-

Morning News: October 20, 2023

Posted by Eddy Elfenbein on October 20th, 2023 at 7:03 amThe Potential Fallout of a Widening Israel-Hamas War

Prospect of Prolonged Israel-Gaza War Adds Economic Havoc to Human Toll

Inflation Raging at 130% Is Pushing Argentina Down a Radical Path

Americans are Worried About Paying Their Bills. That’s Helping Trump in Swing States

The Federal Deficit Is Growing. This Is Why

Economists Boost US Growth Projections, Reduce Recession Odds

Philadelphia Fed President Patrick Harker Discusses the Economic Outlook

How a Vegas Whale, and Many More, Tap Billions Meant for US Housing

AmEx’s Third-Quarter Profit Beats Estimates on Buoyant Spending

China, World’s Top Graphite Producer, To Curb Exports of Key Battery Material

Exxon Makes Up for Lost Time With $60 Billion Shale Deal

SLB Sees Growth Pivoting Overseas Amid Lower North America Sales

CMA CGM’s Saadé Urges Calm as Ocean Carrier Profits Plummet

Union Pacific Profit Falls on Weaker Freight Demand

Silicon Valley Ditches News, Shaking an Unstable Industry

Drug Companies Are Exploring Weight-Loss Shots for Kids as Young as Six

Want to Buy Commercial Aircraft? A Clunker May Be the Safer Bet

Crypto Influencers and ‘Degenerates’ Flock to Sam Bankman-Fried’s Trial

‘Oof’: Sam Bankman-Fried’s Trial Reveals Inside Details of How FTX Died

Paulson’s $1 Billion Caribbean Empire Faces Crisis and Betrayal

Halloween Is for Kids. ‘Kidults’ Too

Be sure to follow me on Twitter.

-

Morning News: October 19, 2023

Posted by Eddy Elfenbein on October 19th, 2023 at 7:05 amUkraine’s Economy Starts to Rebound as It Adapts to War

Why China-Russia Ties Worry America

Don’t Rule Out a Financial Crisis in China

Brazil Must Do More to Stop Foreign Bribery, OECD Says

The Price of Money Is Going Up, and It’s Not Because of the Fed

Markets Look to Powell Amid Rising Tensions in the Middle East

US Treasuries at 5% Are a Buy, Says Morgan Stanley Investment

UBS Looks Beyond Credit Suisse to Bank Even More Billionaires

Gemini, DCG Sued by NY for Defrauding Customers of $1.1 Billion

TSMC Thinks the Turn in the Chip Cycle Is Nigh

OpenAI Is in Talks to Sell Shares at $86 Billion Valuation

An Industry Insider Drives an Open Alternative to Big Tech’s A.I.

Nokia to Cut 14,000 Jobs in Major Overhaul at Telecom Giant

American Air Cuts Forecast on Higher Fuel Costs, Waning Demand

Tesla Tempers Growth Expectations as Musk Sees Storm Ahead

Not Just Autoworkers: Grad Students Make Up a Growing Share of UAW Members

Exxon Mobil’s Pioneer Acquisition Is a Direct Threat to Democracy

Chinese-Owned Pork Producer Smithfield Prepares for U.S. Listing

Is Netflix’s Subscriber Jolt a One-Hit Wonder?

Disney Sheds New Light on ESPN’s Financial Challenges

How Hundreds of US Government Employees Became Gun Industry Sales Reps

Be sure to follow me on Twitter.

-

Morning News: October 18, 2023

Posted by Eddy Elfenbein on October 18th, 2023 at 7:04 amBrazil Is Embracing the Migrant Crisis That Everyone Else Wants to Avoid

Business Leaders Confront a Dilemma Over ‘Davos in the Desert’

European Companies Cut Jobs as Economy Sputters

China’s Strong GDP Report Shows Housing Remains a Big Problem

U.S. Tightens China’s Access to Advanced Chips for Artificial Intelligence

Wall Street Worries Over Swelling US Debt Put Fed in Tight Spot

Why One Fed Official Is Ready to Stop Raising Rates

A Mark-to-Market Maelstrom Is Slamming a $10 Trillion Market Even Worse Than Before

Morgan Stanley Profit Shrinks as Deal Slump Lingers

Walmart Beefs Up Its Third-Party Marketplace As It Challenges Bigger Online Rival Amazon

Prologis Says Industrial-Property Demand Remains Resilient

J.B. Hunt Earnings Tumble on Falling Freight Rates

For Bill Ford, ‘Every Negotiation Is a Roller Coaster’

GM Delays Opening of Electric-Truck Factory Amid Cooling EV Demand

Tesla Earnings to Reveal Profit Impact Wrought by Price Cuts

Health Insurance Premiums Now Cost $24,000 a Year, Survey Says

The Ozempic Effect Is Coming for Everything From Kidney to Heart Disease Treatments

Abbott Narrows Annual Forecast Range as Quarterly Results Beat

How Phoenix Fans Watch Their Teams May Change How You Watch Yours

Barnes & Noble Sets Itself Free

Bug-Out Bags and Survival Training Go Mainstream

Be sure to follow me on Twitter.

