-

Morning News: November 22, 2024

Posted by Eddy Elfenbein on November 22nd, 2024 at 7:03 amCOP29 Summit Pushes for $250 Billion Deal to Narrow Divisions

Zambia Weighs $900 Million Coal-Power Plan as Drought Hits Hydro

Putin’s Nuclear Threat Is a Magic Trick, but a Dangerous One

Ex-Goldman Banker Turned Lithium CEO Vows to Ride Out Downturn

China’s Plan B to Save the Economy: A Crusade Against Busywork

Japan Approves $141 Billion Stimulus to Boost Economy, Offset Living Costs

ECB’s Lagarde Sees Europe Under Growing Trade Threat

European Farmer Angst Revs Up Again Over Trade Deal and Tax

Inside the Deadliest Job in America

Why Trump Allies Say Immigration Hurts American Workers

While You Do 5-Day RTO I’ll Watch Your Best Workers Quit

What Bondi Might Do as Attorney General

The High Risk, High Reward Trump Market

Dollar Set for Longest Run of Gains in a Year Amid Haven Demand

Goldman Gives the Blockchain Revolution a Home

Crypto Tokens Targeted by US SEC Jump on Gensler’s Planned Exit

Private Equity Financier’s Returns Slump in a $1.2 Trillion Market

US Probes JPMorgan’s Ties to Iranian Oil Kingpin’s Hedge Fund

China’s Hacking Reached Deep Into U.S. Telecoms

How Adani’s Indictment Rocked His Empire and What Comes Next

MicroStrategy’s Infinite Money Glitch Won’t Last

Future-Proofing Biden’s Chips Legacy

Japanese Chip Maker Kioxia Plans Tokyo Market Debut

Jeff Bezos Says Elon Musk’s Claims Are ‘100% Not True’ After the Tesla CEO Reignites Their Feud

Roadrunner Scores Fresh Investment, Eyes Deals

What Happens When US Hospitals Go Big on Nurse Practitioners

McDonald’s Reaches for Choosy Diners With Value Menu Revamp

Amazon’s Black Friday NFL Game Is a Play to Keep You Paying for Prime

Be sure to follow me on Twitter.

-

Morning News: November 21, 2024

Posted by Eddy Elfenbein on November 21st, 2024 at 6:57 amBOJ Will Consider Impact of Weak Yen in Making Price Forecasts, Gov Ueda Says

Europe Is Gaslighting Itself About Its Energy Woes

Turkey Holds Rates, Signals Cuts Coming on Slowing Inflation

French Bond Risk Rises as Budget Tensions Keep Markets on Edge

French Factories Shrug off Trump Tariff Threat as November Mood Lightens

Trump Recruits His Season 2 Cast Straight From the Small Screen

Trump Seeks His Perfect Treasury Candidate as Search Drags On

Trump’s Economic Policy Can’t Be Just Nostalgia

Banks Hoping For Looser Trump Reins Are Too Giddy

The US Stablecoin Startup Fueling a $3 Billion Boom in Africa

Worldline to Raise New Debt After Tumultuous Year Hurts Earnings

Nvidia Says New Chip on Track After Forecast Disappoints

Apple Pay, Other Tech Firms Come Under CFPB Regulatory Oversight

U.S. Proposes Breakup of Google to Fix Search Monopoly

US Watchdog Issues Final Rule to Supervise Big Tech Payments, Digital Wallets

Clear’s Dominance in Airports Could Be Coming to an End

Baidu Revenue Falls Again as Advertising Demand Remains Weak

Alibaba Integrates E-Commerce Operations Into Single Business Group

Adani Charged by US in $250 Million Bribery Case, Shaking India

US Charges Erase $15 Billion From Gautam Adani’s Wealth in Hours

Archegos Founder Bill Hwang Is Sentenced to 18 Years

Brazil Finds Chinese Ally in Its Feud with Elon Musk

What Elon Musk Might Want From America

How Froot Loops Landed at the Center of U.S. Food Politics

Be sure to follow me on Twitter.

