-

Morning News: December 15, 2023

Posted by Eddy Elfenbein on December 15th, 2023 at 7:03 amChina’s Policy Combo Gives Investors Hope for a Market Rally

Don’t Buy China’s November Recovery

The Road to China-Free Supply Chains Is Long. Warning: Legless Lizards Ahead

Euro Zone’s Rising Recession Chances Fail to Shift ECB on Cuts

Bank of Portugal Cuts 2024 Growth Outlook, Citing Short-Term Uncertainty

The Fed’s Shrinking Balance Sheet Is Worrying a Key Corner of US Financial Markets

What Fed Rate Cuts Mean For Your Money, Mortgages and More

A $6 Trillion Cash Hoard Could Fuel More U.S. Stock Gains as Fed Pivots

Fidelity, JPMorgan Buck Market by Betting on Stronger Dollar

BlackRock, SEC Clash Over Redemption Model for Bitcoin ETF

Citi Shuts Muni Business That Once Was Envy of Rivals

Mortgage Rates in US Slide Below 7% for First Time Since August

Convenience Stores Would Rather Sell You Pizza Instead of Gas

Pfizer Helped Save the World With Covid Vaccines. Now It Needs to Right Itself

New Mexico Spaceport Leaves Economic Dreams Grounded

RTX Names Christopher Calio as Next CEO

Elon Musk Is Funding a New School Planning to Open in Austin, Texas

Activist Investor Nominates Two to Disney Board, Including Himself

In Search of Cash, Studios Send Old Shows Back to Netflix

Mistrust Looms Over PGA Tour as Deadline for Saudi Deal Nears

Costco Stock Gets Price Target Upgrades. What Wall Street Loved About Its Earnings

Inside the Push to Engineer the Toughest 72-Hour Antiperspirant

Be sure to follow me on Twitter.

-

Morning News: December 14, 2023

Posted by Eddy Elfenbein on December 14th, 2023 at 7:14 amOn Day One of Argentina Overhaul, Milei Scores Crucial Victory

Germany, Roiled by a Court Ruling, Finally Has a Budget

US Defense Tech Start-Ups Are Being Shut Out of Europe’s Defense Market

Deadly New Trade in ‘Frankenstein’ Guns Enabled by a Gap in US Law

The Sea-Monster-Sized Ship Disrupting Biden’s Wind-Energy Dreams

Will the End of Fossil Fuels Spoil the Lucky Country’s Streak?

Oil Demand Growth Shows Signs of Sharper Slowdown, IEA Says

Credit Agricole to Stop Financing New Fossil Fuel Extraction Projects

Wall Street Makes Zero Progress in Energy Finance Transition

Is Jerome Powell’s Fed Pulling Off a Soft Landing?

Treasuries 10-Year Yield Falls Below 4% as Fed Sees Rate Cuts

The Markets Are Getting Ahead of the Fed

Wall Street Traders Go All-In on Great Monetary Pivot of 2024

Fnality Completes ‘World’s First’ Blockchain Payments at Bank of England

UBS Intensifies Cash Clawback From Credit Suisse Defectors

Proponents of Virus ‘Stimulus’ Spending Revive Helicopter Imagery

How a Plan to End Poor Countries’ Debt Crises Created a New One

American Colleges Are Losing Their Students and Money

Federal Regulators Seek to Force Starbucks to Reopen 23 Stores

Range Rovers Become Thief-Magnets, Causing Prices to Tumble

Meta Lets EU Users Sign Up to Threads Without an Instagram Link

Remember What Spotify Did to the Music Industry? Books Are Next

Top Business Leaders Pick the Year’s 62 Must-Reads

To Get Your Positive Review, Businesses Bully, Badger and Guilt-Trip

Be sure to follow me on Twitter.

