-

Happy Birthday Smoot-Hawley!

Posted by Eddy Elfenbein on June 16th, 2006 at 10:45 amTomorrow is the 76th birthday of the Smoot-Hawley Tariff. President Hoover signed the bill into law on June 17, 1930. The president ignored the pleas of over 1,000 economists urging him not to sign the tariff.

By the way, today is the 76th anniversary of the stock market crashing 8%–one of the worst days in history. I wonder if there’s some sort of connection.

Incidentally, also on this day in 1930, the Braves traded veteran spitballer Burleigh Grimes to the St. Louis Cardinals. At the time, the Cards were in fourth place, but Grimes’ pitching helped them rally to win the pennant. His name lives on in the form of a widely panned musical comedy about the stock market. -

Fair Isaac Cutting 200 Jobs

Posted by Eddy Elfenbein on June 16th, 2006 at 10:00 amI’m usually wary of a press release which announces a new cost-cutting initiative. A well-run company should always be looking to cut costs. There’s nothing new about it, it just is. But the truth is, these announcements work, meaning it moves the stocks. This morning, it’s Fair Isaac‘s (FIC) turn:

Fair Isaac Corp., which develops credit scoring systems, said Thursday it will cut 200 jobs as part of its restructuring plan, reducing annual costs by $24 million.

The layoffs will affect workers in the company’s product management, delivery and development units. The cuts will mean one-time severance and related costs of $5.7 million, to be recorded this quarter, Fair Isaac said.

The restructuring also calls for a new chief marketing officer role and the transition of some engineering, quality assurance and maintenance work to Bangalore, India.The stock is up about 3% this morning.

-

The Best Day Since 2003

Posted by Eddy Elfenbein on June 15th, 2006 at 4:42 pmThe market broke its streak of 987 straight days without a daily swing of 2% or more. Today, the S&P 500 (^GSPC) gained 26.12 points, or 2.12%.

The last 2%-er came on October 1, 2003 when the S&P 500 gained 2.23%.

By the way, 987 is a Fibonacci number. (Spooky!) -

The Noonday Market

Posted by Eddy Elfenbein on June 15th, 2006 at 11:53 amThe market is building on yesterday’s late-day surge. So far, it’s the cyclicals leading the charge. The Morgan Stanley Cyclical Index (^CYC) is up 1.87%. Dow Jones tracks 100 industry groups, right now, 94 are higher. The energy and materials sectors are doing the best.

Gold is higher today. The metal fell late yesterday even after Tuesday’s big plunge.

This morning, the Labor Department said that unemployment claims dropped to 295,000 last week. That’s the lowest level in four months. Speaking of employment, McKinsey says that the jobless rate in Sweden is 15%, nearly three times the government’s estimate. Wow.

In the debt market, once again we have a split day. Yields at the long end of the yield curve are higher, while short-term rates are slightly lower. Once you get past maturities of five years, the yield curve is pretty darn flat.

I’ll have to give Bear Stearns (BSC) the award for best broker earnings of the week. The company earned $3.72 a share, 60 cents more than estimates. Both Goldman (GS) and Lehman (LEH) reported good earnings earlier this week, but it didn’t help their stocks.

There was some good news yesterday for Harley-Davidson (HDI), one of our Buy List stocks. Anthony Gikas, the analyst at Piper Jaffray, polled 30 Harley dealers and 28 said that business is meeting or exceeding expectations. The stock is trading at less than 13 times next year’s earnings. Also, the New York Times talked with Kevin Rollins at Dell (DELL).

Oh, and thanks to everyone who wrote in to complain about my World Cup bashing. Interestingly, approximately 98.4% of you mentioned baseball. So I have to admit, yesterday’s Saudi-Tunisia game was very good. The Germany-Poland game was also good except for the German’s late goal. I was really hoping to see the Poles walk away with a tie.

Two quick headlines to note. First, this one made me giggle. The other is from the New York Post on Dick Grasso taking the fifth 168 times, “Grasso Pass-o.” You gotta love the NYP for its headlines. -

Google To Buy Googleplex

Posted by Eddy Elfenbein on June 15th, 2006 at 7:36 am

Google (GOOG) is forking over $319 million to buy the Googleplex. The previous owner was Silicon Graphics (remember them?).

Here’s what the Googleplex looks like from 1,600 feet (via Google Earth).

The New York Times reports that Google is building a massive double top-secret facility in The Dalles, Oregon.The fact that Google is behind the data center, referred to locally as Project 02, has been reported in the local press. But many officials in The Dalles, including the city attorney and the city manager, said they could not comment on the project because they signed confidentiality agreements with Google last year.

“No one says the ‘G’ word,” said Diane Sherwood, executive director of the Port of Klickitat, Wash., directly across the river from The Dalles, who is not bound by such agreements. “It’s a little bit like He-Who-Must-Not-Be-Named in Harry Potter.”

Local residents are at once enthusiastic and puzzled about their affluent but secretive new neighbor, a successor to the aluminum manufacturers that once came seeking the cheap power that flows from the dams holding back the powerful Columbia. The project has created hundreds of construction jobs, caused local real estate prices to jump 40 percent and is expected to create 60 to 200 permanent jobs in a town of 12,000 people when the center opens later this year.I won’t say that I’m worried, but it does remind me of this.