-

CWS Market Review – October 17, 2023

Posted by Eddy Elfenbein on October 17th, 2023 at 6:51 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The First Q3 Earnings Reports Are Coming In

We’re getting a look at the first batch of Q3 earnings reports. On Friday, three of the big banks released their earnings reports. I’m not sure why the banks always go first. Perhaps it’s easier for the accountants.

In any event, all three banks beat earnings and all three stocks gapped up in Friday’s trading, although Citigroup eventually gave it all back and closed slightly lower. I’ll be frank, this hasn’t been a great year for many bank stocks.

This is a YTD chart of the S&P 500 Financials:

Let’s start with Citigroup’s (C). The financial behemoth has had a tough year, but it reported Q3 earnings of $1.52 per share. That was a 31-cent beat. I was not expecting results that good. The key stat for any bank is net interest margin. For Citigroup, that was 2.49% last quarter. Wall Street had been expecting 2.41%.

JPMorgan Chase (JPM) is always one to watch. JPM said it made $4.33 per share for Q3. That was well above expectations of $3.90 per share. JPM is probably the most important bank in the country (behind the Federal Reserve). JPM has nearly $4 trillion in assets. Still, deposits are down 4% from last year.

CEO Jamie Dimon said, “Now may be the most dangerous time the world has seen in decades.” I’m afraid he may be right. The good news is that JPM’s economists are saying that a soft landing is more likely than a recession.

Wells Fargo (WFC) is probably in the most difficult spot. The bank has even talked about layoffs and closing branches. WFC’s CEO said, “this company is not efficient—like period, end of story.”

Unfortunately, that’s about the only statement this bank has gotten right in the past three years. For Q3, Wells said it made $1.39 per share. That’s up significantly from the 86 cents per share it made in Q2. The Q3 results beat Wall Street’s forecast of $1.24 per share. Wells has a way to go before it’s healthy again.

On Tuesday, Goldman Sachs (GS) said it made $5.47 per share last quarter. Wall Street had been expecting $5.31 per share. The bank said it had stronger-than-expected trading revenue. Overall profits were down 33% to $2.058 billion.

Interestingly, both Wells Fargo and JPMorgan tapped the bond market after their earnings reports. Wells sold $6 billion in bonds in two parts. JPM did a three-part offering worth a total of $7.25 billion. This could mean the banks think rates and spreads may go even higher. Another possibility is that the banks maybe are adjusting their balance sheets ahead of new capital requirement rules.

This has been a rough stretch for the bond market. Even blue-chip bond yields are the highest they’ve been since 2009.

How Strong Is the Economy?

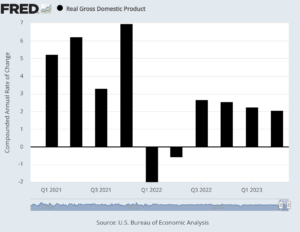

Get ready for next Thursday, October 26. That is when the government will release its first report on Q3 GDP growth. In plain English, this is the report card for the U.S. economy.

This report will be especially interesting because there’s a big divergence among economists. The consensus among Wall Street economists is for growth of just under 3.0%. That’s pretty average, maybe a little on the high side.

On the other side is the Atlanta Fed. Their GDPNow model is very bullish. It currently sees Q3 GDP growth of 5.1%. What does the Atlanta Fed know that no one else does? Beats me.

Growth of more than 5% would be remarkable considering all the rate hikes from the Fed and the fact that the manufacturing sector has been in a recession for more than a year.

Plus, the S&P 500 hasn’t done much since late-July. Mortgage rates are soaring, and the 10-year Treasury just touched 4.8%. Earlier today, we learned that homebuilder confidence fell to a 10-month low. Measures of housing affordability are the lowest on record.

According to stats from S&P Global Market Intelligence, the S&P 500 is now tracking earnings growth of -0.86% for Q3. That’s down from -0.59% one month ago.

