-

October NFP = +250K; Unemployment = 3.7%

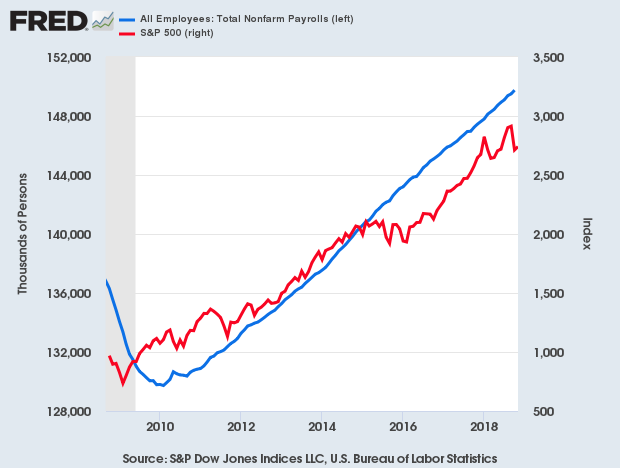

Posted by Eddy Elfenbein on November 2nd, 2018 at 9:03 amThe October jobs report is out! The US economy created 250,000 net new jobs last month. Wall Street had been expecting 190,000. The unemployment rate stayed at 3.7%.

The ranks of the employed rose to a fresh record 156.6 million and the employment-to-population ratio increased to 60.6 percent, the highest level since December 2008, according to the department’s household survey. That headline jobless number stayed level even amid a two-tenths of a percentage point rise in the labor force participation rate to 62.9 percent.

Those counted as outside the labor force tumbled by 487,000 to 95.9 million.

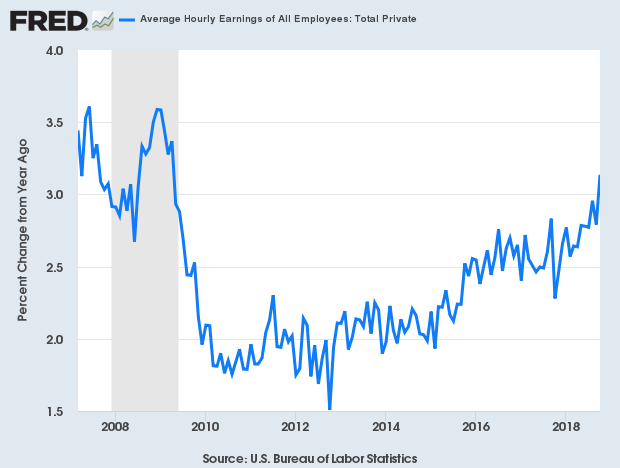

But the bigger story may be wage growth, which has been the missing piece of the economic recovery. Average hourly earnings increased by 5 cents an hour for the month and 83 cents year over year, representing a 3.1 percent gain. The annual increase in wages was the best since 2009.

That number is being watched closely by Federal Reserve, which has increased its benchmark interest rate three times this year and is on track for a fourth quarter-point hike in December. Higher wage growth feeds into the central bank’s desire to raise rates to keep inflation under control.

Here’s the year-over-year increase in average hourly earnings. It finally topped 3%.

U-6, which is a broader measure of unemployment, fell to 7.4%. The futures market is indicating a strong open.

Health care showed some of the biggest gains for the month, adding 36,000. Manufacturing contributed 32,000, thanks to a gain in durable goods and in particular transportation equipment, which added 10,000.

Construction also rose sharply, with an increase of 30,000 while transportation and warehousing jumped by 42,000.

In addition, leisure and hospitality was a strong contributor, with 42,000 new positions after being unchanged in September, due likely to Hurricane Florence, the government report said.

Professional and business services increased by 35,000, bringing its 12-month total gain to 516,000, and mining added 5,000.

Job growth skewed by full-time positions, which rose by 318,000, while part-time jobs increased by 242,000, according to the household survey.

Another closely watched internal metric, the average work week, increased 0.1 hour to 34.5 hours.