-

Morning News: November 20, 2024

Posted by Eddy Elfenbein on November 20th, 2024 at 7:08 amCOP29 Summit Enters Final Stretch With Nations Far Apart on Finance

The Clandestine Oil Shipping Hub Funneling Iranian Crude to China

Asia’s Dark Fleet Hub Highlights Trump’s Oil Sanctions Headache

Trump’s Treasury Search Gains Steam With Fresh Round of Meetings

How Howard Lutnick Could Shake Up Global Trade

Trump’s Cabinet Blitz Is Straight From Orban’s Playbook

Trump and the Triumph of America’s New Elite

Wall Street Is Too Pumped About Trump to Worry About His Policies

American Companies Are Stocking Up to Get Ahead of Trump’s China Tariffs

VCs Look to Secondary Share Sales as The New Exit While M&A Falters

Senator Warren Urges Fed to Keep Wells Fargo Asset Cap

Archegos’ Bill Hwang to Be Sentenced for Massive US Fraud

Why Some Tax Cuts Can Be Better Than Others

To Get the Housing Market Moving, Raise Property Taxes

Miami Condo King Extends Bet on Wealth Boom Spreading up Florida Coast

Resentment is Building as More Workers Feel Stuck

Nvidia Traders Brace for Potential $300 Billion Earnings Move

How Google Spent 15 Years Creating a Culture of Concealment

Iger’s Hero Act Could Leave His Successor Playing the Fool

Comcast to Spin Off Cable Networks, Including MSNBC and CNBC

The Onion’s Bid to Acquire Infowars Has Gotten Messy

Traffic on Bluesky, an X Competitor, Is Up 500% Since the Election. How Will It Handle the Surge?

Target Shares Tumble After Retailer Cuts Profit Outlook

U.S. Military Selects Little-Known Utah Supplier for Drone Program

Hennessy Workers Strike Over Plans to Bottle Cognac in China

The Unusual Power of VW’s Union Boss Is Being Put to the Test

NIO’s Net Loss Widens on Lower Revenue Amid EV Pricing Pressure

Be sure to follow me on Twitter.

-

CWS Market Review – November 19, 2024

Posted by Eddy Elfenbein on November 19th, 2024 at 5:06 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Fifty Years Since the Big Low

We’re soon coming up on a major market anniversary. Two weeks from Friday marks the 50th anniversary of one of the most dramatic lows in Wall Street history. On December 6, 1974, the S&P 500 closed at 65.01. That was the market’s lowest close in the last 60 years.

It’s hard to convey just how low this low was. This was near the low point for post-war American optimism. The stock market had given back all its gains from the previous 12 years. At its low, the market was not far above its peak from 45 years before. In fact, adjusted for inflation, the market was about where it had been in 1929.

Here’s the inflation-adjusted S&P 500 over the last 12 decades:

According to data I saw at Professor Robert Shiller’s data library, the stock market’s P/E ratio in December 1974 was 7.5. It’s more than three times that today. The dividend yield for the entire S&P 500 reached 5.4%.

This was a brutal time for investors. Watergate, Vietnam and inflation dominated the news. In less than two years, the stock market was cut in half. The 1960s saw an explosion in optimism and faith in the future. All of that seemed to unravel by the 1970s.

It’s interesting to note how nostalgic the 1970s was. People were looking backward not forward. One month after the market’s low, President Ford said in his State of the Union Address that the state of the union was “not good.”

Today’s investors assume a constantly rising market that will hit some bumps along the way. That belief hasn’t always been so widespread. Many investors, especially those who had lived during the Great Depression, thought that the stock market was a useless casino that was rigged against them.

As terrible as the headlines were in December 1974, it was a great time to invest. It just took a little courage and a lot of patience. Not including dividends, the stock market has risen more than 90-fold over the last half century. That works out to an annual gain of about 9.5%.

The market works, you just have to wait a little.

Walmart Hits All-Time High

Last Friday, the government released its retail sales report, but today we got an even better report, Walmart’s (WMT) earnings. The retail giant’s earnings are probably a better barometer of how happy consumers are than any government report.

The good news is that Walmart’s customers seem to be pleased. Interestingly, Walmart seems to be doing better with affluent shoppers.