The big loser is the Energy Sector. Earnings for that sector are projected to fall by 36.2%. It’s still very early, but so far, 84.2% of companies have beaten earnings estimates while 66.7% have beaten on sales.

The current consensus has the S&P 500 earning $218.67 per share for 2023. That’s the index-adjusted number. That means the S&P 500 is going for almost exactly 20 times this year’s forecasted earnings.

We did have some good economic news on Tuesday. The Commerce Department released the retail sales report for September. Last month, retail sales rose by 0.7%. That more than doubled Wall Street’s forecast for 0.3%.

The retail sales report can be tricky, so we should always look at the details. If we exclude car sales, then retail sales increased by 0.6%. Wall Street had been expecting an increase of 0.2%. All three retail sales reports for Q3 were above expectations.

The retail sales numbers are not adjusted for inflation. Over the last year, retail sales were up 3.8% while inflation increased by 3.7%.

Sales gains were broad-based on the month, with the biggest rise coming at miscellaneous store retailers, which saw an increase of 3%. Online sales climbed 1.1% while motor vehicle parts and dealers saw a 1% increase and food services and drinking places grew by 0.9%, good for a yearly increase of 9.2%, which led all categories.

There were only a few categories that showed a decline; electronics and appliances stores as well as clothing retailers both saw decreases of 0.8% on the month.

Wall Street is up in the air regarding the Fed’s next move. The current consensus is that the Fed won’t do anything in November. That’s probably right. For December or January, however, futures traders think there’s a decent but not overwhelming chance that the Fed will give us another rate hike.

Rite Aid Goes Bust

This weekend, Rite Aid (RADCQ) filed for bankruptcy. This is a sad ending for a company that seemed to offer so much promise.

To be honest, Rite Aid has been in a death spiral for a few years, so the ending wasn’t much of a surprise.

The major problem for Rite Aid is that it faced a slew of lawsuits related to opioid sales. The company has tons of debt, declining sales and mounting legal bills. It’s hard to come back from that.

With Chapter 11, the company will still be in business, but they’ll have to restructure. That means many of the stores will close, but that will take some time. Your local Rite Aid will probably be there for you.

The lawsuits claim that Rite Aid knowingly filled prescriptions for the addictive painkillers. The DOJ has also gotten in on the act.

I remember in the 1990s when Rite Aid was a terrific stock. Check out Rite Aid’s performance from 1990 through 1998:

It seems to have a limitless future. This is a great example of reading too much into a company’s past performance. It’s as if the chart is speaking to you and pointing ever higher.

It’s easy to fall into that trap, but that’s not how investing works. Here’s the same graph but through today:

Well, that’s quite a different story. To quote Warren Buffett, “If past history was all that is needed to play the game of money, the richest people would be librarians.”

Also, notice how long it took. There’s the famous exchange from The Sun Also Rises:

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually and then suddenly.”

Same for Rite Aid.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: October 17, 2023

Posted by Eddy Elfenbein on October 17th, 2023 at 7:03 amChina Invested $1 Trillion to Gain Global Influence. Can That Go On?

Country Garden, Evergrande Set Up Two Tense Weeks for Creditors

CVC Capital Is Said to Near Kickoff of Mega Private Equity IPO

Dalio’s Abu Dhabi Penthouse Shows Rise of New Hedge Fund Hubs

Goldman Sachs Profit Plunges on Impact from Fintech Sale, Real Estate Bets

Goldman Boss David Solomon Ditches His High-Profile DJ Gigs

BofA Beats Estimates on Trading and Net Interest Income Gains

BNY Mellon Beats Profit Estimates on Boost from Higher Interest Rates

AI Funding Soars to $17.9 Billion as the Rest of Silicon Valley Slumps

The Niche Insurance Policy Behind a Software Company’s Big Legal Payout

Starboard Takes 5%-Plus Stake in Contract-Research Firm Fortrea

Choice Offers to Buy Wyndham Hotels in $9.8 Billion Deal

Holiday Spending to Grow 14% This Year, Deloitte Survey Shows

How Long Can the American Consumer Keep Splurging?

It’s Getting Too Expensive to Have Fun

A Higher Monthly Payment, but Less Square Footage

Real Estate Brokers Pocketing Up to 6% in Fees Draw Antitrust Scrutiny

As Coal Plants Shutter, a Chance to Redevelop ‘the Gates of Hell’

Those Doritos Too Expensive? More Stores Offer Their Own Alternatives

John Legend Looks to Take on Yelp and Google Reviews With His First Tech Startup

No, Really, What Is Going On With Sam Bankman-Fried’s Baffling Defense?

