-

Morning News: February 22, 2023

Posted by Eddy Elfenbein on February 22nd, 2023 at 7:05 amThe EV Question for Auto Executives: How Fast to Make the Shift?

China’s Leading Electric Carmaker Has Arrived in Germany

China Urges State Firms to Drop Big Four Auditors on Data Risk

China’s Economic Support for Russia Could Elicit More Sanctions

Ukrainians Dig Into Their Own Pockets to Fund Everything From Drones to Mortars

U.S. Mortgage Interest Rates Jump to Highest Level Since November

US Home-Purchase Applications Drop to 28-Year Low as Rates Jump

US to Cut Mortgage Insurance Costs for Some New Homeowners

Inside Taiwanese Chip Giant, a U.S. Expansion Stokes Tensions

How Arizona Is Positioning Itself for $52 Billion to the Chips Industry

JPMorgan Restricts Staff’s Use of AI-Powered ChatGPT Bot

Stellantis Rises on Surprise Buyback, Strong Earnings

Palo Alto Networks’ Earnings Blowout Spotlights the Club’s Newest Stock

Chesapeake to Sell Shale Oil Assets to British Chemical Maker Ineos for $1.4 Billion

Japan Auto Giants Offer Biggest Raises in Decades Amid BOJ Focus

New York City Coffers are Flush With Cash as It Taps Bond Market

Pay and Plug: Federal Funds Spur Cleanup of Lost Oil Wells

How Hybrid Work Is Changing Offices of the Future

Be sure to follow me on Twitter.

-

CWS Market Review – February 21, 2023

Posted by Eddy Elfenbein on February 21st, 2023 at 7:21 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The S&P 500’s Worst Day of the Year

Wall Street has apparently re-entered one of its gloomy phases. The S&P 500 has fallen the last two weeks and today was not a good day for the bulls. The S&P 500 lost 2% today making it the worst day of the year so far.

Until recently, the market had been doing quite well. From October 12 to February 2, the S&P 500 gained more than 16%. Now that appears to be yet another of several bear-market rallies we’ve seen over the last 14 months. Today was the market’s lowest close since January 20.

It will be interesting to see if the bears can keep this downturn moving. The S&P 500 closed today below 4,000 for the first time in a month. The index is still above its 50- and 200-day moving averages, but the 50-DMA is getting close. It may seem surprising to you that the market is still up 4.1% this year because sentiment has been so negative this month.

The market’s latest drama centers around the fact that the despite the Fed’s best efforts, the U.S. economy, outside of housing, continues to do well. There’s even talk of the Fed resorting to a 0.50% rate hike at its next meeting. This isn’t the dominant view, at least not yet, but it may be gaining momentum.

Goldman Sachs said it sees the Fed hiking by another 0.75% this year, with zero rate cuts until 2024. We’ll learn more tomorrow when the Fed releases the minutes from its last meeting.

Earlier today, Walmart released a very good earnings report. Walmart is so big that its earnings report is effectively like a report on American consumer behavior. The company said that December was its best sales month in its history. For the quarter, Walmart made $1.71 per share. That was 20 cents more than expectations.

For the quarter, Walmart had sales of $164 billion. That’s a gigantic number and it’s up 7.3% from the same quarter one year before. Despite the good news from the quarter that just ended, Walmart gave a muted forecast for this year. The company warned investors that consumers are getting more cautious. Americans are starting to pull back as they feel the impact of higher prices. The CFO said, “prices are still high and there is considerable pressure on the consumer.”

Until now, most of the fallout from the rate hikes has fallen on the housing market, and not so much on consumers. That might be changing.

Walmart wasn’t alone. Today Home Depot cautioned that this year might not be as strong as they had hoped. Of course, there’s a key difference with Home Depot because its business is closely tied to the housing cycle, and higher mortgage rates have severely impeded the housing market.

Shares of Lowe’s also took a hit today. That’s common on Wall Street. Traders assume that if one company in an industry is having issues, then they all are. On our Buy List, Trex fell over 6% today. The deck company will report earnings this coming Monday. Even with today’s drop, Trex is still our top-performing stock this year.

Morgan Stanley said that the stock market “could” drop by 26% in the first half of this year. These pronouncements always make me smile since the word “could” is doing an awful lot of work. Sure, many things could happen, but what’s likely to happen? Also, it’s 26%. Not 25% or 27%, but 26%. I appreciate the specificity.

