-

Felix Salmon Issues a Plea

Posted by Eddy Elfenbein on December 10th, 2007 at 11:07 amAs usual, Felix nails it:

Please can the punditosphere stop referring to the mortgage-freeze plan as a “bailout”? As Edmund Andrews says in his first sentence on the front page of the NYT today, it isn’t. The FHA’s FHASecure plan, which has existed for ages, might conceivably be considered a bailout. This one involves no government money or government guarantees, and there’s no transfer of funds from the taxpayer to anybody at all. So it’s not a bailout. Thank you.

He’s right. There’s zero public money at stake. The LTCM bailout of 1998 is also often referred to as a bailout. In fact, I just did. The Federal Reserve helped organize it, but no government money was involved. As someone who often criticizes the Fed, that’s exactly what they should have done.

-

Portfolio’s Scoop: There Are These Things Called Index Funds

Posted by Eddy Elfenbein on December 10th, 2007 at 10:16 amI just finished a puzzling 7,000-word article by Michael Lewis for the December issue of Portfolio (The Evolution of an Investor).

The article is about efficient markets—the idea that it’s impossible for a stock-picker or mutual fund to consistently beat the market. Lewis uses the story of Blaine Lourd, a former stock-broker, as the vessel for his article.

The problem is, the idea of efficient markets was popularized 34 freakin’ years ago by Burton Malkiel in “A Random Walk Down Wall Street.” It’s only gone through about a gazillion printings. The original academic paper by Eugene Fama appeared in 1965. Everyone and his brother knows about it. What’s this article doing in a business magazine in 2007? It would be roughly the equivalent of an article on this new-fangled designated hitter rule appearing—mind you, not in Reader’s Digest or People—but in Sports Freakin’ Illustrated!

Does Portfolio think its readers are that ill-informed?

The article doesn’t even present the arguments for and against EMH in any real depth, which could be a more interesting article. In fact, an article attacking EMH would also feel at least 10 years out of date. Closer to 15.

Lewis doesn’t bother touching topics like the gradations of EMH (weak, strong and semi-strong). The frustrating part is that there are lots of interesting angles that could have been explored. Lewis could have discussed developments in fields like behavioral finance and their possible implications for EMH. Or the success of quant guys like Jim Simons. Fuck, even I wrote a post the other day about the astonishing success of momentum stocks, and I’m just an obscenity-using blogger. I mean, what the fuck?

Lewis also conflates the idea of being a good money manager with picking stocks. Money managers do a lot more than that. At least, they should. For example, they may help a client with an investment for a specific time horizon like a college fund. A money manager also helps decide an appropriate risk profile for the client, or how to keep taxes down, or how to plan for retirement. It’s a gross simplification to say these people are worthless because they can’t pick stocks. From personal experience, there were lots of times I talked clients out of exiting the market.

I also have issues with the story of Blaine Lourd, the stock-broker turned cynic turned EMH convert. I don’t think he’s lying, but I get the feeling that Lourd is overscripting his conversion story. Cynical people who grow frustrated by their industries don’t act as Lourd does. Put it this way: He managed his self-loathing well enough to hop to three more firm firms, then to open his own shop in Beverly Hills. If Lourd’s mission is to protect investors, then I wonder who’s covering his rent?

Lewis centers the article on the unusual training ritual (or indoctrination) of indexer Dimensional Fund Advisors. The firm has done very well over the years particularly by pointing out that most mutual funds don’t beat the market. But wouldn’t that mean that the firm’s success is due to a gross inefficiency in the market? Or is that too impolite to ask. Apparently, it is because Lewis never asks it. Nor does he ask any tough follow-up questions.

Later, Professor Fama, a DFA board member, makes an appearance:Forty years of preaching has taught him that his audience either agrees with him or never will. And so he speaks dully, like a man talking to himself. But he makes his point. In his years of researching the stock market, he has detected only three patterns in the data. Over the very long haul, stocks have tended to outperform bonds, and the stocks of both small-cap companies and companies with high book-to-market ratios have yielded higher returns than other companies’ stocks.

These are the facts. The question is how to account for them. Fama’s explanation is simple: Higher returns are always and everywhere compensation for risk. The stock market offers higher returns than the bond market over the long haul only because it is more volatile and thus more risky. The added risk in small-cap stocks and stocks of companies with high book-to-market ratios must manifest itself in some other way, as they are no more volatile than other stocks. Yet in both cases, Fama insists, the investor is being rewarded for taking a slightly greater risk. Hence, the market is not inefficient.Wait a second. High book-to-market stocks outperform with no more volatility but that’s due to higher risk? OK, so where is this risk? C’mon Michael, we just saw evidence disproving the whole point of the article. How does Fama support his assertion?

