-

CWS Market Review – November 21, 2023

Posted by Eddy Elfenbein on November 21st, 2023 at 6:13 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Milei Wins

Earlier this year, I wrote about the stunning presidential primary victory of libertarian economist Javier Milei. This was a major shock, not only to the political establishment, but also to world currency markets. The Argentine Fed responded by raising interest rates 21% to 118%.

Now Milei has been elected president and he has an opportunity to implement his agenda.

The point I want to make wasn’t about the particulars of Argentinian politics but about the interplay of financial markets and government policy. This is an important aspect that’s often overlooked by investors and policy makers.

Investors tend to see the economy as a chessboard and the politicians as those who move the pieces around. In many ways, the truth is the precise opposite. The economy calls the tune, and the politicians adjust their policies.

James Carville famously said, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” Boy, is that right.

Indeed, there many times when investors can serve as the veto of last resort. In the end, currency markets get a vote.

Here’s part of what I wrote:

I should explain that Milei isn’t exactly your typical presidential candidate. Milei isn’t merely a small-government conservative; he’s a full-throated anarcho-capitalist. Two of his dogs are named Milton and Murray, in honor of Friedman and Rothbard.

I don’t want to give you the impression that Milei is somehow odd or unusual. For example, he wants to legalize the selling of organs and children. He also refuses to comb his hair. Additionally, he’s a tantric sex instructor. After that, things frankly start to get a little odd.

Now he’s president. Yes, Milei is zany but that’s part of his charm. The real story is that the economy is Argentina is a disaster. Inflation is running at 138%, and the country is on the brink of its sixth recession in the last decade.

People are frustrated and they want something done, even if it’s dramatic. In the U.S., we were alarmed about 9% inflation. Here’s a look at the inflation rate in Argentina.

This means prices double in less than a year.

One of Milei’s bolder plans is “dollarization.” He wants to ditch the Argentine peso and use the U.S. dollar. Other countries like Panama and Ecuador have tried this, but no one as big as Argentina has given it a shot.

The Argentine peso is governed by strict capital controls. There’s the official rate which is around 350 pesos to the dollar; then there’s the real rate. It never seems to occur to policymakers that their currency can be, and is, traded outside their country. The unofficial price for the peso is about one-third the official price.

For a land of such beauty and promise, Argentina seems to go from one self-induced crisis to the next. Forty percent of the people live in poverty. Yet it’s that frustration that’s driving Milei’s popularity. Milei said he wants to cut taxes and implement large spending cuts.

Did I mention that he cloned his dog? Yep, he did that too.

I’m not sure that the people of Argentina have embraced Milei’s strong views. Perhaps they have, but the truth is that things are so bad that voters are willing to give politicians outside the mainstream a hearing. Of course, we’ve had similar outcomes in our elections.

The problem with replacing the peso with the dollar is that Argentina simply doesn’t have enough dollars. They need outside investors and lots of them. Argentina could go to the IMF, but they’re already the IMF’s largest borrower.

Bond markets have been notoriously troublesome for some politicians. In 1981, Francois Mitterrand won a stunning Socialist victory. A lot of French money quickly found a new home in New York. Eventually, Mitterrand reversed course on his more radical policies.

Liz Truss faced a similar crisis last year, leading her to resign after just seven weeks as U.K. Prime Minister.

A Milei presidency could have a major impact on global commodity markets. Argentina is famous for its beef, but it’s also the world’s fastest-growing lithium producer. Milei has promised to take the axe to farm taxes. That could make Argentina’s agricultural sector more competitive. The country also has major deposits of copper and shale oil.

For now, the markets love Milei. In yesterday’s trading, shares of Argentina-based stocks soared on U.S. markets. There are 15 Argentine stocks that trade in the U.S. Most of the companies are financial or energy stocks, with a few utilities. Shares of Telecom Argentina (TEO) were up 22% yesterday, and they gained another 10% today. YPF Sociedad Anónima (YPF), a large energy company, jumped 40% yesterday. Check out the recent performance of the Argentina ETF (ARGT):

I’m skeptical Milei will get much of his program passed. Bureaucracies are hard to change. Still, it’s another indication that voters aren’t happy with high inflation and corruption. In the end, Milei will be able to go as far as the bond and currency markets let him.

The Fed Says It’s Not Looking to Cut Rates

This afternoon, the Federal Reserve released the minutes from its most-recent FOMC meeting (October 31 to November 1). Today’s minutes show that the Fed is in no hurry to cut rates. While inflation has been much better behaved, it’s still above the Fed’s target rate of 2%.