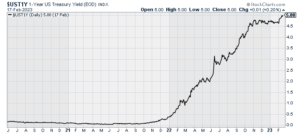

Morgan contends that that the risk-reward ratio has turned against stocks. That makes sense since short-term rates have increased. The one-year Treasury yield closed today at 5.07%. In May 2021, it was yielding 0.04%.

For some investors, it will be tempting to sit out of the market and earn an easy 5% for one year. That’s not me, but I understand the feeling. Higher rates become stiff competition for stocks, and prices will adjust. That explains a lot of what happened today. And yet, housing continues to be a mess.

Today’s Terrible Housing Report

Today we got the home sales report for January, and it was ugly. U.S. home sales fell for the 12th month in a row. CNN said it “was the weakest home sales activity since 2010.”

The data for single-family homes goes back to 1968, and this is the longest streak in declining home sales on record. According to the National Association of Realtors, sales of existing homes fell 36.9% over the last year.

The annualized rate of new home sales fell from over six million one year ago to four million last month. The average rate for a fixed-year mortgage has nearly doubled from around 3.5% to over 6%.

It’s as if the Fed wants to throw a net around consumers but it keeps catching the housing market instead.

Despite the lower home sales, home prices are still going up. In January, the median home price was $359,000. While that’s down from the peak of $413,800 in June, it’s still up 1.3% over last year. That’s the lowest year-over-year change in more than ten years.

It’s a buyer’s market. Last month, the average home spent 33 days on the market. That compares with 19 one year ago. As bad as housing is, I suspect it may finally turn before the end of this year.

Stock Focus: Illinois Tool Works

I like to reserve this space for stocks you may not have heard of. My goal is to show investors that there are lots of great stocks to buy once you leave the area where the popular stocks and cool kids hang out.

This week’s focus is on a very big company that’s still not well-known. Illinois Tool Works (ITW) has 46,000 employees and a market cap of $71 billion which makes it a large-cap stock. It’s odd to call a company like this “little known,” but that seems to be the case. On Wall Street, 18 analysts cover ITW. I’m a sucker for any company with an old-fashioned sounding name.

Illinois Tool Works is based in Glenview, Illinois. The company describes itself as “a Fortune 200 global multi-industrial manufacturing leader with revenues totaling $15.9 billion in 2022. The company’s seven industry-leading segments leverage the unique ITW Business Model to drive solid growth with best-in-class margins and returns in markets where highly innovative, customer-focused solutions are required.”

Since 1990, the shares are up 88-fold. Check out this long-term chart:

Last August, ITW increased its dividend for the 51st year in a row.

Earlier this month, ITW reported Q4 earnings of $2.95 per share. That beat Wall Street’s forecast by 37 cents per share. The stock gapped up 4.6% after the earnings report came out, but it’s given the entire gain back since then.

ITW is a classic cyclical stock which means its fortunes are closely tied to where we are in the economic cycle. These are the kinds of stocks that have suffered lately, especially today. Contrast that with Hershey, one of our Buy List stocks, which is a classic non-cyclical. HSY was one of 36 stocks in the S&P 500 to close higher today.

For all of last year, ITW made $9.77 per share. For the current year, the company expects earnings between $9.40 and $9.80 per share. That gives the stock a P/E Ratio of 24 to 25 which is on the rich side. This is the kind of stock to buy just before the economy hits bottom. That means when the Fed is already cutting rates instead of what we’re seeing now.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

-

Morning News: February 21, 2023

Posted by Eddy Elfenbein on February 21st, 2023 at 7:06 amEurope’s Economy Picks Up After Year of War in Ukraine

U.S., Allies to Tighten Screws on Russian Sanctions Evasion -Treasury’s Adeyemo

Putin Tells Business Elite: Don’t Beg for Western Money, Invest in Russia

China’s Newest Weapon to Nab Western Technology—Its Courts

Star Banker’s Disappearance Surprises Even China’s State Lenders

Looming U.S. Default Risk Prompts Investors to Cut Some Debt Exposure

Morgan Stanley Says S&P 500 Could Drop 26% in Months

Credit Suisse Shares Hit Record Low on Outflow Claims Probe

After Testing Four-Day Week, Companies Say They Don’t Want to Stop

Why Big Layoff Announcements Don’t Always Mean Big Workforce Cuts

You Want at Least $3 Million in Savings to Retire Comfortably

Office Landlord Defaults Escalate as Lenders Brace for More Distress

The Cheap, Powerful Climate Fix Energy Companies Are Ignoring

HSBC Posts Higher Profit After Rise in Global Interest Rates

Home Depot Misses on Revenue, Issues Muted Outlook

Tencent in Talks to Sell Meta’s Quest 2 VR Headset in China

Big Soda’s Alcohol Drinks Worry Health Experts

It’s Time to Tear Up Big Tech’s Get-Out-of-Jail-Free Card

‘Effective Altruism’ Led Bankman-Fried to a Little-Known Wall St. Firm

Be sure to follow me on Twitter.