Lewis concludes the article with this:Blaine still takes great pleasure in describing just how screwed up the American financial system is. “In a perfect world, there wouldn’t be any stockbrokers,” he says. “There wouldn’t be any mutual fund managers. But the world’s not perfect. In Hollywood, especially, people need to believe there’s a guy. They say, ‘I got a friend who made 35 percent last year.’ Or ‘What about Warren Buffett?’ ”

Then he pulls out a chart. He graphs for me the performance of one of D.F.A.’s value funds, which consists of companies with high book-to-market ratios, against the performance of Warren Buffett’s Berkshire Hathaway since 1999. While Buffett’s line rises steadily, D.F.A.’s rises more steeply. Blaine’s new belief in the impossibility of beating the market doesn’t just beat the market. It beats Warren Buffett.That doesn’t prove any point. Buffett has still beaten the market as whole. It’s that value stocks have done much better. Why are we changing the thesis of the entire story and now comparing Buffett to a value fund? We’re not allowed to pick stocks but we can pick benchmarks? To reiterate my earlier point, what the fuck? Lewis’ article is presented to us as if it’s delivering some wise truism, yet it fails to ask any truly probing questions.

When Portfolio debuted, Elizabeth Spiers of DealBreaker said it “will be the Paris Hilton of business magazines: pretty but vapid, and unlikely to produce anything resembling an original thought.” Perhaps some forecasts do have value. -

Hip Hop IPO

Posted by Eddy Elfenbein on December 10th, 2007 at 9:53 amLuther Campbell, the creative force behind 2 Live Crew and some of their timeless melodies such as The Fuck Shop, Get the Fuck out of My House and I Ain’t Bullshittin, has taken his company public.

The New York Post reports:The hip-hop legend – personally responsible for the “Parental Warning” on CDs thanks to the rebellious and outlandish lyrics on his group’s 2 Live Crew discs – has merged his entertainment and sports management company into a public shell company that’s now listed on Nasdaq.

Luke Entertainment Group, ticker symbol LKEN, started trading last month.

“Going public gives me more freedom and a better opportunity,” says Campbell, 46, who’s known in the music industry as Luke Skyywalker.

Campbell, who will serve as Chief Creative Officer, hopes to mimic other so-called 360 deals like the one Live Nation recently inked with Madonna. That is, to represent talent in more than just record deals but in concert promotion, tour management and in other areas.Hmmm. I have to say I’m not terribly impressed by someone who adds an extra “y” to Skywalker being the Chief Creative Officer. The article notes that the stock closed yesterday at $1.

(Via: The Stalwart). -

God, Money and the New York Times

Posted by Eddy Elfenbein on December 9th, 2007 at 3:04 pmThis is from the New York Times’ editorial on Mitt Romney’s recent speech:

Mr. Romney dragged out the old chestnuts about “In God We Trust” on the nation’s currency, and the inclusion of “under God” in the Pledge of Allegiance — conveniently omitting that those weren’t the founders’ handiwork, but were adopted in the 1950s at the height of McCarthyism.

That’s not quite right. The motto “In God We Trust” first appeared on U.S. coins during the Civil War. Although there have been periods when it was removed, the motto has appeared on all U.S. coins for nearly 100 years.

The motto was later added to U.S. paper currency in October 1957, which wasn’t exactly “the height of McCarthyism,” considering that the senator had been dead for five months.

The Treasury Department’s website has the details. -

Prophet of Innovation: Joseph Schumpeter and Creative Destruction

Posted by Eddy Elfenbein on December 7th, 2007 at 3:35 pm

Brad Delong reviews Thomas K. McCraw’s Prophet of Innovation: Joseph Schumpeter and Creative Destruction:Over the previous two and a half centuries, three different economic worldviews, in succession, reigned. In the late 18th and early 19th centuries, Adam Smith’s was the key economic perspective, focusing on domestic and international trade and growth, the division of labor, the power of the market, and the minimal security of property and tolerable administration of justice that were needed to carry a country to prosperity. You could agree or you could disagree with Smith’s conclusions and judgments, but his was the proper topical agenda.

The second reign was that of David Ricardo and Karl Marx. Their preoccupations dominated the late 19th and early 20th centuries. They worried most about the distribution of income and the laws of the market that made it so unequal. They were uneasy about the extraordinary pace of technological, organizational, and sociological change, and about whether an ungoverned market economy could produce a distribution of income — both relative and absolute — fit for a livable world. Again, you could agree or disagree with their judgments about trade, rent, capitalism, and machinery, but they asked the right questions.

The third reign was that of John Maynard Keynes. His agenda dominated the middle and late 20th century. Keynes’s theories centered on what economists call Say’s Law — the claim that except in truly exceptional conditions, production inevitably creates the demand to buy what is produced. Say’s Law supposedly guaranteed something like full employment, except in truly exceptional conditions, if the market was allowed to work. Keynes argued that Say’s Law was false in theory, but that the government could, if it acted skillfully, make it true in practice. Agree or disagree with his conclusions, Keynes was in any case right to focus on the central bank and the tax-and-spend government to supplement the market’s somewhat-palsied invisible hand to achieve stable and full employment.

