-

Nicholas Financial Is Below $6

Posted by Eddy Elfenbein on March 17th, 2008 at 2:41 pmThe earnings yield for Nicholas Financial (NICK), based on trailing earnings, is about 17%. That’s about 20 times what a T-bill can get you.

-

Guess What Investment Bank Hasn’t Updated Their Website?

Posted by Eddy Elfenbein on March 17th, 2008 at 2:26 pm -

Sign of a Bottom?

Posted by Eddy Elfenbein on March 17th, 2008 at 12:59 pmAbby Joseph Cohen won’t make any more predictions for the S&P 500.

Abby Joseph Cohen, the most bullish investment strategist on Wall Street this year, will stop making Standard & Poor’s 500 Index forecasts for Goldman Sachs Group Inc.

She was succeeded in the role by David Kostin, Goldman’s U.S. investment strategist, spokesman Ed Canaday said in a telephone interview. Kostin today predicted the S&P 500 may fall 10 percent to 1,160 before rebounding to 1,380 by year’s end. Cohen, as chief investment strategist, last predicted the benchmark for American equities would end 2008 at 1,675, representing a 32 percent rally from its current level.

The 56-year-old Cohen now has the title “senior investment strategist” and contributor to the portfolio strategy team, according to Canaday. Her prediction for the S&P 500 this year was the highest among 14 Wall Street forecasters followed by Bloomberg.

“She will continue to meet with our clients around the world and provide commentary on financial markets focusing more on longer-term market activity,” Canaday said in an e-mailed statement. -

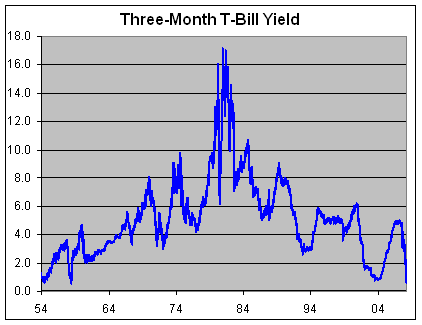

50-Year Low

Posted by Eddy Elfenbein on March 17th, 2008 at 12:42 pmThe yield on the three-month T-bill is at a 50-year low.

“People are confused. They are in a reactive mode,” said Lou Brien, market strategist at DRW Trading in Chicago.

The yield on three-month T-bills, considered by economists as a “risk-free” benchmark return on U.S. assets, was last quoted at 0.84 percent, down 36 basis points from late Friday. It reached a low of 0.63 percent earlier.

“It’s a complete place to hide out,” Brien said.

-

Just In Case No One Noticed…

Posted by Eddy Elfenbein on March 17th, 2008 at 12:26 pmToday is a good time to slip out bad news.

Goldman Sachs to reveal $3bn hit

Goldman Sachs, Wall Street’s most powerful investment bank, will this week announce asset writedowns worth about $3bn (£1.5bn), its biggest jolt to date from the crisis threatening to engulf the world’s financial markets.

Goldman, which has largely thrived amid the turmoil elsewhere on Wall Street, is expected to report a fall in first-quarter earnings of about 50 per cent. The writedown will underline how the financial turbulence is now affecting even the most stellar performers.

The bank’s $3bn writedown will be based partly on the declining value of its 4.9 per cent stake in Industrial & Commercial Bank of China (ICBC), which is held separately on Goldman’s balance sheet. The share price of ICBC, which conducted the world’s biggest ever initial public offering in 2006, has fallen by about 14 per cent in recent months.

Goldman invested $2.3bn for its minority shareholding in ICBC, which is listed on the Hong Kong and Shanghai stock exchanges.

Goldman will also take a hit of about $1.6bn in its leveraged loans business, which has seen a marked decline in recent months amid a dearth in demand for trading bank debt. A further $1.1bn will be written down in connection with assets owned by Goldman’s principal investment area, the bank’s private equity arm. -

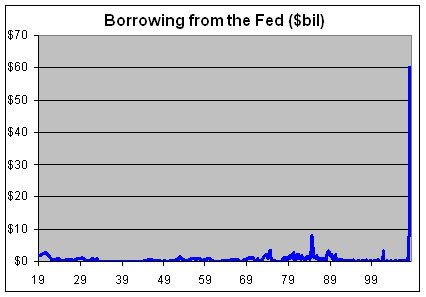

Chart of the Day

Posted by Eddy Elfenbein on March 17th, 2008 at 9:49 am

-

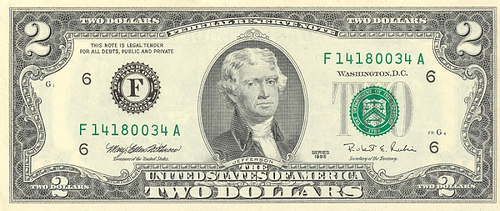

Why $2?

Posted by Eddy Elfenbein on March 17th, 2008 at 9:11 am

Here’s a question I can’t help asking myself: How and why was $2 decided upon? I mean…jeez! That’s around $250 million, meaning there are problem some people who could have bought BSC outright. I guess the easy answer is because that’s what Jamie Dimon said, and no one was in a position to argue with him. It’s really no difference from being given away. Interestingly, Bear Stearns doesn’t pay golden parachutes for top execs in the case of a takeover.

I’m not sure if that price can last. If I were a BSC shareholder, I’d be furious. At some point, lawyers will most certainly be involved. One investor somehow made it onto yesterday’s call and let it be known that he’ll vote against the deal. He ain’t alone. About one-third of BSC shares are owned by employees. Also on the call, Bear insisted that’s its book value is around $80 a share. But the thing about Bear’s equity is that it only has value with in a context which, possibly, JP Morgan can provide.

