-

From Bed Bath & Beyond’s Earnings Call

Posted by Eddy Elfenbein on April 4th, 2012 at 10:04 pmThe transcript is courtesy of Seeking Alpha. Here are some important points:

Before concluding this afternoon’s call, a few additional comments relative to our recently concluded fiscal fourth quarter. Our balance sheet and cash flows remain strong. We ended the fiscal fourth quarter with cash and cash equivalents and investment securities of approximately $1.9 billion. This includes approximately $83.9 million of investments related to auction rate securities.

These securities have an estimated temporary valuation adjustment of approximately $3.7 million to reflect their current lack of liquidity. Since this valuation adjustment is deemed temporary, it did not affect the company’s earnings. As we have said in the past and as we have experienced to date, we believe that given the high credit quality of these investments, we will ultimately recover, at par, all amounts invested in these securities.

Inventories continue to be tailored by store to meet the anticipated demands of our customers and are in good condition. As of February 25, 2012, inventories at cost were approximately $2.1 billion or $57.35 per square foot, an increase of approximately 2.1% on a per square foot basis over last year.

Consolidated shareholders equity at February 25, 2012, was approximately $3.9 billion, which is net of share repurchases, including the approximately $359 million, representing approximately 5.9 million shares repurchased during the fiscal fourth quarter of 2011. As of February 25, 2012, the remaining balance of the current share repurchase program authorized in December 2010 was approximately $919 million.

Cash of $1.9 billion comes to $8 per share. The company may want to consider paying a dividend sometime soon. If Apple can do it, so can BBBY.

-

Bed Bath & Beyond Earns $1.48 Per Share

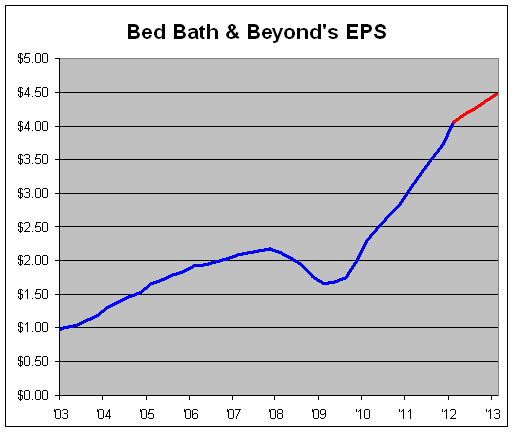

Posted by Eddy Elfenbein on April 4th, 2012 at 4:22 pmWow! A huge earnings beat from Bed Bath & Beyond ($BBBY). For fiscal Q4, the company earned $1.48 per share. That’s 15 cents better than Wall Street’s consensus. The stock is currently up about 6% after hours.

In December, Bed Bath & Beyond told us to expect Q4 results to range between $1.28 and $1.33 per share, so this was much better than expected. The earnings represented a 32% increase over Q4 of 2010. Quarterly sales rose by 9.1% and the key retailing metric, comparable store sales, rose by 6.8%.

For the year, Bed Bath & Beyond earned $4.06 per share which was also a 32% increase over the year before. Sales rose 8.5% to $9.5 billion. Comparable store sales rose by 5.9%.

Now for guidance. For Q1, Bed Bath & Beyond sees earnings ranging between 79 cents and 83 cents per share. For the full-year, they project earnings “to increase by a high single to a low double digit percentage range.” If we take that mean to 10%, that translates to a full-year forecast of $4.47 per share.

This is the twelfth-straight quarter than Bed Bath & Beyond has expanded its net margins. In the three years since fiscal 2009, total sales have grown by 32% but net earnings are up by 133%. The reason is that net profit margins increased from 5.9% in 2009 to 10.4% last year.

This is very good news. BBBY continues to exceed expectations. I said in December that I thought the Street’s forecast for 2012 of $4.39 was too high. Shows what I know.

At $70 per share and $4.47 for this coming year, the stock is currently going for 15.66 times earnings which isn’t that expensive. Given today’s huge earnings beat, I now have reason to believe that the company’s earnings forecast is on the low side (which is smart given that the fiscal year has just begun).

Here’s a look at BBBY’s earnings-per-share along with the company’s forecast in red. Notice how conservative the red line is.

Here’s a look at BBBY’s quarterly numbers for the past few years:

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 Aug-11 $2,314,064 $950,999 $371,636 $229,372 $0.93 Nov-11 $2,343,561 $958,693 $357,020 $228,544 $0.95 Feb-12 $2,732,314 $1,163,669 $550,765 $351,043 $1.48 -

DirecTV Ad with Kate Upton

Posted by Eddy Elfenbein on April 4th, 2012 at 11:05 amHere’s Kate Upton in a bikini. In an ad for DirecTV ($DTV). Which is on our Buy List. Therefore, this is relevant stock information.

