-

The Morning Blog Needs Your Help

Posted by Eddy Elfenbein on October 12th, 2006 at 12:59 am

I always love how Liz Claman begins her Morning Blog entries with, “hey bloggers.” Isn’t that just adorable? It’s so perky!

I know. I know. As much as I adore Liz, she’s committed a slight faux pas. The aforementioned bloggers are in fact, us, the readers. She’s the blogger.

Ok, so Liz isn’t hip to our new fangled techno-lingo. Big deal, right?

Apparently, The Man has put an end to it:Okay gang, Now I *really* need your help. I have been informed by THE POWERS THAT BE at CNBC.com that while they think TheMorningBlog is terrific and that you guys are terrific, they did want me to know (lower voice here:) that ‘people who read blogs, Liz, really *aren’t* called Bloggers, like you’ve been calling them.”

Oh yeah, I got the harsh word from CNBC.com Executive Producer Alex Crippen that *I’M* the blogger, not you guys. So when I write, “Hey Bloggers!” I’m totally uncool and wrong.

But then we both decided that there really isn’t an official word for people who READ Blogs, so I NEED YOUR HELP!! Do you have any ideas of what I should call you? Alex and I threw around “Blog-o-shperians”, “Blogees” or “Bleagers” (Blog + Reader? I know, lame.) But none of these sounds right. Submit Submit Submit!!! If we like one, we’ll start using it!

As always, Thank you, Blog-o-ponders. (Blog + Responder? I know. Totally LAME!)

xoxo

Liz (Ms. Blog)My first effort was to combine Claman and Media, and I got Chlamydia. I don’t think that works.

Liz, let’s just call them “readers.” -

Does the Bond Market Rule the Country?

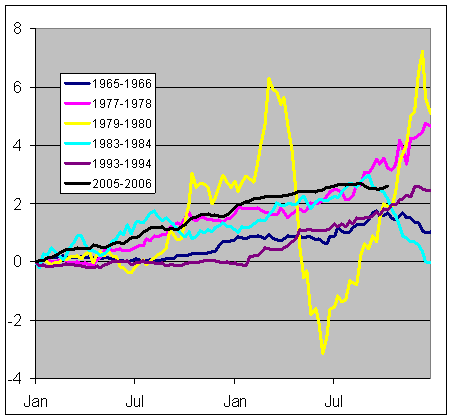

Posted by Eddy Elfenbein on October 11th, 2006 at 10:52 pmI’m a fan of predictions markets, although I think they’re mostly just for fun. There is, however, some evidence that one of the best political markets is the bond market—specifically—short-term interest rates.

The direction of short-term interest rates has had a fairly strong correlation with the political environment of the electorate. I should warn you that this is a soft relationship, and not to read too much into it. But as short-term interest rates rise, the country generally turns to the right. Conversely, when rates fall, the country shifts to the left. Generally,

It’s not that the Federal Reserve “pushes” the country in either direction, but instead, the electorate is reacting to the same things causing the Fed to act. Few things make a country more conservative than a bout of inflation (google Weimar and Germany for more details). The value of a country’s currency is one of those weird mystical bonds that connect a citizen to the state. When that gets ruptured, people don’t like it. It’s almost like a daily referendum on the legitamacy of the state.

Here’s a chart showing the change in short-term interest during the last five GOP-heavy election cycles. The elections were 1966, 1978, 1980 (a particularly crazy time), 1984 and 1994. In each of these elections, voters went to the polls facing higher short-term rates. I’ve also include the current cycle.

Here’s the GOP gain in the House in each of those cycles:

1966……………………47

1978……………………15

1980……………………34

1984……………………16

1994……………………54

James Carville once said that if he could be reincarnated, he’d want to come back as the bond market: “You can intimidate everybody.” -

Bed Bath & Beyond Admits Backdating

Posted by Eddy Elfenbein on October 11th, 2006 at 9:09 amBed Bath & Beyond (BBBY) just completed a big internal probe and has found that the company practiced options backdating. The Wall Street Journal reports:

Bed Bath & Beyond said its internal probe examining the period from its 1992 initial public offering through May 2006 found that the company had misdated options on 44 occasions, 37 of them in favor of the recipients. In many cases, the probe concluded, executives used “hindsight” to select favorable grant dates in the past when the stock was trading at low points.

As a shareholder, I’m not happy with what BBBY has done, but I’m impressed with the way the company has handled this. Here’s the company’s report.

