-

Morning News: October 30, 2024

Posted by Eddy Elfenbein on October 30th, 2024 at 7:07 amOil Producers Wrestle With Plans to Boost Supply

At Three Mile Island, a Test of Nuclear Power’s Promise

China Three Gorges Plans $10 Billion Renewables-Coal Power Base

Logging Is a Way of Life in Appalachia. It’s Hanging on by a Thread.

Spain Opens Its Doors to China as a European Trade War Looms

Eurozone Expands Faster Than Expected, Raising Hopes of Soft Landing

German Economy Avoids Recession But Not Broader Crisis

Supply Chain Woes Carry High Risks, Big Rewards for Some Companies

A Wall Street Landlord Bought Your Neighbor’s House. It’s a Mixed Blessing.

Can Cash Still Make You a King?

Trump Trades — Bitcoin Is Boss, Bonds at a Loss

UBS Profit Outstrips Expectations as CEO Warns on Looming Risks

JP Morgan Chase Is Suing Customers Over ‘Infinite Money Glitch’ ATM Scam

Visa Profit Beats Expectation on Resilient Consumer Spending

Wall Street Giants to Make $50 Billion Bet on AI and Power Projects

AI Leaders Gather in Saudi Arabia to Talk Energy

At a Glitzy Saudi Investment Forum, Almost No Mention of War

US Efforts to Contain Xi’s Push for Tech Supremacy Are Faltering

Alphabet’s Pricey AI Bet Pays Off With Cloud, Search Growth

Reddit Set to Hit Record High After Strong Sales Forecast

Boeing, Union Hold ‘Productive’ Talks in Attempt to End Strike

Volkswagen in Drive to Cut Costs as Earnings Plunge

Lilly Cuts Guidance on Disappointing Weight-Loss Drug Sales

AbbVie Lifts Profit Outlook as Inflammatory Drugs Rinvoq and Skyrizi Beat Estimates

GSK Cuts Vaccine Sales Outlook Amid U.S. Weakness

New Starbucks CEO Is About to Test Wall Street’s $21 Billion Bet

Somewhere Amid the Frappuccinos, Fans Say Starbucks Lost Something

Be sure to follow me on Twitter.

-

CWS Market Review – October 29, 2024

Posted by Eddy Elfenbein on October 29th, 2024 at 6:31 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Job Openings Plunge by 400,000

We’re now in the heart of earnings season, and that’s dominating the news on Wall Street. We’re about one-third of the way through earnings season, and this will be an especially busy week. Companies that make up 42% of the S&P 500’s market value are due to report this week.

Many tech stocks are faring well. In fact, the Nasdaq rallied to a new high today. Alphabet, Google’s parent, reported very good results after the closing bell. Several other tech giants are due to report soon.

It’s hard to draw an overall theme for this earnings season just yet. Some stocks are doing quite well. Royal Caribbean raised its guidance for the fourth time this year, but Ford said that earnings will be at the low end of expectations.

It’s still early, but the beat rate for this earnings season is low. So far, 78% of companies that have reported earnings have beaten expectations. If that trend holds up, this will be the lowest beat rate since Q4 of 2022. That includes the fact that estimates were lowered—sometimes by a lot—as earnings season approached.

The S&P 500 is poised for its sixth positive month in a row, but the market hasn’t moved much in either direction for the past two weeks. That’s usually a bearish sign, but that can change on a dime.

Americans appear to be in an optimistic mood, at least according to the Conference Board. Earlier today, the group said that’s its reading for consumer confidence jumped 11% in October to 138. That’s the largest monthly increase in over three years. The Conference Board also has an “expectations” index, and that rose 8% to 89.1.

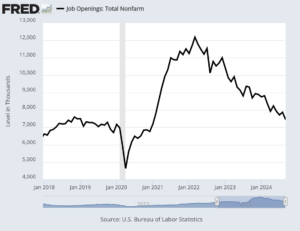

The bad news is that the number of job openings for September plunged to 7.44 million. That’s a drop of more than 400,000, and the prior month was also revised lower. Job openings are now at the lowest level since January 2021. The ratio of vacancies to available workers is down to 1.1. Not too long ago, the ratio was more than 2.0.