-

CWS Market Review – November 2, 2018

Posted by Eddy Elfenbein on November 2nd, 2018 at 7:08 am“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.” – Charlie Munger

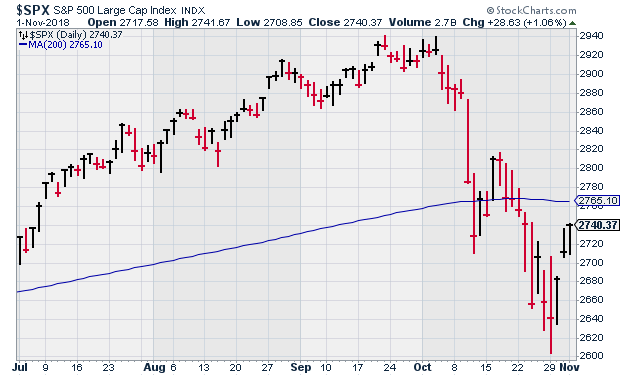

October has mercifully come to an end. The S&P 500 shed nearly 7% during the month making it the worst month for stocks in seven years. The Nasdaq suffered even more. The tech-heavy index was down over 9% for the month.

The good news is that there’s been some relief lately. The S&P 500 has rallied more than 1% for the last three days. That hasn’t happened in more than two years, but don’t think the storm has passed. As long we’re below the 200-day moving average—and we are—then there’s a threat that we’ll move lower. The market loves to “test” its low once or twice before making its next move.

In this month’s issue we have several Buy List earnings reports to cover. Some were good (Church & Dwight), others were not (Carriage Services). I’ll sort it out for you. We also have two more earnings reports next week that will be our final reports for this season. Now let’s take a closer look at the broad market.

The End of Red October

October was a very bad month for stocks. The major event came on October 3 when Fed Chairman Jay Powell said that we’re a “long way” from neutral. The markets took the clue. Later this month, we learned that mortgage rates touched a seven-year high. After that, we got a bad housing report which spooked the bulls even more.

I think the market has forgotten that housing can have a bad year. Not every slowdown means a global bust-up like we had ten years ago. But lately, just about any stock related to housing has felt the pain. With the general market wooziness, some tech stocks have been caught up in the selling, but most of the damage has been related to anything involved in construction. The S&P 500 Materials Sectors dropped 16% in a little over one month.

The market had a dramatic turnaround this week. From Monday’s low to Thursday’s close, the Dow gained more than 1,250 points. I tend to be wary of such strong “contra-trend” moves, especially when there’s so little to justify it. On Monday, the stock market had a pronounced reversal. A morning rally was wiped out. The difference between Monday’s high and low was over 900 points. On Monday, the S&P 500 got as low as 2,603.54. That’s 11.5% below the intra-day high from September 21.

The key for investors is the 200-day moving average. Historically, volatility is much higher below the 200-DMA than above it. Even with this week’s nice bounce, the S&P 500 is still about 1% below its 200-DMA. But a short burst is not a convincing move. Expect to see the S&P 500 back below 2,650 soon. Until then, make sure you have a well-diversified portfolio of high-quality stocks. Now let’s take a look at a busy week of earnings reports.

Eight Buy List Earnings Reports

We had another big batch of earnings this week (here’s our earnings calendar). Let’s start with Moody’s (MCO) which reported last Friday. For Q3, the company earned $1.69 per share, an eight-cent miss. That’s unusual for Moody’s. The company said that non-financial corporate debt issuance slowed down last quarter.

Even though this was an earnings miss, Moody’s earnings were still up 11% from a year ago. The company lowered its full-year range to $7.50 – $7.65 per share. That implies a Q4 range of $1.74 to $1.89 per share. On Friday, shares of Moody’s dropped nearly 9%. Fortunately, the stock made up a lot of lost ground this week. MCO gained more than 3% on Wednesday and then another 3% on Thursday. I’m dropping my Buy Below on Moody’s to $162 per share.