-

Morning News: February 20, 2023

Posted by Eddy Elfenbein on February 20th, 2023 at 7:08 amRussian Crude Exports Surge Despite Impending Cut to Output

Russia and China Have a Stranglehold on the World’s Food Security

China Sets New Rules for Overseas IPOs. What It Means for DiDi, Alibaba and Others

Turkey’s Reeling Economy Is an Added Challenge for Erdogan

Investors Already Bet Nigeria’s Next Leader Has No Chance of Fixing Fiscal Crisis

Despised Dictator’s ‘Scary’ Shrine Becomes a Bet on Albania’s Future

Workers’ Pay Globally Hasn’t Kept Up With Inflation

Debt-Ceiling Standoff Prompts Backup Plans, but They Face Hurdles Too

JPMorgan Strategists Say Stock Rally Will Fade

How Pete Buttigieg and Washington Lobbyists Are Fueling the US Airline Crisis

Supreme Court to Hear Case That Targets a Legal Shield of Tech Giants

Meta Verification Fee Could Raise $3 Billion in Revenue

Amazon Corporate Workers Face Pay Reduction After Shares Slip

Walgreens CEO Bets on Doctors Over Drugstores in Search for Growth

From CEOs to Coders, Employees Experiment With New AI Programs

Adani Maps Comeback Strategy After $135 Billion Hindenburg Rout

Hedge Fund Billionaire Extracts Billions More to Retire

A Fight Over Wine Sales Highlights Push in U.S. to Expand Access to Alcohol

Uniqlo’s Quest to Conquer the US, One Cashmere Sweater at a Time

Be sure to follow me on Twitter.

-

Morning News: February 17, 2023

Posted by Eddy Elfenbein on February 17th, 2023 at 7:02 amCash Crisis Hits Nigeria Cocoa Exports in Fresh Blow to World Supply

‘Boring is the New Sexy’ as UK’s Stock Index Closes Above 8,000 for the First Time

Americans Have Nearly $1 Trillion in Credit Card Debt

U.S. Households Lifting Economy After Being Stung by Inflation Last Year

The Uneasy Dance Between the Markets and the Fed

Why a Strong Economy Is Making Stock Investors Jittery

BofA Says Says Hard Landing to Hit Stocks in Second Half

The S&P 500 Is The Most Popular And Overpriced Benchmark In The World

Lesser-Known Hedge Fund Boss Joins Ranks of Best Paid With 193% Gain

Star Banker’s Disappearance Unnerves China’s Business Elite

Crypto Fugitive Do Kwon Tapped Hoard of 10,000 Bitcoin Via Swiss Bank, SEC Says

Susan Wojcicki, YouTube’s Longtime C.E.O., Says She Will Step Down

The Extraordinary Exit of the Women of Silicon Valley

Wall Street Brings Its Financial Engineering to English Football

Microsoft Defends New Bing, Says AI Chatbot Upgrade Is Work in Progress

Why China Didn’t Invent ChatGPT

In a Violent America, Safety Becomes a Sales Pitch

Barnes & Noble Takes Page From Amazon With $40-a-Year Membership Program

Be sure to follow me on Twitter.

-

Morning News: February 16, 2023

Posted by Eddy Elfenbein on February 16th, 2023 at 7:04 amThe World’s War Machine Is Running Low on Ammunition

‘The World’s Largest Construction Site’: The Race Is On to Rebuild Ukraine

China Hits Back at US with Sanctions on Lockheed, Raytheon

Tesla’s Growing Competition in China Goes Beyond Just EVs

A Tiny Puerto Rican Port Is Turning Into a Test Lab for Trade Fluidity

Lael Brainard’s Fed Departure Could Leave Immediate Imprint on Inflation Fight

US Rates May Be Heading Higher Than Wall Street or the Fed Think

C.B.O. Warns of Possible Default Between July and September

The U.S. Debt Ceiling and Markets: Gauging the Fallout

This Is What Happens If the US Actually Hits the Debt Ceiling

U.S. Retail Sales Rebounded Sharply in January

The Retail C.E.O. Pipeline Is Running Dry

A $6 Trillion Bond Wall Revives an Arcane Corner of Wall Street

SEC Proposes Rule That Could Squeeze Crypto Platforms

Crypto Investors Had Their Funds Frozen. Now They Might Have to Pay Taxes Too

Fear Made John McAfee Rich. It Also Ruined Him

From Math Camp to Handcuffs: FTX’s Downfall Was an Arc of Brotherhood and Betrayal