Layoffs are now at their highest since early 2023. We’re also seeing fewer quits. That’s usually a sign that the labor market is getting weaker. If that’s true, it’s very much different from the data we got in the last jobs report.

We’ll soon learn more. The October jobs report is due out this Friday. Wall Street is looking for a gain of 110,000 new jobs. That’s a low bar, and if that comes in weak, the entire view of the economy could change.

Unfortunately, it’s not going to be easy to divine a trend from these numbers. The problem is that the job numbers could be skewed due to the Boeing strike and the recent hurricanes. In other words, things could be worse than the official numbers say. Also, the job openings data tends to be very volatile.

To add more to the mix, the Federal Reserve meets next week, November 6 and 7. That’s after the election, but it may not be before we know who won. Despite all the hoopla in recent weeks, the expectation on Wall Street is that the Fed will again lower interest rates, this time by 0.25%. The futures market thinks the rate cut has a probability of 99%. I don’t see the Fed altering from its path anytime soon.

The real action lately hasn’t been in the stock market but in the bond market. Treasuries are supposed to be safe and sound but they’re looking at their worst month in two years. That’s probably because traders have realized the economy is better than they thought. Again, it’s not so much that the economy is soaring ahead, but it’s hanging in better than expected.

The yield on the 10-year Treasury rose to 4.28% today. That’s up 55 basis points since October 1. So the Fed lowers rates and the long-terms start to rise? That wasn’t supposed to happen, but Wall Street doesn’t always like to do what it’s told. It’s like a four-year old in that regard, and many others.

Much of the outlook for the market depends on how well the economy fares. Tomorrow morning we’ll get our first look at how the economy did during Q3. Wall Street is optimistic. The consensus is for growth 3.1%.

S&P 500 Calendar Effects

I’ve been working on a project that I thought I’d share with you. I’ve been knee-deep in market data for the last few days.

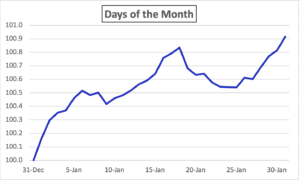

I took all the data for the S&P 500 going back to 1957. This is how the average month has performed for the index:

I used 1957 because that’s when the index was expanded from 90 to 500 stocks. As you can see, the stock market does much better near the start and end of each month (I used January as a stand-in). From the 6th to the 25th of each month has only been a little positive. The rest of the time accounts for the most growth.

Obviously, I don’t favor a strategy of going in and out of the market that quickly. I’m a confirmed buy-and-hold guy, but I find market patterns like this fascinating.

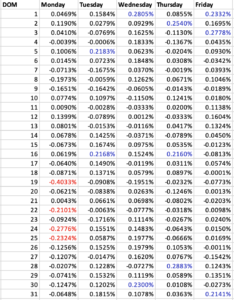

Here’s a look at how the S&P 500 has performed on each day and date of the month:

I’ve highlighted the best days in blue and the worst days in red. Again, I find this interesting, and it took me a long time to compile. Interestingly, Friday the 13th hasn’t been that bad for investors. Sorry, Jason.

By the way, today is the 95th anniversary of Black Tuesday, also a Tuesday the 29th.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: October 29, 2024

Posted by Eddy Elfenbein on October 29th, 2024 at 7:04 amBank of Japan Likely to Hold Rates, But Signal That Hikes Remain on the Table

Potential Japan Kingmaker Is Seeking Tax Breaks for Workers

Milei’s Revamp Offers CEOs a Glimmer of Optimism About Argentina

Two Euro-Zone Bellwether Economies Expanded Last Quarter

Weird Things Are Happening in the Bond Market

Big Bank Chiefs Don’t See Two More Fed Cuts This Year

Fed’s Rate Cut Revives Small Business Optimism and Plans to Borrow

HSBC Takes $300 Million Hit From Legacy Capital Repayment

Wall Street Sees Lines Blur Between Private Credit and Bank Debt

Wall Street Regulator Pledges to Press on Amid Trump Threats, Political Pressure

JPMorgan CEO Jamie Dimon Says ‘It’s Time to Fight Back’ on Regulation

Trump’s Vast Tariffs Would Rock Global Businesses and Shake Alliances

An Ethical Minefield Awaits a Possible Second Trump Presidency

How Russia, China and Iran Are Interfering in the Presidential Election

Elon Musk Wants Big Families. He Bought a Secret Compound for His.

