, Bernanke said that the current unemployment rate probably understates the strength of the jobs market due to low workforce participation. In English, that means we don’t really know how bad things are, because a lot of folks have simply stopped looking for work.

Bernanke also did something interesting in those remarks. He made it clear that short-term interest rates will remain low for a long time after any bond buying starts to taper off. I think he sees rates staying low into 2015, and perhaps beyond. Of course, this will be long after he’s left D.C. The important thing is that QE is not the same as holding down short-term rates, and the Fed sees these as two distinct policies.

A lot of market watchers have been concerned about the rapid run-up in long- and intermediate-term interest rates. The five-year Treasury jumped 95 basis points in two months. In effect, the economy is tightening credit on itself. Bernanke is clearly concerned about this, but any concerns that the housing market is about to be slammed shut are very premature (although there have been some big cracks in a number of mortgage finance stocks).

The odd thing is that a lot of investors have reacted as if the Fed has suddenly changed its game plan. That’s not the case at all. Looking at the details, the central bank has been pretty consistent. The market’s reaction, however, has been wildly inconsistent. While the stock market has made back all of its losses, the five-year Treasury has fallen only 20 basis points from its 95-point surge.

Looking at the makeup of the market also gives us some clues. For example, the Consumer Discretionary Sector ($XLY) has now risen for 12 days in a row. That’s exactly what we would expect to see when knowing that the Fed is on the side of the stock market. The Discretionaries include companies like Bed Bath & Beyond ($BBBY) and Ford Motor ($F). Basically, it’s stuff that people would like to buy, not what they have to buy. This is important because strength here points to broader optimism.

The message from Bernanke is crystal clear even though some folks are desperate to hear something different. The Federal Reserve will continue to be on the side of stocks and not bonds. Bernanke just watched a big drop in bonds and did nothing to stop it. What does that tell you? Keep focusing on our Buy List names, and ignore any market hiccups. That’s just part of being an investor. This will be another good earnings season for us. Now let’s look at our Buy List.

Our Buy List Is up 21.27% for the Year

Our Buy List has been punching like champ lately. We’re now up 21.27% for the year, and it’s not even the All-Star Break yet. I want to run down some of our big winners and give you some new Buy Below prices. Our #1 performer this year is quiet little Moog ($MOG-A), which is inches away from being our first 40% winner for the year. Of our 20 stocks on the Buy List, 13 are up more than 20% this year, including six that are up more than 30%. This week, I’m raising my Buy Below on Moog to $57.

Several of our stocks have been hitting new highs lately, like Ford Motor ($F). On Thursday, shares of F came within one penny of hitting $17 per share. The upcoming earnings report could be a home run. Ford continues to be a great buy up to $18 per share.

It seems like it was only a week ago that I raised my Buy Below on WEX Inc. ($WEX) and Bed, Bath & Beyond ($BBBY). Actually, it was only a week ago, but both stocks have powered right through to new highs. This week, I’m raising WEX to $86, and BBBY to $79.

AFLAC ($AFL) continues to do well for us. On Thursday, the stock got as high as $59.38, which is the highest price in more than two years. AFL is still going for less than 10 times this year’s earnings estimate. I’m looking forward to another good earnings report at the end of this month. I’m raising AFL’s Buy Below to $63 per share.

Last month, traders panicked due to our FactSet’s ($FDS) terrible, awful, horrible earnings. In other words, FactSet merely met the Street’s earnings forecast. At the time, I said FDS “is doing just fine.” Sure enough, the stock has since made back everything it lost and broken out to another new high. (If it weren’t for panicky traders, we wouldn’t have any traders at all.) I’m raising our Buy Below on FactSet to $112 per share.

I have three more Buy Below changes: I’m raising CA Technologies ($CA) to $31 per share, Harris ($HRS) to $53 and CR Bard ($BCR) to $115. Earnings for all three will be coming soon.

I also want to mention that DirecTV ($DTV) is bidding to buy Hulu, which is an online video service. This is a pretty high-profile bidding war for Hulu. I don’t have any new info, but I’ll add that DTV tends to be pretty conservative in these matters, and I know they’re not afraid to walk away from a deal if it’s not a good fit.

I’ll warn you that the bidding war may cause some near-term volatility for DTV. If they lose, which is probable, the stock will probably rally. Incidentally, DTV got a nice bump on Thursday when Liberty Media’s Chairman John Malone said that DISH and DTV should merge. I really don’t see that happening. Either way, DirecTV remains an excellent buy up to $67 per share.

Upcoming Earnings from Microsoft and Stryker

Before we get to the next week’s earnings, I have to make a correction. Last week, I said that JPMorgan ($JPM) and Wells Fargo ($WFC) were due to report earnings on Thursday, July 11th. That’s incorrect. Both banks will report on Friday, the 12th, which is just after the deadline for this week’s issue. No need to worry. I’ll cover the earnings report in next week’s CWS Market Review. Also, I previewed the earnings in last week’s issue, which you can see here. My apologies for any confusion.

