-

Nasdaq Falls to Two-Year Low

Posted by Eddy Elfenbein on October 10th, 2022 at 11:50 amThe stock market is open today, but the bond market is closed in honor of Columbus Day. It’s another rough day for stocks. The Nasdaq Composite fell to a two-year low. The index is now down over 32% this year.

As I write this, the S&P 500 is down 0.68% but the S&P 500 Hi Beta Index is down by 2.23%. It’s another day when risky stocks are getting punished.

This Nobel Prize for economics was awarded to three economists including Ben Bernanke.

The Nobel committee said their work in the early 1980s had “significantly improved our understanding of the role of banks in the economy, particularly during financial crises,” and in showing why it is vital to avoid bank collapses. They added this was “invaluable” during the 2008-09 financial crisis and the coronavirus pandemic.

Bernanke’s analysis of the Great Depression in the 1930s showed how and why bank runs were a major reason the crisis was so long and severe. Diamond and Dybvig’s work, meanwhile, looked at the societally important role banks play in smoothing the potential conflict between savers wanting short-term access to their money and the economy needing savings to be put into long-term investments; and how governments can help prevent bank runs by providing deposit insurance and acting as a lender of last resort.

-

Morning News: October 10, 2022

Posted by Eddy Elfenbein on October 10th, 2022 at 7:00 amBernanke and Two Colleagues Win Nobel Prize in Economics

World’s Emergency-Lending Capacity Is Getting Stretched as Crises Deepen

As Europe Caps Energy Bills, the Merits of Price Controls Get Another Look

Bank of England Offers Further Support for Pension Funds Amid Crisis

What Is the Social Security Cost-of-Living Increase, and How Do People Receive It?

Allianz Chief Economic Adviser El-Erian Believes Core Inflation ‘Is Still Going Up’

‘No Possibility of Reconciliation’ as US Slams China Chips

Strong Dollar Pressures U.S. Manufacturing Rebound

Here’s How Weird Things Are Getting in the Housing Market

Cathie Wood Warns of ‘Serious Losses’ in Automobile Debt

Electric-Vehicle Makers and Suppliers Drive Into a Stormy IPO Market

Not Ready to Go Full EV? Some Car Companies Bet Bigger on Hybrids

A 27-Year-Old Is Taking On Big Banks to Lure Mega-Rich Families

Under Pressure, Goldman CEO Ditches Dream of Consumer Domination

As Warehouses Multiply, Some Cities Say: Enough

That Reusable Trader Joe’s Bag? It’s Rescuing an Indian Industry.

Ye Poses a Test for a Post-Musk Twitter

How a Scottish Moral Philosopher Got Elon Musk’s Number

Burger King’s New U.S. CEO Seeks to Restore Chain’s Luster

Streaming Services Want to Fill the Family Movie Void

Be sure to follow me on Twitter.

-

Morning News: October 7, 2022

Posted by Eddy Elfenbein on October 7th, 2022 at 7:02 amChina Is the Wild Card in the Energy War With Russia

Biden Says the U.S. Is Eyeing ‘Alternatives’ to OPEC Oil

Biden’s Choice After OPEC Cuts: Woo Saudi Arabia, or Retaliate?

Global Outflows Continue from Bond and Equity Funds for a Seventh Week

Global Fallout From Rate Moves Won’t Stop the Fed

Tracking the Coming Economic Storm

The Job Market Has Been Like Musical Chairs. Will the Music Stop?

Credit Suisse Offers $3 Billion Debt Buyback to Calm Nerves

Chipmakers See ‘Breathtaking’ Drop in Demand as Recession Looms

Biden Visits IBM to Promote Investments in U.S. Semiconductor Production

New Cars Are Finally Back in Stock — But Americans Might Not Be Able to Afford Them

A $568 Million Hack of Binance Coin Roils Crypto Sector Anew

Hackers Target Eager Homebuyers With a Dumb Scam That Keeps Working

Elon’s Hidden Motives + A Meetup in the Metaverse

TikTok Parent ByteDance Sees Losses Swell in Push for Growth

Bank of America to Pay Ambac Financial $1.84 Billion in Lawsuit Settlement

Teenagers Keep Vaping Despite Crackdowns on E-Cigarettes

Be sure to follow me on Twitter.