Why a Key Biden Effort to Boost Affordable Housing Has Faced Hurdles

How American Tax Breaks Brought a Chinese Solar Energy Giant to Ohio

Alphabet Needs More Than Strong Results to Tame Wall of Worries

Apple Ships $6 Billion of iPhones From India in Big China Shift

Founder of TikTok Owner ByteDance Jumps to Top of China’s Rich List

China’s Top Oil Companies Turn in Mixed Results Amid Weak Demand

BP’s Profit Hits Four-Year Low on Commodity Market Weakness

Pfizer’s COVID-19 Drug Powers Strong Quarterly Profit as Activist Hovers

Novartis Lifts Guidance Again After Key Drugs Help Results

McDonald’s Sales Miss Estimates on International Weakness

McDonald’s Finds an Unlikely Savior to Finally Fix Its McFlurry Machines

Why You’re Seeing Scary-High Chocolate Candy Prices this Halloween

Be sure to follow me on Twitter.

-

Morning News: October 28, 2024

Posted by Eddy Elfenbein on October 28th, 2024 at 7:07 am$50 Billion Saudi Debt Drive Reflects Rising Financial Strain

Oil Plunges as Israel Limits Iran Strike to Military Targets

Pemex CEO Inherits One of World’s Most Inefficient Oil Companies

Galp Beats Profit Views on Resilient Upstream Performance

Cnooc Profit Rises as Expanded Output Offsets Weaker Demand

China Tightens Its Hold on Minerals Needed to Make Computer Chips

How Beijing Tamed a Lawless Industry and Gained Global Influence

What Japan’s Political Uncertainty Means for Its Market Rally

Britain Braces for ‘Painful’ Budget Meant to Recharge the Economy

Dollar Rises Further Due to U.S. Economic Strength, Ahead of Election

At a Pivotal Moment, U.S. Economic Data Will Be a Mess

Economists Warn of New Inflation Hazards After Election

Can a Democrat Be the Candidate of Small Business? Harris Gives It a Try.

Companies Are Dropping the D or E From DEI to Avoid Criticism

S&P 500 Profit Beats Disappoint as Season Kicks Into High Gear

The Porterhouse at Weis Points to Inflation’s Demise

Banks Seek AT1 Replacements For Year’s Biggest Turnarounds

For Investors, What if This Time Is Different?

Elliott Hunts Bigger Prey, Testing Limits in Barrage of Activism

Apple Blocked From Selling iPhone 16 Models in Indonesia

Meg Whitman’s Mission in Africa: American Tech Over Chinese

Boeing Launches $19 Billion Share Sale to Thwart Downgrade

At Boeing and Starbucks, Different Problems but Similar CEO Messages

VW Eyes Closing Three German Factories in Cost-Cutting Push

Philips Cuts Sales Target Due to Weak China Demand

How Taxpayers Are Helping Health Insurers Make Even Bigger Profits

The Last Few Months Have Been a Lot for McDonald’s

Swiggy Aims to Kick Off $1.35 Billion India IPO Mid-Next Week

Be sure to follow me on Twitter.

