-

Great Moments in Public Relations

Posted by Eddy Elfenbein on February 25th, 2008 at 10:51 am“I’m fairly confident that we’re not going to do anything stupid. We have a history of not doing anything stupid.” Angelo Mozilo, CEO of Countrywide Financial

Countrywide Financial (CFC) had a rough 2007 with the stock being down by 78% and all. So what should a company do? Celebrate, of course!

Countrywide Financial Corp., the nation’s largest mortgage lender by loan volume, will host about 30 representatives of smaller mortgage banks for three nights next week at the Ritz-Carlton Bachelor Gulch ski resort in Avon. At one of the country’s most-glamorous skiing spots, a regular room on a weekday starts at $750.

The first items on the agenda for guests arriving Monday evening are cocktails and ski fittings. Next is dinner at the Spago restaurant, whose menu includes Kobe steak with wasabi potato puree for $105. (For the budget-minded, pan-roasted buffalo filet with Kabocha pumpkin flan is $54.)Since July, Countrywide has laid off 11,000 people. The company has now said that the ski trip is off.

-

Junk-Grade Fed?

Posted by Eddy Elfenbein on February 25th, 2008 at 10:06 amHere’s an interesting editorial today from the New York Sun:

What caught our eye in the markets last week was the verdict by Grant’s Interest Rate Observer that, by its lights, the Federal Reserve Bank of New York was no longer a “presumptive triple-A” credit but rather one of “mid-grade junk” quality. This news didn’t exactly rock the financial world, as Grant’s is no kind of formal rating agency, even it if does have as elite and savvy a readership as any market newsletter could want. It wouldn’t surprise us, though, were people — including some in Congress — soon to sit up and take notice of a worrying set of facts.

Grant’s was reacting to the sudden appearance on the Federal Reserve’s balance sheet of $60 billion in lending under the new Term Auction Facility. The New York Fed’s share of that $60 billion is no less than $44.9 billion. The TAF is a credit facility. Its purpose is to lend to banks under stress in the sub-prime credit crisis. The banks front collateral against which the Fed advances money. “The rub,” Grant’s writes, “is the quality of the collateral.” It quotes a Financial Times interview with one financial strategist, Christopher Wood, as saying that banks “are increasingly giving the Fed the garbage collateral nobody else wants.”

The New York Fed doesn’t seem overly concerned about all this. When our Julie Satow called over to the fortress on Liberty Sreet a spokesman said the bank took the downgrading by Grant’s to be a form of humor. “Reserve banks operate under well-established guidelines regarding margining and collateral,” the spokesman said. However that may be, the Fed’s Web site invites would-be borrowers to submit collateral of decidedly low quality. Against this dubious stuff, the Fed stands ready to lend on highly generous terms — as much as 90 cents on the dollar against “private label” mortgage-backed securities. Unless we have been misreading the papers these past six months, the Fed is alone in assigning that much value to that particular class of mortgage asset.

It’s a little-noted irony that the Federal Reserve, the supposed conscience of the American banking system, is itself an exceedingly highly leveraged institution. At the latest weekly tallying up, $881 billion in assets rested on just $38.5 billion in capital, As for the New York branch office, $312 billion in assets (including those $44.9 billion in TAF credits) were balanced on a little less than $10 billion in capital. The scant showing of capital was of no especial concern when the Fed owned nothing but Treasury securities. But now that it’s in the business of lending against what may well be mongrel mortgages, that extreme leverage introduces real risks. As Grant’s points out, it’s not so farfetched to imagine the Fed itself needing a bailout one of these days. We wonder how a headline on the order of “Fed insolvency fears” would play in the already skittish world currency markets.

* * *

Why not let an independent auditor check up on the value of the collateral that the Fed is so willingly taking aboard? It would not be lost on such an auditor that the New York Fed is, as they say on Wall Street, a kind of “hidden asset story.” It carries slightly more than $4 billion of gold on its balance sheet at the early 1970s price of $42.22 an ounce. At today’s prices, that works out to more than $90 billion. On that basis, as the editor of Grants, James Grant, sketched it for us, “the hometown central bank would be in the clover, credit-wise.” He goes on to say that “the Fed is unlikely to acknowledge the great bull market in gold bullion for the obvious reason that it, itself, is largely the author of it.” Or, to put it another way, if the salvation of the Fed is all the gold it has in its basement, what does that tell us about the monetary system on which the rest of the world is relying? -

After Hours: The Carter Family – Are You Lonesome Tonight

Posted by Eddy Elfenbein on February 22nd, 2008 at 5:14 pm -

Hacking For Profits

Posted by Eddy Elfenbein on February 22nd, 2008 at 11:26 amHere’s a strange story. In October, Oleksandr Dorozhko hacked into IMS Health’s computers to get inside information which he used to load up on puts on the company’s stock. He made a killing, about $300,000 off a $41,000 investment.