America’s Priciest Neighborhoods Are Changing as the Ultra-Rich Move to Florida

Magic: The Gathering Becomes a Billion-Dollar Brand for Toymaker Hasbro

Be sure to follow me on Twitter.

-

Morning News: February 15, 2023

Posted by Eddy Elfenbein on February 15th, 2023 at 7:04 amU.K. Inflation Eases to 10.1 Percent, but Food Prices Push Higher

Ray Dalio Says China’s Winning Trade War With US, But a Clash Is Avoidable

ASML Says Ex-Employee in China Misappropriated Chip Data

Europe’s Energy Aid Tab Nears €770 Billion, Close to EU Covid Response

Central Bankers in Bunkers Keep Ukraine’s War Economy Afloat

A Big Breakup at the Federal Trade Commission

Biden’s I.R.S. Nominee Will Be Grilled About $80 Billion Overhaul

What Is Pushing the National Debt to Its Limit?

As Lawmakers Spar Over Social Security, Its Costs Are Rising Fast

El-Erian, Rogoff Say It’s Too Late to Fix Too-Low Inflation Target

Mortgage Demand Drops as Interest Rates Bounce Higher

The Outlook for Home Buyers This Spring: Not Terrible

Goldman Says Consumer-Facing Credit Cards Never Became ‘Meaningful’ Part of Strategy

Carmakers Are Pushing Autonomous Tech. This Engineer Wants Limits.

Tesla to Open Some Superchargers to Other Vehicles, White House Says

Health Startups Offer Diabetes Drugs Like Ozempic for Weight Loss With Little Oversight

Netflix Shuns Live Sports but Embraces Sports Documentaries

Black Women Are Banding Together to Leave America Behind. Here’s Why

Poor, Busy Millennials Are Doing the Midlife Crisis Differently

Be sure to follow me on Twitter.

-

CWS Market Review – February 14, 2023

Posted by Eddy Elfenbein on February 14th, 2023 at 7:23 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

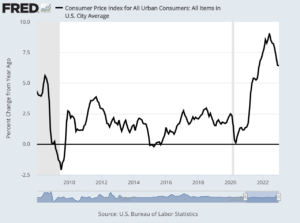

January Inflation Was Slightly Higher Than Expected

Today was the day of the big inflation report, and numbers came in slightly higher than expected. This morning, the government said that inflation rose by 0.5% in January. Economists had been expecting an increase of 0.4%. Over the last 12 months, inflation has increased by 6.4%. That was 0.2% above expectations.

The 12-month inflation rate ending in January was a teeny tiny bit lower than the 12-month rate for December. That means we can technically say that year-over-year inflation has declined for seven months in a row. Inflation peaked last June at 9.1%.

The core rate, which excludes food and energy prices, rose by 0.4% in January. That was 0.1% higher than expected. Over the last 12 months, core inflation is running at 5.6%. While the core rate has been lower than the headline inflation, it’s been tougher to bring down. The 12-month core rate peaked in September at 6.6% and has now declined for four months in a row.

Rising shelter costs accounted for about half the monthly increase, the Bureau of Labor Statistics said in the report. The component accounts for more than one-third of the index and rose 0.7% on the month and was up 7.9% from a year ago. The CPI had risen 0.1% in December.

Energy also was a significant contributor, up 2% and 8.7%, respectively, while food costs rose 0.5% and 10.1%, respectively.

Rising prices meant a loss in real pay for workers. Average hourly earnings fell 0.2% for the month and were down 1.8% from a year ago, according to a separate BLS report that adjusts wages for inflation.

The takeaway is that inflation continues to fade, but it’s taking its time. The battle to beat inflation won’t be a quick one.

Today’s inflation report didn’t have much of an impact on today’s trading. The S&P 500 fell by a minuscule amount. The real action was in the futures pits where traders bet on what the Fed will do. Traders think the Fed will now be more aggressive with its interest rate hikes.

We can look at the price for interest-rate contracts to find the implied probability of what the Fed will do. It doesn’t mean the market is right, but it gives us a sense of what the market is thinking. Until today, the market had been thinking that the Fed was all talk.