-

Morning News: October 25, 2024

Posted by Eddy Elfenbein on October 25th, 2024 at 7:04 amArctic Doomsday Vault Stashes More Seeds for Future Food

Gender Rift on Climate Change Widens Among Young Americans

South Africa Unveils Job Plan Amid Coal Phase-Out Backlash

Why the Philippines Is Building Its Capital Market

Tokyo Consumer Inflation Slows Below Bank of Japan’s Target

Russia’s Central Bank Lifts Key Interest Rate to Post-Invasion High

China Lawmakers to Meet During US Election Amid Stimulus Hopes

Trump 2.0 Haunts World Economy Chiefs Gathering in Washington Before Vote

It’s the Inflation, Stupid: Why the Working Class Wants Trump Back

U.S. Bond Market Braces for the ‘Trump Trade’ of Large Tariffs and Deficits

Clock Change Will Spark Headache for Power Market Traders

Wall Street Takes Tax-Loss Harvesting to the Next Level

Millennium Among Hedge Funds Losing Money Over Failed China Deal

Barclays Wins Bid to Slash UK Investors’ $727 Million ‘Dark Pool’ Lawsuit

What Can We Learn From the Romans About Money?

Masayoshi Son Inflates the AI Bubble Even More

Arm CEO Sees AI Transforming the World Much Faster Than the Internet

Apple Gets Sell Rating as ‘Unrealistic’ Expectations Turn KeyBanc Bearish

Why Boeing Workers Rejected a New Contract: Retirement Benefits

Auto CEOs Aren’t Telling the Whole Story About Phasing Out Combustion Cars

Mercedes-Benz Earnings Slump on Tough Economic Backdrop, Fierce Competition

Elon Musk’s Dream of a Drive-In Movie Diner With EV Charging Is Taking Shape

Electrolux Shares Tumble After North America Weakness Weighs on Results

Sanofi Earnings Get Boost From Early Vaccine Sales

Tapestry $8.5 Billion Capri Deal Halted by Judge in FTC Win

The Influencer Bros Selling More Baseball Bats Than the Pros

Be sure to follow me on Twitter.

-

Morning News: October 24, 2024

Posted by Eddy Elfenbein on October 24th, 2024 at 7:04 amEurozone Activity Stagnates on Germany, France Weakness

Putin Warns of Middle East Conflagration and Debates Ukraine at BRICS

Brazil Reluctant to Pick Between US and China in Polarized World

The U.S. and IMF Disagree About China. That’s A Problem.

Trump Inflation Is Being Priced In by Traders

Bond Markets Fear the ‘Known Unknown’ of a GOP Sweep

The French Connection to Online Bets on Trump

Era of Big Price Hikes Is Over, Giving Comfort to the Fed

Rate Cuts to Accelerate US Banks’ Move to Higher-Yielding Investments

Bankers Do Anything It Takes to Grab a Slice of Rare Buyout Deal

Apple and Goldman Sachs Must Pay Nearly $90 Million in Credit-Card Inquiry

Russia Says It Can’t Build All the Vessels It Needs for Arctic Shipping Route

More Companies Ditch Junk Carbon Offsets but New Buyers Loom

Tether Asks Turkey to Consider Digital Token for Borate Minerals

Biden Administration Outlines Government ‘Guardrails’ for A.I. Tools

The White House Bet Big on Intel. Will It Backfire?

How Intel Got Left Behind in the A.I. Chip Boom

Boeing Workers Resoundingly Reject New Contract and Extend Strike

Why It’s Getting Harder to Fly to China

New York’s Air Traffic Has Still Been Messy, Even When Run Out of Philadelphia

Southwest Air Tops Profit Estimates as Cost Cuts Take Hold

Southwest Airlines Ends Feud With Activist Investor Elliott

Keurig to Buy Ghost Energy Drinks for Over $1 Billion

Unilever Underlying Sales Beat Forecasts as Shoppers Welcome Easing Price Hikes

Kroger and Walmart Deny ‘Surge Pricing’ After Adopting Digital Price Tags

TKO to Pay $3.25 Billion for Endeavor’s Bull Riding, Other Units

Gucci Has Problems. The Biggest May Be a Safe New Look

Be sure to follow me on Twitter.

-

Morning News: October 23, 2024

Posted by Eddy Elfenbein on October 23rd, 2024 at 7:05 amGold’s Record-Breaking Run Is Drawing Attention

Producing Lithium Is Slow and Dirty. Is There a Fix?