The Fed is not fully convinced that the battle against inflation has been won. That’s probably correct. During the 1970s, inflation came back again and again, worse each time. The Fed wants to avoid that.

The Fed is saying that policy should remain “restrictive” until it’s clear that inflation is headed back to 2%.

From today’s minutes:

In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time.

All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

Participants noted that further tightening of monetary policy would be appropriate if incoming information indicated that progress toward the Committee’s inflation objective was insufficient.

Translated from Fedspeak, this is simply the Fed trying to sound tough. That’s quite different from making an actual tough-minded policy decision.

The markets continue to believe strongly that the Fed is done hiking rates. Odds of a rate hike at the December FOMC meeting are currently at 5%. For March, traders see a 28% chance of a Fed cut.

That’s interesting because at his last news conference, Jerome Powell said the Fed isn’t even talking about rate cuts. For May, the rate-cut odds rise to 59%, and by Election Day, traders expect to see three rate cuts.

We’re now witnessing a growing gap between what the Fed is saying, and what the public believes. When in doubt, I have greater confidence in the market’s opinion.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: November 21, 2023

Posted by Eddy Elfenbein on November 21st, 2023 at 7:05 amFor Argentina, Dollarization May Work Better on YouTube Than in Reality

South African Inflation Breakevens Tumble as Rates Seen on Hold

Russian Agricultural Bank Files Lawsuit Against JP Morgan

Bond Managers of $2.5 Trillion Make Case for Leaving Cash Behind

Is the US Headed for a Recession? Look at What Richer Americans Do on Black Friday

New ETF Tracks Developers of Obesity Drugs Amid Ozempic Hype

The Great Disconnect: Why Voters Feel One Way About the Economy but Act Differently

Higher Interest Rates Are Shattering Housing Dreams Around the World

October Home Sales Likely Fell to New 13-Year Low

Houses Too Expensive to Buy Underpin Lofty Rents

China Property Stocks Surge After Beijing Picks 50 Firms to Fund

US Is Seeking More than $4 Billion From Binance to End Case

A New Front Is Opening Up in the US-China Conflict Over Chips

How Microsoft’s Satya Nadella Kept the ‘Best Bromance in Tech’ Alive

OpenAI in ‘Intense Discussions’ to Quell Potential Staff Mutiny

The Long Shadow of Steve Jobs Looms Over the Turmoil at OpenAI

India Closer to Agreement With Tesla to Import EVs, Set Up Plant

GM’s Driverless Taxis Need to Slow Down

Wyndham Rebuffs Latest Takeover Attempt From Choice Hotels

How a Billionaire Banker Is Helping Elite US Colleges Recruit New Talent

A Descendant of Freed Slaves, Financier Pursues Family’s $900 Million Oil Claim

Soon You May Know Exactly Where Your Diamond Was Mined

Be sure to follow me on Twitter.

-

Morning News: November 20, 2023

Posted by Eddy Elfenbein on November 20th, 2023 at 7:03 amMilei Opens a New Era: What Comes Next in Argentina Policymaking

China Drafts List of 50 Property Firms Eligible for Funding

Trudeau’s Spending Plans Are Squeezed by Soaring Debt Payments

UK Convenes Wall Street Titans at Royal Palaces to Woo Investment

Fed Increasingly Turning to Anecdotes to Make Sense of Economy

The White House May Condemn Musk, but the Government Is Addicted to Him

Bayer’s Investment Case Seen Shaken by Double Whammy

US Securities Regulator Signals It May Curb Climate Rule Ambitions

This Coal Giant Now Wants to Get Out of Coal

NRG Energy CEO Exits Amid Board Shakeup

Pritzker Chases Every Federal Dollar With New $1 Billion EPA Bid

How to Boost EV Sales? Pay Drivers to Turn in Old Polluting Cars

‘Lost Time for No Reason:’ How Driverless Taxis Are Stressing Cities

Kyle Vogt Resigns as CEO of GM’s Driverless-Car Unit Cruise

Talks to Bring Sam Altman Back to OpenAI Stretch Through Weekend

Microsoft Ends Weekend of OpenAI Drama With Coup of Its Own

A 30-Year Trap: The Problem With America’s Weird Mortgages

More Americans on Ozempic Means Smaller Plates at Thanksgiving

Black Friday, Cyber Monday Spending Projected to Hit New High

Shakira Reaches Deal with Spanish Prosecutors on First Day of Tax Fraud Trial

Be sure to follow me on Twitter.