On Tuesday, we had two more reports. First up is Cognizant Technology Solutions (CTSH). For Q3, the IT outsourcer earned $1.19 per share. That beat estimates by six cents per share. The company had told us to expect earnings of at least $1.13 per share. Revenue rose 8.3% to $4.88 billion.

For Q4, Cognizant sees earnings of at least $1.05 per share and full-year earnings of at least $4.50 per share. That’s a bit light. The Street had been expecting $1.14 for Q3 and $4.53 for the year. Cognizant sees Q4 revenue between $4.09 billion and $4.13 billion.

The stock fell close to 4% on Tuesday, but it gained nearly all of it back on Wednesday. Cognizant is doing just fine. This week, I’m lowering our Buy Below to $74 per share.

Also on Tuesday morning, Wabtec (WAB) said they made 95 cents per share for Q3 which matched estimates. This is a crucial time for WAB with the big merger coming. Frankly, any merger news probably outweighs earnings news at this point.

Wabtec said they now expect full-year 2018 earnings of $3.85 per share which excludes merger costs. The company is aiming for a 13% operating margin and $200 million in cash flow. The CEO said he expects a strong Q4 and that the freight business continues to show strong growth. The merger with GE Transportation is expected to happen in early 2019. There will be a special shareholder meeting to vote on the deal on November 14.

I wasn’t as disappointed with this report as traders seemed to be. Shares of WAB dropped about 9% over Tuesday and Wednesday, but rallied some on Thursday. I still like this stock, but I’m dropping our Buy Below to $91 per share.

Earnings from ICE, Fiserv and Carriage

We had three earnings reports on Wednesday. Before the bell, Intercontinental Exchange (ICE) reported Q3 earnings of 85 cents per share. That was five cents ahead of expectations. Total revenue, excluding transaction-based expenses, rose 4.7% to $1.2 billion. Also, the board of directors authorized a new share-buyback program of $2 billion.

This was a good quarter for ICE. The company noted that it was the 22nd quarter in a row of year-over-year revenue growth. ICE didn’t offer any financial guidance. The company is also in the midst of a regulatory battle on the future of data fees. This is a very profitable business for ICE and the other exchanges, but the fight over regulations will probably wind up in the courts. The stock jumped 5.4% on Wednesday. ICE remains a solid buy up to $79 per share.

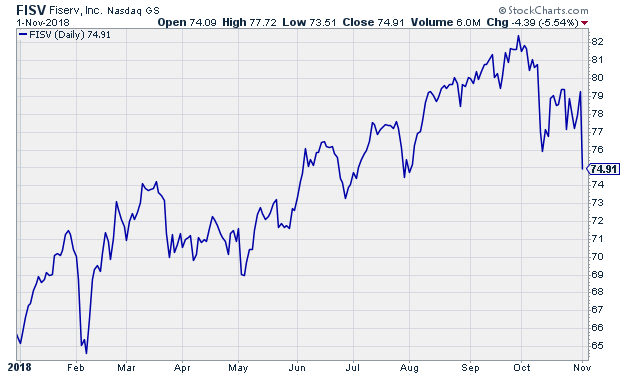

After the closing bell on Wednesday, Fiserv (FISV), “a leading global provider of financial-services technology solutions,” reported third-quarter earnings of 75 cents per share. That was two cents below estimates. In last week’s issue, I said I had been expecting an earnings beat from Fiserv.

Despite the earnings miss, Fiserv is having a generally good year. For the first nine months of this year, Fiserv has made $2.26 per share. Operating margin dipped to 31.6%, but that’s still quite good.

Fiserv also raised the lower end of its full-year guidance. The range had been $3.02 to $3.15 per share. Now it’s $3.10 to $3.15 per share. That represents growth over last year of 25% to 27%. That also translates to a Q4 range of 84 to 89 cents per share. Wall Street had been expecting 86 cents per share. This year looks to be Fiserv’s 33rd year in a row of double-digit earnings growth. The stock took a 5.5% bath on Thursday, but don’t let the earnings miss scare you. Fiserv is a buy up to $81 per share.