-

Morning News: December 13, 2023

Posted by Eddy Elfenbein on December 13th, 2023 at 7:04 amOPEC Leaves Global Oil-Demand Views Unchanged

COP28 Ends With Deal on Transition Away From Fossil Fuels

The World’s Poorest Countries Buckle Under $3.5 Trillion in Debt

‘There Is No Money’: Argentina Begins Economic Shock Remedy

Xi Disappoints Investors by Skipping Signal for Big Stimulus

E.U. Moves to Tap Frozen Russian Assets to Help Ukraine

U.K. Sets Up New Office to Help Enforce Sanctions Against Russia

Blistering Treasuries Rally Silences Deficit-Obsessed Vigilantes

Inflation Holds Roughly Steady Ahead of Fed Meeting

The Fed Isn’t Ready to Speculate on Rate Cuts — Yet

Vanguard Is Closer Than Ever to Ending BlackRock’s ETF Reign

UK Proposes Capping Some Visa, Mastercard Fees After Fivefold Jump Since Brexit

Microsoft Tops the List of Best-Managed Companies of 2023

Google’s Antitrust Loss to Epic Could Preview Its Legal Fate in 2024

Chatbot Hype or Harm? Teens Push to Broaden A.I. Literacy

SpaceX Value Jumps Closer to $180 Billion in Tender Offer

Swedish Labour Union to Stop Collecting Tesla Waste in Sweden

Tesla Recalls 2 Million Cars to Fix Autopilot Safety Flaws

GM Moves Forward After Strike, Focusing on Cost Cuts and EVs

Why Biden’s EV Tax Credit Could Become Hard to Claim

Hospitals Creeping Toward Recovery Grapple With ‘Out of Control’ Costs

There’s a Black Market on Social Media for Pricey Fertility Drugs

Bill Ackman’s Campaign Against Harvard Followed Years of Resentment

Be sure to follow me on Twitter.

-

CWS Market Review – December 12, 2023

Posted by Eddy Elfenbein on December 12th, 2023 at 6:32 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Stock Market Is Closing in on an All-Time High

The bulls are in charge! On Tuesday, the S&P 500 closed at its highest level in 23 months. This was its fourth up day in a row.

The index is getting very close to its all-time high reached nearly two years ago. We’re now only about 3% away. The S&P 500 Total Return Index, which includes dividends, is extremely close to making an all-time high (about 0.03% away).

The index is up for the last six weeks in a row. It’s been 14 months since the last time the bear market made a new low. The S&P 500 is up nearly 30% from its low reached in October 2022.

I’m pleased to see that our ETF continues to do well. The AdvisorShares Focused Equity ETF (CWS) made another new all-time high on Tuesday for its net asset value.

We had a lot of news this week. On Friday, we got the latest jobs report. This morning, we got the CPI report for November. Also, the Federal Reserve started its two-day meeting today. The FOMC will release its policy statement tomorrow afternoon. Spoiler Alert: The Fed won’t make any changes to interest rates.

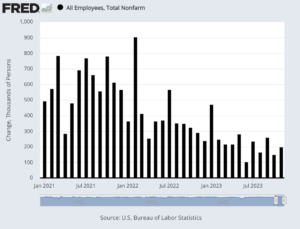

On Friday, the Labor Department said that the U.S. economy created 199,000 net new jobs last month. That was slightly ahead of Wall Street’s forecast for a gain of 190,000 jobs. For October, the economy added 150,000 jobs. The unemployment rate ticked down from 3.9% to 3.7%.

Here’s a look at the monthly nonfarm payrolls:

One problem for the economy is that a large amount of the new jobs are healthcare and government jobs. Manufacturing added only 28,000 jobs last month. That needs to be higher. Retail lost 38,000 jobs.

The labor force participation rate rose to 62.83%. That’s now at its highest level since Covid broke out in early 2020.

One good sign is that average hourly earnings increased by 0.4%. Wall Street had been expecting an increase of 0.3%. Over the last year, wages are up by 4%. While the wage gains have been good, much of the increase has been eaten up by inflation. Adjusted for inflation, workers’ pay increased by 0.2% last month and 0.8% in the last year.