-

Morning News: October 6, 2022

Posted by Eddy Elfenbein on October 6th, 2022 at 7:01 amWTO Sees Sharp Slowdown in Global Trade, Pointing to Possible Recession

Serbia’s Central Bank Raises Benchmark Rate to 4%

In Global Slowdown, China Holds Sway Over Countries’ Fates

In Rebuke to West, OPEC and Russia Aim to Raise Oil Prices With Big Supply Cut

OPEC Move Shows the Limits of Biden’s Fist-Bump Diplomacy With the Saudis

U.S. Gasoline Prices Are Climbing Again and May Get Worse

U.S. Looks to Ease Venezuela Sanctions, Enabling Chevron to Pump Oil

A Strong Dollar Is Wreaking Havoc on Emerging Markets. A Debt Crisis Could Be Next.

Credit Suisse Weighs Outside Investor for Investment Bank Spinoff

Elon Musk’s Renewed Twitter Bid Puts Pressure on Wall St. Banks Backing Him

Ford Races to Win Over Pickup Fans With Electrified F-150

Hello, Fellow Car. We’ve Got a Problem. Let’s Talk.

Even After $100 Billion, Self-Driving Cars Are Going Nowhere

Peloton to Cut 500 More Jobs in Effort to Save the Company

How Macy’s Has Avoided—So Far—the Inventory Pileup Plaguing Other Apparel Chains

Secretive Chip Startup May Help Huawei Circumvent US Sanctions

How YouTube Created the Attention Economy

Be sure to follow me on Twitter.

-

Morning News: October 5, 2022

Posted by Eddy Elfenbein on October 5th, 2022 at 6:09 amEU Chief Urges Funds for Energy Pivot, Floats Gas Price Cap

Oil Holds Surge as OPEC+ Mulls Biggest Supply Cut Since 2020

World’s Largest Oilfield Contractor Tackles Lithium’s Water Woes

U.S. Electric-Vehicle Tax Rules Rile Asian, European Allies

Lebanese Lawmaker Enters Bank Branch to Demand Frozen Savings

As Asia’s Borrowers Turn Homeward, Local Bond Issuance Surges

The First Global Deflation Has Begun, and It’s Unclear Just How Painful It Will Be

Fed Official Says Inflation Fight Will Take Time, Despite Signs of Progress

US Stocks Have Just Started Pricing In Recession, Citi Quants Say

U.S. National Debt Tops $31 Trillion for First Time

Endowment Tax on Wealthiest Universities Netted a Fraction of Predictions in 2021

Musk’s Everything App ‘X’ Sounds a Lot Like China’s WeChat

Facebook Is the Only Game in Town for Digital Political Ads

Amazon Freezes Corporate Hiring in Its Retail Business

N.L.R.B. Issues Complaint Against Apple

Who’s Operating Your Flight? Air Travel Is Getting More Complicated

Bayer Hits Courtroom Winning Streak as It Battles Remaining Roundup Lawsuits

433 People Won a $4 Million Lottery. Was It Pure Luck?

Be sure to follow me on Twitter.

-

CWS Market Review – October 4, 2022

Posted by Eddy Elfenbein on October 4th, 2022 at 7:16 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Stock Market Rallies 5.7% in Two Days

The stock market put on a furious rally over the last two days, but is it just another bear-market rally? After this summer’s rally got blown apart in a few weeks, it’s hard to feel hopeful.

In just two days, the S&P 500 has gained 5.73%. Sadly, big moves like this don’t normally come in healthy markets. Historically, most of the market’s big short-term gains have come during rough markets. They’re usually snapbacks from major lows.