For the quarter, Walmart made 58 cents per share which was a nickel ahead of expectations. Quarterly revenue was $169.59 billion compared with expectations of $167.72 billion. On average, Walmart generates $1.3 million of revenue every minute of every hour of every day for the entire quarter. The stock rose to an all-time high today.

Walmart now expects full-year sales growth of 4.8% to 5.1%. That’s up from the previous forecast of 3.75% to 4.75%. Sales of general merchandise had year-over-year sales growth for the second straight month, but that comes after 11 straight quarters of declines.

The current quarter, which ends in January, is the all-important holiday shopping quarter. For many retailers, this quarter is the biggie. That’s why so many retailers have off-cycle reporting dates. They don’t want to have December and January in different reporting quarters. Last week, I told you about the encouraging report from Home Depot (HD). We’ll soon hear from other big box retailers.

Walmart said it expects sales growth of 3% to 4% for this quarter. Last quarter, Walmart’s e-commerce sales increased by 22%. It’s now 18% of Walmart’s overall business. This was a solid quarter for Walmart and it could be an omen for a good holiday shopping season.

Housing Starts Plunged Last Month

This morning, the Commerce Department said that single-family housing starts fell last month. The drop was most likely due to the recent hurricanes in the South. Still, higher mortgage rates are holding back the housing market.

Even though the Fed is lowering interest rates now, the housing sector is still dealing with the Fed’s aggressive rate hikes of 2022-2023.

Single-family housing starts, which account for the bulk of homebuilding, plunged 6.9% to a seasonally adjusted annual rate of 970,000 units last month, the Commerce Department’s Census Bureau said. Data for September was revised higher to show homebuilding rising to a rate of 1.042 million units from the previously reported pace of 1.027 million units.

Single-family starts dropped 10.2% in the densely populated South, large parts of which were devastated by Helene in late September. Milton struck Florida in October. Ground-breaking on single-family housing projects plummeted 28.7% in the Northeast, but increased 4.6% in the Midwest and the West.

Single-family homebuilding slipped 0.5% from a year ago.

Starts for multi-family housing jumped 9.8% to a pace of 326,000 units. Overall housing starts dropped 3.1% to a rate of 1.311 million units. That was below Wall Street’s forecast. What’s happening is that many homeowners already locked in low rates on their mortgages so they’re reluctant to move now.

The yield on the 10-year Treasury, which tends to track mortgage rates, recently touched a five-month high. Longer yields have moved against the Fed’s policy of lower short-term rates.

This is a good reminder that it takes time for the Fed’s policies to impact the real economy. Traders currently think there’s a 60% chance that the Fed will cut again next month. That’s much lower than I expected. Perhaps Wall Street thinks there will soon be good reasons for the Fed to pause.

Get Ready for Nvidia’s Earnings

One more item. Nvidia (NVDA) is set to report earnings tomorrow. Get ready because this report could move the entire market. I confess, I have no idea what to expect, and neither does anyone else. The company now has a market value of roughly $3.6 trillion.

A year ago, Nvidia made 40 cents per share. The consensus this time is for earnings of 75 cents per share. Sales are expected to increase from $18.12 billion to $33.14 billion.

We can look at the action in the options market and see what to expect. For example, options traders expect shares of NVDA to swing by 8.5% after the earnings report comes out. That’s up or down and that average swing is roughly $300 billion. That amount is far larger than the vast majority of companies in the S&P 500.

NVDA has had several impressive after-earnings rallies, but that didn’t happen last time. Reuters quoted Matt Amberson who said that of the last 12 quarterly earnings reports, five post-earnings moves have been outside what has been expected by the market. “Of those, all have seen the stock price go higher, Amberson said.”

Nvidia’s CEO recently said that demand for the company’s next-generation AI chip Blackwell is “insane.” What would people in 1974 have said?

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: November 19, 2024

Posted by Eddy Elfenbein on November 19th, 2024 at 7:07 amOil Glut Set to Thwart Trump’s Call to ‘Frack, Frack, Frack’

German Defense Chief Sees Baltic Cable Breaches as Sabotage

Why US Will Let Ukraine Strike Inside Russia With American Missiles

Gold Is at the Mercy of Trump, China and King Dollar

Things Are Quiet in Consumer Credit. Too Quiet.