The Labor Department also tracks a broader measure of unemployment called the U-6 rate which counts “discouraged” workers. For November, the U-6 rate fell 0.2% to 7%.

We’re not in a recession, but the economy is clearly slowing down. Most economists think the economy grew in real, annualized terms by 1% to 1.5% in Q4. The Fed is trying to engineer a “soft landing” for the economy. The goal is for inflation to dissipate but for the economy to avoid a recession.

Frankly, that’s tough to do. In the last 40 years, I’d say the only example of a soft landing was in 1994-95. I hope we can repeat it, but I’m skeptical. For now, the promise of lower rates are good for stocks. Don’t let yourself get scared out of the market.

The Inflation Numbers Aren’t So Bad

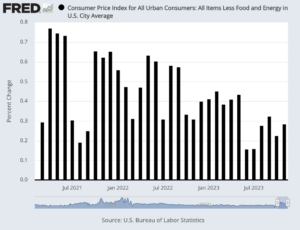

This morning, the Labor Department said that inflation increased by 0.1% in November. That’s not bad, although it was 0.1% higher than Wall Street’s forecast.

Over the last 12 months, inflation is up by 3.1%. That matched Wall Street’s expectations. Bear in mind that prices are still going up, but the rate of increase is slowing down.

There’s a curveball to this data and it’s energy prices. Last month, energy prices were down a lot. For example, gasoline prices were down 6% in November. The drop in energy prices weighed heavily on the CPI data.

That’s why we also want to look at the core rate (see above), which excludes food and energy prices. Last month, the core rate increased by 0.3%. Over the last year, core CPI is up by 4%. That was in line with estimates. The-year-over-year core rate has declined for eight months in a row, although the most recent one was very small.

A 2.3% decrease in energy prices helped keep inflation in check, as gasoline fell 6% and fuel oil was off 2.7%. Food prices increased 0.2%, boosted by a 0.4% jump in food away from home. On an annual basis, food rose 2.9% while energy was down 5.4%.

Shelter prices, which make up about one-third of the CPI weighting, increased 0.4% on the month and were up 6.5% on a 12-month basis. However, the annual rate has showed a steady decline since peaking in early 2023.

For the last several months, the Fed has sounded tough on inflation even though the central bank has backed off its rate hikes. The Fed first paused on rate hikes at its June meeting. It raised again in July, but it paused again at its last two meetings.

You can forget about a rate hike tomorrow, or one in January. There’s a good chance that the Fed will cut rates sometime in the spring. It could even come as early as March, but May or June is a safer bet. Futures traders currently think there’s a 92% chance that the Fed will cut rates by June. Traders see the Fed lowering short-term interest rates by 1.25% next year. That would be very good for stocks.

Stock Focus: Alamo Group

This week, I want to look at an interesting yet overlooked company, the Alamo Group (ALG). No, this has nothing to do with car rentals. Instead, Alamo is in the business of making farm machinery.

Before you roll your eyes at farm machinery, I’ll tell you that since its low in 2009, Alamo is up 18-fold. Despite having a market cap of $2.3 billion, Alamo is largely ignored by Wall Street. The company is followed by a grand total of three Wall Street analysts. One rates it a buy; the other two are holds. A lot of experts missed this one.

Check out this chart:

Honest question. How many of those downdrafts would have scared you? I’m sure a few would have, but every single one was reversed. So much of good investing comes down to waiting.

Alamo was founded in 1969. The company has 4,200 employees. Last year, it registered sales of $1.5 billion. For this year, sales will probably be close to $1.7 billion.

When I said that Alamo makes farm machinery, that’s not entirely fair. The company makes a wide range of products from street sweepers and snow trucks to tractor-mounted mowing equipment. Alamo divides its business into two units: industrial and vegetation. The company is based Seguin, Texas, about 35 miles from the actual Alamo.

Shares of Alamo have been rallying very well since early November when the company reported strong results for its Q3. Alamo said it made $2.91 per share which was 26 cents better than estimates. This was the eighth-straight quarter for record sales and earnings. The stock is up 21% since then.