Imagine if you have a Maserati. Sweet, right? Now imagine if you have it at the South Pole. Now it’s completely worthless. The car might as well be a big freakin’ rock. It only has value where you can use it, or sell it. If Bear doesn’t have capital and access to capital, then everything it owns is of no value. To continue with my bad metaphor, the role of JPM is to transport the Maserati from the tundra to a nice highway.

If we were to consider the value of Bear’s sweet crib (see pic below), then JPM is basically being paid to take on BSC. It’s not far from the government nationalizing the bank. The only difference is that they did it through the vehicle of JPM.

One more note, If I were in charge of the ECB (that’s a mighty big if), I’d be buying dollars like crazy. -

Official Presentation: JP Morgan Acquiring Bear Stearns

Posted by Eddy Elfenbein on March 17th, 2008 at 8:06 amFrom Seeking Alpha.

John Carney blogs the call.

DealBook has a handy Q&A. Here’s a good question:Can Bear’s shareholders stop it?

Absolutely. There will be a shareholder vote and Bear’s shareholders can vote no. But there appears to be a unique provision in the merger agreement that Bear is required to re-hold the vote over the course of 12 months if Bear’s shareholders vote no the first time. Only after twelve months of meetings and no votes can the transaction be definitively rejected. A bit shaky under Delaware law, but given the circumstances, I find it hard to see how the Delaware courts would refuse to enforce it.

If, after 12 months, there is still a no vote it appears that the JPMorgan and Fed guarantees go away. Talk about a pill to swallow. This would likely leave shareholders with the only alternative to try and seek back money through the bankruptcy process. But the bankruptcy process is unlikely to be fruitful even though Bear has a building worth about a billion dollars. And of course, the delay may find Bear in an improved position such that the acquisition no longer makes sense.

It all sets up some interesting arbitrage opportunities. Perhaps Bear has negotiated a better deal than the market thinks – negotiating itself a year to shop for a higher offer.

And Bear will still have the option to accept a higher bid if someone chooses to make it. Here, I note the irony that Kohlberg Kravis Roberts was reportedly part of the other bidder group looking at Bear this weekend. K.K.R. started at Bear Stearns and in 1976 the management there rejected a proposal by the trio to start a separate buyout unit within the investment bank. The trio then went out to start K.K.R. In hindsight, yet another bad decision.

Of course, the more interesting question is whether Bear should have held out a few more days for some form of contingent consideration instead of settling for $2 by threatening the Federal Reserve with a Chapter 11 and its systemic ramifications. Perhaps we will find an answer on Monday if Bear does indeed trade over the $2 price.

But I do know one thing. If I were Alliance Data Systems, I would announce early tomorrow morning the long-expected termination of my deal to be acquired by the Blackstone Group. No one will care. -

Who Traded 55,000 Bear $30 Puts Tuesday?

Posted by Eddy Elfenbein on March 17th, 2008 at 7:40 amSteven Smith asks the question:

This past Tuesday, when Bear Stearns was trading around $65 a share, there was huge put volume in the March $30 strike.

Over 55,000 contracts traded that day at an average price of 15 cents a contract. This is an extremely unusual trade in terms of the number of contracts and how far out-of-the money those options were at the time. This begs the question of why someone would execute such a transaction.

First, it’s important to understand that buying a put gives you the right to sell the stock at the strike price. So to buy a put that requires the stock to decline over 50% is essentially a bet that the company is possibly on the brink of going out of business or about to deliver some terrible news.

Remember, these options expire on March 20, so that left only 10 days for some event to occur that would cause these puts to go into the money and have some value. So it appears that as rumors began swirling early in the week that Bear was having liquidity problems and might possibly be bordering on insolvent, someone took that to heart and bought the puts as disaster insurance. And today came news that several banks, including Goldman Sachs, would no longer act as a counterparty to any transactions with Bear. The inability to execute trades would essentially put Bear Stearns out of business. -

Bear Stearns Goes for $2

Posted by Eddy Elfenbein on March 17th, 2008 at 7:23 am

The Panic of 1907 was eventually resolved when J.P. Morgan organized a group of bankers to keep the credit markets functioning. The U.S. Treasury kicked in $25 million to the cause. In other words, the government wasn’t powerful enough to lead this itself. It had to transfer money to private bankers.

One of the repercussions of Morgan’s aid was that some people felt that it might not be a great idea to have one person act as a lender of last resort. The Panic of 1907 eventually led to the creation of the Federal Reserve.

One hundred and one years later, the Federal Reserve combined with JP Morgan Chase (JPM), the company, not the man, to bail out the economy.

Scratch that, this isn’t a bailout. JP Morgan is buying Bear Stearns for $2 a share. What if I told you last week, when shares of BSC were at $70, that they would soon be less than a gallon of gas? You might have thought that gas was the one that rose.

The idea that this move will create some sort of moral hazard simply doesn’t wash. This company was effectively wiped out. Few bankers are going to feel comforted by a $2 share price. Last year, shares of Bear were going for $150 a pop. Today, they’re worth less than a gallon gas.

The Fed did what it’s supposed to do. The problem with Bear failing is counter-party risk which means that if Bear went under, a lot of other folks would have taken a big hit as well. Really, there wasn’t much of a choice.

The WSJ reports:To help facilitate the deal, the Federal Reserve is taking the extraordinary step of providing as much as $30 billion in financing for Bear Stearns’s less-liquid assets, such as mortgage securities that the firm has been unable to sell, in what is believed to be the largest Fed advance on record to a single company. Fed officials wouldn’t describe the exact financing terms or assets involved. But if those assets decline in value, the Fed would bear any loss, not J.P. Morgan.

Sorta like 1907.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His