B ut there ought to have been a fourth reign, for there was a set of themes not sufficiently explored. That missing reign was Schumpeter’s, for he had insights into the nature of markets and growth that escaped other observers. It is in that sense that the late 20th and early 21st centuries in economics ought to have been his: He asked the right questions for our era. -

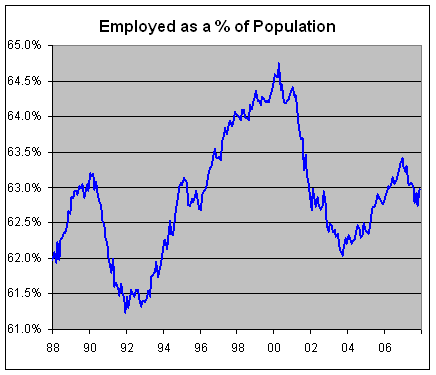

Looking Behind Today’s Jobs Report

Posted by Eddy Elfenbein on December 7th, 2007 at 10:34 amThe government reported that unemployment rate in November remained steady at 4.7%. One of the problems about the unemployment rate is that it only measures people looking for a job. If you’re not out there looking, you don’t count. Obviously, the worse the job market is, the more people stop looking for work.

At the beginning of the decade, around 67% of the population was considered part of the jobs market. Today, that number is closer to 66%. One percent is a big deal in a country this size.

If the labor market participation rate simply matched the peaked number from February 2000, then it would mean that nearly three million more people would be in the job market.

Here’s a more accurate picture of employment. This chart shows the number of people working as a percentage of the entire population.

It’s not horrible, but it’s hardly something to brag about either. Clearly, we’re far from our full potential. What I find interesting is the deterioration in the number this year. The good news is that today’s number is a small break in that trend. In November, we saw the largest increase in the percent of the population employed in over five years. -

Nicholas Financial Is Now Trading Below Book Value

Posted by Eddy Elfenbein on December 6th, 2007 at 3:27 pmShares of Nicholas Financial (NICK) are now down to $7.20. According to the most recent 10-Q, the company’s book value is $7.50 a share.

-

It Was Only a Matter of Time

Posted by Eddy Elfenbein on December 6th, 2007 at 1:12 pmTired of those socially responsible funds? Well, Focus Shares gives us a sin-based ETF. You guessed it…the Sindex.

*Groan*

The ticker symbol is PUF.

*Double Groan*

Here are the stocks in the Sindex:

ABV UN AmBev -PN (ADR)

AOI Alliance One International Inc.

ASCA Ameristar Casinos

BF.B Brown-Forman Corp.

BTI UA British American Tobacco (ADR)

BUD Anheuser-Busch

BYD Boyd Gaming Corp.

BYI Bally Technologies Inc

CEDC Central European Distribution

CG Loews Corp. – Carolina Group

DEO UN Diageo (ADR)

HET Harrah’s Entertainment

IGT International Game Technology

ISLE Isle of Capris Casinos Inc

LVS Las Vegas Sands

MGM MGM Mirage

MO Altria Group, Inc.

MPEL Melco PBL Entertainment Macau Ltd.

PENN Penn National Gaming Inc

PNK Pinnacle Entertainment

RAI Reynolds American Inc.

SGMS Scientific Games

SHFL Shuffle Master

STZ Constellation Brands

TAP Molson Coors Brewing Company

UST UST Inc.

UVV Universal Corp.

VGR Vector Group

WMS WMS Industries

WYNN Wynn Resorts Ltd -

High-Yield Defaults Could Quadruple

Posted by Eddy Elfenbein on December 6th, 2007 at 9:34 amHere’s a stunning story. Moody’s says that high-yield bond defaults will quadruple next year, and that’s assuming the economy doesn’t go into a recession. If it does fall into a recession, defaults could rise tenfold.

The global default rate will rise to 4.2 percent by November from 1 percent now, the lowest since 1981, Kenneth Emery, director of corporate default research at Moody’s, wrote in the report e-mailed today. His forecast is based on an assumption the U.S. economy slows without falling into recession. In a recession, defaults may approach 10 percent, he said.

“We’re certainly looking for an economic slowdown next year and a pick-up in default rates,” said Simon Ballard, macro credit strategist at ABN Amro Asset Management in London. “Any default rate above 3.5 percent would require a very bearish outlook on the U.S. economy.”

More than one in 10 of the borrowers to which Moody’s assigns ratings are treated as “distressed” by bond traders, the highest proportion since global defaults reached 10.5 percent in 2002. At that time, bondholders charged as much as 11.4 percentage points above government rates to buy high-risk, high-yield debt, double the current average of 5.73 percentage points, according to Merrill Lynch & Co. indexes. -

JOSB Same-Store Sales Up 15%

Posted by Eddy Elfenbein on December 6th, 2007 at 9:12 amFrom MarketWatch:

JoS. A. Bank Clothiers Inc., (JOSB) the Hampstead, Md., retailer, reported that for November, same-store sales rose 15% while total sales increased 25% to $63.1 million from $50.6 million in the year-earlier month. A survey of analysts by Thomson Financial produced a consensus estimate of same-store sales up 2.2% in the month.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His