Hydrogen Startup Verdagy Opens California Plant at Risky Moment

Javier Milei Infuriates G-20 by Rejecting Call for Gender Equality

Despite Global Crises, Gas Prices Slide as U.S. Election Nears

European Officials Voice Concerns About US Shift From Free Trade

As Election Looms, Disinformation ‘Has Never Been Worse’

How the Media Can Escape Its Doom Loop of Distrust

Harris Backs $15 Minimum Wage in Fight With Trump Over Pay

Jamie Dimon Privately Supports Kamala Harris. He Just Won’t Say So.

Deutsche Bank’s Bad Debt Outlook Deteriorates for Second Time

Shares in Operator of Tokyo’s Subways Soar in First Day of Trading

The ‘Irresistible’ Real Estate Bet Gripping Investors

US Mortgage Activity Gauges Drop to Lowest Levels Since August

Arm to Scrap Qualcomm Chip Design License in Feud Escalation

What’s Going on With AI Model Names?

Boeing’s New C.E.O. Calls for ‘Culture Change’ as Strike Vote Looms

Boeing CEO Says Planemaker’s Problems Will Take Time to Fix

American Airlines Fined $50 Million for Treatment of Passengers Using Wheelchairs

Frontier, Spirit Airlines Revive Merger Talks

Cracked Skull, Fractured Bones Show Danger for Rivian Factory’s Workers

F.D.A. Names a New Chief of Medical Devices

E. Coli Outbreak Linked to McDonald’s Quarter Pounders

Coca-Cola Raises Outlook, Continued Price Hikes Lift Sales

Starbucks CEO Pours a Cold Brew

Lysol Maker Reckitt Benckiser Beats Views as Easing Prices Draw Shoppers

Cash-Strapped Colleges Are Selling Their Prized Art and Mansions

Be sure to follow me on Twitter.

-

CWS Market Review – October 22, 2024

Posted by Eddy Elfenbein on October 22nd, 2024 at 2:19 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Q2 Earnings Are Looking Good (Mostly)

Q2 earnings season is in full swing. This week, 112 members of the S&P 500 and seven of the 30 stocks in the Dow are due to report earnings. The early numbers look mostly good. The good news is that more companies are beating earnings, but they’re doing it by smaller amounts.

This looks to be the fifth quarter in a row of earnings growth, but it will be the slowest growth in the last year.

The stock market doesn’t seem terribly concerned. The S&P 500 is down a bit since its last all-time high close reached on Friday.

The stock market has had a very impressive run since the last low reached in early August. The index is currently more than 3% above its 50-day moving average.

So far, 14% of the companies in the S&P 500 have reported earnings results. Of those, 79% have beaten expectations. That’s a little above the usual rate. (Yes, on Wall Street, you’re expected to beat expectations.)

Companies are reporting results that are 6.1% above expectations. That’s lower than normal. Over the last five years, companies have topped results by 8.5%.

Digging into the details, we’ve seen decent results from many large banks, but the weak spot is that we’ve seen lower guidance from industrials.

Some of these numbers for expectations have been helped by analysts cutting back on their forecasts. Earnings growth is now tracking at 3.4%, but that’s down from 4.3% at the end of Q3.

Of the companies that have reported so far, 64% have beaten on revenue which is a little below the five-year average of 69%. On average, companies are beating on revenue by 1.1%. That’s below the five-year average of 2%.

If 4.7% is the actual revenue growth rate for the quarter, it will mark the 16th quarter in a row of positive revenue growth.

The “Magnificent 7” stocks are expected to report earnings growth of 18.1% for Q3. If you took those seven out of the S&P 500, then the other 493 stocks are expected to report earnings growth of 0.1%.

For this calendar year, analysts expect earnings growth of 9.4%. They see that ramping up to 15.1% for next year. I expect to see both numbers gradually lowered. The forward price/earnings ratio is currently 21.9 which is elevated but not extreme.

Moody’s Posts a Big Earnings Beat

Seven of our Buy List stocks are due to report this week. We already had three reports out earlier today. I’ll go over all of them in our premium issue, but I wanted to highlight one of them for today’s issue.