Trump’s Impossible Task: Delivering for the Working Class and Billionaires

Rethinking the Worst-Case Fears About Trump Tariffs

Wall Street’s Top Cop Plans to Exit Before Trump Takes Power

Five Ways R.F.K. Jr. Could Undermine Lifesaving Childhood Vaccines

RFK Jr. Would Put the Economy at Risk, Too

Companies With Immigrant Workforces Are Preparing for Raids

While You Were Voting, Corporate America Made Bank

Goldman Sachs Chairman Expects Deals to Pick Up in 2025

Morgan Stanley Courts Employees of Near-IPO Companies for Wealth Management

China’s Chip Advances Stall as US Curbs Hit Huawei AI Product

When IR Met AI: How the Technology Is Shaping Earnings-Day Prep

Nvidia’s Options Primed for $300-Billion Price Swing After Earnings

Google’s Anthropic AI Deal Cleared by UK Antitrust Agency

DOJ Will Push Google to Sell Chrome to Break Search Monopoly

Amcor to Acquire Berry Global in $8.4 Billion Packaging Deal

The Future of Abortion Rights Could Be Decided by Accident

Lowe’s Lifts Sales Forecast on Improving Housing Spend

Robots Struggle to Match Warehouse Workers on ‘Really Hard’ Jobs

Walmart Raises Outlook on Strong Spending From Value-Seekers

Shoppers Are Ditching Classic Brands They Once Loved

Blackstone Strikes Deal for Jersey Mike’s Subs

Swiss Watch Exports Fall Again Amid Plummeting Demand in China

Be sure to follow me on Twitter.

-

Morning News: November 18, 2024

Posted by Eddy Elfenbein on November 18th, 2024 at 7:04 amWhy Oil Companies Are Walking Back From Green Energy

Why Big Oil Doesn’t Mind Big Regulation

A Global Fund for Climate Disasters Is Taking Shape in Trump’s Shadow

Turkmenistan’s Gas Company Will Enlist Experts to Combat Methane Leaks

For Decades, Installing E.V. Chargers Didn’t Pay Off for Retailers. Now It Does.

Indian Students Rush to US Colleges, Driving Attendance Record

Moody’s Cuts Bangladesh Further Into Junk on Political Risks

Greek Banks Looking at Deals Abroad After Painful Restructurings

Eurozone Trade Surplus Rises on Jump in Exports to U.S.

Powell May Be Waiting Until 2026 for Housing Inflation to Cool

Trump Treasury Cabinet Pick in Flux as Jockeying Slows Selection

Trump Picks Brendan Carr to Lead F.C.C.

Four Priorities for Trump’s Top Telecom Regulator

Crypto Prediction Markets Have a Cloudy Future

HSBC Managers Are Competing to Keep Their Jobs in CEO’s Revamp

Bain Capital Raises $5.7 Billion for Global Special Situations

Wall Street Bankers Spot a Fat Payday in $1 Trillion AI Hysteria

Manufacturing Was Set to Rebound. Then Trump Happened.

Tim Berners-Lee Wants the Internet Back

Xiaomi Profit Beats on Robust Sales Across Segments

Why Tech Billionaires Love the Author of Jurassic Park

Ben & Jerry’s Vs. Unilever Is the End of Corporate Do-Gooderism

Spirit Air Files Bankruptcy Following Failed JetBlue Tie-Up

Auto Industry Braces for Whiplash as Trump Takes Power

Novo Nordisk Launches Wegovy in China With Prices Well Below US

Substack’s Great, Big, Messy Political Experiment

Paramount Takes Promotional Stunt to New Level for ‘Gladiator II’

Be sure to follow me on Twitter.

-

Morning News: November 15, 2024

Posted by Eddy Elfenbein on November 15th, 2024 at 7:03 amRussia Envoy Backs Paris Climate Deal, Hopes Trump Will Too

Oil Set for Weekly Loss Amid Demand Worries, Rate-Cut Slowdown Prospects

World Fears a Wider Trade War. Malaysia Sees an Opportunity.