-

Up, Up, Down, Down, Down….

Posted by Eddy Elfenbein on April 4th, 2012 at 10:19 amFor the 14th day in a row, the stock market is following its pattern of rising on Monday and Friday and then falling on Tuesday, Wednesday and Thursday.

-

ADP Says 209,000 Jobs Were Created in March

Posted by Eddy Elfenbein on April 4th, 2012 at 9:08 amThe big jobs report comes out on Friday but we got a sneak preview this morning when private payroll firm ADP said that 209,000 jobs were created last month. Wall Street expected ADP to say 206,000.

The market got knocked yesterday by the release of the minutes from the last Fed meeting. Traders interpreted the comments to be on the hawkish side, meaning that the Fed is growing leery of playing nursemaid to this economy. I’ve long been a skeptic that any form of QE3 will be coming.

As a result, stocks pulled back and gold dropped significantly. That trend may continue today. All eyes will be on Friday’s jobs report, but the market will be closed for Good Friday.

-

Morning News: April 4, 2012

Posted by Eddy Elfenbein on April 4th, 2012 at 5:56 amDraghi Tested as German Pay Deals Add to Euro Divergence

Unscramble the Euro Omelet. Win $400,000!

Euro-Region Retail Sales Declined in February, Led by Germany

Occupy London Hinders Burrito Sales More Than Banker Bonuses

Spain Borrowing Cost Rises as Demand Drops at Bond Sale

China’s Wen Urges Breakup of Bank Monopoly as Growth Slows

In China Press, Best Coverage Cash Can Buy

Singapore Dollar Weaker Late As Hopes For Fed Stimulus Wane

Gold Falls for Second Day on Fed Stimulus Stance

Oil Falls a Second Day on Supply as Fed May Halt Stimulus

As Home Rents Head Higher, Owning Regains Its Appeal

Molson Coors Attacks Craft Armada With $3.5 Billion Deal

Regulators Expected to Penalize JPMorgan Over Lehman Collapse

Cullen Roche: Slaves of Some Defunct Economist

Joshua Brown: Hedge Funds Accomplishing Very Little in the Aggregate…

Be sure to follow me on Twitter.

-

Ford Posts Best March Sales in Five Years

Posted by Eddy Elfenbein on April 3rd, 2012 at 12:15 pmFord Motor Company posted its best March U.S. sales month since 2007 – with the Ford Fusion recording its best month ever, Ford Focus and Ford Edge achieving their best March ever and the F-Series showing the strongest March sales in five years.

Total company sales totaled 223,418 vehicles for March, a 5 percent gain over year-ago levels. Retail sales increased 11 percent for the month.

For the first quarter, Ford Motor Company’s sales were up 9 percent versus year-ago levels, totaling 539,247 vehicles sold. The increases were driven by the popularity of Ford’s most fuel-efficient models posting record sales months.

“Rising gas prices continued to drive strong customer demand for Ford’s fuel-efficient vehicles throughout March and the first quarter,” said Ken Czubay, vice president, U.S. Marketing, Sales and Service. “Ford is answering the call with what we call the power of choice – a full family of cars, utilities and trucks that offer leading fuel economy in their classes.”

March sales highlights:

* Fusion set an all-time monthly sales record, with 28,562 vehicles sold.

* Focus delivered its best March sales performance ever, selling 28,293 cars.

* F-Series sold 58,061 for the month – a 9 percent increase versus last March and F-Series’ best March sales performance since 2007. EcoBoost accounted for 41 percent of the F-150 retail sales, with all V6 engines comprising 56 percent for the month.

* The Ford Edge had it best March sales month ever, with 14,058 vehicles sold.

* Ford began selling its Police Interceptor Sedans and Utilities at the end of March.

During the first quarter:

* Car sales at Ford Motor Company were up 8 percent. The fuel-efficient Focus was the biggest seller among Ford’s car lineup, with sales up 78 percent during this period, with 66,043 vehicles sold.

* Utility sales totaled 150,415 vehicles, a 6 percent increase versus year-ago levels. Escape sales were up 5 percent, making it the strongest-ever first quarter start for Escape – America’s best-selling utility.

* Ford Motor Company truck sales increased 11 percent, with 195,807 vehicles sold. F-Series pickups – America’s top-selling truck for 35 years – posted sales of 143,827 vehicles for the quarter, a 14-percent increase versus the same period in 2011.

-

Dividends Are Making a Comeback

Posted by Eddy Elfenbein on April 3rd, 2012 at 11:04 amNow that the first quarter is over, we have some stats on dividends. The S&P 500 paid out 7.09 in dividends (that’s the number adjusted for the index) which is a 15.06% increase over the first quarter of 2011.

