Seven Years Ago

This time of year has been fairly popular for major stock market turns. In 2000, the Nasdaq reached its nosebleed peak on March 10. Sixteen years later, we’re still below that level.

On March 11, 2003, the S&P 500 reached its closing low ahead of an impressive rally sparked by the opening of the Iraq War.

But the most impressive turn came seven years ago when the market reached one of the best buying opportunities in market history.

On Friday, March 6, 2009, the S&P 500 reached an intra-day low of 666.79. Like last Friday, that was also Jobs Day. That morning, the government reported that the economy had lost an astounding 651,000 jobs in February. The number for January was revised to a loss of 655,000, and December to minus 681,000. The unemployment rate rose to 8.1%, which was a 25-year high. So you can see why everyone was so bummed out.

That morning, The Wall Street Journal ran a piece from Michael Bostin, “Obama’s Radicalism is Killing the Dow.”

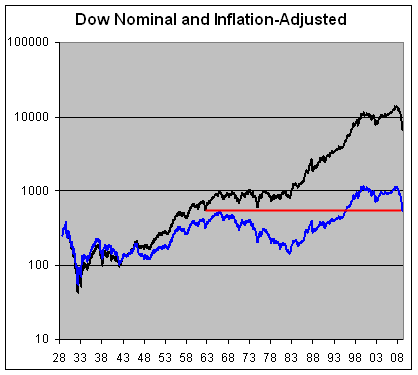

That day I posted a chart showing that the Dow, adjusted for inflation, was where it was 43 years before.

Then on Monday March 9, 2009, the S&P 500 reached its low close of 676.53, although it never dipped below the intra-day close from the previous Friday. The market hadn’t been this low in over 12 years.

To give you an idea of how nervous people were, the Volatility Index was near 50, and the TED Spread was over 1%. Yet this was a great time to buy. Or rather, I should say “because of this,” it was a great time to buy.

On Thursday, March 12, 2009, Bernie Madoff pled guilty to charges around his Ponzi scheme. In Forbes, Nouriel Roubini said the S&P 500 “could fall to 600.”

This was also the time when comedian Jon Stewart was criticizing CNBC and Jim Cramer. Stewart first mocked CNBC on March 5. That led to some public back-and-forth between him and Cramer. On the evening of March 12, Cramer came on The Daily Show for their famous matchup.

From its closing low on March 9, 2009, the S&P 500 would triple by November 6, 2014.

Posted by Eddy Elfenbein on March 7th, 2016 at 9:12 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His