The SEC tried to block him from taking his profits. A judge has ruled that what he did may be illegal but it’s not insider trading. Dorozhko may face more charges, but for now, he can keep his cash.The SEC argues that deception was involved in hacking into the computer system, which was designed to allow access only to authorized persons.

That view drew scorn from Charles Ross, Dorozhko’s lawyer, at the appellate court hearing Wednesday. “They want you to believe there is a deception of a computer,” he said. “All there is is a high-tech lock pick.” -

The Phillips Curve

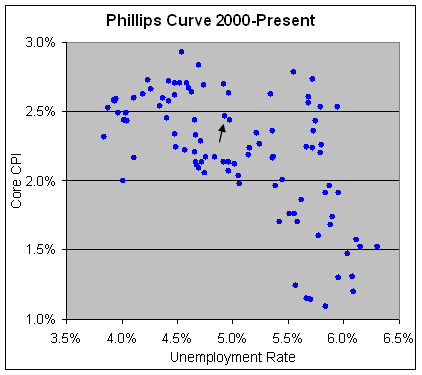

Posted by Eddy Elfenbein on February 21st, 2008 at 11:11 amI’m not much of a believer in the Phillips Curve, the trade-off between employment and inflation, but with all the stagflation talk, it’s worth taking a look.

This data is from 2000 to the present. The X-axis is the unemployment rate and the Y-axis is the trailing 12-month core CPI. The arrow points to the data from January and December.

All the data I used is from the government so consider it at your own risk. Actually, I’m rather surprised by how well the curve holds up, meaning the dots seem to run diagonally from lower right to upper left. (Well, sort of…the R-squared is 0.3734.) If we’re in stagflation, then this relationship should breakdown and the dots would start drifting to the upper right. So far, that isn’t happening.

At least, not yet. -

How Does Inflation Impact Stock Prices?

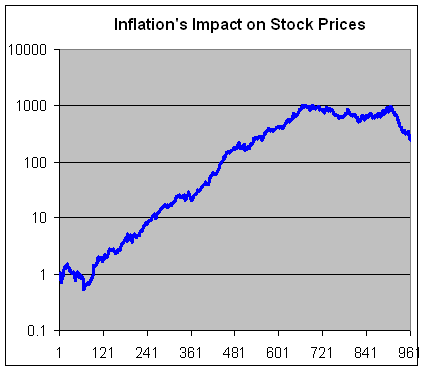

Posted by Eddy Elfenbein on February 20th, 2008 at 1:41 pmSince the market is digesting a troubling inflation report today, I wanted to look at how inflation impacts the market. I took the inflation-adjusted monthly market returns from 1925 to 2005 (thanks to my Ibbotson Yearbook), resorted them by inflation rate and look at the cumulative return by rate of inflation.

As you might expect, high inflation is bad for equity prices. In fact, the only thing worse for stocks is deflation, which is really, really bad for stocks. Here’s my chart:

Stock returns do very poorly when deflation runs over 5.6% (data points 0 to 68). After that, stocks do quite well up to an inflation rate of 3.1% (data point 490). They then slow down a bit but still climb up to an inflation rate of 5% (data point 698).

Now the trouble starts. Above 5%, stocks flat line up to an inflation rate of 12% (remember, I’m looking at the inflation-adjusted returns). After 12%, things get very ugly and stock returns plunge.

So inflation isn’t good for stocks, but the troubling numbers we’re seeing are still a long way from being a major problem. -

Housing Indexes

Posted by Eddy Elfenbein on February 20th, 2008 at 12:59 pmCalculated Risk has a great post looking at the differences in housing price indexes. As an admitted indexaholic (my name is Eddy, and I’m…), I’m afraid I have to resign myself to the fact that it’s basically impossible to come up with one simple index of house prices.