-

Morning News: November 17, 2023

Posted by Eddy Elfenbein on November 17th, 2023 at 7:04 amOil Collapses Into Bear Market as Robust Supply Pressures OPEC+

China Wants to Bulldoze Old Neighborhoods to Revive the Economy

ECB’s Lagarde Says Europe Needs Single Market Watchdog in Push for Capital Union

France Makes Case for Paris to Host New EU Dirty Money Watchdog

US Consumer Watchdog Hands Wall Street Rare Win With Big Tech Crackdown

Biden Signs Bill Averting Shutdown, Teeing Up 2024 Budget Battle

Powell’s Fed Sticks Together in Fight Against Inflation Despite Differences

Treasury Yields Dive as Oil Craters, Economy Softens

Where Have All the Foreign Buyers Gone for U.S. Treasury Debt?

Active ETF Boom Is Mostly a Mirage as Stockpicking Fades Away

Wall Street Bosses Turn to AI to Help Write Performance Reviews

Swedish Dockworkers Are Refusing To Unload Teslas At Ports In Broad Boycott Move

Union Workers Back Contract Deals at 3 Big Automakers

Are Americans Falling Out of Love With EVs?

The Share of Americans Who Are Mortgage-Free Is at an All-Time High

Congrats, Your House Made You Rich. Now Sell It.

Companies Hesitate on Specialized Industry Clouds

When Huawei Shocked America With a Smartphone

Apple Plans to Make It Easier to Text Between iPhones and Androids

Gap Is Righting the Ship With Old Navy

This Thanksgiving, Full Planes to Go With Full Plates

These People Are Responsible for Thanksgiving’s Most Polarizing Food

The Estée Lauder Family Built a Beauty Empire. A Succession Rift Threatens It

Be sure to follow me on Twitter.

-

Morning News: November 16, 2023

Posted by Eddy Elfenbein on November 16th, 2023 at 7:06 amPandas, Ping-Pong and Profits: Chinese Leader Woos U.S. CEOs

Musk-Xi Meeting Shows Tight Relationship China Has With Tesla

Alibaba Nixes Cloud Spinoff After US Blocks AI Chips From China

Covid’s Biggest Economic Winner Is Running Out of Steam

While All Inflation Feels Bad, Housing Inflation Is the Worst

The Global Fight Against Inflation Has Turned a Corner

EU Banks May Face Major Hit If They Need to Sell Bonds -Lagarde

Systematic Hedge Funds Pummeled in Post-U.S. CPI Stocks Rally – Goldman Sachs

Lina Khan Has a Warning for the World of Private Equity

A Secretive Hedge Fund Tycoon Is the World’s Greatest Shipwreck Hunter

How R.F.K. Jr. Has Turned His Public Crusades Into a Private Windfall

The Pentagon’s Deadly Secret: It Makes Money From Bullets Used in Mass Shootings

‘Everything’s Locked Up’: Shoppers Turn to Amazon as Big-Box Retailers Combat Theft

Walmart Shares Retreat on Wary Earnings Outlook For Year

G.M.’s Contract Deal With U.A.W. Faces Surprisingly Stiff Opposition

Starbucks Unionized Baristas’ Strike Coincides With Red Cup Giveaway

Chicken Finger Craze Fuels $7.6 Billion Fortune for Raising Cane’s Founder

McDonald’s Growing Appetite for Fashion

Guinness Maker’s Morning After Offers Little Reassurance

Breaking Down Your Thanksgiving Costs

GrainCorp Holds Dividend Despite 34% Fall in Annual Profit

Stop Corporatizing My Students

Be sure to follow me on Twitter.

-

Morning News: November 15, 2023

Posted by Eddy Elfenbein on November 15th, 2023 at 7:03 amA Global Hunt for Water Profit Risks Draining Cities Dry

Ethiopia to Suspend Debt Service, Plans to Restructure Eurobond

Japan’s Economy Shrinks for First Time in Three Quarters

Biden, Xi Eye Economic and Military Thaw in High-Stakes Meeting

U.K. Inflation Slows to 4.6 Percent, Lowest in Two Years

An Optimistic Inflation Report Reduces Pressure on the Fed to Raise Rates

The Elusive Soft Landing Is Coming Into View

The Inflation Rally Goes Global

House Approves Spending Plan, Easing Risk of Government Shutdown

Carson Block, Nate Anderson Become SEC Tipsters for Cash Payouts

Ken Griffin Sees Miami Possibly Replacing NYC as Finance Capital

Wall Street Is Tapping Women, Minority-Owned Banks For Billion-Dollar Bond Deals

Schonfeld Ends Millennium Partnership Talks, Secures Billions Elsewhere

What to Watch in the Retail Report: Is Spending Cooling as Holidays Arrive?