These results calmed investors who were concerned after Alamo slightly missed its Q2 earnings. The company made $3.05 per share in Q2 which was two cents below estimates.

Prior to that, Alamo had been crushing its estimates. For last year’s Q4, Alamo made $2.44 per share. That was a 45-cent beat. Then in Q1, Alamo made $2.79 per share which was well ahead of Wall Street’s estimate of $2.12 per share.

In last month’s report, CEO Jeff Leonard was very optimistic. He said, “our strong, high quality order backlog gives us excellent forward visibility. Combined with the health of our markets, this bodes well for our performance for the remainder of this year and for the first several quarters of 2024.”

Alamo is currently trading at about 15 times next year’s earnings estimate. However, if Alamo keeps beating estimates as it had, then it’s probably going for around 12 or 13 times earnings. Alamo currently pays out a small quarterly dividend of 22 cents per share. That works out to a yield of less than 0.5%.

Alamo’s next earnings report won’t be out for two months, but I’m expecting another big beat.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: December 12, 2023

Posted by Eddy Elfenbein on December 12th, 2023 at 7:07 amGas Prices Are Falling, Hitting Their Lowest Level in Almost a Year

Making Oil is More Profitable than Saving the Planet. These Numbers Tell the Story

Inflation Expected to Stay Flat, Giving Fed Room to Cut Rates

Best Bond Forecasters of 2023 Say the Rally Is Doomed to Fizzle

Goldman Reshuffles Private Credit in Bid to Double Assets

Goldman Trader Who Was Paid $100 Million Since 2020 to Step Down

JPMorgan Is in a Fight Over Its Client’s Lost $50 Million Fortune

EY Is Laying Off U.S. Partners Amid Tough Economic Conditions

Cathie Wood Boosts Stake in Microsoft, Facebook in AI Push

Essential AI Comes Out of Stealth With $57 Million in Funding

Google Loses Antitrust Court Battle With Makers of Fortnite Video Game

Google’s Antitrust Setback Could Remake the Mobile App World

Jet Defects Stoke Debate Over Who Should Inspect Mechanics’ Work

U.S. Companies Are Finding It Hard to Avoid China

Why Volkswagen Is Building a Team of 3,000 Engineers in China

Pernod Ricard Releases First China Whisky Amid Economic Slowdown

Commodities Carriers Star Bulk and Eagle Bulk Shipping Agree to $2.1 Billion Merger

Macy’s Billion-Dollar Question: What’s More Valuable, Real Estate or the Business?

Lowball Bid Could Spur Macy’s to Look for Better Options

Choice Hotels Launches Hostile Bid for Wyndham

Redstone’s Predicament: Whether to Sell or Fix Her Media Empire

The Strangest Toy on Wish Lists This Year

Be sure to follow me on Twitter.

-

Morning News: December 11, 2023

Posted by Eddy Elfenbein on December 11th, 2023 at 7:04 amArgentina Prepares for Milei to Start Shock Therapy

What India Needs to Ditch Coal

OPEC+ Will Need to Maintain Oil Cuts to End-2024, Citigroup Says

What Ails Offshore Wind: Supply Chains, Ships and Interest Rates

Occidental to Buy Oil Driller CrownRock in $12 Billion Deal

The Power Vacuum at the Top of the Crypto Industry

Bitcoin’s 2023 Rally Frays During Brief 7.5% Drop Toward $40,000

If You Fight Inflation With Fed Rate Hikes, You Don’t Fight Inflation

What’s Next for Interest Rates? An Era of ‘Peak Uncertainty’

Rate Cut Pivot Can’t Come Soon Enough for Debt-Strapped Companies

Abu Dhabi Is the World’s Newest Wealth Haven for Billionaires

Real Estate Titans Battle DeSantis Over China Property Crackdown

US Awards $35 Million to Defense Firm BAE in First Chips Grant

Boeing Picks a Frontrunner to Be Its Next CEO

This A.I. Subculture’s Motto: Go, Go, Go

TikTok to Invest More Than $1.5 Billion in GoTo to Restart Indonesia E-Commerce Business

Jack Ma’s Biggest E-Commerce Rival Is Coming for Amazon

Amazon Suit Claims International Ring Stole Millions in Fraudulent Refunds

Pinterest, Snap Upgrades Signal Brighter Advertising Outlook

Macy’s Is Said to Get $5.8 Billion Offer From Investor Group

Corporate America Is Testing the Limits of Its Pricing Power

Be sure to follow me on Twitter.