The report from Carriage Services (CSV) was a disaster. There’s no way to put a positive spin on this one. The stock plunged 21.5% on Thursday. When the weak Q2 report came out, management said the issues were temporary, and that they will experience “broadly higher performance during the latter part of the second half of the year.” That was wrong.

I took management’s word, and that was a big mistake. For Q3, Carriage earned 14 cents per share which was far below consensus of 22 cents per share. That’s down from 25 cents per share one year ago. I’m dropping my Buy Below down to $14 per share. You’ll notice that I’m not much bothered by a small earnings miss from companies like Fiserv because I have faith in the company’s management. Not so with Carriage. I apologize for this one.

Church & Dwight and Ingredion

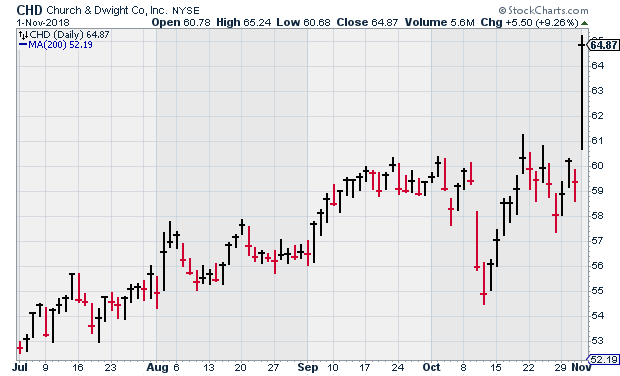

Church & Dwight (CHD) may be our star pupil this earning season. On Thursday, the consumer-brand powerhouse reported Q3 earnings of 58 cents per share. That beat estimates by four cents per share. Net sales rose 7.2% to $1.04 billion.

Consumer Domestic, which is CHD’s largest unit, saw net sales growth of 7.6%. Business growth was led by Arm & Hammer. I was pleased to see the company raise its estimate for full-year organic revenue growth from 3.5% to 4.0%.

For Q4, CHD expects earnings of 57 cents per share which makes the full-year total $2.27 per share. The stock jumped over 9% on Thursday. Church & Dwight qualified as my only Buy Below price increase this week. I’m lifting our Buy Below on CHD to $70 per share.

Last week, Ingredion (INGR) warned that Q3 earnings would be about $1.70 per share which was 26 cents less than what Wall Street had been expecting. The company also lowered its full-year guidance from a range of $7.50 to $7.80 per share to a new range of $6.80 to $7.05 per share. The company blamed weak currencies in developing markets plus power outages in North America. Ingredion said it will require more than one quarter to recover.

On Thursday, Ingredion confirmed that they did, in fact, make $1.70 per share last quarter. The company didn’t offer much more in specifics outside what we already know. The plan is to invest more in its specialties portfolio. I afraid I’m skeptical about Ingredion’s plans. I had been expecting to hear more concrete plans from them.

Two More Buy List Earnings Reports Next Week

We have our final two earnings reports next week. Becton, Dickinson (BDX) had a strange reaction to its last earnings report. The stock initially dropped but then regained its composure and proceeded to rally strongly to a new high. The good times ended in October when the stock pulled back sharply. I actually don’t mind seeing BDX at a discounted price.

The next BDX earnings report is scheduled for Tuesday, November 6. In August, BDX reported $2.19 per share for Q2. That beat the Street by three cents, and it was up 18.3% over last year. Becton also raised their revenue guidance for this year. Plus, they bumped up the low end of their full-year forecast. Becton now sees full-year EPS of $10.95 to $11.05 from a previous range of $10.90 to $11.05. For Q3, the consensus on Wall Street is for $2.93 per share.

Continental Building Materials (CBPX) is due to report on Thursday, November 8. Continental was our worst-performing stock last month. For October, CBPX shed more than one-quarter its value. At one point during the summer, we had nearly a 40% YTD gain in Continental. A few days ago, it was negative on the year for us. More remarkably, we didn’t hear anything from the company. As a wallboard stock, it’s certainly tied to the housing sector.