Right now, futures traders still think there’s a very high probability of another 0.25% rate hike next month, but traders also see another 0.25% rate hike coming in May. The odds of a May rate hike are now up to 85%.

After that, it starts to get interesting. Thanks to today’s inflation report, traders now expect an additional rate hike in June. One month ago, the implied odds of a 0.25% rate hike in June were 6%. Now those odds are 55%. That’s all due to today’s report. Going out a few months, traders think there will be a rate cut by December. Previously, the market had been expecting two rate cuts before the end of the year.

In plain English, today’s inflation report gives Jerome Powell and his friends at the Fed more cover to keep raising interest rates. The idea that the economy is about to tip over into a recession seems just a tad less likely. Or it may happen, but not quite so soon. A few months ago, Wall Street was expecting the Fed to pivot. Now, not so much.

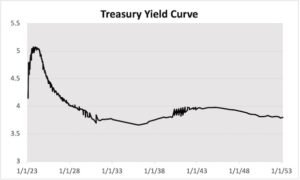

Here’s a look at the complete Treasury yield curve. I plotted every single outstanding U.S. Treasury which is over 300 securities. Note how after a short-term increase, interest rates are expected to fall rapidly.

The International Monetary Fund just raised its estimate for U.S. economic growth this year to 1.4%. That’s not a lot, but it’s better than a recession.

What’s interesting is that many stock markets around the world are outpacing the U.S. market. Some are doing it by a lot. From 2008 to last year, the American stock market was the place to be. That came to an end last October. Since then, stock markets in countries such as Poland and Hungary have soared. Even China is doing well amid its lockdowns.

This Has Been a Crummy Earnings Season

We’re now heading into the closing part of Q4 earnings season. Frankly, this has been a disappointing season. Jonathan Golub, who is the Chief U.S. Equity Strategist at Credit Suisse, said that excluding recessions, this has been the worst earnings season in 24 years.

So far, 69% of companies have reported results. Of those, 69% have beaten estimates. That’s below the five-year average of 77%. It’s weaker than that considering how much analysts lowered their estimates prior to earnings season.

Overall, 69% of the companies in the S&P 500 have reported actual results for Q4 2022 to date. Of these companies, 69% have reported actual EPS above estimates, which is below the percentage of 70% at the end of last week, below the 5-year average of 77%, and below the 10-year average of 73%.

Earnings are coming in at 1.1% higher than estimates. That’s not that good. The five-year average is 8.6%. Q4 earnings are tracking a decline of 4.9% compared with Q4 2021. If that holds up, it will be the first overall earnings decline since Q3 2020.

So far, 63% of the earnings reports have beaten their revenues estimates. That’s below the five-year rate of 69%. The S&P 500 is on track to report revenue growth of 4.6% compared with Q4 2020.

The overall picture is that revenues are slightly higher while earnings are slightly lower. That means that profit margins are under pressure. That often happens late in an economic cycle. Wall Street expects earnings to decline for Q1 and the entire year.

As we discussed before, on Wall Street, stocks are expected to beat expectations. Some companies are experts at guiding Wall Street analysts to believe that earnings will be a few pennies per share less than where they really are. This lets companies pretend that they beat expectations when that’s not really the case.

John Butters with FactSet noticed something interesting about this earnings season. Companies that have beaten expectations are getting a larger bump than normal while companies that miss expectations are getting a smaller ping than normal.

It’s as if Wall Street is onto the analysts this time. As a result, traders are taking the earnings misses in stride.

I should point out that our Buy List is having a much better performance. Of our 16 earnings reports so far, 14 beat estimates, one missed and one met expectations.

Stock Focus: Investors Title

I like to use this space to tell you about stocks that few people know about. I figure that it’s not hard to find someone to tell you what they think about Tesla or Facebook. Not many people will let you know about U.S. Lime and Minerals (USLM). Well, I’m happy to do that. (By the way, USLM hit another new 52-week high yesterday.)

This week, we’re going to look at Investors Title (ITIC). As you might guess, ITIC is a title insurance company based in Chapel Hill, NC. Title insurance protects homeowners against competing claims for their property. It’s not a very big outfit. ITIC only has about 500 employees and a market cap of $300 million. Over the last 33 years, ITIC has returned 4,800%. I suppose it’s a good business when homeowners are forced by law to buy it.