-

Morning News: December 8, 2023

Posted by Eddy Elfenbein on December 8th, 2023 at 7:02 amChina to Step Up Fiscal Support to Strengthen Economic Recovery

China Proposes Cut to Transaction Fees on Funds to Boost Market

China’s Electric Car Factories Can’t Hire Fast Enough

EU Considers Restarting WTO Case Against US Over Steel Tariffs

U.S. and Mexico Try to Promote Trade While Curbing Flow of Fentanyl

The New World Bank Leader Has the Climate Crisis at the Top of His Agenda

You’re Better Off Going All In on Stocks Than Bonds, New Research Finds

Double Trouble: Investors Fight the Fed on Two Fronts

US Unemployment Rate to Tick Up Amid Early Signs of Recession

How Bosses Won the Fight for Power in 2023

Hottest Job in US Pays $80,000 a Year, No College Degree Needed

Apple Aims to Make a Quarter of the World’s iPhones in India

Microsoft’s Partnership With OpenAI Facing UK Scrutiny

Honeywell to Buy Carrier Unit for $5 Billion

Yellow Rejects Bid to Revive the Collapsed Trucking Company

The World’s Most Anonymous CEO Is About to Take Center Stage

Americans Rush to Portugal Ahead of Changes to Expat Tax Breaks

World’s Richest Families Add $1.5 Trillion in Wealth

Hermès Created Europe’s Biggest Family Fortune After Spurning LVMH

The Record Rush to Buy a Rolex or a Patek Philippe Is Over

Be sure to follow me on Twitter.

-

Morning News: December 7, 2023

Posted by Eddy Elfenbein on December 7th, 2023 at 7:07 amThe Last Hope for the World’s Fastest-Sinking Megacity Is a Noodle Billionaire

U.S. Spending on Clean Energy and Tech Spurs Allies to Compete

Hottest Job in US Is Still in Demand Despite Wind Energy Woes

Frontier Carbon Removal Fund Makes $57 Million Bet on Crushed Rocks

Woodside Energy, Santos in Merger Talks to Create Global Energy Giant

China’s Exports Snap Half-Year Slide

China’s Weak Trade Data Signals More Economic Pain to Come

Ukraine Funding Fight Stokes New Fears Over US Reliability

After So Many False Dawns, the Market Is Convinced the Fed Will Finally Cut

Robinhood Launches Crypto Trading Service in the EU

Dimon Says He Would Shut Down Crypto If He Had Government Role

Salesforce Signals the Golden Age of Cushy Tech Jobs Is Over

What a Slowing Jobs Market Might Mean for Interest Rates

AI Drive-Thru Firm Reveals Humans Needed on 70% of Orders

Once Unstoppable, Alibaba Is Now Faltering

From Unicorns to Zombies: Tech Start-Ups Run Out of Time and Money

Blackstone-Backed Candle Media Seeks Debt Help After Deal Binge

How the Biggest Boutique Fitness Company Turned Suburban Moms Into Bankrupt Franchisees

Elon Musk’s SpaceX Valued at $175 Billion or More in Tender Offer

JetBlue Airways Lifts 4Q Forecasts on Strong Holiday-Travel Demand

Shopping for Luxury Online Has Fallen Out of Fashion

Hot Glazed Doughnuts on the Menu, and Parisians Can’t Get Enough

McDonald’s Unveils CosMc’s, Its Answer to Starbucks

Be sure to follow me on Twitter.

