-

PPI Rose Less than Forecast

Posted by Eddy Elfenbein on June 16th, 2009 at 9:10 amPrices paid to U.S. producers rose less than forecast in May as food expenses dropped, leading to the biggest 12-month slump in wholesale costs in a half century.

The 0.2 percent increase in prices paid to factories, farmers and other producers followed a 0.3 percent gain in April, the Labor Department said today in Washington. Excluding food and fuel, so-called core prices unexpectedly fell.

The lack of sustained gains in sales is one reason companies will need to keep a lid on prices, preventing inflation from flaring. The rising cost of commodities such as gasoline may further limit consumers’ discretionary spending at a time when the economy is showing signs of stabilizing.

“Outside of oil, inflation is still tame,” James O’Sullivan, a senior economist at UBS Securities LLC in Stamford, Connecticut, said before the report. “Given the huge amount of slack in the economy, the broad trend in inflation is more likely to be down than up.”

Economists forecast producer prices would rise 0.6 percent, according to the median of 73 projections in a Bloomberg News survey. Estimates ranged from no change to a 2.3 percent gain.

Compared with a year earlier, companies paid 5 percent less for goods, the biggest decrease since 1949 and reflecting the drop in fuel costs late last year that has since partially reversed.Meanwhile, Job title inflation reaches alarming levels.

-

Morning Call

Posted by Eddy Elfenbein on June 16th, 2009 at 8:56 amDetroit now has zero bookstore chains, zero national grocery chains, zero Chrysler Jeep dealers and only four Starbucks.

G.M. Sells Saab to Swedish Automaker

Smithfield swings to loss but bests estimates

European car sales sink 4.9% in May

Volvo says demand has bottomed out

Best Buy posts lower quarterly profit, keeps view

China to Pass Germany as Porsche’s Second-Biggest Market. Apparently, there is a substitute.

One of the world’s largest dairy farms is in…Saudi Arabia? -

Captain America Redux

Posted by Eddy Elfenbein on June 15th, 2009 at 11:42 pmThe New York Times reports that Marvel Entertainment (MVL) is bringing back Captain America:

More than two years after his comic book death, the sentinel of liberty known as Captain America is returning to the land of the living. “Captain America Reborn,” a five-part series published by Marvel Entertainment, will begin next month and is written by Ed Brubaker and illustrated by Bryan Hitch, one of the comic book industry’s most acclaimed artists. Mr. Brubaker is the regular writer of the Captain America series, including issue No. 25, published in 2007, in which the title hero was felled by an assassin’s bullet. It was a shot heard around the world as many news organizations carried word of the captain’s death. The story of his return begins in Captain America No. 600 (the series is returning to the original numbering from Volume 1, with a cover date of March 1941), which is in comic book stores now. New comics typically go on sale Wednesdays, but in an unusual move Marvel has allowed the comic to go on sale immediately.

Conan O’Brien said they’ll start making Captain America once they get a loan from Captain China.

-

Stunning Pictures from Iran

Posted by Eddy Elfenbein on June 15th, 2009 at 5:15 pmThe Iranian military raided Isfahan University of Technology (warnings graph images).

-

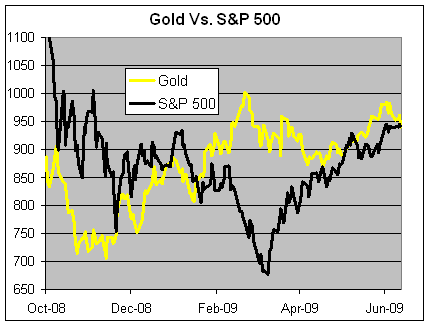

S&P 500 and Gold Are the Same

Posted by Eddy Elfenbein on June 12th, 2009 at 1:06 pmGold and the S&P 500 are basically neck and neck today.

-

Today’s Consumer Confidence Report

Posted by Eddy Elfenbein on June 12th, 2009 at 11:13 amThe Michigan Consumer Confidence reading rose again this month. Actually, I think it might be more accurate to say that the level of consumer self-hatred eased a bit in June.

It wasn’t a big increase, going from 68.7 to 69.0. The Street was looking for 69.5. We’re at the highest level since Lehman Brothers went kablooey.

What really jumps out at me is that consumer’s view of the future took a big plunge this month. For May, the reading for the 12-month outlook was 75. This month is was just 61. Youch! Inflation expectations rose to 3.1% from 2.8% in May. -

OMG DELL Ernd $3 Mil Off Twttr So How Mch Did Twtte Mke? = $0 LOL :o)

Posted by Eddy Elfenbein on June 12th, 2009 at 10:38 amThe New York Times reports:

These days, lots of companies are talking about their “Twitter strategy,” but few have figured out how to measure what amassing hundreds of thousands of followers on Twitter does for their businesses. Dell has shown that it can go directly to the top line.

Dell said Thursday night that the company had earned $3 million in revenue directly through Twitter since 2007, when it started posting coupons and word of new products on the microblogging site. In the last six months, Dell Outlet earned $1 million in sales from customers who came to the site from Twitter, after taking 18 months to earn its first $1 million. Dell has also earned another $1 million from people who click from Twitter to Dell Outlet to Dell.com and make a purchase there.