The smart take is to view the last two days with a healthy dose of skepticism. We’ve been fooled before.

Still, I’m willing to take whatever profits Wall Street wants to throw our way. Look at Trex (TREX), our worst-performing Buy List stock this year. It’s up 11.8% over the last two days.

The next big test for the market will come this Friday when the Labor Department releases the September jobs report. It will also update the numbers for July and August. The last report was a good one. According to the government, the U.S. economy created 315,000 net new jobs during August, and the unemployment rate ticked up to 3.7%. For Friday, the consensus on Wall Street is to see a gain of 275,000 jobs in September and that the jobless rate will stay at 3.7%.

One interesting feature of the unemployment rate is that it tends to oscillate between extremes. This is the idea behind the “Sahm Rule,” named for economist Claudia Sahm. My shorthand definition for the rule is that if the unemployment rate goes up a little, then there’s a good chance it will go up a lot.

More technically, the Sahm Rule says that we’re probably in a recession if the three-month average of the unemployment rate rises by 0.5% from its low over the last 12 months. Best of all, it’s easy to calculate.

The lowest unemployment rate of the last 12 months came in July when it got down to 3.5%. That means that we’re not that far away from a recession. Friday’s report will tell us a lot more.

One promising sign is that the jobless-claims numbers have been much improved since the summer. That number tends to be whatever stats people call “noisy,” which means it bounces around a lot. That’s why economists like to look at a rolling average to smooth out the bumps.

If Friday’s jobs report comes in weak, that could take some pressure off the Federal Reserve. On the other hand, if the number is strong, then it could reiterate the Fed’s commitment to higher interest rates.

Interestingly, the bond market shot up yesterday and the rally continued into today. That could be a bet that the Fed may ease up a bit. Still, I think the safe assumption is that the Fed will hike again at its next meeting in November by 0.75%. After that, it’s hard to say. For their part, futures traders are leaning towards a smaller hike in December. That could be right, but it depends on the direction of the economy.

One worrying sign for the economy came out yesterday. The ISM Manufacturing Index fell to 50.9 for September. That’s down from 52.8 in August. Any number above 50 means that the factory sector of the economy is growing; below 50, and it’s contracting. This was the 28th month in a row of a growth.

After the jobs report, the next big report for us will be the CPI report for September. While most people follow the CPI for the official inflation number, the Federal Reserve prefers to follow the Personal Consumption Expenditure stats.

The last PCE report came out on Friday, and as I expected, inflation is still worse than many people think. The core PCE number rose by 0.6% in August which was 0.1% higher than estimates. Over the past year, core PCE rose by 4.9%. Wall Street had been expecting 4.7%.

The non-core rate rose by just 0.3% in August. Falling energy prices played a big role in keeping that number low. Either way, the annual numbers are running well above the Fed’s target of 2%.

Lael Brainard, the Vice Chair of the Fed and someone who is considered more of a dove, nevertheless spoke in strong terms regarding inflation:

“Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target,” the central bank official said in remarks prepared for a speech in New York. “For these reasons, we are committed to avoiding pulling back prematurely.”

Earlier today we got the latest JOLTS report. That’s the Job Openings and Labor Turnover Survey which is put out by the Bureau of Labor Statistics. According to the report, the number of job openings dropped by 1.1 million in August. That’s huge.

The number of available positions fell by 10% to 10.05 million. Wall Street had been expecting 11.1 million. This was the biggest drop since the early days of the pandemic. A major problem for the Fed has been to manage inflation during a very tight labor market. There used to be two jobs for every unemployed person. Now it’s 1.67.

One interesting side note is that lumber prices are back to where they were before the pandemic. That’s a good sign of normalcy. The construction spending report should show a decline of 0.7% in August. Construction spending is still 8.5% above the number from one year ago.