-

Morning News: December 6, 2023

Posted by Eddy Elfenbein on December 6th, 2023 at 7:07 amMongolia Seeks $11 Billion Green Finance to Reshape Its Economy

How Russia Punched an $11 Billion Hole in the West’s Oil Sanctions

The U.S. Gas Startup at the Center of an Epic Feud With Global Energy Giants

Exxon Boosts Buybacks 14% as Hunt for More Oil Accelerates

FTC Investigates Exxon’s $60 Billion Deal for Pioneer

The U.S. Can Afford a Bigger Military. We Just Can’t Build It

India Stock Value Tops $4 Trillion, Narrowing Gap With Hong Kong

Trafigura Targeted by US and Swiss Prosecutors Over Corruption

UK Watchdog Says Savers Lapping Up Higher Interest Rates at Banks

Here Are the Rookie Mistakes Being Made by Millennial and Gen Z Investors

Wall Street Donors Keep Wallets Closed as 2024 Race Heats Up

Mortgage Refinance Demand Jumps 14% as Rates Fall to Lowest Point Since August

Another Part of Commercial Real Estate Is in For a Reckoning

How Nations Are Losing a Global Race to Tackle A.I.’s Harms

SEC Head Warns Against ‘AI Washing,’ the High-Tech Version of ‘Greenwashing’

Apple Set to Avoid EU Crackdown Over iMessage Service

Tesla Suffers Fresh Legal Setback in Sweden Over License Plates

Truck-Stop Billionaire Fights Warren Buffett to Increase $18 Billion Fortune

P&G Bought Gillette 18 Years Ago. It’s Still Paying the Price

Years After Monsanto Deal, Bayer’s Roundup Bills Keep Piling Up

CVS Says It Will Change the Way Its Pharmacies Are Paid

Can Wegovy Fight Alcoholism? For Big Pharma, This Isn’t a Priority

Cigarette Giant BAT to Take $31.5 Billion Charge on U.S. Brands

Obamas’ Vision for Hollywood Company: ‘This Isn’t Like Masterpiece Theater’

Be sure to follow me on Twitter.

-

CWS Market Review – December 5, 2023

Posted by Eddy Elfenbein on December 5th, 2023 at 6:32 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Coming Soon: The 2024 Buy List

Before I begin, I have a special announcement. Circle your calendars for Monday, December 25, 2023.

This year, December 25 is a very important day that millions of people look forward to. That’s the day I’ll unveil the 2024 Buy List. In honor of our new Buy List, the New York Stock Exchange will be closed that day. I’m deeply honored by this recognition.

I always announce the new Buy List a few days before the end of the year so no one can claim I’m somehow messing with the pricing.

I’m going to add five new stocks and sell six current stocks. We got an extra stock in the portfolio this year when Danaher spun off Veralto. We’ll bring the Buy List back down to its normal size of 25 stocks.

The new Buy List will go into effect on January 2 which will be the first trading day of next year. For track record purposes, the “buy price” of each stock will be the closing price from December 29 which is the final day of trading for this year.

All the stocks will be equally weighted based on the end of the year’s closing price. This will be the 19th year that I’ve made our Buy List public.

Our ETF, the AdvisorShares Focused Equity ETF (CWS) is based off the Buy List, and we try to make the fund track our Buy List as close as we can.

Speaking of our Buy List, yesterday we had a very good earnings report from Science Applications International (SAIC). The company is an important IT resource for the federal government, especially the Department of Defense.

SAIC beat Wall Street’s earnings forecast by more than 30%. The company also raised its full-year guidance for the third time this year. Yesterday, the stock jumped more than 13% for us. I’ll have more details in this week’s premium newsletter. You can sign up for the premium letter here.

Is the Labor Market Starting to Crack?

On Friday, the S&P 500 closed at 4,594.63 which finally exceeded its high from July 31st.

There’s some unusual symmetry at work. The first trading day in December surpassed the peak from the last day of trading in July. Now the next-highest peak came on the second-to-last day in March 2022. We’re still below the all-time peak which came on the first day of trading in 2022.