China Stimulus Boosts Domestic Consumption as Trump Tariffs Loom

Eurozone Economy to Grow Less Strongly as Trade Spat Brews, EU Says

Trump US Election Win Comes With a Catch for Israel’s Far-Right

America’s Homes Are Piggy Banks That Few People Can Afford to Raid

CEOs Brace for the Chaos of Another Four Years of Trump

Boston Fed President Says December Rate Cut Isn’t a ‘Done Deal’

‘Flood of Money’ Chases US Banking’s Hottest New Trade

Traders Chase Post-Election Stock Gains in US Options Market

Investors Circle the Trump Trade’s Global Market Victims

Betting on Tesla Helped Ron Baron Beat the Index. Now He’s Getting a Trump Bump

Pay Close Attention to Your Credit Card Balance Under Trump 2.0

Musk’s New Job For Trump Already Exists

How Musk’s DOGE Can Actually Do Some Good

Trump’s Anti-Regulation Pitch Is Exactly What the AI Industry Wants to Hear

Musk Escalates Altman Legal Feud, Casting OpenAI as Monopolist

Super Micro’s Looming Nasdaq Deadline Stokes Delisting Fears

Biden Cements TSMC Grant Before Trump Takes Over

Hokkaido Electric Sees Power Demand Surge With Data Center Boom

Disney Targets $1 Billion in Streaming Profit in New Fiscal Year

DoorDash Wants to Give You a Ride and a TV Show With Dinner

Startups Turn to Ponds to Find the Next Climate-Fighting Superfood

The Onion Wins Bid to Buy Infowars, Alex Jones’s Site, Out of Bankruptcy

Returns Are a Headache. More Retailers Are Saying, Just ‘Keep It.’

Human in Bear Suit Was Used to Defraud Insurance Companies, Officials Say

Be sure to follow me on Twitter.

-

Morning News: November 14, 2024

Posted by Eddy Elfenbein on November 14th, 2024 at 7:03 amEuro Likely to Fall Further on ECB-Fed Divergence

Why the Dollar Keeps Getting Stronger

Dollar’s Enduring Appeal on Show in China’s Sovereign Bond Sale

Lula’s Embrace of Xi Sets Up a Clash Over Trump’s China Policy

Global Oil Market Faces a Million-Barrel Glut Next Year, the IEA Says

EIB to Unveil €500 Million in Bank Guarantees for Clean Tech

Trump Threatens ESG Investing That Thrived in His First Term

Kugler Says Fed Must Focus on Both Inflation and Jobs Goals

Inflation Needs Subtlety Right Now. It’s Getting Trump

Wall Street Bankers Temper Optimism A Week After Trump Victory

Crypto Industry Pushes for Policy Sea Change After Trump Victory

What Can Musk’s Department of Government Efficiency Actually Do?

Private Equity Finds Yet Another Way to Keep the Money Coming In

Brookfield Corp. Profit Climbs as Wealth Unit Boosts Results

CEOs Think Silence Will Save Them From Trump. They’re Wrong.

What Would a Matt Gaetz Justice Department Mean for Business?

Meta’s Week of Setbacks Suggests Tough Times Ahead

Homeland Security Department to Release New A.I. Guidance

Siemens Profit Tops Forecasts as Data-Center Demand Offsets Automation Woes

Disney Profit Beats Expectations as Movies, Streaming Gain

Disney Paints a Rosy Picture for Coming Years

The Fight for 7-Eleven Isn’t Just About Money

Capri, Tapestry Scrap Merger After FTC Wins Blocking Order

Arnault Son Climbs LVMH’s Top Ranks in Further Leadership Reshuffle

JD.com Profit, Revenue Rise as Consumer Sentiment Improves

Be sure to follow me on Twitter.

-

Morning News: November 13, 2024

Posted by Eddy Elfenbein on November 13th, 2024 at 7:05 amCountries Are Pledging Money They Don’t Control at COP29

Microsoft and Royal Bank of Canada Bet on New Approach to Carbon Cleanup

North Dakota Wants Your Carbon, But Not Your Climate Science

Copper Smelters Battered by Tight Supply and Weakening Demand

RWE Plans $1.6 Billion Buyback Due to Expected U.S., Europe Project Delays

Pro-Government Economists Blame Central Bank for Plunging Russia Into ‘Stagflation’

Gamblers Pay 400% Loan Rates to Fund Betting Frenzy in Brazil

Trump’s Contempt Is China’s Gain in Latin America

Trump Picks Musk, Ramaswamy for Government Efficiency Effort

Mr. Musk Goes to Washington — With a $2 Trillion Agenda

Powell Says US Inflation Views Are Anchored — Are They?