The last earnings report in August was quite good. CBPX made 59 cents per share which was 14 cents more than estimates. Net sales were up 15.5%, while EBITDA rose more than 21%. Gross margins improved to 29.4% from 25.5%. It’s not just about price increases; wallboard sales volume rose from 647 million square feet last year to 722 million square feet this year. The consensus on Wall Street is for earnings of 48 cents per share.

That’s all for now. The big news next week will be the mid-term U.S. elections on Tuesday. There will also be another Federal Reserve meeting on Wednesday and Thursday. Don’t expect to see any move on interest rates. The policy statement will come out on Thursday at 2 pm ET. I’m also curious to see Monday’s ISM Non-Manufacturing Index. The last report was the highest since the index was created ten yeas ago. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Can This Tech Stock Save Your Portfolio from the Market Crash?

Buy These 3 High-Yield Stocks to Protect Your Portfolio

Make This Easy Trade to Profit from Stalled Real Estate Prices

-

Morning News: November 2, 2018

Posted by Eddy Elfenbein on November 2nd, 2018 at 7:03 amA Synchronized Slowdown Is Looming

U.S. Oil Prices Fall to Lowest Since April

Trump Asks Cabinet to Draft Possible Trade Deal With China

Start-Ups Ask, ‘Are We Making Money for Saudi Arabia?’

Apple Warns on Holiday Sales, Sending Value Below $1 Trillion

Apple Silence on iPhone Unit Sales Sparks Concern, Shows Future

Boeing Eyes Services M&A, Small or Big, in Tussle with Airbus

Ford, Volkswagen Explore Venture to Challenge Tesla, Waymo

Starbucks Satisfies Investors With Stronger Sales, but Traffic Still Weak

Why Wait for Black Friday? Target and Walmart Just Launched Massive Holiday Sales

Succession at CBS Will Be Tougher Than It Looks

AT&T’s WarnerMedia Accuses DOJ with ‘Collaborating’ With Dish in HBO Dispute

Howard Lindzon: Apple and The Meta Game

Jeff Miller: Boost Your AT&T Dividend Yield

Roger Nusbaum: IRA & 401k Contribution Limits Going Up In 2019!

Be sure to follow me on Twitter.

-

Church & Dwight Earns 58 Cents per Share

Posted by Eddy Elfenbein on November 1st, 2018 at 11:37 amThis morning, Church & Dwight (CHD) reported Q3 earnings of 58 cents per share. That beat estimates by four cents per share. Net sales rose 7.2% to $1.04 billion.

Consumer Domestic, CHD’s largest unit, saw net sales growth of 7.6%. Business growth was led by Arm & Hammer.

Net sales for the consumer goods company rose 7.2% to $1.04 billion, ahead of the consensus forecast of $1.02 billion. Organic sales grew 4.7% driven by global consumer products growth of 5.4%.

For 2018, the company now expects organic sales growth to be about 4%, up from its previous estimate of 3.5%. It still expects sales growth to exceed 9% for the full year.

For Q4, CHD expects earnings of 57 cents per share which makes the full-year total $2.27 per share. The stock is up about 8% this morning.

-

ISM Falls to 57.7

Posted by Eddy Elfenbein on November 1st, 2018 at 10:46 amIt’s the first business day of the month and that means it’s time for the ISM Manufacturing report. For October, the ISM came in at 57.7. That’s the lowest reading since April, and it was below Wall Street’s forecast of 59.0.

Economists polled by Refinitiv expected the ISM manufacturing index to hit 59 in October. An index tracking new orders registered 57.4 percent, a decrease of 4.4 percentage points from the September reading of 61.8 percent.

“Demand remains moderately strong, with the New Orders Index easing to below 60 percent for the first time since April 2017, the Customers’ Inventories Index remaining low but improving, and the Backlog of Orders Index remaining steady,” Timothy Fiore, Chair of the ISM Manufacturing Business Survey Committee, said in a press release. “Consumption softened, with production and employment continuing to expand, but at lower levels compared to September.”

The current number is still a good one. Bad numbers don’t start until the mid-40s.