The Case-Shiller Index has a monthly gauge of prices in 20 major markets. There’s also a quarterly national index. Calculated Risk writes, “OFHEO covers more geographical territory, OFHEO is limited to GSE loans, OFHEO uses both appraisals and sales (Case-Shiller only uses sales), and some technical differences on adjusting for the time span between sales.”

The numbers from Case Shiller have been much gloomier recently. The reason is that lower-priced and non-GSE homes have fallen faster, which is probably because the lending standards were questionable.

As long as home prices were rising, all the lending problems were invisible. Now that prices are falling, the problems are accelerating. The difficulty we’re having is that we’re not exactly sure what home prices, in aggregate, are doing. -

Obamanomics

Posted by Eddy Elfenbein on February 20th, 2008 at 12:04 pmNow that it’s very likely he could become president, what does Barack Obama want for his economic policy? I’m not sure if this is real policy or just pandering.

Mr Obama’s plan would lower the corporate tax rate for companies that met criteria including maintaining their headquarters in the US, maintaining or increasing their US workforce relative to their overseas workforce, holding a neutral position in union drives among their employees and providing decent healthcare.

The lowered rate would be paid for by the abolition of tax breaks that encourage companies to shift jobs overseas. “In the last year alone, 93 plants have closed in Ohio,” Mr Obama said. “And yet, year after year, politicians in Washington sign trade agreements that are riddled with perks for big corporations but have absolutely no protections for American workers.”

Mr Obama’s plan met instant scepticism from otherwise sympathetic Democratic economists who said it would require a large regulatory apparatus to put into practice. They also said that companies could “game the system” by spinning off overseas subsidiaries in order to reduce the offshore-onshore workforce ratio.

They questioned whether it was necessary to provide incentives for employers to provide health insurance since Mr Obama’s healthcare plan would already mandate them to do so. Finally, Mr Obama has already tied up the estimated $10bn (€6.8bn, £5.1bn) in revenues that would be saved from abolishing tax incentives for multinational companies that retain their profits overseas.

“I would say that this plan is borderline unimplementable,” said a Democratic economist in Washington. “It is also puzzling. Normally presidential candidates only come up with plans that are unrealistic when they are losing. But Obama is now the favourite.” -

Defaulting Before the Resets

Posted by Eddy Elfenbein on February 20th, 2008 at 10:23 amOne of the big fears over the housing mess is that borrowers would default once their mortgages reset. It turns out, this is happening before the reset:

Defaults for subprime loans issued in 2007 – none of which have reset yet – hit 11.2 percent in November. That represents perhaps 300,000 households, and is twice the default rate that 2006 loans had 10 months after being issued, according to Friedman, Billings Ramsey analyst Michael Youngblood.

Defaults are spiking well before resets come into play thanks to the lax lending environment of the past few years. Many borrowers were approved for mortgages that they had little chance of affording, even at the low-interest teaser rates .

“I was rather shocked by the characteristics of the 2007 loans,” said Youngblood.

Hybrid ARMs start with very affordable fixed-rate terms of two or three years. After that, rates can jump three percentage points or more, and then re-adjust even higher every six months to a year. On a $200,000 mortgage, a reset could add nearly $400 to the monthly mortgage payment. -

Today’s Inflation Report

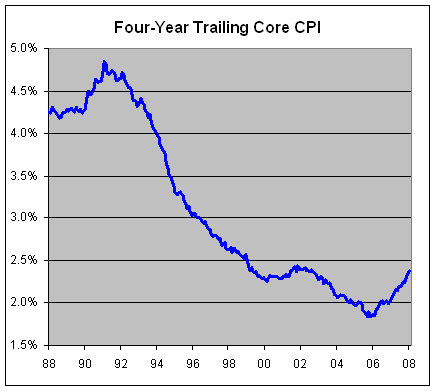

Posted by Eddy Elfenbein on February 20th, 2008 at 9:55 amToday’s report on consumer prices shows that inflation is a still a problem. The headline rate was 0.4% and the core rate was 0.3%. Both were 0.1% above expectations.

Over the last four years, the headline CPI Index has grown at a 3.3% rate. The Fed Funds rate is currently targeted at 3%.

To put the resurgence of inflation into some perspective, here’s a look at the four-year trailing rate of the core CPI.

The line is clearly moving in the wrong direction, but we’ve seen a lot worse.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His