Fed’s Waller Says Central Bank Should Limit Its Role in Payment Systems

Republicans See a Better Economic Outlook. Now It’s Democrats Who Don’t.

Crypto Industry Lobbies Trump and His Allies to Capitalize on Election Wins

US CPI to Show Another Firm Reading, Leaving Fed Path Up in Air

Citadel Warns Recruiters: Don’t Pitch Fake Jobs

Klarna Readies US IPO With Valuation Recovering From Plunge

Europe’s Tech Startups Staggered by Lilium, Northvolt ‘Disaster’

Mizuho Financial Group to Buy 15% of Rakuten Card for $1 Billion

Swiggy Delivers 17% Surge in Debut as Investors Bet on Indian Quick Commerce

Tesla’s Meme-Like Stock Surge Leaves Wall Street Feeling Wary

7-Eleven Owner Considers Going Private in Japan’s Biggest $58 Billion Buyout

Spirit Air Nears Bankruptcy That Would Wipe Out Shareholders

Inside VW and Rivian’s $5.8 Billion Bet to Rescue Each Other

Sports League Platform Volo to Grow Via M&A With Bluestone Stake

The Streaming Wars Didn’t Kill the Little Guys. In Fact, They’re Thriving.

Be sure to follow me on Twitter.

-

CWS Market Review – November 12, 2024

Posted by Eddy Elfenbein on November 12th, 2024 at 6:20 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

On Monday, the stock market rallied to another new high. This was the S&P 500’s first ever close above 6,000 and it was the index’s 51st record high this year. The S&P 500 closed a bit lower today which snapped a five-day winning streak. Over those five days, the index gained a little over 5%.

For some context, the S&P 500 first closed above 600 on November 17, 1995. The index first closed above 60 on July 7, 1959.

We can even go back to a few days in 1932 when the S&P 500 closed below 6, but there’s a footnote attached to that stat. That would be the last time the index closed below 6, but we can’t say when the first time was because that day preceded the lifespan of the S&P 500. Still, a 1,000-fold gain in 92 years is impressive.

The Trump Trade Takes Over Wall Street

We now know what the “Trump Trade” is, but it may not last long. The Trump Trade is the market rewarding cyclicals, especially domestic manufacturers. That tends to skew towards small-cap stocks and the little guys have been very popular in recent days. The Russell 2000 ETF (IWM) is already up more than 10% this month.

The bond market reacted swiftly. The yield on the 10-year Treasury jumped 16 basis points to close at 4.42%, although the yield has backed down after the past few days.

I’ve been impressed by how some cyclical stocks have responded. That often happens at the same time long-term bond yields rise. For example, the S&P 500 Industrials ETF (XLI) has performed well. Financial stocks have also done well. The S&P 500 Financials ETF (XLF) rallied more than 6% on Wednesday and continued to go higher after that.

A good example of rallying financials comes from our Buy List. On Tuesday, shares of Farmer Mac (AGM) rallied more than 6% thanks to a good earnings report. Then on Wednesday, the day after the election, Farmer Mac ran up another 10%. The shares reached their highest point since this summer. The stock had been cheap for a long time, but the market seemed to only realize it all at once.

How about the rally in Bitcoin? President-Elect Trump promised to be a crypto-friendly president. He even talked about having a bitcoin strategic reserve. On election day, Bitcoin rose 9%, and it gained another 10% over the weekend.

Bitcoin is getting very close to $90,000. Two years ago, it was at $17,000. So far this month, Bitcoin has gained 28%, and November isn’t even half over.

By the way, in September, former NBA great Scottie Pippen made a deadly accurate prediction about the price of Bitcoin.

Satoshi Nakamoto visited me in my dream last night and predicted that #Bitcoin would be at $84,650 on November 5, 2024. Not financial advice.

— Scottie Pippen (@ScottiePippen) September 3, 2024

If you feel that you need to invest in Bitcoin, I’ll simply add that Bitcoin has had several major pullbacks in its short history.

