-

Unemployment and Stock Returns

Posted by Eddy Elfenbein on January 27th, 2011 at 10:21 pmOne of the best times in stocks is when it’s a rotten time for everyone else. It’s sad, but true. When the stock market was a “screaming buy” in August 1982, the unemployment rate was close to 10%.

In March 2009, the jobless rate was 8.6% and it continued to rise to a peak of 10.1% in October 2009.

I broke out stock market returns since 1948 and sorted them by unemployment rate. Of the 63 years, a total of 396 months or 33 years saw the unemployment rate over 5.5%. Combined, the stock market produced an average annualized return of 15.0%.

For the remaining 360 months or 30 years, the unemployment rate was below 5.5%. The stock market produced an annualized return of 7.1%.

-

NICK and DLX Gave Us a Big Boost Today

Posted by Eddy Elfenbein on January 27th, 2011 at 5:44 pmToday was an outstanding day for our Buy List. Thanks to great earnings from Nicholas Financial (NICK), that stock rallied for a 4.89% gain today. The shares closed at $12.22 which is NICK’s highest close in over four years.

The other big gainer was Deluxe (DLX) which rose 3.95% on better-than-expected earnings. The stock hit a new 52-week high today. We already have a 10.95% gain in DLX for the year.

We also saw decent gains from Ford (F) and Leucadia (LUK). Both Oracle (ORCL) and Leucadia made new 52-week highs. AFLAC (AFL) also hit a new 52-week high of $58.84 early in the day but it gave some back before the close.

For the day, the Buy List gained 0.74% which was well ahead of the 0.22% gain for the S&P 500. For the year thus far, we’re up 5.52% compared with the S&P 500’s 3.33%.

This is shaping up to be one of the best Januarys for Wall Street in a long time. My advice: Don’t get used to it.

-

Hawkins -17%, I Called It

Posted by Eddy Elfenbein on January 27th, 2011 at 1:46 pmHawkins Inc. (HWKN) is getting killed today. The stock is down about 17% due to a disappointing earnings report.

This caught Wall Street off guard, but NOT those who have been reading this website. Six weeks ago, I wrote, Time to Sell Hawkins:

I’ve watched Hawkins for years, so it’s odd for me to see the stock become so popular lately. The shares closed at a new all-time high of $49.20 — and I say that that is way too much. If I owned the stock (which I don’t), I’d sell it right now. It’s had a good ride, but $50 is simply too expensive.

-

Breaking Down NICK’s Earnings

Posted by Eddy Elfenbein on January 27th, 2011 at 1:07 pmI’m looking through NICK’s earnings report and the numbers are very strong. For the calendar year, NICK earned $1.18 per share. That’s outstanding.

Even if NICK merely maintains the 38 cents per share rate of this past quarter for all of 2011, they’ll earn $1.52. That’s not even including the company’s overall net portfolio yield of about 7%.

I always like how the company breaks down the numbers in their reports. You can check out this spreadsheet for all the important numbers.

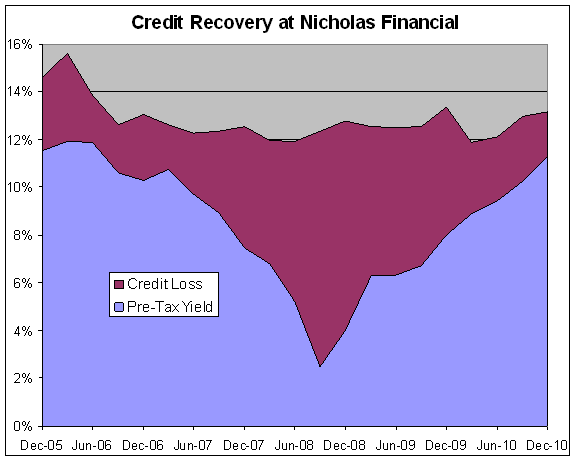

The story with NICK is that their portfolio has continued to do well but the provision for credit losses took a large bite out of the bottom line.

Here’s a look at NICK’s pre-tax earnings yield plus the credit losses. When you add them together, you can see that it’s been pretty stable.

