-

Wall Street Expects $115.28 for 2013 S&P 500 Earnings

Posted by Eddy Elfenbein on August 10th, 2012 at 3:35 pmI’m always a bit suspicious of analysts’ forecasts and I’m particularly leery of forecasts that go out too far in time. In the near-term, forecasts aren’t so bad. Of course, they’re much less important as well.

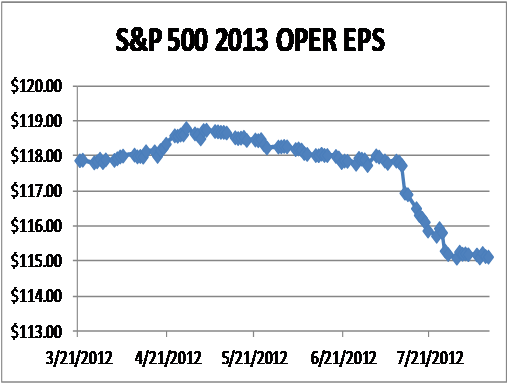

But now 2013 isn’t so far away. Wall Street currently expects the S&P 500 to earn $115.28 for next year. Below is a chart from S&P and it shows how much that forecast has fallen in recent months, although it has stabilized recently.

For this year, Wall Street expects earnings of $101.86. That’s down from $113 one year ago. Going by yesterday’s close, the S&P 500 is going for just 12.2 times next year’s earnings. Unless earnings suddenly plunge, I think the S&P 500 is very reasonably priced.

-

CWS Market Review – August 10, 2012

Posted by Eddy Elfenbein on August 10th, 2012 at 6:49 amThe world’s most-hated rally continues pace. On Thursday, the S&P 500 closed higher for the fifth day in a row. The index is now at its highest level since May 1st, and we’re a little over 1% away from taking out a four-year high.

Our Buy List is also doing quite well. Oracle ($ORCL), for example, got to its high for the year, and it’s close to breaking through $32 per share. DirecTV ($DTV) just hit a new 52-week high. Stocks like AFLAC ($AFL) and JPMorgan Chase ($JPM) have been quite strong recently, and Harris Corp. ($HRS) has rallied for seven days in a row. Also, Nicholas Financial ($NICK) gave us a big present this week by increasing its dividend by 20%.

In this week’s CWS Market Review, we’ll take a closer look at what could be the end of Wall Street’s huge defensive rotation. I’ll also look at why the economy might be stronger than most people believe. Plus, we’ll preview Sysco’s ($SYY) earnings report. SYY currently yields a hefty 3.76%, and I’m expecting them to increase their dividend for the 43rd year in a row. Not many stocks can say that. But first, let’s look at the new mood on Wall Street.

“Believe Me, It Will Be Enough”

On July 26th, ECB President Mario Draghi dropped a bomb on world markets when he said: “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

Heavens to Murgatroyd! Central bankers aren’t supposed to speak in such dramatic tones. I mean, that’s just not done. Of course, the worry is that if he thinks there’s a reason to say “believe me,” that must mean that there are plenty of folks who, in fact, don’t believe him.

But any reason for doubt shouldn’t rest solely with Mr. Draghi and his level of commitment. For one, Draghi seems to be blurring the lines between monetary policy and fiscal policy. Plus, we still have to contend with the familiar question: “Will the Europeans set aside their bickering and do what it takes to save the euro?” As always, the Europeans appear to be a quintessential “hot bed of cold feet.”

The Germans, for example, are very much opposed to more bond buying. If anything, their opposition seems to be growing. If a new bond buying program does start—and it most certainly will—it will only be for countries in the periphery and after a formal request.

But let’s turn back to Mr. Draghi’s remarks. I’ll give him credit for one thing—he shook up the markets. Long-term bonds in Italy and Spain have rallied, and stock markets there have come back to life. The day before Draghi spoke, the Spanish 10-year yield peaked at 7.751%. Recently, it’s been below 6.8%.

