-

Look Out Below!

Posted by Eddy Elfenbein on June 8th, 2006 at 11:39 amThe market is plunging this morning. The S&P 500 just lost all of its gains for the year. The index fell below 1240 to reach its lowest point in six months.

-

Abu Musab al-Zarqawi Is No More

Posted by Eddy Elfenbein on June 8th, 2006 at 9:37 amWe got him.

This probably won’t be enough to lift the stock market. Ticker Sense notes that the blip the market got from Saddam’s capture was very short-lived.

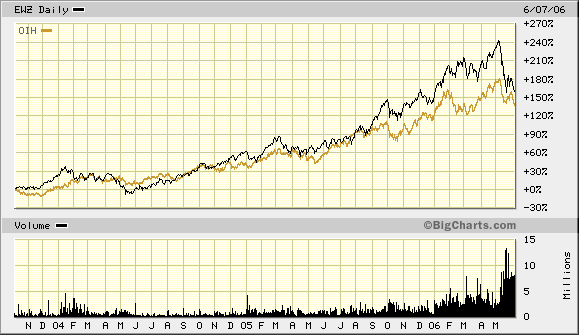

Here’s something interesting I noticed. Look at how strongly the Oil Services HOLDRs ETF (OIH) is correlated with the iShares Brazil ETF (EWZ):

-

From 1999

Posted by Eddy Elfenbein on June 8th, 2006 at 8:29 amSmart Money‘s Ten Stocks for the Next Decade:

Inktomi (INKT)

Red Hat (RHAT)

Scientific-Atlanta (SFA)

America Online (AOL)

Broadcom (BRCM)

Nokia (NOK)

Nortel Networks (NT)

MCI WorldCom (WCOM)

Monsanto (PHA)

Citigroup (C) -

Soccer and the Stock Market

Posted by Eddy Elfenbein on June 8th, 2006 at 7:16 amThe key to being a graduate student in finance is to compare any variable you can think of to the stock market. Since the World Cup starts tomorrow, I thought I’d show you results of a Dartmouth study comparing soccer matches to a nation’s stock market:

Stock markets move with soccer scores because they have a “decisive impact” on the mood of a nation, according to a study by Dartmouth College.

Match results may “have an important effect” on share prices, Professor Diego Garcia said, commenting on a report released by Tuck School of Business at Dartmouth this week. “There are forces influencing our economies that have little to do with rational thought.”

Stock markets decline 0.39 percent on average after the national team loses in a World Cup game and 0.29 percent in any international match, according to the study, co-written by Massachusetts Institute of Technology’s Alex Edmans and Norwegian School of Management’s Oyvind Norli.

The correlation is the highest in countries with the biggest public support for soccer such as England, France, Germany, Italy and Spain, the report said. In South American nations, the phenomenon is similar, it said.Here’s the entire paper.

-

Survey: iPods More Popular Than Beer

Posted by Eddy Elfenbein on June 7th, 2006 at 8:47 pmDamn.

SAN JOSE, Calif. – Move over Bud. College life isn’t just about drinking beer.

In a rare instance, Apple Computer Inc.’s iconic iPod music player surpassed beer drinking as the most “in” thing among undergraduate college students, according to the latest biannual market research study by Ridgewood, N.J.-based Student Monitor.

Nearly three quarters, or 73 percent, of 1,200 students surveyed said iPods were “in” – more than any other item in a list that also included text messaging, bar hopping and downloading music. In the year-ago study, only 59 percent of students named the iPod as “in,” putting the gadget well below alcohol-related activities.

This year, drinking beer and Facebook.com, a social networking Web site, were tied for second most popular, with 71 percent of the students identifying them as being “in.” -

Harley-Davidson Shares Rise on Note

Posted by Eddy Elfenbein on June 7th, 2006 at 4:12 pmFrom AP:

NEW YORK (AP) – Shares of Harley-Davidson Inc. rose Wednesday after an analyst issued a report saying the motorcycle manufacturer’s spring sales may be up more than expected.