For Q3, Moody’s (MCO) said that its adjusted earnings rose 32% to $3.21 per share. Wall Street had been expecting $2.86 per share. The CFO said this was a “fantastic” quarter for Moody’s and I agree.

Moody’s also raised its full year guidance to a range of $11.90 to $12.10 per share. The previous range was $11 to $11.40 per share. Since Moody’s has already made $9.85 per share so far this year, the new guidance implies Q4 earnings of $2.05 to $2.25 per share. Wall Street had been expecting $2.18 per share.

CEO Rob Fauber said:

“Moody’s record-breaking revenue performance in the third quarter is a testament to our unwavering status as the Agency of Choice for our customers and our actions to prime the business for durable future growth. In parallel, we delivered strong recurring revenue growth in our analytics business, driven by investments and innovation that enhance our offerings and empower our customers with the insights necessary to navigate the complexities of an increasingly dynamic risk environment.”

The stock fell after the earnings report, but I’m not at all concerned. It’s not unusual for our stocks to drop after their earnings reports. The company continues to do very well. Over the last two years, shares of Moody’s have doubled for us, and that includes some big drops.

This week will be dominated by earnings news. There’s not much going on as far as economic reports. Several Fed officials will be speaking but that’s usually not so important for economic news.

Next week, however, will see some important news. The October jobs report will be out next Friday, November 1. If you recall, the jobs numbers for September were quite good. The U.S. economy created 254,000 net new jobs last month.

The other report to look out for is the first report on Q3 GDP. Of course, this report will be revised many times, but next Wednesday we’ll see the government’s first stab at it. Growth for Q2 was 3.0%. The Atlanta FED’s GDPNow model sees Q3 growth of 3.4%. That would be very impressive.

If the economy is doing better than expected, then we can see possible evidence in other places. For example, the yield on the 10-year Treasury has slowly crept higher. On October 1, the 10-year yield was 3.74%. By Monday’s close, it had risen by 45 basis points.

Tied to the higher bond yields is that growth stocks have been outperforming value stocks over the last few weeks. It’s not by a huge amount but the value/growth divide often mimics what Treasury bonds are doing.

Stock Focus: MarketAxess

Lately, I’ve been watching shares of MarketAxess (MKTX). This is a good example of a company that’s fairly large but not well known outside the world of financial data.

The company runs an electronic trading platform for the institutional credit markets. In other words, this is how the big boys trade bonds, and MarketAxess dominates the field. In electronic trading, 85% of bonds are traded on MKTX’s platform, as are 84% of junk bonds. That works out to 20% of all corporate bond trading in the U.S.

The company was started by Richard McVey in 2000, and he served as CEO until last year. The stock IPO’d in 2004 at $11 per share and it was a huge success. By 2020, MKTX got to $600 per share. Then it started to struggle. Earlier this year, the stock dropped below $200 per share.

Is there a potential bargain here? Possibly. MKTX dominates its business, and the company continues to be profitable, although it’s not seeing much growth in recent years. The business was impacted last year by lower corporate bond issuance.

The stock is suddenly popular again. In August, MKTX reported Q2 earnings of $1.72 per share. That was a four-cent beat. Last week, the stock briefly broke above $300 per share. That’s a huge turnaround for a short period of time.

MarketAxess is due to report earnings again on November 6. Wall Street is looking for earnings of $1.85 per share. The stock is hardly cheap. It’s currently going for about 35 times next year’s earnings. At a lower price, it could be worth buying.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: October 22, 2024

Posted by Eddy Elfenbein on October 22nd, 2024 at 7:06 amHow a Vicious Poverty Cycle Is Plaguing 12 Million People in the Amazon

Modi Touts Closer Russia Ties at BRICS Summit Amid US Annoyance

Why Turkey, a NATO Member, Wants to Join BRICS

Countries Wary of Picking Geopolitical Sides Now Have a Name

World’s Hottest Market Could Be Magnet for Foreign Issuers

ASML Chief Sees US Pressure Building for More China Restrictions

Yellen Rebukes Chinese Lending Practices in Call for Debt Relief

Bonds Slump Globally as Traders Rethink Fed’s Rate Cut Path

Helter-Skelter in Bonds as Markets Doubt Fed Cuts

Emerging-Market Debt Joins Global Selloff on Slower US Easing Bets

Private Markets Are Reserved for the Rich. Should a Test Let You in?