The effect isn’t just in Europe, but it’s being felt in the U.S. as well. Here’s what you need to understand: Investors are creeping away from their tightly-held defensive posture and they’re slowly taking on more risk. Just look at the U.S. bond market: The yield on the 10-year Treasury jumped from an all-time low of 1.39% on July 24th to 1.69% on Thursday. I thought it was interesting that the U.S. Treasury had a lousy auction this week for a fresh batch of 10-year bonds. The auction had the lowest big-to-cover ratio in three years. Perhaps investors have finally grown weary of ultra-low risk.

Before Draghi’s remark, investors were shunning risk at every chance. I mentioned in last week’s CWS Market Review how dramatic the defensive posture had become. Consider that from July 5th to August 1st, the Russell 2000, which is a gauge of small-cap stocks (think “higher risk”), dropped by 5.7% while the S&P 500 managed to make a small gain. No one wanted anything with a hint of risk. But since August 1st, the tables have turned. The Russell has gained 4.1% which is more than double the S&P 500.

The move toward offense can also be seen with the highest-yielder on our Buy List, Reynolds America (RAI). The stock soared to a new high but dropped 90 cents per share on Tuesday. That’s a very big drop for a stock like Reynolds. I think it has less to do with the company’s business outlook, which is fine, than with the fact that investors are searching for growth opportunities. We’ve also seen key defensive sectors like Healthcare ($XLV), Utilities ($XLU) and Consumer Staples ($XLP) trail the market in recent days.

It’s too early to say if this turn towards the offensive will last. For now, our strategy is to focus on high-quality stocks, especially ones that the market doesn’t get. Speaking of which, let me say a few words about DirecTV ($WXS) and Wright Express ($WXS) because these are perfect examples of why our strategy of concentrating on high-quality stocks works.

Last week, I highlighted the market’s bizarre reactions to the earnings reports from DirecTV and Wright Express. The earnings reports certainly weren’t outstanding, but the market initially treated both stocks as if they’re in serious trouble. That’s clearly not the case. Yet all we had to do was wait a few days as both stocks recovered. In the last six days, WXS gained 6.4% and DirecTV is on the cusp of making a new 52-week high. Wright Express is an excellent buy anytime the shares are below $65. I’m also raising my buy price on DirecTV to $53.

Some Modest Economic Bright Spots

We had some surprisingly good economic news this week. I’m not saying that the economy is doing well, but it may be the case that things aren’t as dire as they seem. The trade deficit report for June, for example, came in narrower than expected. The deficit for May was also revised favorably.

The trade suggests that the government’s initial estimate for Q2 GDP of 1.5% is too low and is perhaps closer to 2%. This is good news because it indicates that weakness in Europe and the strong dollar aren’t hurting us as much as was feared.

The other good news was that jobless claims fell by 6,000. This is a very volatile metric with a lot of noise, but the trend is still going in the right direction. What we’re seeing is that companies are working hard to become more efficient. On Wednesday, the productivity report showed that worker productivity rose by 1.6% in the second quarter after falling by 0.5% in the first quarter. The short-term downside of rising productivity is that it may lead firms to be cautious about expanding their payrolls.

I was also impressed to see that the median price for a new home in the second quarter was up 7.3% from the same period a year ago. That’s the strongest growth rate in six years. The housing news is especially promising because a pick-up in the housing sector has often been the catalyst for U.S. economic expansions. This time around, we had an enormous over-supply of homes so prices went nowhere. At last, we’ve finally worked off that inventory.

Nicholas Financial Gives Us a 20% Raise

Also in last week’s CWS Market Review, I discussed the possibility of Nicholas Financial (NICK) raising its dividend. Sure enough, that’s exactly what the company did this week. I would have preferred to see NICK go for a bolder increase, but the company gave us a 20% raise which ain’t too shabby. NICK now pays 12 cents per share per share or 48 cents for the entire year. Going by Thursday’s closing price, NICK yields 3.57%. That’s a good deal.