This should have no effect on the stock. The company said that it won’t restate historical results, but it will take an $8 million charge next quarter, which is about three cents a share. -

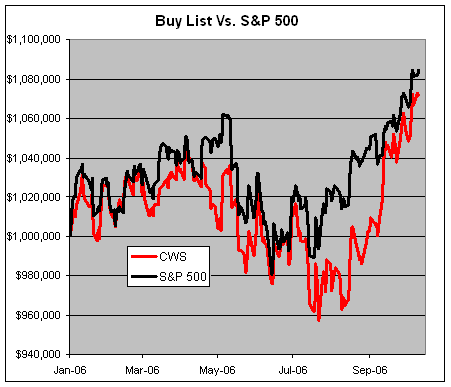

Buy List Update

Posted by Eddy Elfenbein on October 10th, 2006 at 8:11 pm

Through today, the Buy List is up 7.18% compared with 8.42% for the S&P 500. The good news is that we’ve closed the gap over the last two months. Since August 9, we’re up 11.30% compared with 6.91% for the S&P 500. -

Two Stocks I’m Watching

Posted by Eddy Elfenbein on October 10th, 2006 at 1:12 pmOne of things I enjoy about this blog is that it let’s me think out loud. Given that, here are two stocks that I’m keeping a close eye on right now. It doesn’t mean I’ll add them to the Buy List, but they look somewhat interesting at the moment.

The first is TrustCo Bank Corp. NY (TRST). This little bank is about as dull as they get. The share price has slooowwwlly drifted down from $13 to $11. This thing just doesn’t move much, and no one follows it. But TRST pays a nice dividend (hey, 16 cents a quarter is more than any T-bond will get you).

The other is Lincare (LNCR). Frankly, I’m undecided on this one. It’s a health care company that makes home oxygen equipment. The stock got slammed after Medicare cut back on its reimbursements. The stock is down, and it may be a great value. I’ll have to look at this more closely. -

Google Buys YouTube

Posted by Eddy Elfenbein on October 10th, 2006 at 10:00 amThe Google guys have swallowed YouTube for $1.65 billion. Marking its biggest deal ever, the Internet giant agreed to snap up the red hot site in a major push for video supremacy on the Internet.

“Google has taken the first step toward being more of a media company than a technology company,” said Joe Laszlo, senior analyst at Jupiter Research. “They bought the idea that social networking is big business – and they bought the leader.”

The Google-YouTube match-up marks another stunning story for an online start-up that didn’t even exist two years ago.

YouTube’s twenty-something founders, Chad Hurley and Steven Chen, started the company just 19 months ago, with the idea of giving regular folks a shot at uploading their own short videos onto the Web. In short order, YouTube became the Internet’s No. 1 video-sharing site.

The YouTube-ers and their 67-person staff – now overnight millionaires – will join Google but remain largely independent in Silicon Valley headquarters.Sigh. Will the 90s ever end?

-

Phelps Wins Nobel Prize

Posted by Eddy Elfenbein on October 9th, 2006 at 11:09 amCongratulations to Edmund Phelps, the winner of this year’s Nobel Prize in Economics:

The 73-year-old Columbia University professor’s work showed how low inflation today leads to expectations of low inflation in the future, thereby influencing future policy decision making by corporate and government leaders.

Phelps is the sixth American to win a Nobel this year, meaning that every prize except for the literature and peace awards, which are yet to be announced, have gone to Americans.U.S.A! U.S.A!

-

Fifty Years Ago Today

Posted by Eddy Elfenbein on October 8th, 2006 at 9:59 pm

Twenty-seven batters up. Twenty-seven down.

Retrosheet has the details: -

Today’s Jobs Report

Posted by Eddy Elfenbein on October 6th, 2006 at 9:25 amThis morning, the government reported that the unemployment rate fell to 4.6% (or 4.578% to be exact), which is the lowest rate since before 9/11. But the economy only created 51,000 new jobs last month which is less than half what economists were expecting.

The economic environment continues to be defined as one with surging corporate profits and very meager job growth. Over the last three years, the economy has created an average of 160,000 new jobs a month, which is just barely above the rate of growth of the labor pool. Contrast this with the 1990s when the economy routinely created over 250,000 jobs a month. -

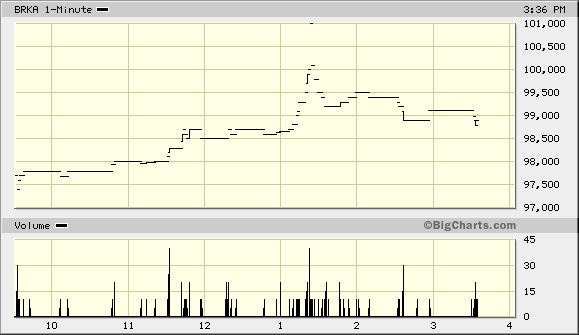

Berkshire Hathaway Breaks $100,000

Posted by Eddy Elfenbein on October 5th, 2006 at 4:04 pm

The stock reached $100 a share on the first day of trading in 1977.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His