-

Nicholas Financial Earns 38 Cents Per Share

Posted by Eddy Elfenbein on January 27th, 2011 at 10:07 amMore great earnings today, this time from Nicholas Financial (NICK): For their fiscal third quarter, NICK earned 38 cents per share which is a big jump from 25 cents per share last year.

Nicholas Financial, Inc. (NASDAQ: NICK), announced that for for the three months ended December 31, 2010 net earnings increased 54% to $4,475,000 as compared to $2,909,000 for the three months ended December 31, 2009. Per share diluted net earnings increased 52% to $0.38 as compared to $0.25 for the three months ended December 31, 2009. Revenue increased 11% to $15,995,000 for the three months ended December 31, 2010 as compared to $14,365,000 for the three months ended December 31, 2009.

For the nine months ended December 31, 2010, net earnings increased 58% to $12,033,000 as compared to $7,605,000 for the nine months ended December 31, 2009. Per share diluted net earnings increased 55% to $1.01 as compared to $0.65 for the nine months ended December 31, 2009. Revenue increased 11% to $46,679,000 for the nine months ended December 31, 2010 as compared to $42,216,000 for the nine months ended December 31, 2009.

According to Peter L. Vosotas, Chairman and CEO, “We are pleased to report record 3rd quarter revenue and earnings. Our results were favorably impacted by an increase in revenues and a reduction in the net charge-off rate. In the third quarter the Company entered the Illinois and Missouri markets, where we have signed leases for new branch locations in Chicago and St. Louis. We expect these new locations to be fully operational by the end of the fourth quarter. The Company will then operate in fourteen states with a total of 56 branch locations.

Nicholas Financial, Inc. is one of the largest publicly traded specialty consumer finance companies based in the Southeastern states. The Company presently operates 54 branch locations in both the Southeastern and the Midwestern states. The Company has approximately 11,800,000 shares of common stock outstanding. For an index of Nicholas Financial, Inc.’s news releases or to obtain a specific release, visit our web site at www.nicholasfinancial.com.

-

Deluxe Earned 78 Cents Per Share

Posted by Eddy Elfenbein on January 27th, 2011 at 9:29 amDeluxe (DLX) just reported adjusted earnings of 78 cents per share which was seven cents more than expectations. They also gave EPS guidance of $2.85 to $3.10 for this year which makes the forward P/E Ratio somewhere around eight.

Here’s the press release:

Deluxe Corporation (NYSE:DLX – News) reported fourth quarter revenue of $351.5 million, up 3% compared to the prior year, and adjusted diluted earnings per share (EPS) of $0.78 compared to $0.70 in the prior year. Adjusted diluted EPS for both periods excludes restructuring costs related to our cost reduction initiatives. Adjusted diluted EPS for 2009 also excludes the impact of transaction-related costs associated with acquisitions. Earnings were better than the previous outlook for the current period due primarily to favorable product mix, cost reduction and spending controls and a lower effective tax rate.

Reported diluted EPS was $0.68 on net income of $34.8 million in the fourth quarter of 2010 and was $0.59 on net income of $30.5 million in the comparable quarter of 2009. Results for 2010 include restructuring-related costs of $7.8 million, or $0.10 per diluted share, associated with infrastructure consolidations, operational improvements in sales, marketing and fulfillment, and other cost reduction initiatives. Results for 2009 included restructuring and transaction-related costs of $8.7 million, or $0.11 per diluted share.

“We are pleased to finish the year by delivering another solid quarter,” said Lee Schram, CEO of Deluxe. “With strong performance in all three segments, we reported revenue near the high end of our expectations. Business services revenue grew 17 percent over last year, while checks and forms performed well against our expectations. All this, combined with continued strong execution against our cost reduction program and spending controls drove higher than expected earnings per share.”