Assuming my calendar is right, this Thursday, July 18th, Microsoft ($MSFT) and Stryker ($SYK) are due to report Q2 earnings. For Microsoft, the June quarter is the fourth quarter of their fiscal year. Both have been excellent stocks for us this year.

In April, Microsoft had a very good earnings report, and this news came at a time when a lot of big-name firms were disappointing Wall Street. The software giant earned 72 cents per share, which was four cents more than estimates.

It’s true that MSFT is being hurt by slower PC sales, and Windows 8 didn’t blow people away. But lots of other areas are going well for them. Microsoft’s corporate business is picking up, and Xbox biz looks quite good. The company generates an astounding cash flow.

On Thursday, Microsoft announced a major reorganization. They’re revamping their eight divisions into four. The new structure is designed to offer more collaboration and diminish rivalries. Steve Ballmer has said he wants Microsoft to be known as a “devices and services” firm.

I tend to be a bit skeptical about high-profile reorganizations. They can be done, but reorgs are usually more difficult than originally assumed. On Thursday, MSFT came within one penny of a new 52-week high. Wall Street currently expects 75 cents per share for next week’s earnings report. That’s almost certainly too low. I’m going to bump up my Buy Below price to $38 per share. Microsoft remains a very good buy.

Stryker exploded out of the gate for us this year. SYK was up 16% before the end of January. The medical-devices company has said that it expects $4.25 to $4.40 per share this year. It’s still early, but I think SYK should easily clear $4.30 per share this year. Stryker earned $1.03 per share for Q1, and their result for Q2 is usually very close to what they earned in Q1. Sure enough, Wall Street’s consensus for Q2 is for $1.03. Stryker remains a very good buy up to $71 per share.

That’s all for now. Earnings season rolls on next week. We’ll get reports from Microsoft and Stryker. There will also be several key economic reports. Retail sales is on Monday; on Tuesday, we’ll get a look at consumer inflation; and industrial production is on Wednesday. Then housing starts on Thursday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

DirecTV Crushes Earnings

Eddy Elfenbein, May 7th, 2013 at 9:58 amExcellent news today for DirecTV ($DTV). The company absolutely demolished its earnings report. For Q1, DTV earned $1.43 per share which was 33 cents better than Wall Street’s forecast. The earnings were higher than all 18 forecasts made by analysts on Wall Street. Revenues rose 7.6% to $7.58 billion which was $50 million better than estimates.

Once again, Latin America was the key to DTV’s success. Subscriber count grew by 583,000 in that region and there are now 16 million subscribers in Latin America. They’re not doing so badly in North America either. DTV added 21,000 subscribers in the U.S.

I’ve often highlighted DTV as a company that does share repurchases right. Last quarter, they bought back $1.38 billion worth of their shares. The stock closed yesterday at $57.96. It’s been as high as $61.50 this morning, which is a 6.1% gain. Right now, it’s hanging in at $60.36, which is a 4.1% gain.

-

DirecTV’s Outlook for 2013

Eddy Elfenbein, February 15th, 2013 at 9:21 amAfter DirecTV ($DTV) reported great earnings yesterday, the stock opened higher, but the shares retreated throughout the day.

I think traders were unnerved by the company’s loss on Venezuela’s currency devaluation. According to the earnings call, the devaluation will cost DTV “approximately $160 million.”

Still, the company has a fairly upbeat outlook. DirecTV specifically said, “we’re forecasting earnings per share to be $5 or greater in 2013.”

Here are some key bits from the earnings call:

Next I would like to make a few comments about our consolidated outlook. Let me begin by providing some additional color on our EPS outlook for 2013. Depreciation expense at DIRECTV Latin America and DIRECTV U.S. will increase by roughly 30% and 10%, respectively, compared to 2012. In addition, our effective tax rate will also be a few percentage points higher in 2013 as our 2012 rate benefited from the completion of a prior year audit, and we don’t expect to have benefit going forward. As a result, we’re expecting our effective tax rate this year to be in the mid-to-high 30% range. Having said that, excluding onetime items such as the Venezuela pretax devaluation charge of approximately $160 million, our guidance that we provided at our Investor Day in December 2010 remains intact as we’re forecasting earnings per share to be $5 or greater in 2013. Free cash flow will likely come in lower than 2012 levels due mostly to the impact of the Venezuelan devaluation, as well as from higher taxes and interest. Cash taxes are expected to be higher in 2013 due to greater earnings before taxes, and a higher cash tax rate is expected to be in the mid-to-high 30% range, primarily due to an expected tax payment in 2013 upon the close of a tax audit, reversal of depreciation of benefits associated with prior year economic stimulus programs and the absence of a state tax credit carryforward that we had in 2012.