Sysco (SYY) is due to report earnings on Monday, August 13th. The food service company is usually one of the last companies on our Buy List to report earnings. The June quarter is the fourth quarter of their fiscal year so we’re going to get a look at their year-end results.

In May, Sysco reported earnings of 44 cents per share which was a penny more than Wall Street’s consensus. This time around, the Street expects 54 cents per share. I think that’s about right, although it will be interesting to see how much inflation and currency impacted their bottom line. What I like about Sysco is that its business tends to be very stable.

For the year, Sysco should earn about $1.93 per share, and Wall Street expects $2.00 per share for the current fiscal year. That means Sysco is going for less than 15 times earnings. Furthermore, Sysco pays out 27 cents per share in dividends. That makes the current yield 3.76%. Plus, the company will almost certainly raise its payout this fall for the 43rd year in a row. I’m raising my price on Sysco to $32 per share.

Before I go, a few of the bargains on our Buy List include Ford Motor ($F), Stryker ($SYK), Medtronic ($MDT) and JPMorgan Chase ($JPM).

That’s all for now. Stay tuned for Sysco’s earnings report on Monday. We’ll also get the key industrial production report on Wednesday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: August 10, 2012

Posted by Eddy Elfenbein on August 10th, 2012 at 6:49 amMonti’s Bond Frustrations Mount as Yields Stay High

Banks Seek ‘Scientific’ Libor Process, FSA’s Wheatley Says

Weak July Data Dims China Outlook

Easing U.S. Ethanol Mandate Would Help Prevent Food Crisis

Justice Department Drops Goldman Financial Crisis Probe

F.T.C. Fines Google $22.5 Million for Safari Privacy Violations

U.S. Postal Service Posts Quarterly Loss of $5.2 Billion

Manchester United Prices I.P.O. at $14 a Share

Key Events Involving Yahoo And Its Performance

SAP’s Chen Challenges Oracle, IBM With Database Advances

ThyssenKrupp Posts Profit as Europe Steelmakers Struggle

Regulator Shines a Spotlight on a Bank, and on Himself

Joshua Brown: Until the Market Rallies

Phil Pearlman: Talking Markets and Trending Tickers with Reuters’ Rhonda Schaffler

Be sure to follow me on Twitter.

-

30 Years Ago

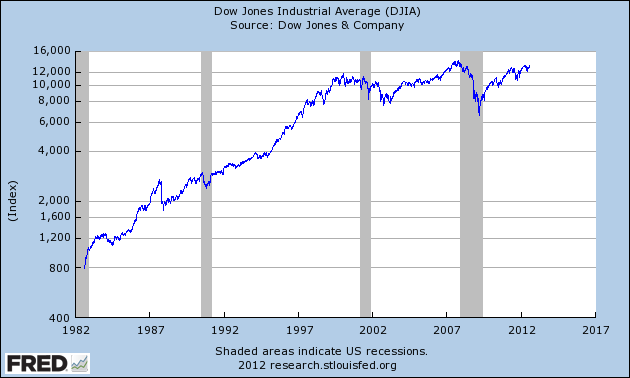

Posted by Eddy Elfenbein on August 9th, 2012 at 4:00 pmThis Sunday marks the 30th anniversary of the 18-year bull market. On August 12, 1982, the Dow reached its mega-low of 776.92. That’s less than where it had been 18 years before.

The Dow would soar for the next 18 years until it finally tapped out at 11722.98 on January 14, 2000.

For time context, the day after the Dow bottomed in August 1982, the movie Fast Times at Ridgemont High opened in theaters. That’s right, Spicoli happened 30 years ago.