I still think the economy is likely to fall into a recession sometime next year. I suspect it will be a fairly shallow recession, but a lot of this will be determined by how successful the Fed will be in fighting inflation.

Elon Musk to Buy Twitter

It’s really happening! Well, maybe it’s really happening.

This afternoon, news broke that Elon Musk has agreed to buy Twitter (TWTR) for the original offer price of $54.20 per share. (Yes, Musk worked “420” into his offer price.)

If you recall, Musk had originally offered to buy Twitter in April for $54.20 per share, but then he seemed to get cold feet. Instead of simply admitting that, he claimed that Twitter was less than upfront about its user data.

Then the lawyers got involved, and it looked like Twitter was ready to take the matter to court. It’s difficult to imagine a scenario where a person is forced to buy a company even when making commitments to do so, but it looked like that was about to happen. The trial was scheduled to start on October 17.

I’m making a few guesses. The first is that Musk’s lawyers told him that he if were to take it to court, then there’s a very good chance he would lose. In many of the pre-trial motions, the judge repeatedly sided with Twitter.

Musk and Twitter’s management have had a, shall we say, less-than-cordial relationship. Ever since Musk made his original offer, he’s been a constant critic of Twitter, and most importantly, he’s accused Twitter of lying about its number of users.

Another guess of mine is that Musk was simply impulsive, and the “bot issue” was his strategy to back out of the deal. Once it became clear that that wasn’t going to work, Musk chose the best way to lose.

Twitter stuck by the original offer and last month, Twitter shareholders voted to approve the deal. According to a filing with the SEC, Musk made the offer to Twitter yesterday. The stock immediately shot up higher on the news and trading in Twitter was eventually halted. Twitter said it aims to close the deal at the original price.

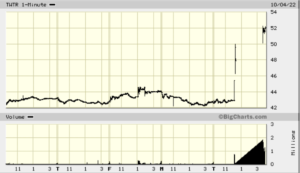

If you look very closely at this chart, you can make out when the Musk news broke:

How did this all begin? Earlier this year, Twitter suspended the satirical news site called the Babylon Bee for referring to a trans woman as “Man of the Year.” That seems to have spurred Musk on. Twitter has received a lot of criticism for its suspension policies which seem to be arbitrary and politically motivated. I suspect that once Twitter is private, it will allow former President Trump back on the platform.

Given that shares of Twitter closed today at $52 per share, this suggests to me that the market is taking this offer seriously. In fact, the deal may happen quickly. Of course, this is a very different stock market than what we had this past spring.

Another guess is that Twitter’s people told them that the deal is a lot more than Twitter is truly worth. Let’s look at some numbers. Wall Street expects Twitter to earn $1.20 per share this year and 60 cents per share next year. I should add that that’s a major decrease in expectations. Three months ago, Twitter was expected to make $1.68 per share for this year and $1.31 per share for 2023.

Frankly, Twitter simply isn’t that profitable, and it never has been, Personally, I’d be skeptical paying half of Elon’s price. The only hitch is if there’s some way to alter Twitter’s business model to be more profitable. If there is, I don’t know it and I’m not sure Musk does, either. He has said he could get Twitter to 500 million daily users, which is a significant part of the planet.

The lesson here is to be cautious in your business dealings. It may cost you $44 billion.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

-

Morning News: October 4, 2022

Posted by Eddy Elfenbein on October 4th, 2022 at 7:03 amBusinesses Brace for Currency Chaos in Asia, a Region With a History of Crisis

Britain’s Economic Experiment Stumbles at the Start

Less Turnover, Smaller Raises: Hot Job Market May Be Losing Its Sizzle

Rising Interest Rates Test Demand for Cars

Crypto Needs More Rules and Better Enforcement, Regulators Warn

Kim Kardashian Could Be ‘Tip of the Iceberg’ for Celeb Crypto Crackdown

Ray Dalio No Longer Thinks ‘Cash Is Trash’