Finally, in terms of DIRECTV’s strategy for returning capital, I’d like to first point out that our top priority for creating shareholder value remains to reinvest in our businesses. And as you heard from Mike earlier, if opportunities do not arise that meet our regular strategic and financial hurdles, we will continue our capital allocation strategy for share repurchases as we believe DIRECTV stock remains significantly undervalued. As such, on Tuesday, our Board of Directors authorized a new $4 billion share repurchase program and terminated the balance of roughly $860 million that remained from the previous authorization. We’re expecting that this new authorization will provide sufficient funding to support our buyback program through early next year.

All in all, we entered 2013 from a position of strength, thanks to our strong balance sheet, cash flow, competitive position and quality subscriber base across the Americas. And if we accomplish all of our targets and deliver the expected financial results, I believe we will continue to lead the industry in revenue and earnings growth, as well as creating substantial shareholder value.

-

CWS Market Review – February 15, 2013

Eddy Elfenbein, February 15th, 2013 at 6:07 am“Individuals who cannot master their emotions are ill-suited to

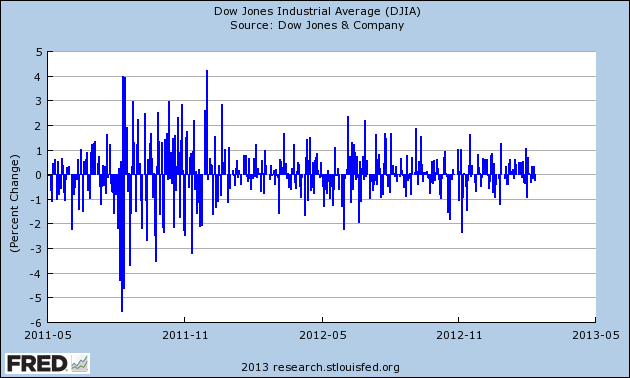

profit from the investment process.” – Benjamin GrahamRemember when stock prices used to change each day?

OK, I’m exaggerating…but not by much. Bespoke Investment Group notes that the average daily spread between the high and the low on the Dow Jones is at a 26-year low. Stocks simply ain’t moving around very much these days.

While the stock market got off to a great start this year, since late January it’s nearly slowed down to a complete halt, particularly the intra-day swings. The Volatility Index ($VIX) is near a six-year low. Fortunately, the little volatility there has been has been positive, so the broad market indexes have continued to rise, albeit very slowly. On Thursday, the S&P 500 closed at its highest level since Halloween 2007.

One theme that’s been dominating Wall Street lately is the idea of a Great Rotation, meaning money will massively swarm out of bonds and into stocks. I do think some of that will happen—in fact, it’s currently happening—but I don’t foresee sky-high bond yields anytime soon. The 10-year T-bond is right at 2%, which is pretty darn low. Instead, what we’re seeing is investors gradually becoming bolder and taking on more risk. That’s very good for our style of investing.

In this week’s CWS Market Review, I want to take a closer look at this moribund market. As quiet as it’s been, I don’t think the market’s reticence will last much longer. I also want to highlight an outstanding earnings report from DirecTV ($DTV). The stock crushed Wall Street’s estimate by 42 cents per share! We’ll also focus on Bed, Bath & Beyond ($BBBY), which has finally drifted low enough to be a very compelling buy. But first, let’s look at what’s been happening on the street of dreams.

Investors Need to Focus on High-Quality Stocks

One important development is that economically cyclical stocks are again leading the market. If you recall, the cyclicals began a massive rally last summer right around the time when Mario Draghi promised to do “whatever it takes” to save the euro. The cyclicals were given another boost a few weeks after that when the Fed announced its QE-Infinity program.

Consider this: If the S&P 500 had kept pace with cyclicals, it would be at about 1,750 today instead of 1,521. Cyclical leadership finally petered out in late January but has come back with a vengeance. The Morgan Stanley Cyclical Index (CYC) has outpaced the S&P 500 for five days in a row. The ratio of the Cyclical Index to the S&P 500 is now close to an 18-month high.

I think there are two reasons for this trend. One is simply that many cyclical stocks got very cheap. I think our own Ford Motor ($F) is a perfect example of that. Harris ($HRS) and Moog ($MOG-A) are other good examples. But another reason is that economy is probably better than many analysts realize. The negative GDP report for Q4 understandably upset a lot of folks, but the recent trade numbers will probably cause that negative 0.1% to be revised upward to somewhere around +1.0%.

Earnings for Q4 have been pretty. According to data from Bloomberg, 73% of the 288 companies in the S&P 500 that have reported Q4 earnings have topped estimates; 67% have beaten sales estimates. As I’ve discussed before, the major concern is that corporate profit margins have been stretched about as far as they can go. I’m concerned that Wall Street’s earnings forecasts are too optimistic, and we’re going to see a spate of earnings as the year goes on.