Fourth Quarter Performance

Revenue for the quarter was $351.5 million compared to $340.3 million during the fourth quarter of 2009. Small Business Services segment revenue of $204.2 million was $1.8 million lower than the comparable 2009 quarter as growth in business services, the Safeguard distributor channel and the Canadian businesses nearly off-set the decline in check and form usage. Financial Services revenue was $6.9 million lower than the fourth quarter of 2009 driven by lower order volume. Direct Checks revenue increased $19.9 million due to $21.5 million of revenue from the April 2010 acquisition of Custom Direct, Inc. Excluding the effect of Custom Direct products, Direct Checks would have been down only 4 percent due to strong customer re-order performance.

Gross margin was 64.0 percent of revenue compared to 62.8 percent in 2009. The favorable impact of the Company’s cost reduction initiatives was partially offset by increased material costs and delivery rates.

Selling, general and administrative (SG&A) expense increased $5.5 million in the quarter compared to 2009. Increased SG&A expense associated with the Custom Direct acquisition and our brand awareness and direct response advertising campaigns were partially offset by benefits from the continued execution of our cost reduction initiatives.

Operating income in 2010 was $60.9 million compared to $55.8 million in the fourth quarter of 2009. Operating income was 17.3 percent of revenue compared to 16.4 percent in the prior year driven primarily by benefits from our cost reduction initiatives.

Reported diluted EPS increased $0.09 from the prior year driven by the higher operating income and a lower effective tax rate.

Fourth Quarter Performance by Business Segment

Small Business Services revenue was $204.2 million versus $206.0 million in 2009. Revenue was lower in the quarter as growth in business services, the Safeguard distribution channel and the Canadian businesses did not fully offset volume declines in checks and forms. Operating income in 2010 increased to $32.7 million from $23.6 million in 2009. Restructuring and transaction-related costs were $4.2 million lower than in 2009.

Financial Services revenue was $88.0 million compared to $94.9 million in 2009. The decrease was primarily due to lower order volumes caused by check usage declines, partly offset by growth from non-check services. Operating income in 2010 decreased to $13.0 million from $17.8 million in 2009. Restructuring-related costs were $2.7 million higher than in 2009.

Direct Checks revenue was $59.3 million compared to $39.4 million in 2009. The Custom Direct acquisition in April contributed $21.5 million in the quarter which was partly offset by lower order volume resulting from the continued decline in check usage. Operating income in 2010 was $15.2 million, compared to $14.4 million in 2009. Restructuring-related costs were $0.6 million higher than in 2009.

Cash Flow Performance

Cash provided by operating activities for 2010 totaled $212.6 million, an increase of $6.2 million compared to 2009. The increase was due primarily to improved earnings and a contract settlement received during the third quarter, partially offset by higher performance-based compensation payments in the first quarter and higher income tax payments.

Business Outlook

The Company stated that for the first quarter of 2011, revenue is expected to be between $342 and $350 million. Diluted EPS is expected to be between $0.68 and $0.73. For the full year, revenue is expected to be between $1.375 and $1.415 billion, and diluted EPS is expected to be between $2.85 and $3.10, which includes benefits from an incremental $65 million in cost reductions, net of investment. The Company also stated that it expects operating cash flow to be between $205 million and $225 million in 2011. Capital expenditures are expected to be approximately $35 million.

“We have made tremendous progress in transforming Deluxe and still have many opportunities ahead of us in 2011,” Schram stated. “We believe we are entering the new year well positioned to grow revenue through clear alignment on our strategic direction, focus on our customers, diversity in our channels, and the extensive depth and breadth of our product and services offerings. If the economy improves, we should have further upward opportunity in our Small Business Services revenue.”

Quarterly Dividend

The Board of Directors of Deluxe Corporation declared a regular quarterly dividend of $0.25 per share on all outstanding shares of the Company. The dividend will be payable on March 7, 2011 to shareholders of record at the close of business on February 21, 2011. The Company had 51,360,017 shares outstanding as of January 24, 2011.

The stock has been as high as $25.33 today which is a 3.1% gain.