-

Morning News: August 9, 2012

Posted by Eddy Elfenbein on August 9th, 2012 at 6:37 amStimulus Hopes Lift European Shares Near Five-Month High

Greece Says Will Get Aid Tranche After Review In Mid-September

Parts of Europe Have Quietly Become Competitive

China Adds Scope to Cut Rates as Japan, S. Korea Hold: Economy

China Factory Output Disappoints, More Stimulus Seen

Powerful Indian Financial Exchange Trades Accusations With Economist

In Laundering Case, a Lax Banking Law Obscured Money Flow

Productivity in U.S. Rebounds as Employers Try to Curb Costs

Boston Fed Head Calls for ‘Open-Ended’ QE

With Rates Low, Banks Increase Mortgage Profit

Dish Won’t Pay For AMC, Furthers Wireless Plans

Mcdonald’s Left Hungry By Rivals, Economy In July

Starbucks and Square to Team Up

Credit Writedowns: The Fed’s Zero Rate Policy Is Toxic For US Household Interest Income

Howard Lindzon: BoardFlipping…Get Used to It

Be sure to follow me on Twitter.

-

Nicholas Financial Raises Dividend By 20%

Posted by Eddy Elfenbein on August 8th, 2012 at 2:53 pmNicholas Financial ($NICK) announced that it is raising its quarterly dividend by 20%. The payout is rising from 10 cents per share to 12 cents per share.

Nicholas Financial, Inc. announced today that its Board of Directors has declared a cash dividend of $.12 per share on its common stock. This represents a 20% increase from its previous dividend of $.10 per share. The dividend will be paid on September 6, to shareholders of record as of August 30, 2012.

Peter L. Vosotas, Chairman and CEO noted, “Our capital position and continued confidence in our earnings capability played a large part in the Board of Director’s decision to increase our quarterly cash dividend 20% from $.10 to $.12 per share. The dividend yield, based on the most recent closing price of $13.44, will be approximately 4%.”

Subject to market conditions and profitability targets, the Company anticipates it will continue to declare quarterly cash dividends in the future; however, no assurances can be given. In the fiscal year ended March 31, 2012, the Company reported earnings of $1.85 per share. In the first quarter of the 2013 fiscal year which ended June 30, 2012, the Company reported earnings of $0.44 per share.

The annual dividend of 48 cents per share works out to a yield of 3.57% based on yesterday’s closing price.

-

Stocks Against Bonds

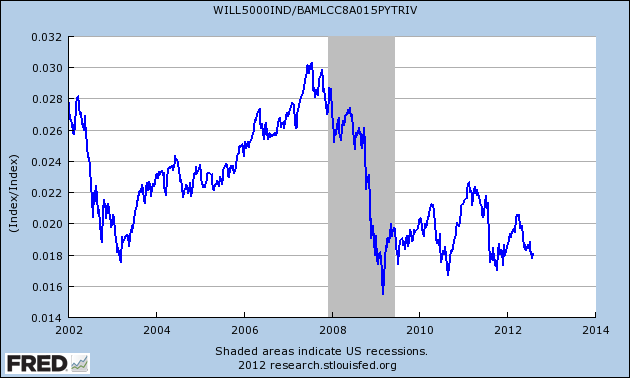

Posted by Eddy Elfenbein on August 8th, 2012 at 2:35 pmHere’s a chart I like to look at periodically. It’s the stock market divided by the long-term bond market (specifically, the Wilshire 5000 Total Return divided by the ML 15+ Bond Index).

I think it’s interesting that despite a very strong stock rally since March 2009, the bond market has held its own. In fact, if you had switched into bonds before the end of March, you’d be outperforming stocks.

I’d expect stocks to slightly outperform bonds over the long haul. Given the strong rally in bonds and their ultra-low yields, I think stocks are the safer place to be right now.

-

Bob Dylan Bonds?

Posted by Eddy Elfenbein on August 8th, 2012 at 2:00 pmWhen interest rates are near 0%, investors get creative. From the WSJ:

Bob Dylan’s music was the soundtrack for the counterculture of 1960s America.