-

A Funny Story Out of Japan

Posted by Eddy Elfenbein on June 15th, 2006 at 7:12 amWanna hear a funny story?

There’s this guy in Japan named Yoshiaki Murakami. (Wait, it gets better.)

He’s a legend in the Japanese mutual fund industry. To some people, he’s like a folk hero. The reason for his popularity is that he stands up for shareholders, and let’s just say that that’s not too “groovy” among the Japanese financial elite (it’s too…American).

But now Murakami is in serious hot water. Apparently, he heard from some guys at an Internet company called Livedoor that they wanted to buy a company called Nippon Broadcasting. Actually, Murakami didn’t think they were serious, but he already owned lots of Nippon, and he bought even more. Well, the Livedoor guys were serious, and they went after Nippon. The fight turned ugly and Livedoor lost. But the stock soared and Murakami sold his stake to Livedoor making a huge profit.

That’s pretty smart business, except for a minor problem—it’s against the law. Now Murakami has been arrested for insider trading. This is a HUGE deal in Japan. It would be like the Feds busting Jim Cramer on live TV.

But now, it’s gotten even weirder. It turns out that a guy named Toshihiko Fukui invested 10 million yen with Murakami. Oh, did I mention that he’s the head of the Bank of Japan? So not only has Cramer been arrested on live TV, but he’s managing Bernanke’s money! That’s what we’re talking about. Some people are now demanding Fukui’s resignation. The Japanese market just had its biggest one-day plunge since 9/11.

Come to think of it, the story really isn’t that funny.

The side story is that the Japanese economy is actually doing well for the first time in years. Fukui has hinted that he might lift interest rates from their current level of 0%. He just balked at an increase, but it’s coming soon. This scandal might actually have an impact on what the BOJ does. -

The Argument Sketch

Posted by Eddy Elfenbein on June 15th, 2006 at 6:53 amM: Oh look, this isn’t an argument.

A: Yes it is.

M: No it isn’t. It’s just contradiction.

A: No it isn’t.

M: It is!

A: It is not.

M: Look, you just contradicted me.

A: I did not.

M: Oh you did!!

A: No, no, no.

M: You did just then.

A: Nonsense!

M: Oh, this is futile!

A: No it isn’t.

M: I came here for a good argument.

A: No you didn’t; no, you came here for an argument.

M: An argument isn’t just contradiction.

A: It can be.

M: No it can’t. An argument is a connected series of statements intended to establish a proposition.

A: No it isn’t.The “Argument Sketch” from Monty Python

This is from CNBC yesterday. The video is about nine minutes long (after a brief Ford commercial). I don’t even know how to describe it. Joe Kernan is moderating an inflation “debate” between Diane Swonk of Mesirow Financial and Peter Schiff of Euro Pacific Capital. -

The Mark of the Bust

Posted by Eddy Elfenbein on June 15th, 2006 at 6:48 amMartin Mayer on the fate of the dollar:

What we have to watch out for is a sudden and drastic increase in foreign official holdings. Rapid growth in this number in the late 1960’s and 1970’s forecast the recessions of the early 1970’s and 1980’s, and it could happen again.

Recent large increases in foreign official holdings indicate that foreign private investors see fewer attractive places to put their money in the American economy. They could presage a significant fall in the price of American assets, stocks (witness the recent drops in American stock markets) and bonds and real estate and all, and a hard landing for a world economy still floating on the crest of cheap credit. -

The Flat Yield Curve

Posted by Eddy Elfenbein on June 14th, 2006 at 2:47 pm

For all the talk about commodities, bear in mind that the most important commodity that’s traded in the markets is risk. The thing about risk is that it mysteriously floats around in different market, but it’s always there.

Risk isn’t so easy to see in the equity market, but it’s very obvious in the yield curve. The chart above is a a good example of the effect that the stock market has on the bond market, and vice versa.

In March and April, the long-end of the yield curve was flat. But as the risky stock sectors rallied, the yield started to curve again. Now that money is leaving risky areas of the equity markets, the yield curve is flattening again. The same thing is going on, just expressed in different languages. -

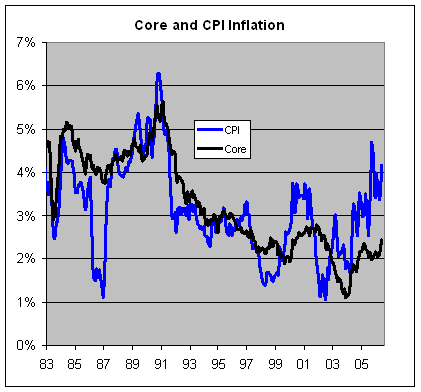

Today’s CPI Report

Posted by Eddy Elfenbein on June 14th, 2006 at 12:21 pmThe government reported that consumer inflation rose by 0.4% last monht, and the “core rate” rose 0.3%. This pretty much gurantees that the Fed will raise rates in two weeks.

Over the last twelve months, the CPI has risen by 4.2% and the core rate is up 2.4%. Here’s what inflation has looked like since 1983:

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His