-

Morning News: January 27, 2011

Posted by Eddy Elfenbein on January 27th, 2011 at 7:33 amECB’s Bini Smaghi: Economic Recovery Uncertainty, Inflation Risks Increase

Japan’s Credit Rating Cut to AA- by S&P on Debt Load

Davos Seeks `Shared Norms’ as Reality Turns Grim on West

Gold Declines as Investor Demand for Wealth Protection Wanes

U.S. Stock Futures Edge Up Before Earnings Deluge, Data

U.S. Treasury Notes Rise Before Fed Prepares to Buy Notes After Japan Downgrade

United Continental, US Airways Surge as Profits Top Estimates Amid Demand

Nokia Sags on Weak Outlook, 16% Profit Drop

ConocoPhillips Profit Climbs on Refining, Oil Prices

Lilly Fourth-Quarter Profit Increases More Than Analysts Estimated

Nielsen, Demand Media IPOs Soar in Debuts

-

Buy List Earnings Calendar

Posted by Eddy Elfenbein on January 26th, 2011 at 10:33 pmThere are still lots of holes, but hopefully they’ll all be filled in soon.

Company Symbol Date EPS Est EPS JPMorgan Chase JPM 14-Jan $0.99 $1.12 Gilead Sciences GILD 25-Jan $0.94 $0.95 Johnson & Johnson JNJ 25-Jan $1.03 $1.03 Stryker SYK 25-Jan $0.91 $0.93 Abbott Laboratories ABT 26-Jan $1.29 $1.30 Deluxe Corp. DLX 27-Jan $0.71 AFLAC AFL 1-Feb $1.35 Becton, Dickinson BDX 8-Feb $1.29 Wright Express WXS 10-Feb $0.71 Fiserv FISV n/a $1.07 Ford Motor F n/a $0.48 Moog MOG-A n/a $0.63 Reynolds American RAI n/a $0.61 Sysco SYY n/a $0.47 Nicholas Financial NICK n/a n/a -

CWS Buy List +4.74% YTD

Posted by Eddy Elfenbein on January 26th, 2011 at 7:47 pmThe Dow broke 12,000 today for the first time since June 20, 2008. However, the index closed the day just below the mark at 11,985.44. The S&P 500 got as high as 1,299.74 but closed at 1,296.63 which is its highest close since August 28, 2008. So we came very close to a double milestone day.

The Buy List rose by 0.46% today which slightly beat the S&P 500’s 0.42%. For the year, the Buy List is now up 4.74% to the S&P’s 3.10%. I hope we’re on our way to our fifth-straight market-beating year.

Today was another good lesson on the benefits of diversification. Even though Abbott Labs (ABT) got knocked down today by 2.52%, other stocks picked up the slack. Moog (MOG-A), for example, hit a new 52-week high. So did Deluxe (DLX) and AFLAC (AFL). I was happy to see that AFL got as high as $58.79. I said it was going to make a run for $60.

I should add that I have no idea why ABT dropped 2.5%. It’s still a very solid stock.

I’m also happy to see Ford (F) back above $18 where it belongs.

The big winner today was Gilead Sciences (GILD). By the closing bell, shares of GILD had gained $1.50 which was close to 4%. Again, I don’t know why Wall Street reacted this way. Gilead only beat by a penny. The reason why GILD should be rising is because it’s very inexpensive. Anyway, I won’t argue with stocks heading in my direction.

-

Today’s FOMC Statement

Posted by Eddy Elfenbein on January 26th, 2011 at 3:17 pmInformation received since the Federal Open Market Committee met in December confirms that the economic recovery is continuing, though at a rate that has been insufficient to bring about a significant improvement in labor market conditions. Growth in household spending picked up late last year, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, while investment in nonresidential structures is still weak. Employers remain reluctant to add to payrolls. The housing sector continues to be depressed. Although commodity prices have risen, longer-term inflation expectations have remained stable, and measures of underlying inflation have been trending downward.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Although the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, progress toward its objectives has been disappointingly slow.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. In particular, the Committee is maintaining its existing policy of reinvesting principal payments from its securities holdings and intends to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

Nothing here is unexpected. The only major change is that Thomas Hoening, the usual sole dissenter, has rotated off the committee. The Fed plans to continue doing what it’s been doing. The market is taking this in stride. The Dow is holding above 12,000 and the S&P 500 is closing in on 1,300.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His