Now it has become a selling point for an unusual bond offering being marketed to institutional investors and wealthy individuals.

A privately held Nashville, Tenn., company is preparing a $300 million bond backed by the cut it receives as a middleman between music companies and songwriters and the outlets that broadcast their music.

The company, Sesac Inc., has the exclusive rights to the public broadcast or performance of the music of Mr. Dylan, pop singer Neil Diamond, Canadian rock band Rush and jazz singer Cassandra Wilson.

S&P rated the offering triple B minus, one notch above junk, which seems kinda high.

-

Priceline.com Plunges $113

Posted by Eddy Elfenbein on August 8th, 2012 at 12:10 pmShares of Priceline.com ($PCLN) are getting severely crushed today. Imagine the USA-Nigeria basketball game, but in stock form. PCLN has been down as much as $113.70, or 16.73%. After the close yesterday, the company reported earnings of $7.85 per share which was very good; it was 49 cents per share more than Wall Street’s consensus.

The problem, however, was guidance for this quarter. The Street had been expecting Q3 earnings of $12.79 per share on revenue of $1.795 billion. Priceline now says earnings will range between $11.10 and $12.10 per share and sales will be between $1.6 billion and $1.67 billion.

Both Priceline and Orbitz are being hurt by the problems in Europe. So is Priceline a good buy at this price? Let’s bring in our World’s Simplest Stock Valuation Measure:

Growth Rate/2 + 8 = PE Ratio

As a reminder, this is just a simple, ballpark tool and we shouldn’t overly rely on it. Wall Street currently projects a five-year earnings growth rate for Priceline of 23.68%. That translates to a P/E Ratio of 19.84. Wall Street’s earnings forecast for 2013 is $38.95, so that works out to a fair value of $772. It appears that Priceline is currently going for $200 below its fair value.

But we should make some adjustments based on the recent lower guidance. The midpoint of today’s guidance is about 9.3% below Wall Street’s forecast. If we apply that as a constant to next year’s earnings, that brings it down to $35.33.

Now as far as growth is concerned, we have to get a little creative. I don’t believe we need to adjust the long-term growth rate by the full 9.3%. Instead, I think it’s better to ratchet it down by half or 4.65%. Decreasing the rate of growth by 4.65% (note, not the overall number but a reduction in the rate) brings the new five-year growth rate to 17.93%. That’s gives us a fair value of $599.

That’s just an estimate but I think it’s a reasonable one. This means that Priceline may be a bit undervalued but not by much. I don’t think something is a strong buy until it’s at least 30% undervalued.

-

Morning News: August 8, 2012

Posted by Eddy Elfenbein on August 8th, 2012 at 6:44 amBank Of England Slashes Growth Forecasts To ZERO As Double-Dip Recession Deepens

German June Industrial Production Fell on Construction Output

Greece’s Rating Outlook Lowered by S&P as Economy Weakens

ECB’s Rescue Worsens Spain, Italy Maturity Crunch

Indigestion for ‘les Riches’ in a Plan for Higher Taxes

Bernanke Promotes Financial Literacy, Says Next Generation Will Be Better Off

Regulators Irate At NY Action Against Standard Chartered

Accusations Against Bank on Iran Deals Surprised U.S. Regulators, Too

‘Avengers’ Helps Disney Smash 3Q Profit Forecast

ING Profit Falls 22% on Spain Investment Sales, Loan Losses

Molson Coors 2nd-Quarter Net Slumps 53% on Higher Costs

Pfizer Settles U.S. Charges of Bribing Doctors Abroad

Mobile Payments Go Mainstream With Square’s Nationwide Starbucks Deal

Jeff Carter: Where Is My Buggy Whip?

Cullen Roche: The Anniversary of the S&P Downgrade – Have we Learned Anything?

Be sure to follow me on Twitter.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His