At REI, a Progressive Company Warns That Unionization Is Bad for Vibes

So Thieves Nabbed Your Catalytic Converter. Here’s Where It Ended Up

Goodyear to Explore Strategic Alternatives for Chemical Business, Dunlop Brand

Target Sales Slump as Shoppers Pull Back

How David Zaslav Blew Up Hollywood

Aristocrat Leisure Raises Dividend After FY Profit Jumps 53%

Young and Rich: China’s Scions Set to Inherit $120 Billion in Wealth Transfer

Be sure to follow me on Twitter.

-

CWS Market Review – November 14, 2023

Posted by Eddy Elfenbein on November 14th, 2023 at 6:38 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Stocks Soar on Soft Inflation Report

Finally, some good inflation news!

This morning, the government said that inflation was unchanged last month. That was 0.1% below expectations. Not surprisingly, the report was helped by falling energy prices. Over the last year, inflation is running at 3.2%.

This is a very good report. Bear in mind that inflation was running very hot in September (+0.4%), so this report is a nice change of pace.

The inflation story isn’t just about energy prices. The core rate, which excludes food and energy, rose by only 0.2% last month. That was also 0.1% below expectations. Over the last year, core inflation is up by 4%. That’s the slowest 12-month rate in over two years.

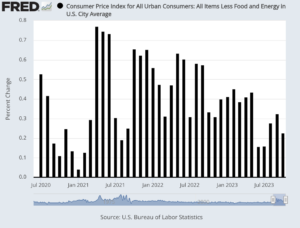

Here’s a look at the monthly seasonally-adjusted core rate. My apologies for the econ jargon, but this way, you can really see how the threat of inflation has faded over the last year:

Here are some details:

The flat reading on headline CPI came as energy prices declined 2.5% for the month, offsetting a 0.3% increase in the food index. It was the slowest monthly pace since July 2022.

Shelter costs, a key component in the index, rose 0.3% in October, half the gain in September as the year-over-year increase eased to 6.7%. Within the category, owners equivalent rent, which gauges what property owners could command for rent, increased 0.4%. A subcategory that includes hotel and motel pricing dropped 2.9%. 0.4% for September.

(…)

Vehicle costs, which had been a key inflation component during the spike in 2021-22, fell on the month. New vehicle prices declined 0.1%, while used vehicle prices were off 0.8% and were down 7.1% from a year ago.

Airfares, another closely watched component, declined 0.9% and are off 13.2% annually. Motor vehicle insurance, however, saw a 1.9% increase and was up 19.2% from a year ago.

Wall Street celebrated as it now looks like the Federal Reserve won’t be raising rates anymore this cycle.

In Wall Street’s mind, there’s nothing better than lower interest rates. On Tuesday, the S&P 500 rallied for the tenth time in the last 12 sessions. For the day, the index gained 1.9%. The S&P 500 is already up 7.2% in November and the month isn’t quite halfway over.

Futures traders think there’s only a 0.2% chance the Fed will hike next month. One month ago, the odds for a December rate hike were at 30%. Traders think there’s a 0.2% chance it will hike in January. By May, the market says there’s a 65% chance that the Fed will start cutting rates.

On our Buy List, Trex (TREX) was up more than 7.5% today. The deck-maker recently beat earnings and raised guidance. Celanese (CE) rallied 6.7% on Tuesday, and Polaris (PII) was up close to 6%.

Tuesday’s market was heavily concentrated on higher-risk areas of the market. On days like today, I like to look at the spread between the S&P 500 Low Volatility Index and the S&P 500 High Beta Index. On Tuesday, High Beta gained 4.45% while Low Vol gained 1.24%.

What’s going on? I think a lot of investors mistakenly believe that the promise of lower rates will lead us back to the glory days of 2020-2021. That’s when rates were at 0% and the government was spending money to boost the economy. The Fed effectively took risk out of the investing equation and high-risk areas soared.