Be sure to follow me on Twitter.

-

Morning News: October 16, 2023

Posted by Eddy Elfenbein on October 16th, 2023 at 7:03 amXi’s $1 Trillion ‘Project of the Century’ Faces Uncertain Future

Risk-Advisory Firms Decide Hong Kong Isn’t Worth It

China Got a Big Contract. Nepal Got Debt and a Pricey Airport

US to Tighten Curbs on China’s Access to Advanced Chip Tech

As Global Debt Worries Mount, Is Another Crisis Brewing?

Janet Yellen Says Higher Interest Rates May Persist in US

Home Sales on Track for Slowest Year Since Housing Bust

Surge in Health-Insurance Costs Pose Next Challenge for Finance Chiefs

The Goldman Banker on a Crucial Mission to Help Juice Its Stock

Florida’s Battered Orange Growers Are Cashing In on a Housing Boom

How a Fertilizer Shortage Is Spreading Desperate Hunger

Oil Prices Fluctuate as Concerns Mount Over Middle East Tensions

IMF, World Bank ‘Impotent’ on Israel-Gaza War Shock as Reforms Edge Forward

Warning of ‘Grave’ Errors, Powerful Donors Push Universities on Hamas

Harvard Cozies Up to #MentalHealth TikTok

Netflix Deepens Videogame Push, Ripping Page From Its Hollywood Script

Ad-Free Versions of Facebook and Instagram Have One Audience in Mind: Regulators

Brands Are Handing Out Freebies at Walmart as Online Ads Lose Appeal

Taylor Swift’s ‘Eras’ Is Easily the Biggest Concert Film Opening Ever

Rite Aid Files for Bankruptcy, Will Close More Stores

Altice Employees Raised Red Flags Years Before Corruption Probe

Be sure to follow me on Twitter.

-

Morning News: October 13, 2023

Posted by Eddy Elfenbein on October 13th, 2023 at 7:03 amU.S. Clamps Down on Russian Oil Sales With New Sanctions

The Oil Price Has a Safety Valve. Gas Doesn’t

China on Brink of Deflation Again Reveals Still-Weak Rebound

Investors Bet Thriftier Chinese Shoppers Are Here to Stay

Across U.S., Chinese Bitcoin Mines Draw National Security Scrutiny

Inflation Slowdown Remains Bumpy, September Consumer Price Data Shows

The Latest Tool to Refinance Short-Term Debt: Double-Dip Financing

JPMorgan Notches Another Net Interest Income Record, Lifts Guidance

Wells Fargo Raises Interest Income Forecast as Third-Quarter Profit Beats Estimates

BlackRock Clients Pull $13 Billion From Long-Term Funds

Dreams of Big Bond Gains Backfire With $10 Billion ETF Loss

Sam Bankman-Fried’s Lawyers Fail To Shake Ellison’s Account About FTX Crimes

Microsoft-Activision’s $69 Billion Pact, Biggest Gaming Deal, Cleared by UK

Retailers’ Seasonal Hiring Plans Signal a Cooling Labor Market

Detroit’s Electric Reckoning Has Arrived

Why Being an Auto Worker Isn’t as Lucrative as It Used to Be, in Charts

Detroit Carmakers Paid $1 Billion to CEOs as Auto Wages Slumped

South Korea Had High Hopes for 5G. What Happened?

Verizon Turns to Inside Fixer to Pull Mobile Giant Out of Downward Spiral

Your Face May Soon Be Your Ticket. Not Everyone Is Smiling

Green Energy Builders Sought Billions More in Subsidies. New York Said No.

Be sure to follow me on Twitter.

-

Morning News: October 12, 2023

Posted by Eddy Elfenbein on October 12th, 2023 at 4:39 amEnergy Firms, Green Groups and Others Reach Deal on Solar Farms