In afternoon trading, Harley-Davidson shares were up $1.59, or 3.3 percent, to $49.55 on the New York Stock Exchange. Over the past year, the company’s shares have traded between $44.40 and $55.93.

Robin M. Farley of UBS Investment Research maintained his “Neutral” rating of the company, but said Harley-Davidson could post a 6 percent to 7 percent increase in U.S. retail sales at the dealer level for the period of April through May.

“Solid numbers so far in the second quarter seem to show Harley-Davidson consumer is intact,” Farley wrote in a note to investors.

“Unless we see a decline in June (we don’t think likely), second-quarter retail sales should meet Harley-Davidson’s target of plus 5 percent to 9 percent, and well ahead of Harley-Davidson’s planned increase in shipments of plus 1 percent in the second.”

But Farley cautioned that despite a year-to-date increase in retail sales of about 5 percent, the company’s shipments are back-end loaded and demand is not growing as much as Harley-Davidson’s planned production rate. -

Free Money!

Posted by Eddy Elfenbein on June 7th, 2006 at 11:36 am

One of the cases often made by market bears is that the economic recovery, such as it is, is largely illusionary, thanks to lots of cheap money and inflated real estate prices. There’s certainly a lot of truth to that, although I think too many bears overstate the case.

But they’re exactly rights about loose money. The chart above shows a good historical perspective. It charts the growth of an investment in Treasury Bills, adjusted for inflation, since 1953. In other words, real short-term interest rates. Over the long-term, real rates are rather puny–about 1.2% to 1.4% a year.

The problem with inflation is “some” begets “more,” and it can easily spiral out of control. If the cost of borrowing falls below inflation, then borrowers are being paid to borrow money. That’s what happened in the 70’s and you can see that the blue line headed down. In other words, real rates were less than 0%.

What’s interesting about this chart is that in the 80’s, the line appeared to revert to its long-term trend. But the trend was snapped again four years ago. I was shocked to see how much of a departure from history the last four years have been. Real short rates have been running about -1% a year since 2002.

The chart (based on Ibbotson numbers) runs through December 2005, although it looks like rates have stayed negative this year as well. For the first four months of 2006, the CPI (which may be understated) is up about 2.4%, or 7.3% annualized. Since January, the three-month Treasury yield has climbed from 4% to 4.7%. -

A Response to StockLemon.com

Posted by Eddy Elfenbein on June 7th, 2006 at 10:21 amIt certainly took them long enough. Here’s American Renaissance Homes’ response to yesterday’s allegations. Home Solutions of America (HOM) is rallying today.

-

Save the Penny

Posted by Eddy Elfenbein on June 7th, 2006 at 10:02 amGreg Mankiw and Tyler Cowen think we ought to get rid of the penny. I’m not so sure. Despite any economic rationalizations, people are weirdly loyal to their currencies.

Proper British gentlemen would never dream of conducting their racehorse business in anything but guineas. (I mean…really.) Did I mention that the last guinea was minted 193 years ago?

See here for an example. -

Jim Stack: Recession Dead Ahead

Posted by Eddy Elfenbein on June 7th, 2006 at 8:32 amI don’t always agree with Jim Stack, but he’s certainly someone worth listening to. Here’s his bearish outlook in the latest Forbes:

Slowly and methodically, the forces have been moving us toward an imminent recession. These cyclical forces include commodity inflation, which on a long-term basis is at the highest level since the 1970s. But they also extend deeper– into the monetary forces and even consumer psychology behind the economic expansion.

The yield curve has changed dramatically in the past 24 months, and is as “flat” as we can ever remember seeing it. The danger is the 88% historical probability of a recession that this represents. And if pressures preclude the Fed from easing later this year, one might say the odds of recession are closer to 100%.

In the past 40 years, there have been eight instances where the yield curve (10-year T-bond minus 3-month T-bill) has flattened to this extent. In four of those instances, the yield curve temporarily widened, only to flatten again: 1973, 1989, 1998 and 2000. But in only one of those eight instances was the economy able to avoid a recession.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His