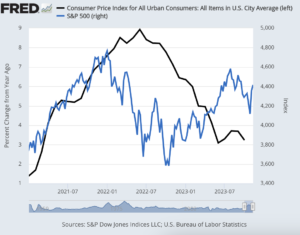

As I look at the stock market and inflation numbers, I can’t help wondering how overly complicated the game appears. Perhaps it’s as easy as leaving the market when inflation hits 7% and then coming back in when it drops below 7%. That’s an easy rule that’s pretty much worked perfectly. You can see it in this chart. The black line is the rate of inflation and it follows the left scale. The S&P 500 is the blue line and it follows the right scale.

The earnings numbers for Q3 are almost all in. It looks like the S&P 500 will report earnings growth of 4.1%. What about for Q4, which is already halfway done? Analysts are expecting Q4 earnings growth of just 3.2%.

But after that, things are expected to improve. Analysts expect earnings growth to improve to 6.7% for Q1, and 10.5% for Q2. FactSet notes that while these projects are down since September, they’re still above the results for Q3. In other words, not only is Corporate America still profitable, but earnings growth is accelerating.

The fastest-growing sectors are projected to be Communication Services (19.9%), Consumer Discretionary (16.5%) and Information Technology (15.2%). The stocks that are expected to contribute the most to earnings growth for Q1 are Nvidia, Amazon, Meta Platforms and Alphabet. Without these four, the S&P 500 would have earnings growth of 3.2%. With them, it’s 6.7%.

Stock Focus: Simulations Plus (SLP)

I’ve been a fan of Simulations Plus (SLP) for some time now. It’s a neat company that’s not well known. SLP’s market cap is just over $725 million and only three analysts follow it. The stock rallied 5.2% today. Incidentally, today was also SLP’s Investor Day.

Simulations Plus makes software that lets drug companies simulate tests of their products in the virtual world before using any human or animal test subjects. That’s a major cost-saver for drug companies.

Simulations Plus helps streamline the R&D process by making it faster and more efficient. Not only is this cost effective, but it also helps drug companies in dealing with time-consuming regulatory hurdles.

In fact, there are times when the results from SLP’s products have allowed companies to waive clinical studies. The cost savings are substantial. This means drug companies don’t have to deal with the time and expense of recruiting test subjects and analyzing test results.

By using SLP’s software, drug companies can experiment with many variables like fine-tuning dosage amounts. Companies can also see potential harmful side effects. Another important factor is that companies can identify treatments that have no benefits.

In healthcare, cost control is a major issue. That’s why SLP’s products are in heavy demand. A great business to buy is one that helps other companies control their costs.

In many ways, I think what Simulations Plus does for pharmaceutical researchers is closely akin to what Ansys (ANSS) does for engineers. By sitting at a computer, an employee can efficiently iron out a lot of kinks before experimenting in the real world. Simulations Plus is also branching out from their core customer base of drug companies. They work with consumer products companies to see the side effects of things like pesticides.

Unfortunately, the shares have not performed well over the past few years. That could make it a compelling buy.

Simulations Plus recently reported its fiscal-Q4 earnings. For the quarter, SLP’s revenues increased 33% to $15.6 million. The company’s gross profit grew 35% to $12.3 million.

For the quarter, the company earned 18 cents per share. That matched Wall Street’s consensus although I don’t know if three analysts count as a consensus. The stock dropped 15% after the report.

For all of last year, SLP’s revenue grew 11% to $59.6 million, and earnings increased from 60 cents to 67 cents per share.

For the new fiscal year, SLP sees revenues ranging between $66 million and $69 million. That works out to a growth rate of 10% to 15%. For earnings, SLP sees profits ranging between 66 cents and 68 cents per share. I’m particularly impressed that SLP can maintain gross margins that are nearly 80%. Simulations Plus pays out a small quarterly dividend of six cents per share.

As much as I like this business, valuation is still a concern. Going by SLP’s latest guidance, the shares are going for 50 times forward earnings. That a lot for any stock.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: November 14, 2023

Posted by Eddy Elfenbein on November 14th, 2023 at 7:04 amArgentina’s Election Isn’t Just High Stakes for Argentina — But for China, Too