This week is Jobs Week. Tomorrow, we’ll get the ADP private payroll report. Then on Thursday, the government will release the latest report on jobless claims. That leads us up to Friday when we’ll get the official jobs report for November.

Until now, the labor market had been the solid base of the economy. As the housing market started to feel the heat of higher mortgage rates, we’ve still seen robust hiring. That may be changing.

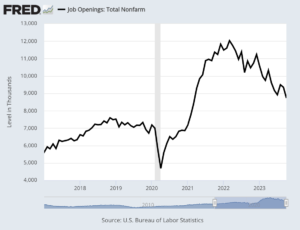

This morning, we got the JOLTS report for October. That stands for Job Openings and Labor Turnover Survey. According to the JOLTS report, job openings dropped to a 2-1/2 year low in October.

The number of job openings fell by 617,000 to 8.72 million. That was below Wall Street’s expectations for 9.4 million. There are now 1.3 job openings for each available worker. Not that long ago, the ratio was 2-to-1.

Interestingly, the “quits rate” didn’t change much. That’s an important number to watch because it’s a good barometer of how easy it is to change jobs. Or more precisely, how easy workers think it will be to change jobs.

During the pandemic, the quits rate got to 3%. You probably remember a lot of talk of the Great Resignation. Now the quits rate is down to 2.3%. Workers have quit quitting.

CNBC noted that “the biggest sector decline was education and health services (-238,000), followed by financial activities (-217,000), leisure and hospitality (-136,000), and retail (-102,000).”

On Friday, the ISM Manufacturing Index came in at 46.7. Any number below 50 means that the factory sector of the economy is contracting. This was the 13th month in a row that the ISM was below 50. That’s the longest streak in more than 20 years. Generally, recessions have been aligned with ISM readings below 45.

For Friday’s jobs report, Wall Street expects to see a gain of 190,000 net new jobs. That would be an increase over October’s sluggish gain of 150,000, but as important as any jobs gain is, I’ll be curious to see any wage gains. Unfortunately, inflation has taken a big bite out of wage gains.

The unemployment rate for October was 3.9%. If the rate for November is 4.3% or higher, that would trigger the “Sahm Rule,” meaning that the U.S. economy would be in a recession.

I discussed the Sahm Rule a few weeks ago. It’s a simple rule to see if the economy is in a recession or not. The Sahm Rule is easy to calculate. It says we’re in a recession when the rolling three-month average for unemployment is 0.5% or more higher than the rolling three-month low over the last 12 months.

I doubt that unemployment will rise that much, but it’s not unthinkable. This news is taking a lot of heat off the Federal Reserve. The Fed meets again next week, and you can dismiss any idea that the Fed will hike interest rates. In fact, you can dismiss the idea for this week and the following meeting next month.

Futures traders are indicating that there’s a 65% chance of the Fed slashing interest rates by 0.25% in March. A weak jobs report might increase those odds.

I like to follow the Treasury yield curve and see what maturity is the highest-yielding one. These tend to go in cycles, from longest maturity to shortest and back again. This is a good way of spotting the peak in the interest-rate cycle.

Lately, the highest-yielding maturity has been in the very near term. From late August through October, the highest-yielding maturity was the four-month Treasury. Then, through most of November, it was the two-month Treasury. For the last few days, it’s been the one-month Treasury. The current yield for the one-month bill is around 5.5%.

Notice in this chart how the one-month Treasury (the black line) is now higher-yielding than both the one-year (blue) and five-year (green) notes. In fact, there’s a noticeably growing gap between the black and blue lines.

That growing spread is the bond market’s way of telling the Fed to knock it off. The market currently thinks there’s a good chance that interest rates will be more than 1% lower by this time next year. That would be very good news for investors.

Friday’s jobs report will tell us a lot. Next Tuesday, we’ll get the CPI data for November. There’s a good chance the S&P 500 will make a new all-time high before the end of the year.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His