Simple Economic Explanations Keep Breaking Down. Here’s Why.

America’s Most Famous Inflation Gauge Is Easing — But Some of Your Biggest Expenses Are Left Out

S&P 500 Exposure Hits Levels That Preceded 10% Slide, Citi Says

The Era of Outsized Market Rallies Could Be Over

The Case Against Goldman’s Post-Election Stock Bounce

HSBC Appoints Pam Kaur as First Female CEO in Bank’s History

Elon Musk’s $1 Million Giveaways Test the Bounds of Election Law

Retailers Grasp for Holiday Magic Amid Raucous U.S. Elections and Shorter Season

How Kyiv Became a Leader in Digital Services Amid Wartime Strain

Japan’s Biggest Electronics Show Loses Its Consumer Charm

Form Energy’s Utility-Sized Battery Can Run for Four Days

SAP Gains $26 Billion in Market Value, Surging Past ASML

The Surprisingly Lucrative Business of Recycled E-Waste

The Quest to Save the ‘King’ of Japanese Rice From Rising Temperatures

America Is Primed for a Home-Renovation Resurgence

Walmart to Offer Prescription Delivery, Challenging Amazon

The CEO-Obsessed Succession Pro Leading Disney’s Search for Iger’s Replacement

Be sure to follow me on Twitter.

-

Morning News: October 21, 2024

Posted by Eddy Elfenbein on October 21st, 2024 at 7:05 amWhat to Know About the BRICS Group of Countries Rivaling the G-7

Chinese Banks Slash Lending Rates to Bolster Ailing Economy

Why Chinese Are Rushing Into a ‘Casino’ Stock Market

Israel Hits Hezbollah Finances as US Eyes Diplomacy in Lebanon

As Poor Nations’ Default Wave Peaks, Cash Shortage Could Take Its Place

JPMorgan Figures Show Surging Dollar Demand as US Election Nears

Trump’s Tariffs Appeal to Voters. Don’t Be Fooled.

Elon Musk Is Giving Away $1 Million a Day in Bid to be the ‘Secretary of Cost-Cutting’

U.S. Agencies Fund, and Fight With, Elon Musk. A Trump Presidency Could Give Him Power Over Them.

Wall Street Braces for a Lost Decade — But Not Yet

So You Have Decided to Buy Bonds. Here Are Six Charts Showing Your Options.

The Climate Short: Hedge Funds Pile Up Huge Bets Against Green Future

Coming in 2025: Even More Restraint on the Oilfield

The Energy Transition Is Powered By — Wait for It — Coal

Threat of Chinese Overcapacity Looms Over Memory Chips

TSMC’s Dominance Is Starting to Worry More Than Just Rivals

MetLife Said to Be in Talks to Buy Tycoon Li’s PineBridge Assets Outside of China

UBS sells its 50% stake in Swisscard to American Express

Crises at Boeing and Intel Are a National Emergency

Apple CEO Tim Cook’s Other Job: Helping Nike Turn Things Around

Meet the Florida Billionaire Who Wants to Be a Newspaper Baron

Behind Many Powerful Women on Wall Street: A Doting ‘Househusband’

Eight Bosses Confess Their Pop-Culture Guilty Pleasures

Empty Tables and Rising Costs Push More Restaurants Into Bankruptcy

CITIC to sell stake in McDonald’s China, HK operations for $430.3 Million

Watch Parties, Clinics and Guinness: How the N.F.L. Builds a Fan Base in Ireland

Halloween’s Mutation: From Humble Holiday to Retail Monstrosity

Be sure to follow me on Twitter.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His