One of the interesting aspects of the recent rally is that the large mega-caps haven’t really joined in. Since the beginning of October, the S&P 100, which is the biggest stocks in the S&P 500, has consistently lagged the S&P 500. That’s not necessarily bad news, but it means that the little guys are getting most of the gains. One possible worry is that the gains are largely going to low-quality names. That’s often a sign of a market peak. Our Buy List, for example, started trailing the overall market in 2007. But when the plunge came, we didn’t fall nearly as much as rest of the market.

Until this sleepy market eventually wakes up, I urge investors to focus on top-quality. Please pay close attention to my Buy Below prices on the Buy List. We don’t want to go chasing after stocks. Let the good stocks come to you. Speaking of which, my favorite satellite TV stock just reported great earnings, and the stock is lower than where it was five months ago.

Buy DirecTV Up to $55 per Share

We had very good news on Thursday when our satellite-TV stock, DirecTV ($DTV), reported blow-out earnings for Q4. The company raked in $1.55 per share for the quarter, which creamed Wall Street’s forecast by 42 cents per share. Wow! For comparison, DTV made $1.02 per share in the fourth quarter of 2011,

So what’s the secret to DirecTV’s success? That’s easy; it’s all about Latin America. DirecTV has done very well in the United States, but that’s a fairly saturated market. Not so in the Latin world, where satellite TV demand is just getting started. DTV now has 10.3 million subscribers in Latin America, up from 7.9 million one year ago. Last quarter, DirecTV added 658,000 customers in Latin America, which was a lot more than expected.

For Q4, DirecTV added 103,000 subscribers in America, which brings their total to 20.1 million. That’s a big business, and I especially like anything involving recurring revenue. The company said it expects to see mid-single-digit revenue growth in the U.S. over the next three years. I was also pleased to see that the cancellation rate in the U.S. dropped from 1.52% to 1.43%. DirecTV has specifically made an effort to increase retention. The cost of adding one new subscriber is far more than that of retaining an existing one. For all of 2012, DTV had a solid year, earning $4.58 per share.

The only negative is that DTV said its earnings will take a one-time hit from the currency devaluation in Venezuela. The company also announced a $4 billion share buyback, which is equivalent to about 13% of DTV’s market value. I think DTV should have little trouble earning $5 per share this year. This is a good stock going for a good value. DirecTV remains an excellent buy up to $55.

Bed, Bath & Beyond Is Finally Looking Cheap

I want to focus on Bed, Bath & Beyond ($BBBY), which had been one of my favorite Buy List stocks, but a string of earnings warnings rocked the shares last year. While 2012 was unpleasant, I think the stock has now fallen back into being a very good buy at this price.

Let’s review what happened last year. In June 2012, Wall Street had been expecting fiscal year earnings (ending February 2013) of $4.63 per share, which represented 14% growth over the year before. But the company surprised investors by telling us to expect earnings growth somewhere between the single digits and the low double digits.

No biggie, right? Guess again. Traders gave BBBY a super-atomic wedgie as the stock got crushed for a 17% loss in one day. Now here’s the odd part: Here we are eight months later, and it looks like BBBY will earn about $4.54 per share for the year, give or take. In other words, that dreaded earnings warning turned out to be about 2% or so.

After the earnings report in September, BBBY got hammered for a 10% one-day loss when it reiterated the exact same full-year forecast. Then, for the December earnings report, BBBY only got nailed for 6.5% after it reiterated, you guessed it, the exact same full-year earnings forecast.

For Q4 (which covers the holidays so it’s the big dog of BBBY’s fiscal year), the company said earnings would range between $1.60 and $1.67 per share. The Street was expecting $1.75 per share. C’mon, this lower guidance isn’t that bad. But traders have lost confidence in BBBY. The shares have plunged from over $75 in June to as low as $55 in December, although it’s come up a bit since then.

Now let’s run some numbers: If Bed, Bath & Beyond can increase earnings by 10% for next fiscal year (which begins in two weeks), that should bring them to roughly $5 per share. That means we’re looking at a stock that’s going for less than 12 times earnings and growing at 10% per year. Furthermore, the recovering housing market should continue to aid them. While BBBY looks cheap, I suspect it will take a while before the stock comes back to life. The earnings warnings really spooked traders. The next earnings call isn’t until April 10. Bed, Bath & Beyond is a good buy up to $60 per share.

That’s all for now. Next week, the stock market will be closed on Monday in honor of George Washington’s birthday. On Tuesday morning, Medtronic ($MDT) will report fiscal Q3 earnings. Last month, MDT bumped up the low end of their fiscal year guidance. We’ll also get the CPI report on Thursday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I recently posted a list of 11 very overpriced stocks that you should sell ASAP.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015