Natural Gas Prices Rise on Israel Concerns and Finland Pipeline Leak

Biden Weighs Freezing $6 Billion for Iran After Hamas Attack on Israel

Facing Exclusion From U.S., Chinese EV Suppliers Map a Circuitous Route Back In

China State Fund Buys Bank Shares, Fueling Rescue Hopes

ECB Should Not Stop Bond Buys Early, Stournaras Says

Fed Minutes Show Officials Divided on Future Rate Rise

What to Watch in the CPI Report: A Mild Inflation Reading Could Keep Fed on Hold

Bond Traders Are Starting to Bail on Winning Yield-Curve Bets

Barclays CEO Warns Banking Deal Revival Still Some Way Off

Goldman Sachs Offloads ‘Buy Now, Pay Later’ Firm in Quick Retreat

Goldman Sues Malaysia as 1MDB Settlement Dispute Escalates

Caroline Ellison Says ‘Sam Was the One’ Who Caused FTX Collapse

Birkenstock’s Stock Falls Nearly 13% in Trading Debut, Ends Well Below IPO Price

Billionaire Bets That a $12 Mobile Phone Can Get More of the World’s Most Populous Country Online

Ghost in the Machine: How Fake Parts Infiltrated Airline Fleets

NY’s Cannabis Rollout Could Destroy a Legal Entrepreneur

Autoworkers Escalate Strike as 8,700 Workers Walk Out at a Ford Kentucky Plant

Hollywood Studios Suspend Talks With Actors

Be sure to follow me on Twitter.

-

Morning News: October 11, 2023

Posted by Eddy Elfenbein on October 11th, 2023 at 7:05 amThis Country Won the Global Tax Game, and Is Swimming in Money

Yellen Says Nothing Is ‘Off the Table’ as U.S. Considers New Sanctions on Iran and Hamas

Higher Rates May Be Needed to Curb Inflation, Fed’s Bowman Says

Largest US Banks Grapple With Worst Write-Offs in Three Years

KKR and Carlyle Take No Carry on New Private Credit Funds

JPMorgan Has a Master Plan to Beat Competitors in Silicon Valley

Even Google Insiders Are Questioning Bard AI Chatbot’s Usefulness

U.S. Considers Dropping Sanctions Against Israeli Billionaire in Push for EV Metals

Exxon to Buy Pioneer for $60 Billion to Dominate Shale Oil

Fear and Anger Follow the Path of Joe Manchin’s Mountain Valley Pipeline

Birkenstock, the German Sandal Maker, Raises $1.48 Billion in Its I.P.O.

The Californization of the Texas Housing Market

Biden to Announce New Actions Slashing Junk Fees

Amazon Wants You to ‘Buy Again’

High UAW Wages Shrink Detroit’s Room to Maneuver

Boeing’s 737 MAX Output Falls to Lowest Level in Two Years

Walgreens Names Veteran Health-Care Executive Tim Wentworth as Next CEO

Claudia Goldin’s Nobel-Winning Research Shows ‘Why Women Won’

Only Question for Taylor Swift Film: How Big Will It Be?

Disneyland Lifts Prices Up to 9%; Florida Annual Passes Rise Too

Caroline Ellison, Adviser to Sam Bankman-Fried, Says He ‘Directed’ Her to Commit Crimes

Be sure to follow me on Twitter.

-

CWS Market Review – October 10, 2023

Posted by Eddy Elfenbein on October 10th, 2023 at 10:25 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

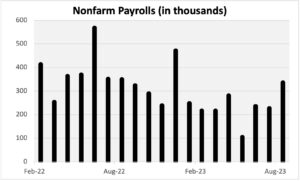

Wall Street Rallies on the September Jobs Report

On Friday, the government said that the U.S. economy created 336,000 net new jobs last month. That was well above expectations for a gain of 170,000. It was also an improvement of more than 100,000 jobs compared with August. September was the best month for job gains since January.

This report is very good news and it’s a sign that the economy may not be in as much trouble as the bears believe. While I’m pleased to see these numbers, I still think the economic cycle may be nearing its end.

Let me explain.

The labor market tends to be a lagging indicator. It usually tells us what just happened instead of what’s about to happen. After all, folks generally don’t lose their jobs until after business conditions weaken.

The jobs report also said that the unemployment rate was 3.8%. Wall Street had been expecting the jobless rate to fall to 3.7%.

I had been particularly interested to see the wage gains numbers. Unfortunately, they weren’t that good. For September, average hourly earnings rose by 0.2%. Wall Street had been expecting a gain of 0.3%. Over the last year, earnings are up by 4.2%. That’s above the rate of inflation but not by much. I disagree with the Fed about lots of things, but we’re on the same page on an important point. The recent bout of inflation was not caused by excess wages.

Here are some details from the jobs report:

From a sector perspective, leisure and hospitality led with 96,000 new jobs. Other gainers included government (73,000), health care (41,000) and professional, scientific and technical services (29,000). Motion picture and sound recording jobs fell by 5,000 and are down 45,000 since May amid a labor impasse in Hollywood.