Wall Street Braces for Tomorrow’s CPI Report

Now that Wall Street is past the election, the next big test for the market comes tomorrow morning when the October CPI report is released.

I’ll be honest, this report has some folks scared. The inflation data has mostly been getting better, but a bad report could unravel a lot of market narratives.

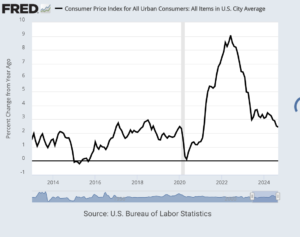

For September, the Consumer Price Index increased by 0.18%. That almost matched the 0.15% increase we had in July, and the 0.19% increase we had in August. The last five reports have all come in less than 0.2%.

For September, the 12-month rate reached 2.4% which was more than expected. Still, that’s a lot better than March when the 12-month rate hit 3.5%, and it’s far better than the peak of 9.1% reached in June 2022. Inflation has been improving, but it’s happened slowly.

The “core rate,” which excludes food and energy prices, hasn’t fared as well. For September, core inflation increased by 0.3%. That was the highest since March. In September, the 12-month core rate reached 3.3%.

The Fed meets again in five weeks, and there appears to be some doubt whether the Fed will cut rates again. Futures traders currently think there’s a 55% chance that the Fed will cut and a 45% chance that they’ll hold steady.

I suspect that a cut is probably coming next month but the number of cuts for next year may be in doubt. In September, Wall Street thought the Fed would have interest rates at 3% by this June. Now they think the Fed will be at 4% by June. I wouldn’t be surprised if we only see two more rate cuts next year.

Fed Chairman Jerome Powell was recently asked if he would resign if President-Elect Trump wanted him to. He gave a one word reply: “No.”

I noticed that Home Depot (HD) raised its sales guidance today. Last quarter, ending in late October, same-store sales fell 1.3%. Those beat expectations, and it was HD’s best sales performance in nearly two years. That says a lot when your best quarterly growth of the last seven quarters was still a drop.

I like to keep an eye on Home Depot’s fortunes because it’s a good barometer for the health of the home improvement sector. HD said it now expects to see comparable store sales fall by 2.5% for this year. That’s not great, but it’s better than the previous guidance for a drop of 3% to 4%.

Home Depot saw a pickup in demand for seasonal items and supplies for certain outdoor projects, some of which was related to hurricanes that have struck the US in recent months. Warm weather also helped with sales of products like grills, Chief Financial Officer Richard McPhail said in an interview Tuesday.

Home Depot said it anticipates some hurricane-related sales during the current quarter. Generators, lumber and clean-up products typically sell well during weather events.

Home Depot’s business can be particularly sensitive to the Fed’s policies since consumers often use debt to finance their home improvement projections. HD said that sales of garden and paint products increased but lumber and plumbing came in below expectations.

Home Depot is one of the first major big box retailers to report earnings. Soon we’ll get reports from companies like Target, Walmart and Lowe’s. These companies could be looking at a strong holiday shopping season.

Shares of Tyson Foods (TSN) got a nice bump today after the food company said it beat earnings. At one point, TSN was up more than 12% in today’s trading. It was the best-performing stock in the S&P 500 today.

This is interesting to see because Tyson is a good company, but the stock price had not done well. Tyson now sees its operating profit rising by 22% this year. That’s more than Wall Street had expected.

Demand for chicken, Tyson’s second-largest source of revenue, has improved as consumers look for cheaper alternatives to beef. Plunging prices for corn and soybeans also made it cheaper to feed animals, while a series of factory shutdowns and other measures boosted cost savings.

Last quarter, Tyson’s chicken business made up 70% of its sales while beef was a money loser. For its fiscal Q4, Tyson made 92 cents per share. The consensus on Wall Street had been for earnings of 69 cents per share.

Over the last five years, the S&P 500 has nearly doubled but TSN is down by two-thirds. Even after today’s rally, shares of TSN still yield a healthy 3.3%. Tyson’s been down so long, it’s hard for me to see this as a bargain, but with more quarters like this last one, Tyson would be a compelling buy.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His