Would you like to guess how many analysts follow ITIC? If you’ve been around here, you probably know the answer. Zero. Not a single analyst bothers to follow this stock.

Another neat aspect of ITIC is that it occasionally pays out special dividends Sometimes these have been quite large. The current regular dividend is 46 cents per share. Last year, ITIC paid out a special dividend of $3 per share. In 2021, it was $18 per share. In the three years prior to that, ITIC paid out dividends of $15, $8 and $11 per share. This is on top of the regular dividend.

Here’s an interesting historical tidbit for you: Title insurance played an important role in the history of our two greatest presidents. In the 1750s, Lord Fairfax, the only peer living in North America, asked a young man named George Washington (a distant relative) to survey some of his land in the western part of Virginia. Fairfax owned some five million acres. Earlier, the Virginia House of Burgesses tried to do what governments like to do, claim some of his land for itself.

About 60 years later, and not that far away, a Virginia-born farmer named Thomas Lincoln bought a small farm in Kentucky. At this time, this was frontier country. He built a log cabin there and soon, he and his wife had a son. Then along came a man with a competing claim to the farm and the court ruled against the Lincoln family. They had to move and the legal costs were a great hardship to the young family. They were able to lease another farm and soon, the same things happened again.

Thomas Lincoln was fed up with Kentucky and moved to Indiana which had recently been surveyed by the Federal government, so land claims were more secure. Shortly after the family got in Indiana, Thomas’ wife Sarah died. The whole episode left a great impression on Abraham Lincoln, and it may have led him to study surveying and the law.

This morning, Investors Title reported Q4 earnings of $3.97 per share. That’s terrible compared with one year ago, but that’s due to the Fed and the housing market. Real estate is cyclical. Quarterly revenues were down 28%. For the year, ITIC made $12.59 per share.

ITIC is a tough stock to own when rates are rising, but once you sense the Fed will soon start cutting, ITIC could be a very attractive buy.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

-

Morning News: February14, 2023

Posted by Eddy Elfenbein on February 14th, 2023 at 7:03 amLael Brainard Set to Lead White House National Economic Council

Kazuo Ueda, Tapped as Bank of Japan Chief, Is Seen as Pragmatic Insider

Packed With Tourists, Japan Returns to Economic Growth

TikTok’s Talks With U.S. Have an Unofficial Player: China

Beijing Urges Rural Officials to Hire Humans—Not Machines

Inside the Gray Market Keeping Cisco Tech in Stock in Russia

Russia’s Grip on Nuclear-Power Trade Is Only Getting Stronger

EU Lawmakers Back Deal to Ban New Combustion-Engine Cars by 2035

New Cars Are Only for the Rich Now as Automakers Rake In Profits

Ford Will Build a U.S. Battery Factory With Technology From China

Ferrari Heir Races Onto World’s Richest List With 400% Stock Boom

What Layoffs? Top Wall Street Traders Score Giant Paydays

The Countries With the Longest — and Shortest — Retirements

Food Prices Weigh on Seniors’ Savings, Health and Even Social Ties

Air India to Buy 250 Planes from Airbus as It Transforms Under Tata

Coca-Cola Revenue Rises in Fourth Quarter, Fueled by Higher Prices

How Nelson Peltz and Disney’s Marvel Chief Teamed Up in Proxy Fight

Bed Bath & Beyond’s Tough Challenge: Shutting Stores Without Paying a Fortune

Be sure to follow me on Twitter.

-

Stocks Up Ahead of Tomorrow’s CPI

Posted by Eddy Elfenbein on February 13th, 2023 at 12:20 pmThe CPI report comes out tomorrow. The recent trend has been favorable so it will be interesting to see if that continues. Wall Street expects January inflation to come in at 0.5% and the core rate to be 0.4%.

Tomorrow’s CPI report will have a slightly different methodology. The categories’ “weights” will be redone and based off spending data from 2021. Owners equivalent rent will now be a little over 25%.

The stock market is up 0.93% at noon today. Once again, the High Beta stocks are leading the Low Volatility names.

Last week was the worst week for stocks this year. I wouldn’t be surprised to see some pushback this week. We’re in the latter half of earnings season but there are still many reports left to see. Microsoft and Meta are having good days. Both stocks are up over 3%.

The U.S. shot down its fourth balloon, or whatever it is. The U.S. and China may be meeting later this week at the Munich Security Conference.

Jack Henry & Associates (JKHY), a stock I like to follow, raised its dividend today by 7% to 52 cents per share. This is its 34th consecutive dividend increase.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His