Despite the moderation in the manufacturing numbers, October marked the 114th consecutive month of overall economic growth, according to the Manufacturing ISM report.

The latest read on the health of the manufacturing sector comes amid an ongoing trade dispute between the United States and China as a part of President Donald Trump’s “America First” policy. The White House hopes that it can pressure Beijing into a more favorable trade deal through taxes on Chinese goods.

The president escalated the economic spat in September, imposing tariffs on an additional $200 billion worth of goods from China as of Sept. 24. The next wave of tariffs started at a 10 percent rate before climbing to 25 percent at the start of 2019 if the disagreement between the two nations is not resolved.

This morning’s jobless claims report showed a small drop to 214,000. We’re still near the lowest levels in 50 years. We’ll get the October jobs report tomorrow morning.

-

Morning News: November 1, 2018

Posted by Eddy Elfenbein on November 1st, 2018 at 7:01 amThe Fed Is Relaxing Banking Rules. What Goodies Are the Banks Getting?

U. S. Workers See Fastest Wage Growth in a Decade, But Inflation Takes a Toll

Private Sector Added 227,000 Jobs in October

Trump’s Budget Bet Piles Debt on Voters Promised a Pay Raise

Royal Dutch Shell Sees Profits Jump as Oil Price Rises

Why Apple Is Becoming a Major Obstacle to Facebook’s Growth

Did IBM Buy Red Hat At A Fair Price?

HBO and Cinemax Aren’t Available on Dish Network Due to a Dispute

Quad Graphics Acquires LSC Communications In Consolidation Of The Top Two Magazine Printers

Ford And Volkswagen Taking Their Self-Driving Efforts Abroad

How Mark Zuckerberg Became Too Big to Fail

Ben Carlson: Panic A Little & The Relative Anchor in Rates

Blue Harbinger: Do You Exit Your Trades When Conditions Get Risky?

Joshua Brown: Chart o’ the Day: Buying Stocks Before, During and After the Peak

Be sure to follow me on Twitter.

-

Carriage Services Earns 14 Cents per Share

Posted by Eddy Elfenbein on October 31st, 2018 at 8:06 pmCarriage Services (CSV) said they made 14 cents per share for Q3. This is not a good report. Revenue rose 5.2% to $64.1 million.

Mel Payne, Chief Executive Officer, stated, “The following quotes by me are from our second quarter earnings release:

‘We view the disappointing second quarter as a temporary performance aberration related to challenging revenue and margin vagaries in our funeral portfolio which is not historically symptomatic of long term operating trends…We have complete confidence that our operating leadership is effectively dealing with the revenue and margin challenges in our funeral portfolio and that we will experience broadly higher performance during the latter part of the second half of the year compared to our second quarter.’

Everything I said in the above quote I believed at the time, but after continued operating performance weakness in July and August I led a comprehensive analysis by our operating leadership and support teams of each of our businesses since 2011 using both operating and financial data trends as well as the corresponding Standards Achievement trends in each case.

On October 1st I wrote a Memorandum to all of our Managing Partners, Sales Managers, Field Operating Leadership Teams, as well as Houston Support Center Leaders explaining that our many long term high performance winners were subsidizing “too many” businesses with underperformance trends. Our Board of Directors is also fully informed and supportive of our analysis of the underperformance challenges and issues (85% – 90% self-inflicted) and of the plans we have developed and are executing to quickly restore the GAAP Earnings and Free Cash Flow Value Creation Power to our company.

We have developed detailed plans of action for each underperforming business that are being executed weekly, a program that began on October 2nd and will continue through the end of this year but will be essentially complete by the end of November. The simple goal of the underperformance turnaround plans on a case by case business basis is to have each business in our portfolio positioned for High and Sustainable Standards Achievement success in 2019 and thereafter. In other words, we fully expect to head into next year with our operating and financial performance substantially higher than the recent past and to have performance trends again being our friend.

