CWS Market Review – October 10, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Wall Street Rallies on the September Jobs Report

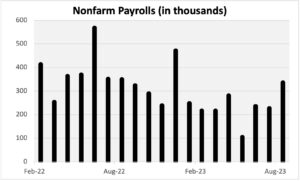

On Friday, the government said that the U.S. economy created 336,000 net new jobs last month. That was well above expectations for a gain of 170,000. It was also an improvement of more than 100,000 jobs compared with August. September was the best month for job gains since January.

This report is very good news and it’s a sign that the economy may not be in as much trouble as the bears believe. While I’m pleased to see these numbers, I still think the economic cycle may be nearing its end.

Let me explain.

The labor market tends to be a lagging indicator. It usually tells us what just happened instead of what’s about to happen. After all, folks generally don’t lose their jobs until after business conditions weaken.

The jobs report also said that the unemployment rate was 3.8%. Wall Street had been expecting the jobless rate to fall to 3.7%.

I had been particularly interested to see the wage gains numbers. Unfortunately, they weren’t that good. For September, average hourly earnings rose by 0.2%. Wall Street had been expecting a gain of 0.3%. Over the last year, earnings are up by 4.2%. That’s above the rate of inflation but not by much. I disagree with the Fed about lots of things, but we’re on the same page on an important point. The recent bout of inflation was not caused by excess wages.

Here are some details from the jobs report:

From a sector perspective, leisure and hospitality led with 96,000 new jobs. Other gainers included government (73,000), health care (41,000) and professional, scientific and technical services (29,000). Motion picture and sound recording jobs fell by 5,000 and are down 45,000 since May amid a labor impasse in Hollywood.

Service-related industries contributed 234,000 to the total job growth, while goods-producing industries added just 29,000. Average hourly earnings in the leisure and hospitality industry were flat on the month, though up 4.7% from a year ago.

The private sector payrolls gain of 263,000 was well ahead of a report earlier this week from ADP, which indicated an increase of just 89,000.

The labor force participation rate stayed the same at 62.8%. That number has improved a lot but it’s still below the pre-Covid levels. I also like to look at the labor force participation rate for prime working-age adults. That was unchanged at 83.5%. The broader U-6 jobless rate rose to 7%.

The stock market was initially soft after the jobs report came out, but the bulls eventually got in control and the market closed higher. The rally was strong enough to continue into Monday and today. The bond market was closed yesterday for Columbus Day, but yields fell sharply today in a global desire for safety.

The problem with the economy right now isn’t jobs. The economy has created more than two million jobs this year, and there are nearly 10 million open positions. The problem is inflation.

Even if people are employed, they sense that the economy is not as good as it used to be. It’s often noted that if unemployment rises from 4% to 9%, that affects 5% of people. If inflation rises from 2% to 9%, that impacts 100% of people.

We’re at an odd point where jobs are plentiful but your money doesn’t go as far. For example, the cost of housing has been particularly hard on consumers. The median home price is up 27% since late 2019. The median age of a homebuyer is now 36. That’s the highest on record which goes back 40 years.

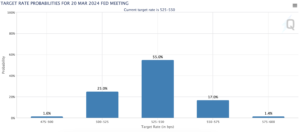

Wall Street seems to have reconciled itself to the fact that the Federal Reserve will pause once again at its next FOMC meeting. The Fed is scheduled to meet again on November 1.

The futures market currently places the odds of another pause decision at 86%. I was surprised to see traders place the odds of a Fed rate cut in March of next year at 25%. One week ago, those odds were at 7%. Those odds may get higher soon. The Fed doesn’t see a rate cut as probable until June 2024.

Here are the odds for the June FOMC meeting:

Raphael Bostic, the head of the Federal Reserve Bank of Atlanta, said he doesn’t see the need for more rate hikes. He’s been one of the more dovish members on the FOMC. It’s as if the recent rise in long-term bond yields has helped do some of the Fed’s work for it.

The market has a few hurdles to get through. Tomorrow, the Fed will release the minutes from its last meeting. This is when the Fed decided to pause on rates, but it tried to sound tough.

On Thursday, the government will release the CPI for September. Wall Street expects both core and headline inflation to have increased by 0.3% last month.

We’re also about to get some of the first earnings reports for the Q3 earnings season. The big banks usually go first. On Friday, Citigroup, JPMorgan and Wells Fargo are set to report.

SAIC Is Worth a Look

Defense stocks got a nice boost yesterday for obvious reasons. On our Buy List, we have Science Applications International (SAIC), which is a very good company. SAIC gained more than 4% yesterday and another 2% today.

Last month, SAIC said that its fiscal-Q2 earnings increased by 17% to $2.05 per share. That was well ahead of Wall Street’s consensus for $1.62 per share. This is the third quarter in a row in which SAIC has beaten the Street by more than 17%.

SAIC’s CEO Nazzic Keene said, “I am proud of the financial performance we delivered in the quarter with both strong organic-revenue growth and margin expansion. We remain on track to achieve our three-year financial targets and are off to a strong start.”

SAIC’s operating income increased 7% to $134 million. Operating margin widened by 70 basis points to 7.5%. Q2 EBITDA increased by 5% to $174 million, and EBITDA margin was 9.8%. Free cash flow was $143 million. These are solid results.

One impressive stat is that SAIC reduced its number of outstanding shares. For Q2, SAIC’s number of shares decreased from 55.9 million to 53.9 million. During the quarter, SAIC used $100 million to buy back shares and paid out $20 million in dividends.

SAIC also raised its outlook for the rest of this year. The company now sees full-year earnings coming in between $7.20 and $7.40 per share. That’s an increase of 20 cents to both ends of the previous guidance. Wall Street had been expecting $7.16 per share.

This is the second time this fiscal year that SAIC has increased its full-year guidance. The previous increase was also by 20 cents per share at both ends.

Shares of SAIC had a very nice run earlier this summer, but they had been somewhat weak lately. That is, until this week. SAIC’s next earnings report will be due out in early December. Look for more good results.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

Posted by Eddy Elfenbein on October 10th, 2023 at 10:25 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His