Samsung Kicks Advanced-Chipmaking Race Into High Gear With Road Map

South Korean Internet Giant Buys Poshmark in $1.2 Billion Deal

Credit Suisse’s Options Worsen as Markets Mayhem Takes Toll

Apple Will Be Forced to Use New Charger After EU Votes for USB-C

Meta Is Closing One New York Office With Cutbacks Looming

Pfizer’s Unthinkable Boom Now Leaves Investors Anxious

Warren Buffett’s Successor Is Building an $68 Million Berkshire Holding

How McKinsey Cashed In by Consulting for Both Companies and Their Regulators

Few Customers Get Refunds for ‘Rampant’ Zelle Fraud, Senator’s Report Says

Be sure to follow me on Twitter.

-

The Market Snaps Back

Posted by Eddy Elfenbein on October 3rd, 2022 at 2:19 pmThe stock market is having a nice rally today. As I write this, the S&P 500 is up more than 2.4%. On Friday, the stock market closed out a lousy day, week, month and quarter. Give it time and we can add “year” to that sentence.

The bond market is doing quite well today which may suggest that we’re returning to a daily battle of stocks against bond. This is a change from before when both stocks and bonds moved lower. That’s what inflation can do. The 10-year yield is down about 16 basis points.

This morning’s ISM Manufacturing Index came in at 50.9. Any number below 50 means the factory sector of the economy is contracting.

-

Morning News: October 3, 2022

Posted by Eddy Elfenbein on October 3rd, 2022 at 7:00 amOPEC Plus Considering Major Production Cut to Prop Up Oil Prices

Europe Faces ‘Unprecedented Risk’ of Gas Shortage, IEA Says

Cargo Shipowners Cancel Sailings as Global Trade Flips From Backlogs to Empty Containers

Inflation in Europe Now Looks Even Less Transitory Than in US

Liz Truss Drops Tax Cut for Top UK Earners to Fend Off Rebellion

Central Banks’ Higher Rates, Bond Sales Clash With Government Needs

Inflation Keeps the U.S. From Stepping In to Slow Dollar’s Rapid Rise

Relentless Dollar Rally Raises Bets on Interventions, Investors Say

Wealthy Use Loophole to Reap Tax Breaks — And Delay Giving Away Money

Millions in Cryptocurrency Vanished as Agents Watched Helplessly

Credit Suisse Market Turmoil Deepens After CEO Memo Backfires

Supermarket Discounts Are Harder to Find as Food Prices Rise

US Home Prices Now Posting Biggest Monthly Drops Since 2009

Tesla Slumps as Deliveries Disappoint Due to Logistic Snarls

These Job-Training Programs Work, and May Show Others the Way

Walgreens Turns to Prescription-Filling Robots to Free Up Pharmacists

Backing Lindt, Swiss Court Orders Lidl to ‘Destroy’ Its Chocolate Bunnies

Producer Bets Streamers Want the Next ‘Judge Judy,’ Not ‘Game of Thrones’

Be sure to follow me on Twitter.

-

This Morning’s August PCE Report

Posted by Eddy Elfenbein on September 30th, 2022 at 11:28 amThis morning, the government released the Personal Consumption Expenditure stats for August. This report gets attention because the PCE is the Fed’s preferred measure of inflation.

The core PCE number rose by 0.6% in August which was 0.1% higher than estimates. Over the past year, core PCE rose by 4.9%. Wall Street had been expecting 4.7%.

The non-core rate rose by just 0.3% in August. Falling energy prices played a big role in keeping that number low. Either way, the annual numbers are running well above the Fed’s target of 2%.

Lael Brainard, the Vice Chair of the Fed and someone who is considered more of a dove, nevertheless spoke in strong terms regarding inflation:

“Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target,” the central bank official said in remarks prepared for a speech in New York. “For these reasons, we are committed to avoiding pulling back prematurely.”

The stock market is up so far today but it looks to close out a difficult week, month and quarter.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His