We have also completed an outreach program to our Standards Council Members, Field Operating Leaders and members of our Operations and Strategic Growth Leadership Team and Operations Analysis and Planning Group. I have confidentially asked each for feedback on how best to reorganize our operating leadership and update our Funeral and Cemetery Performance Standards to achieve and sustain high operating and financial performance for a five year timeframe beginning January 1, 2019 and ending December 31, 2023.

I’ll give them points for frankness, but this report is very troubling.

-

Fiserv Misses By Two Cents

Posted by Eddy Elfenbein on October 31st, 2018 at 4:17 pmAfter the closing bell, Fiserv (FISV), “a leading global provider of financial services technology solutions,” reported third-quarter earnings of 75 cents per share. That was two cents below estimates. The stock is down in the after-hours market.

“We delivered another quarter of strong financial results in line with our expectation for internal revenue growth acceleration and excellent bottom-line performance,” said Jeffery Yabuki, President and Chief Executive Officer of Fiserv. “We completed the acquisition of the debit payment assets of Elan Financial Services which expands our reach and further enhances our growth profile.”

Fiserv made $2.26 per share for the first nine months of this year. Operating margin dipped to 31.6%, but that’s still quite good.

The company repurchased 5.6 million shares of common stock for $438 million in the third quarter, and 16.6 million shares of common stock for $1.23 billion in the first nine months of 2018.

The company announced a new 30 million share repurchase authorization in the quarter and had 34.9 million remaining shares authorized for repurchase as of September 30, 2018.Fiserv also raised the lower end of its full-year guidance. The range had been $3.02 to $3.15 per share. Now it’s $3.10 to $3.15 per share. That represents growth of 25% to 27%. That also translates to a Q4 range of 84 to 89 cents per share. Wall Street had been expecting 86 cents per share. This year will be Fiserv’s 33rd year in a row of double-digit earnings growth.

-

ICE Earns 85 Cents per Share

Posted by Eddy Elfenbein on October 31st, 2018 at 9:13 amStill more Buy List earnings reports. We have three more today. This morning, Intercontinental Exchange (ICE) reported Q3 earnings of 85 cents per share. That’s five cents more than expectations. Total revenue, excluding transaction-based expenses, rose 4.7% to $1.2 billion. Also, the board of directors authorized a new share buyback program of $2 billion.

“Our third quarter performance reflected strength across our futures, cash equities, listings and data services businesses, marking the 22nd consecutive quarter of year-over-year revenue growth,” said ICE Chairman & Chief Executive Officer, Jeffrey C. Sprecher. “Against an uncertain regulatory and political backdrop, we are focused on driving innovation, delivering growth and helping to serve our customers’ risk management needs.”

Scott A. Hill, ICE Chief Financial Officer, added, “Through the end of the third quarter, we have grown revenues and earnings, generated record operating cash flows and returned nearly $1.5 billion dollars to stockholders – more than any full year in our history. As we approach the end of 2018, we remain focused on our growth initiatives and value creation.”

The company didn’t offer any financial guidance.

-

Morning News: October 31, 2018

Posted by Eddy Elfenbein on October 31st, 2018 at 7:09 amChina Feels Trade War Pain as Export Gauge Signals Worse to Come

The Number 7 Could Make China’s Currency a Trade-War Weapon

These Are the Charts That Scare Wall Street

Facebook Expects Rising Costs to Combat Scandals to Moderate After 2019

Facebook’s Vision For the Future: Less News Feed, More Stories

Job No. 1 For GE’s New Chief: Fix Its Ailing Power Business

Samsung Reaps Record Profit, But Tougher Times Could Come

Carlyle Reports 25 Cents For Third-Quarter Earnings Per Unit, Misses Forecast

Coca-Cola Gets Lift From a Perennial Laggard: Diet Coke

Disney World’s Top Foe Is Ready to Punch Back

Reese’s Created a Machine to Swap Out All the Halloween Treats You Hate

The Get-Rich-Quick Scheme That Almost Killed a German Soccer Team

Nick Maggiulli: You Have No Competition

Michael Batnick: A Top or The Top?

Roger Nusbaum: Taking Control Of Adverse Financial Situations

Be sure to follow me on Twitter.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His