China Mulls $137 Billion of New Funds to Aid Housing Market

The Rise and Fall of the World’s Most Successful Joint Venture

Why Xi Can No Longer Brag About the Chinese Economy

Elon Musk and Jane Fraser Among CEOs Wooing Xi Jinping

US Inflation Report to Keep Fed Leaning Toward More Rate Hikes

US Bank Regulators to be Grilled by Congress on Capital Hike Plan

UBS Predicts Tricky Start to 2024 for Emerging Market Assets

UBS Climate Change’s $150 Billion Hit to the U.S. Economy

How Wall Street Makes Millions Selling Car Loans Customers Can’t Repay

Bankers Brace for Smaller Bonuses With No Relief Seen Next Year

CEOs Aren’t Hearing A Lot of ‘Great Quarter, Guys’ This Earnings Season

With Interest Rates Above 9%, Small Businesses Slam the Brakes

Rolex, Patek Prices Hit Fresh Two-Year Lows: Subdial Index

Facing Financial Ruin as Costs Soar for Elder Care

How Microsoft’s Legal Legacy Shapes the Antitrust Case Against Google

What Google Argued to Defend Itself in Landmark Antitrust Trial

Glencore Wins Teck Coal Business, Paving Way for Its Own Split

Fisker Shares Fall More Than 10% After EV Startup Cuts Production Target

Home Depot Sales, Earnings Fall but Top Analyst Estimates

Insider Co-Founder Henry Blodget Steps Down as CEO Amid Strategy Shift

Can Tequila Really Go Global? This Booze Boss Is Giving It a Shot

Be sure to follow me on Twitter.

-

Morning News: November 13, 2023

Posted by Eddy Elfenbein on November 13th, 2023 at 7:03 amItaly Faces Barriers to Obtain About €90 Billion in EU Funds

Greece Starts Process to Sell 20% Stake in National Bank

Indian Students Flock to US Colleges, Offsetting Drop From China

What’s at Stake in the Biden-Xi Meeting

What It Took to Get Biden and Xi to the Table

Goldman Sachs, Morgan Stanley Diverge on Fed Rate-Cut Forecasts

Morgan Stanley Sees Bullish Opportunities for US Assets in 2024

Talent Agency CAA and Michael Klein Launch Sports and Media Investment Bank

Inside Wall Street’s Scramble After ICBC Hack

Mint, the Budgeting App, Is Going Away. Here Are Some Alternatives

Health Insurance Is About to Boost US Inflation

Vermont May Be the Face of a Long-Term U.S. Labor Shortage

The Low-Wage Pay Surge Is Over, Threatening the Consumer Boom

Home Depot and Lowe’s Face Slump From Higher Rates and Housing Prices

The ‘Georgists’ Are Out There, and They Want to Tax Your Land

Los Angeles Mansion Owners Test $150,000 Rents as Sales Slump

China’s Spending on Green Energy Is Causing a Global Glut

Polluting Industries Say the Cost of Cleaner Air Is Too High

Electricity Use Booms in Texas, a Harbinger for the Country

Exxon Makes Lithium Play in Long-Term Bet on EV Demand

The Diamond World Takes Radical Steps to Stop a Pricing Plunge

Novo Shares Rise After Wegovy Demonstrates Heart Benefit in Trial

Target Tries to Find Its Mark After Year of Misfires

Be sure to follow me on Twitter.

-

Morning News: November 10, 2023

Posted by Eddy Elfenbein on November 10th, 2023 at 7:04 amChina Is Making Too Much Stuff—and Other Countries Are Worried

India’s Factory Output Slows in September on Weak Demand

Delhi Could Use Artificial Rain to Subdue World’s Most Toxic Air

How Power Companies Profited From Italy’s Covid Lockdown

U.K. Economy Stagnates as High Interest Rates Take Toll

RBA Revises Up Near-Term Inflation Forecasts, Warns Inflation More Persistent

Even if the Fed Stays on Hold, Jerome Powell Is Keeping His Options Open

US Bond Funds Rack Up Biggest Weekly Inflow In Three Months

IRS Announces New Income Tax Brackets for 2024

Citigroup Resumes Retail Banking Sale in Poland – Bank Handlowy CEO

Mark Mobius Plans to Step Back From Mobius Capital Partners

It’s Boom Times for Startups Trying to Electrify Aviation

Personalized A.I. Agents Are Here. Is the World Ready for Them?

Man vs. Musk: A Whistleblower Creates Headaches for Tesla

Amazon’s New Approach to Selling Enterprise Software? In-Person Demos

Apple Agrees to $25 Million Settlement with US Over Hiring of Immigrants

Sleep Number’s ‘Drastic Miss’ Resulted in Drastic Marketing Measures

Las Vegas Strike Averted as Wynn Resorts Rounds Out Labor Deals

An Opioid-Like Drink Is Masquerading As a Wholesome Alcohol Alternative

Be sure to follow me on Twitter.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His