I think this will be a very good year for dividends, especially with the dividend news from Apple ($AAPL). The market also responded very well to the five-fold dividend increase from CA Technologies ($CA), plus the recent increase at JPMorgan ($JPM). So far this year, there have been 122 dividend increases in the S&P 500, plus seven new dividend payers. Only three companies have lowered their payouts.

Looking at dividends has been a surprisingly good way of valuing the market over the past few years. You can never be quite sure about a company’s earnings or cash flow since accounting rules allow for enormous latitude. But if a company is willing to send shareholders a check, you can be pretty certain those numbers are legit (though not always).

Dividends also tend to be very stable. Once a company raises its quarterly dividend, there’s an implicit understanding that that’s the new level. Shareholders will put up with a lot, but they do not like cuts in dividends, and woe be unto the company that lowers their payout. The recent recession, however, saw an unusually higher number of cut dividends or suspended payouts altogether. In 2009, annual dividends dropped by 21%. Contrast this with 2001 when the stock market crash led to dividends falling by just 3%.

The lower dividends this time around have been largely concentrated in the financial sector. Part of this is due to rules around receiving TARP payments. I don’t have the exact numbers for the financial sector but the quarterly dividends for the Financial Sector ETF ($XLF) fell about 70%. The Financial Sector currently makes up 15% of the S&P 500.

The good news is that higher profits are leading to higher dividends. Dividends are on pace to hit a new record this year. On top of that, the dividend payout ratio—the percent of profits paid out as dividends—is still below 30% which is far below normal.

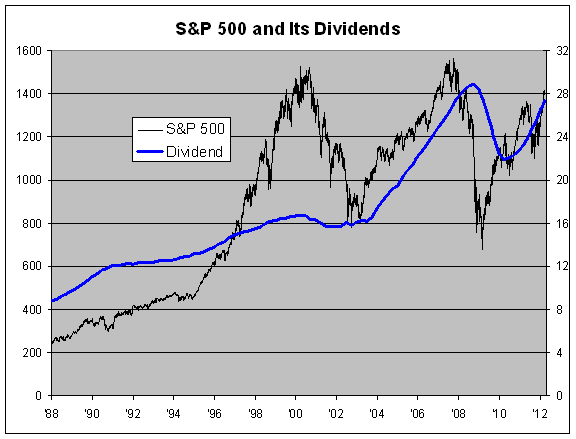

Here’s a look at the S&P 500 in the black line along with its dividends in the blue line. The black line follows the left scale and the blue line follows the right. The two lines are scaled at a ratio of 50-to-1 which means that the S&P 500 yields exactly 2% whenever the lines cross.

I think the chart shows some interesting facts. For example, you can see how different the market crashes of 2000-01 and 2008-09 were. In the first, prices soared above fundamentals. In the latter, fundamentals crumbled beneath the price. From 2003 to 2007, stock prices generally followed the trend in dividends. We can also see how much investors panicked during the financial crisis. In March 2009, the S&P 500’s dividend yield eventually reached 4%.

I asked Howard Silverblatt, the head stat guy at S&P, to tell me the dividend estimate for this year. He said it’s $29.70. To equal a dividend yield of 2%, the S&P 500 needs to get to 1,485 which is a 4.6% jump by the end of the year.

-

Backstage Wall Street

Posted by Eddy Elfenbein on April 3rd, 2012 at 10:11 amJosh Brown discusses his new book, Backstage Wall Street, with Joe Weisenthal.

-

Morning News: April 3, 2012

Posted by Eddy Elfenbein on April 3rd, 2012 at 5:48 amDAX Beating S&P 500 by Most Since ’06 on Economy Optimism

PBOC’s Zhou Urges Fed to Consider Global Effect of Policy Easing

Did Spain Commit Economic Suicide?

Regulator Accuses R.B.C. of ‘Massive’ Trading Scheme

U.S. Economy Enters Sweet Spot as China Slows

US Stocks Climb To Multiyear Highs After Manufacturing Data

Where Housing Once Boomed, Recovery Lags

Oil Drops After Biggest Gain in Six Weeks on Supplies

‘Apple Fever’ to Push Stock to $1,001, Topeka Capital Says

JPMorgan Lead Over Morgan Stanley Widening on Rating Cuts

Small Banks Shift Charters to Avoid U.S. as Regulator

Groupon Hit as Analysts Question Model

F.T.C. Approves Merger of 2 of the Biggest Pharmacy Benefit Managers

Coty Low-Ball Offer Seen Emerging as Avon’s Best Option

Roger Nusbaum: Real Life Retirement Example

Edward Harrison: Faber: Japanese Stocks Will Outperform as US Margins Deteriorate

Be sure to follow me on Twitter.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His