Service-related industries contributed 234,000 to the total job growth, while goods-producing industries added just 29,000. Average hourly earnings in the leisure and hospitality industry were flat on the month, though up 4.7% from a year ago.

The private sector payrolls gain of 263,000 was well ahead of a report earlier this week from ADP, which indicated an increase of just 89,000.

The labor force participation rate stayed the same at 62.8%. That number has improved a lot but it’s still below the pre-Covid levels. I also like to look at the labor force participation rate for prime working-age adults. That was unchanged at 83.5%. The broader U-6 jobless rate rose to 7%.

The stock market was initially soft after the jobs report came out, but the bulls eventually got in control and the market closed higher. The rally was strong enough to continue into Monday and today. The bond market was closed yesterday for Columbus Day, but yields fell sharply today in a global desire for safety.

The problem with the economy right now isn’t jobs. The economy has created more than two million jobs this year, and there are nearly 10 million open positions. The problem is inflation.

Even if people are employed, they sense that the economy is not as good as it used to be. It’s often noted that if unemployment rises from 4% to 9%, that affects 5% of people. If inflation rises from 2% to 9%, that impacts 100% of people.

We’re at an odd point where jobs are plentiful but your money doesn’t go as far. For example, the cost of housing has been particularly hard on consumers. The median home price is up 27% since late 2019. The median age of a homebuyer is now 36. That’s the highest on record which goes back 40 years.

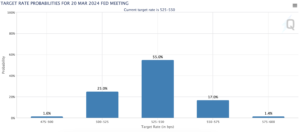

Wall Street seems to have reconciled itself to the fact that the Federal Reserve will pause once again at its next FOMC meeting. The Fed is scheduled to meet again on November 1.

The futures market currently places the odds of another pause decision at 86%. I was surprised to see traders place the odds of a Fed rate cut in March of next year at 25%. One week ago, those odds were at 7%. Those odds may get higher soon. The Fed doesn’t see a rate cut as probable until June 2024.

Here are the odds for the June FOMC meeting:

Raphael Bostic, the head of the Federal Reserve Bank of Atlanta, said he doesn’t see the need for more rate hikes. He’s been one of the more dovish members on the FOMC. It’s as if the recent rise in long-term bond yields has helped do some of the Fed’s work for it.

The market has a few hurdles to get through. Tomorrow, the Fed will release the minutes from its last meeting. This is when the Fed decided to pause on rates, but it tried to sound tough.

On Thursday, the government will release the CPI for September. Wall Street expects both core and headline inflation to have increased by 0.3% last month.

We’re also about to get some of the first earnings reports for the Q3 earnings season. The big banks usually go first. On Friday, Citigroup, JPMorgan and Wells Fargo are set to report.

SAIC Is Worth a Look

Defense stocks got a nice boost yesterday for obvious reasons. On our Buy List, we have Science Applications International (SAIC), which is a very good company. SAIC gained more than 4% yesterday and another 2% today.

Last month, SAIC said that its fiscal-Q2 earnings increased by 17% to $2.05 per share. That was well ahead of Wall Street’s consensus for $1.62 per share. This is the third quarter in a row in which SAIC has beaten the Street by more than 17%.

SAIC’s CEO Nazzic Keene said, “I am proud of the financial performance we delivered in the quarter with both strong organic-revenue growth and margin expansion. We remain on track to achieve our three-year financial targets and are off to a strong start.”

SAIC’s operating income increased 7% to $134 million. Operating margin widened by 70 basis points to 7.5%. Q2 EBITDA increased by 5% to $174 million, and EBITDA margin was 9.8%. Free cash flow was $143 million. These are solid results.

One impressive stat is that SAIC reduced its number of outstanding shares. For Q2, SAIC’s number of shares decreased from 55.9 million to 53.9 million. During the quarter, SAIC used $100 million to buy back shares and paid out $20 million in dividends.

SAIC also raised its outlook for the rest of this year. The company now sees full-year earnings coming in between $7.20 and $7.40 per share. That’s an increase of 20 cents to both ends of the previous guidance. Wall Street had been expecting $7.16 per share.

This is the second time this fiscal year that SAIC has increased its full-year guidance. The previous increase was also by 20 cents per share at both ends.

Shares of SAIC had a very nice run earlier this summer, but they had been somewhat weak lately. That is, until this week. SAIC’s next earnings report will be due out in early December. Look for more good results.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His