Dell joins companies like Starbucks, JetBlue and Whole Foods as one of the most active corporate Twitter users. “It’s a great way to fix customer problems and hear what customers have to say, it’s a great feedback forum and it leads to sales — how can you miss?” said Richard Binhammer, who works in Dell’s corporate affairs office and is active on its Twitter accounts.

Twitter made exactly $0 from those Dell sales, something that will very likely change. Twitter’s founders have said that it someday hopes to make money from its corporate users, with paid accounts that offer additional features like analysis of the traffic to businesses’ Twitter profiles and verified accounts so customers know they are not dealing with an impostor. When asked whether Dell would pay Twitter for an account, Mr. Binhammer said, “We’ll cross that bridge when we come to it.” -

Small Stocks, Big Dividends

Posted by Eddy Elfenbein on June 12th, 2009 at 10:13 amBarron’s scanned for small stocks that pay generous dividends. They looked for stocks that have raised their dividend over the last five years that have market caps between $800 million and $3 billion. They also knocked out financial stocks or stocks with too much debt.

Here’s what they found:

Flowers Foods (FLO)

Owens & Minor (OMI)

South Jersey Industries (SJI)

ABM Industries (ABM)

Universal (UVV) -

Morning Links

Posted by Eddy Elfenbein on June 12th, 2009 at 8:49 amBlackRock to become world’s biggest money manager

Google’s CEO on Bing: “They do this about once a year.”

Parking Space In Boston Sells For $300,000

Volkswagon’s sales rose in May; suck on that recession

OPEC says worst appears to be over for oil market

Lehman to pay Barclays $6 million for its own desks and chairs

Citigroup Bailout Pays Taxpayers Three Times as Much as S&P 500

Roubini: Is Eastern Europe On The Brink Of An Asia-Style Crisis?

A.I.G. Balks at Claims From Jet Ditching in Hudson

World Bank Predicts Deeper Economic Contraction -

Volcker says US growth possible this year

Posted by Eddy Elfenbein on June 12th, 2009 at 8:44 amHere are some interesting comments from the always interesting Paul Volcker:

Global financial markets are starting to heal and the U.S. economy could begin to grow again this year, but a strong recovery is unlikely, said President Barack Obama’s top adviser Paul Volcker.

“An expectation of some growth late this year and next in the United States seems reasonable,” Volcker, a former Federal Reserve chairman who leads a panel advising Obama on economic recovery, said in a speech Thursday at a conference of global bankers in the Great Hall of the People, the seat of China’s legislature.

However, “a really strong recovery, typical of most recessions, seems unlikely,” he said. “Rather, it is going to be a long slog, with continuing high levels of unemployment.”

The slump also is easing “most clearly” in Britain, trailed by other European economies, with less evidence of recovery in Japan, Volcker said. He said a “healing process” seems to be under way in financial markets.

Volcker cautioned that U.S. growth depends on stimulus spending and “years of deficit spending far beyond past peacetime experience lie ahead.” However, he said inflationary pressures were unlikely for some time to come. That could allow greater leeway to combat the downturn by expanding the money supply.

The legendary Volcker, 81, served as Fed chairman in 1979-87, when he tamed raging inflation, though at the cost of painful interest rate hikes that triggered a recession. Obama named him in November to lead the Economic Recovery Advisory Board.

Volcker expressed no enthusiasm for initiatives under discussion in Washington, including regulating bankers’ compensation. He said there is “ample justification” for public anger at pay practices that were “wildly excessive” and encouraged risk-taking at the expense of stability. But he warned against too much political involvement.

“It is far better that individual and professional groups come to grips with these matters than heavy-handed and inflexible regulation or legislation,” he told members of the Washington-based Institute of International Finance, a global association of bankers.

Volcker said there is a “strong case” for reviewing so-called “fair value” rules that determine the value of assets of banks, insurers and other institutions. He said efforts to enforce “mark-to-market” rules on assets fueled confusion and uncertainty.

But he said that while more international consistency is required in accounting standards, politicians should avoid excessive involvement.

“Political bodies in Europe and the United States or any other country are simply not the appropriate venue for reaching well-considered judgments that can be enforced internationally,” he said. “We need a bit patience,” he said, as the International Accounting Standards Board carefully reviews the rules.

Volcker expressed support for a global currency, which he called “the ultimate logic of a globalized financial system.” China and Russia have called for such a currency to replace the dominant dollar, but Volcker gave no opinion on any individual proposal.

He said governments should take steps to limit the possibility of bailouts of financial institutions, possibly by making clear that traditional savings banks will receive deposit insurance while those in riskier businesses are excluded.

“A presumption of government protection and support for financial institutions outside the ‘safety net’ should be avoided,” he said.

But Volcker also defended the role of hedge funds, which some blamed for increased market volatility in late 2008. Some U.S. lawmakers are discussing proposals to increase oversight on such funds, which have an estimated $2.5 trillion in assets but operate mostly outside government supervision.

“Hedge funds and private equity funds have an entirely legitimate role to play in providing liquidity and innovation in our capital markets,” Volcker said. “I do not believe they need to be so closely supervised and regulated as depository institutions.”

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His